Tesla is worth more than Aston Martin, Ferrari and Porsche combined

News

News

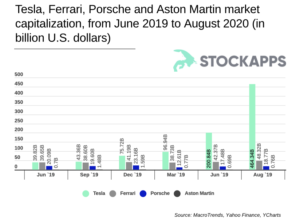

Tesla has surpassed Johnson & Johnson to become the 8th most valuable US company and is worth seven times more than three top carmakers combined — Aston Martin, Ferrari and Porsche.

Following its five-for-one share split Monday, Tesla traded 4.6 per cent lower Tuesday to close at $US475.05 per share, putting its market cap at $US442.6bn ($602bn), according to Yahoo Finance.

The company was valued even higher at $US460bn on Monday, when its stock price topped $US500 a share, according to data gathered by investor website StockApps.com.

Healthcare company Johnson & Johnson had a market cap on Wednesday of $US399bn, putting it in 9th place in the ranking for top US companies, and credit card company Visa took out 7th spot at $US454bn.

“One of the reasons for such a premium valuation is Tesla’s ability to convince investors that it is much more than just an automaker and plans to make its vehicles capable of deploying into an autonomous ‘robotaxi’ ride-sharing service to prove that,” StockApps said.

Upmarket car brands Aston Martin, Ferrari and Porsche had a combined stock market value of $US67.7bn this week, the website said.

Ferrari has a market valuation of $US48bn and the Italy-based carmaker revealed a 42 per cent plunge in profit for Q2 after closing its factories for seven weeks as a result of the COVID-19 pandemic.

London-listed luxury car brand Aston Martin experienced a sharp fall in sales in the 2020 first half, and only sold 1,770 cars worth £1.77bn ($2.4bn) , down 41 per cent year on year.

Aston Martin’s share market value was $US700m this week, and for the German carmaker Porsche it was $US18.7bn, StockApps said.

The global auto industry generally has had a torrid year thanks to COVID-19, with carmakers stopping production, dealerships and showrooms closing, and sales slumping.

Tesla’s feat of increasing its market cap to vault into the Top 10 US companies has happened relatively quickly, its share price has surged 200 per cent in the past quarter.

Only in early August did Tesla’s market value of $US270bn make it more valuable than Japan’s volume carmaker Toyota, which at the time had a market value of $US200bn.

And it was only back in January that Tesla reached a market value of $US100bn.

Investment banks have price targets for Tesla’s shares that are lower than its current market price.

Goldman Sachs’ price target for Tesla is $US295 per share, based on six times the company’s revenue from electric car sales, it said in a note Tuesday.

Royal Bank of Canada has a price target for Tesla of $US290 per share.