Report: The post-COVID asset boom’s best performing Australian investment funds

News

News

FY21 is in the books, which means Mercer can release its survey of the best performing Australian investment funds.

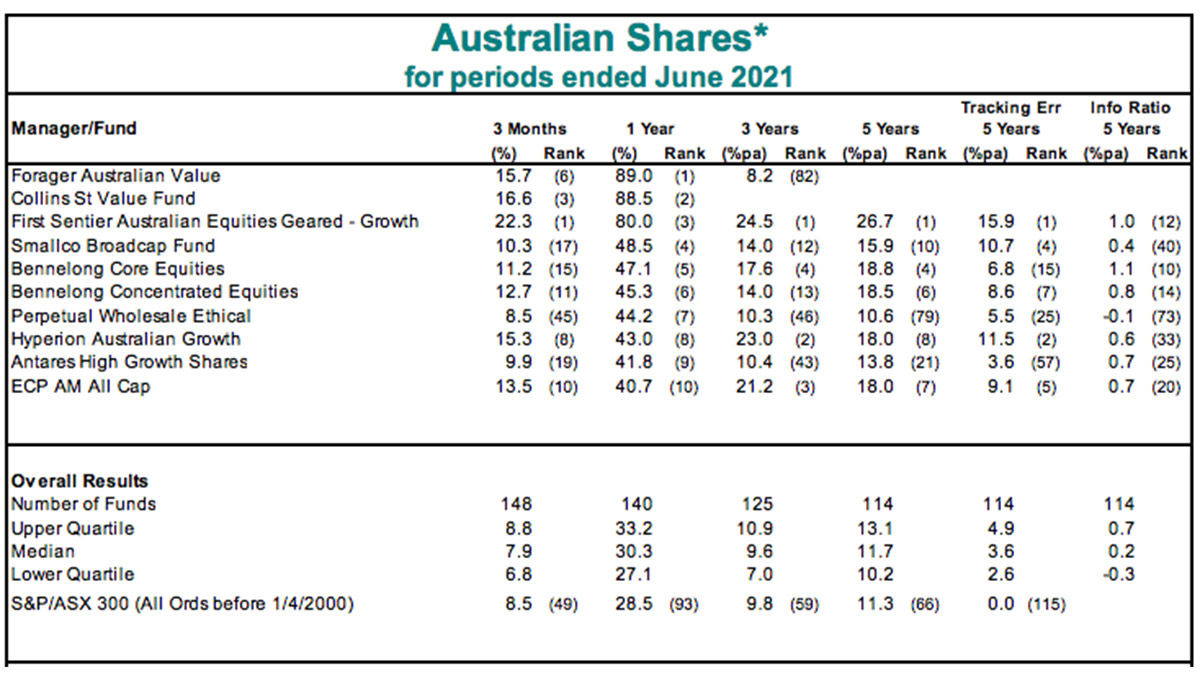

Here’s the Top 10:

The Forager Australian Value fund held its quarterly lead, giving its investors an 89% return on their money over the full year.

Things dialled back a bit over the past three months, after Forager closed out the March quarter with a barnstorming 12-month return of 128.1% (factoring in some low base effects from the March 2020 Covid calamity).

However, Forager’s FY21 return is indicative of the gains that were on offer for investors as markets emerged from the pandemic amid a deluge of fiscal and monetary stimulus.

This year, there were three funds that posted an annual return of 80% or more – literally almost doubling their investors’ money.

A simple way to put that in perspective is to compare it to FY19 and FY20.

The best performing fund in the 2020 financial year was the Long/Short fund run by QVG Capital, which takes positions to benefit from both share price gains and falls.

It posted a return of 29.3% — strong by historical standards, but a result which wouldn’t have landed it in the Top 10 for FY21.

In FY19 – the last comparative year with no impact from COVID-19 – the best performing fund posted an annual return of just 18.8%.

In that context, the Mercer survey helps shed some light on just what an unusual investment year it’s been.

Commenting on the quarterly update, Mercer’s regional head of portfolio management Ronan McCabe said the June quarter consolidated the rotation which took place at the start of 2021.

“While the second half of 2020 was a strong period for Quality/Growth managers, as markets rallied from the March 2020 Covid lows, the last six months of the financial year have seen a recovery in Value stocks, and in particular Financials and Materials,” McCabe said.

“At an individual stock level, CBA was the largest stock contributor over the financial year, followed by ANZ, Fortescue, BHP, NAB and Westpac,” Mercer said.