You might be interested in

News

Hot Money Monday: Here's why tweaking the 'buy low, sell high' strategy could generate handsome profits

News

Closing Bell: Mega miners leave ASX with barely a thread after giving it all away on weak China data

News

News

Funerals. Not a subject most people want to talk about, but it’s one of the few industries with a lot of staying power.

The sector has very favourable economics – characterised by low competition, high margins and returning customers (not the same ones).

Death is inevitable so the industry is relatively protected from a recession, although some customers may opt for lower-cost services. Inflation could also squeeze margins slightly.

Unlike tech stocks, funeral stocks are mainly valued on exisiting cashflows.

Historically, the industry was dominated by “mum and dad” shops, and although larger companies have since emerged, it’s still very fragmented.

There is no one global leader, but NYSE-listed Service Corporation International (SCI) is as close as you would get to a benchmark.

The Houston based company is the biggest provider of funerals and cemetery services in North America, with over 1500 funeral homes and 400 cemeteries.

Billionaire fund manager Peter Lynch (of Magellan and Fidelity fame) was one of the first investors in the company.

SCI did very well during the pandemic period, and has just reaffirmed its full year guidance for FY22.

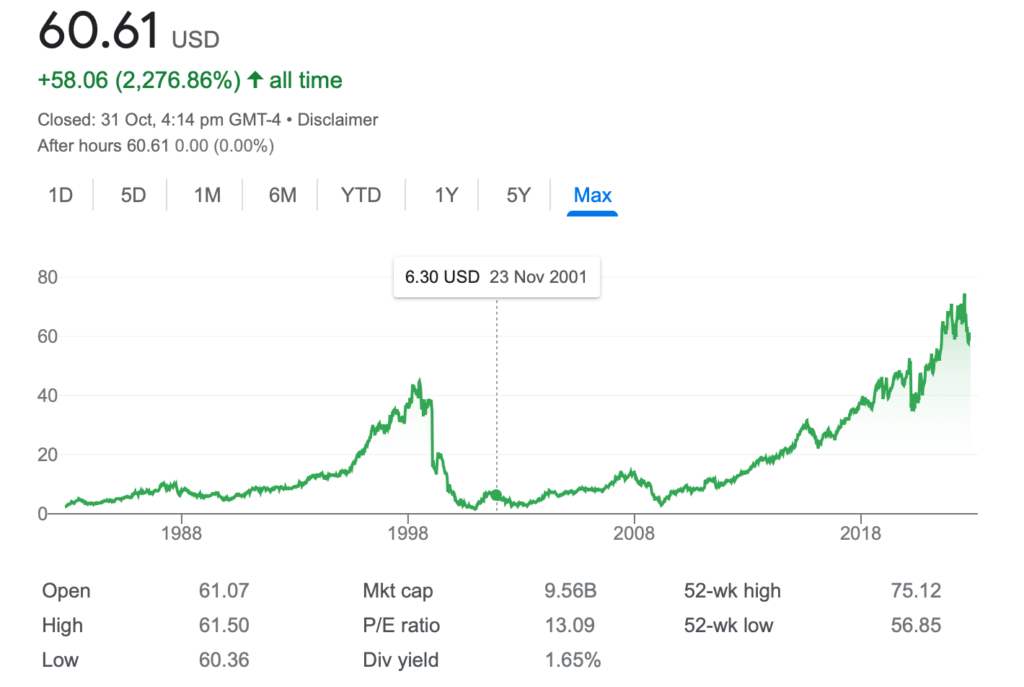

If you had invested in the SCI stock in the year 2000, you would have made close to 30x your initial investment.

In Australia, the funerals industry is also driven by the same market factors elsewhere.

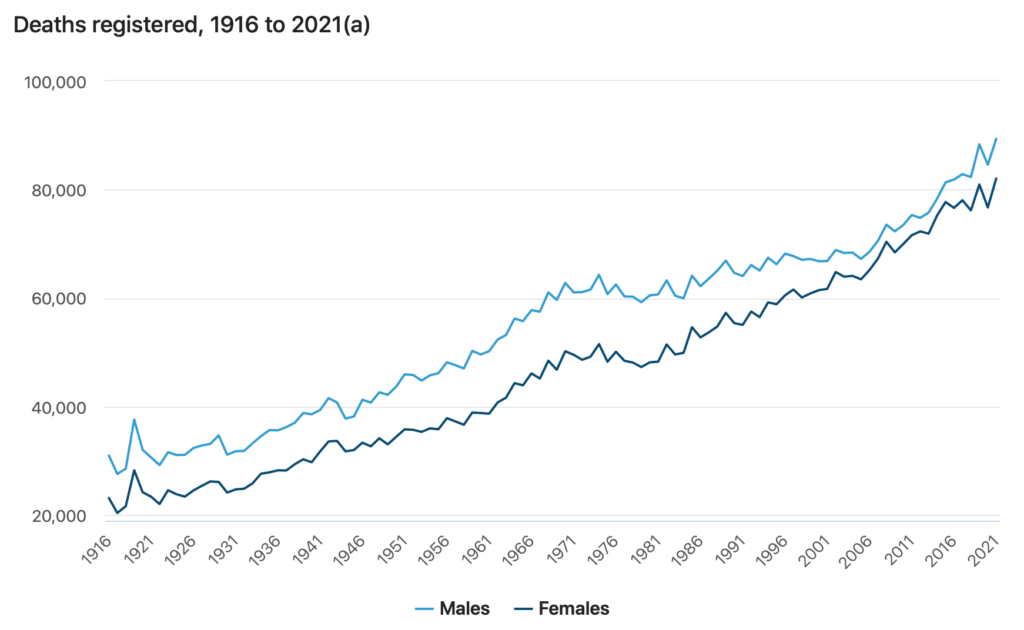

Population growth and death rates are the two leading factors dictating the industry’s success.

According to the ABS, the 2021 census counted 25,422,788 people in Australia, an increase of 8.6% since the 2016 census.

There were 171,469 registered deaths in 2021, an increase of 10,169 since 2020. The standardised death rate (deaths per 1,000 standard population) meanwhile increased to 5.1 deaths from 4.9 in 2020.

As a side note, the top 5 leading causes of death in Australia according to the ABS are: ischaemic heart disease (also known as coronary heart disease), dementia, cerebrovascular diseases, lung cancer and lower respiratory disease.

Although the number of deaths has increased over the years (reflecting the increase in population), the overall death rate in Australia has actually declined.

Another headwind facing the industry is a higher inclination toward cremation over traditional funerals, which has been accelerated by Covid.

This obviously poses a threat to revenue per client in the funeral services space, not just in Australia but around the world.

Another reason for people opting for cremation is that costs are much lower than a traditional funeral, with the average cremation service cost being roughly $6,000 in Australia.

The average cost of a traditional burial, on the other hand, is a hefty $19,000.

There are two funeral stocks listed on the ASX – InvoCare and Propel Funeral Partners.

The bigger player InvoCare is a market darling in the funerals space.

It owns over 290 funeral locations and 17 cemeteries and crematoria in its network.

The company delivered record operating earnings of $44 million for the first half of FY22, a 10% increase on the pcp.

During the half, InvoCare delivered record funeral case volumes, and case average grew 4% to a record $8,511, which combined to drive operating revenue of $166.6 million.

The company puts down the strong results to the sharp jump in ‘excess deaths’ – a term used to describe the difference between the number of deaths and the expected number based on previous trends.

Its market leading pet cremations business delivered close to 50,000 cremations in the half, up 20% on the pcp, and generated revenue of $16.7 million.

“With a growing and ageing population, the longer-term fundamentals of our business remain positive, and we are well placed to deliver near and long-term shareholder value,” said CEO Olivier Chretien.

The InvoCare share price is down 11% so far this year, but it isn’t cheap as it trades at well over 70x multiple of earnings (P/E ratio) – compared to SCI’s P/E ratio of just 13x.

Propel had a solid FY22, with revenue of $145m, up 20% on the prior year.

The company’s bottom line net profit after tax was $16.9 million, up 45% on the prior year.

Propel continued its momentum into Q1 FY23, reporting revenue of ~$44 million, up ~33% on the pcp.

Its expansion strategy is to acquire other companies, and in FY22 the company committed $21 million for six seperate acqusitions.

Since its IPO in November 2017, Propel has committed a total of $155.5 million on acquisitions, as it continues to explore other potential acquisitions.

Propel currently operates from 144 locations, including 32 cremation facilities and nine cemeteries.