Ranked: The best performing ASX investment funds in FY19

News

Finance consulting firm Mercer Australia has released its 2019 rankings of the best ASX investment funds.

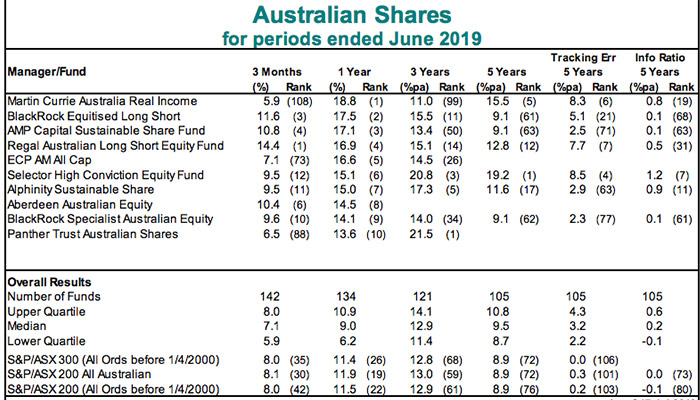

Topping the tables was the Real Income fund at Martin Currie Investment Management — run by portfolio manager Ashton Reid — which returned 18.8 per cent before fees.

That was followed by BlackRock Australia Equitised Long-Short fund (17.5 per cent) and the AMP Capital Sustainable Share fund (17.1 per cent).

Mark Vrkic, lead specialist in equity investments at Mercer, highlighted that the bigger end of town turned the tables from the March quarter to outperform the small-cap sector in Q4.

“Interestingly, the S&P/ASX 50 had the highest returns of the main Australian equity indices, while the Small Ordinaries index exhibited the weakest returns,” Vrkic said.

“While this was a reversal from last quarter, it was a continuation of relative outcomes seen over the financial year.”

He attributed the prevailing shift to a reallocation of capital back towards traditional investments such as the big banks, in the wake of last year’s Royal Commission.

On the other side of the ledger, the Forager Australian Value long-only fund was the worst performer, with an annual loss of 18.8 per cent.

Of the 85 long-only funds with annual results, the average return in FY19 was 8 per cent.

By sector, the Enhanced Index category had the best average annual return, with a gain of 11.6 per cent.

Of the five funds in that category, SSGA Australian Enhanced Equities was the best performer with a gain of 13.4 per cent.

“Median manager performance worsened in the second quarter of calendar year 2019 on a relative basis versus the S&P/ASX 300 Index, compared to the first quarter,” Vrkic said.

Underperformance was largely driven by a lack of exposure to out-performing large cap sectors in financials, materials and communication services, as well as an over-allocation to cash.

Here’s a summary of this year’s top performers and industry totals: