Pop Quiz: Is it wiser to buy property, rent property or just buy shares in listed property owners?

News

News

One can experience the full confounding gamut of human emotion when reading this column sipping decaf latte and skipping smashed avo, the brain in neutral – which means thinking about buying a house – and then coming across this next bit:

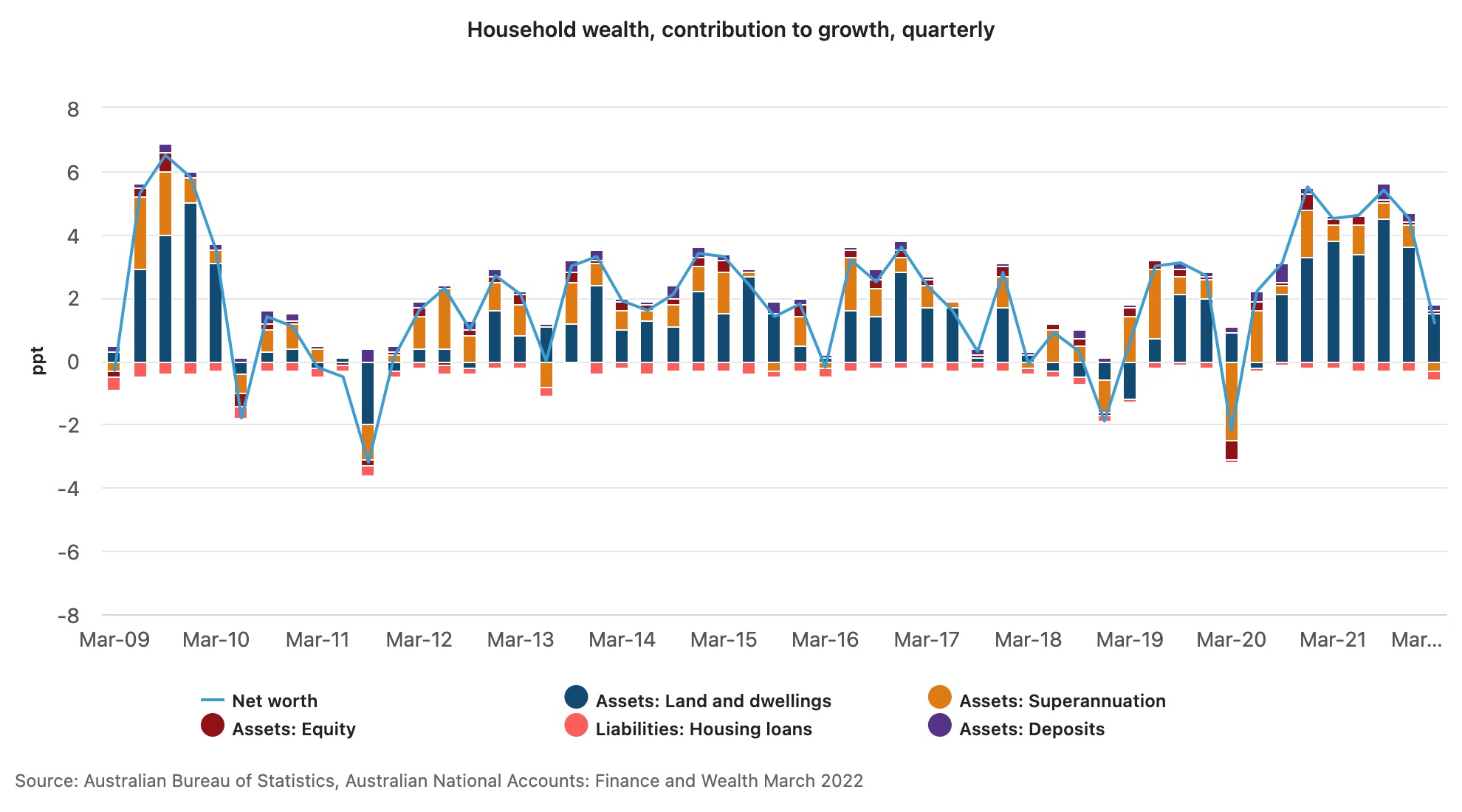

Since the onset of COVID-19 Aussie household wealth has gone supernova, expanding by well over a third (some 35.3%). And driven almost single apartmently by surging home values.

Get that smashed avo because it’s been raining money, you fools!

The mad scientists at the Bureau of Stats (ABS) reckon – on average – we’ve all gotten about $150k richer. Damn, in the last quarter alone our combined household riches grew by almost $175 billion to a wonderfully obscene $14.9 trillion record.

If we were decent socialists everyone in the country would be worth exactly $574,807 each. More rationally, put us all in the same casino and we’d have an accumulated $300bn extra in currency and deposits to (always) bet on black then we would’ve pre-pandemic.

Super accounts got fatter thanks to the equity boom (that’s getting a bit of a correction) but it was the appreciation of home-owning property assets which accounted for the boomsticks in household wealth that started circa March 2020 with COVID-19.

Get extra bacon, because, believe it or not, household wealth has risen 40% over those two sad-arse years.

Katherine Keenan, head of finance and wealth at the ABS, says it’s still all about having a house.

“While the pace of property price growth started to moderate, with falls in Sydney and Melbourne this quarter, other capital cities and regional areas rose, resulting in an overall rise in house prices of 1.9 per cent nationally,” Keenan notes.

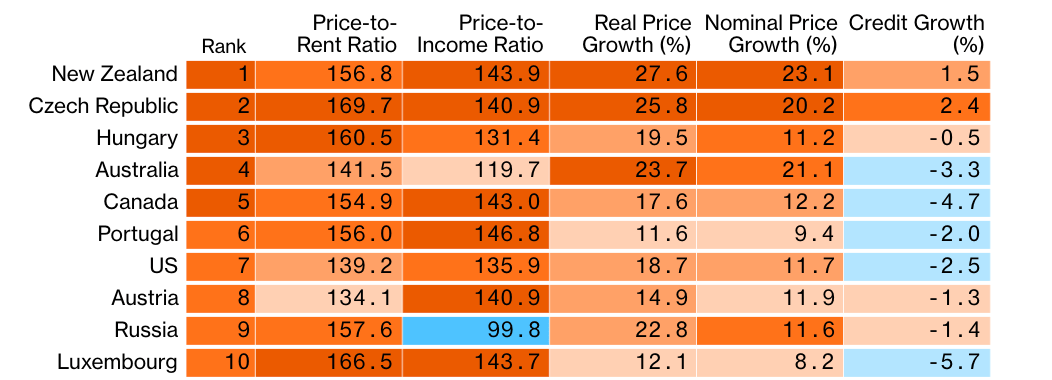

And if you thought all of this was just a tad insane, Bloomberg Economics says you’d be right. The wee table below in garish shades of orange shows the top 10 OECD countries with combined price-to-rent and home price-to-income ratios which are higher today than they were just before the 2008 financial crisis which gave us the Oscar-winning Ryan Gosling vehicle – like Ryan needs a vehicle – The Big Short.

There are wonky rations that show how much house prices have moved out of line with fundamentals. We’re number #4.

At least it’s New Zealand at the top.

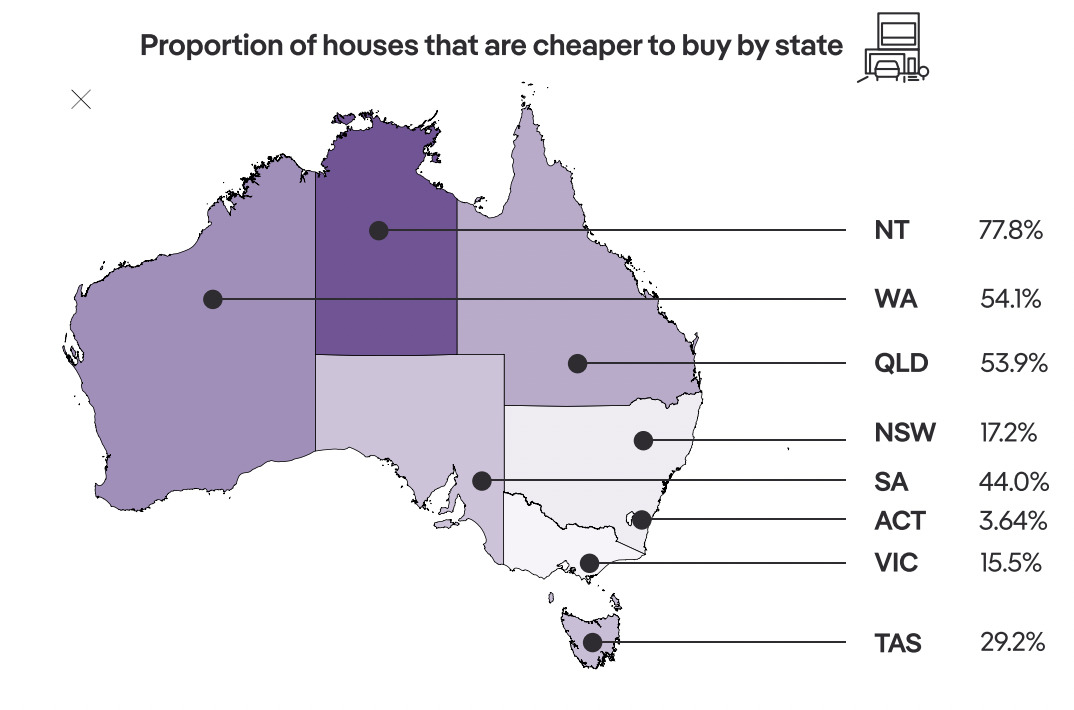

Still, according to PropTrack’s newly minted Buy or Rent Report it’s cheaper to buy a place than rent one across about a quarter of this fine but No. #4 dangerously expensive country (some 27% of dwellings across Australia).

Big change. This time a year ago, that figure was above 50%.

As I do with all slightly complex topics, I like to look at the rise and fall of rates in relation to the value of property through the prism of a Keanu Reeves film.

Continued price increases combined with higher-than-dreamed-of interest rates make buying a house both harder and less attractive than ever before.

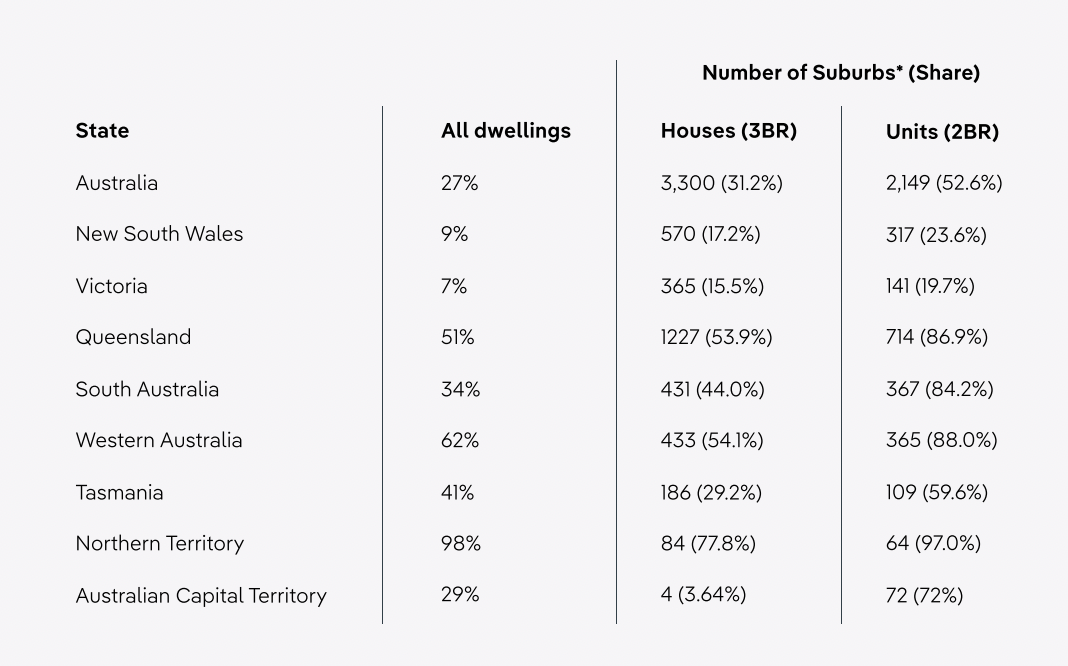

Of course it’s a big country and like the spread of wealth it depends a lot on where you are and what you’ve got. More than a third of apartments for example are expected to be cheaper to buy than rent over the next 10 years.

This attractiveness of buying vs renting reveals a nation divided.

“This will continue to drive stronger price growth in the smaller capitals and regional areas, where buying is more affordable. By contrast, rent price growth is likely to continue in some areas where buying is considerably more expensive – particularly Sydney and Melbourne,” PropTrack reports.

Buying conditions are much better once you get the hell out of New South Wales, The ‘Bra and Victoria.

More than 50% of dwellings are estimated to be cheaper to buy in Queensland, Western Australia, and the Northern Territoire.

And by contrast, in NSW and Victoria, less than 20% of dwellings would seem to be cheaper to buy at current ‘No. #4 shittiest in the OECD’ prices. The Australian Capital Territoire? Fuhgeddaboudit.

Downward pressures are constellating around our ridiculously mean house prices, which every single economist I’ve spoken to agrees are expected to fall further as poor affordability and the inevitability of looming cash and rising mortgage rates come home to roost.

There’s danger too, because the bomb is still on the bus.

Westpac’s rate whisperer Bill Evans says our economy is super sensitive to any fiddling the RBA is intent on doing with the cash rate and it’s “markedly higher than the sensitivity of the US economy to the federal funds rate.”

Every six out of 10 Aussie mortgages are on floating rates with a further 75% of the remaining fixed rate loans pretty short – set to mature by the end of next year.

“Effectively 90% of mortgage borrowers are directly exposed to moves in the RBA cash rate over the next year and a half,” Evans warns.

Once the income to mortgage ratio falls under 50 miles an hour…

“The rate affects borrowers and homeowners through multiple channels, including: the cash flow of existing borrowers; the capacity of prospective borrowers to obtain and service new loans; the wealth effect from associated adjustments in house prices; and via confidence effects.”

In the States by contrast, the current surge in the mortgage rate only affects new home owners that borrow, because all the existing borrowers typically have fixed rate mortgages for up to 30 years.

AMP says to expect a 10% to 15% top-to-bottom fall in prices over the next 18 fun-filled months.

But again it all depends on where you are sipping your decaf monstrosities. In Sydney and the Other Place prices are already falling and more aggressive up front RBA rate hikes risk pushing them price falls to 20%, Doc Oliver warns.

Mortgage rates have already risen 75bps thus far in 2022 – with more in the post, sans bloody doubt.

Combine that with still strong growth in home prices – yeah, they’re still moving up – some 14% this year alone – renting has become a more affordable option across most of the country now compared to a year ago. Relatively. Relatively.

According to PropTrack, in NSW, it’s cheaper to buy than rent for just 9% of the state’s dwellings – either flats or houses.

But because of the pandemic-era boom in home values across Sydney, renting houses is cheaper than buying almost everywhere cross the city.

In Victoria, it’s cheaper to buy than rent only 7% of properties. PropTrack notes there’s pockets in the north, east and west of Melbourne which still hold more affordable places for keen house hunters.

Up north, in sunny Queensland, living choices are more dynamic with over half of Queensland properties cheaper to buy than rent. In BrisVegas, there’s suburbs to the south and south-west of the CBD hiding some homes more affordable to buy.

SA holds 34% of properties cheaper to buy than rent.

In WA, PropTrack says its cheaper to buy than rent in 62% of properties

In Tasmania, it is cheaper to buy than rent 41% of properties and in the ACT 29% of properties are cheaper to buy than rent.

That whole thing about renters getting squeezed out of somewhere to live is no joke.

*How can you not love this messed up table?

REITs are a unique asset class on the ASX; they’re listed trusts which focus on various property assets which are rented out, bringing in the goodness of regular income.

Compared to investing in off-market properties or shares in property development entities, REITs offer the advantages of liquidity, diversification, income stability and potentially more favourable tax treatment – not being subject to corporate tax.

“Generally speaking the income is passed through to the investor and the investors pay tax,” Morningstar Alexander Prineas told Stockhead.

“[REITS] will typically pay a higher yield because they’re passing it all through – the yield will not be franked because they don’t pay company tax.”

REITS own property assets ranging from agricultural land to shopping centres and collect rental income from them.

These are larger assets out of reach of the average ABS calculated $500k retail Joe Investor, but it allows investors to share ownership and receive rental income.

“Typically the vehicle needs to be focused on owning property to generate rental income so it will not have exposure to development and other activities – it’s about owning properties and collecting rent.”

James Gerrish’s team at Market Matters noted this week that property stocks rallied well, with one catalyst being a better update from Vicinity Centres (ASX:VCX) with the mall operator talking up operational performance and property revaluations.

“The property sector is very cheap – it is where contrarians with a medium-term horizon should be looking and it will bounce if we get signs that inflation (and thus rates) are under control.”

VCX, the shopping centre owner, popped last Monday on the back of strong valuations and better guidance.

“The book value on their assets was increased by $245m ahead of the end of the financial year, largely on the back of tighter cap rates which fell to 5.31%, from 5.35% with 56% of their assets independently valued,” Market Matters observes.

“Funds From Operations (FFO) guidance was also increased to at or above the top end of the previous 11.8-12.6cps guidance that was reaffirmed last month, though distribution guidance was amended to the lower end of the 95-100% range. The update said that foot traffic had continued to improve and collections had followed as a result, with rental collections up to 91%.”

Meanwhile, in the current fast rising rate environment, UBS this week lowered its earnings across the entire Australian listed real estate sector:

In a note from June 20, UBS adjusted their price targets 15% lower on average across the sector reflecting the updated view on toppy interest rates. In Friday’s follow-up note, they highlighted that the looming cash rate headwinds haven’t largely been reflected in the consensus earnings.

So UBS expects that FY23 FFO per share is now -5% below consensus, on average. So the analysts are prepping for further downside risk to earnings if the interest rates get as bad as the market expects.

UBS says the biggest negative funds revisions are for the Charter Hall Long WALE (ASX:CLW), Centuria Office (ASX:COF), Centuria Industrial (ASX:CIP), the Agriculture REIT Rural Funds (ASX:RFF), GPT Group (ASX:GPT) and Charter Hall (ASX:CHC).

In a note on Friday, Crestone Wealth said their preferred REITs are names with low leverage, high cash flow security and that are trading at a material discount to valuation.

Within the sector, their order of preference is:

At a stock level, the most preferred names are SCA Property Group (ASX:SCP), GPT Group, Stockland (ASX:SGP), Charter Hall (ASX:CHC), Centuria Industrial (ASX:CIP), Mirvac (ASX:MGR).

And the least preferred are Vicinity Centres (ASX:VCX), Dexus (ASX:DXS), Centuria Office, and Charter Hall Long WALE (ASX:CLW).

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.