New home loans surged in June, but housing outlook remains sluggish

News

News

June lending data from the Australian Bureau of Statistics showed a big pickup in activity in Australia’s housing market.

New home loans (excluding refinancing) ripped higher by 6.2 per cent, albeit off a sharp fall in April and May when stricter COVID-19 rules were still in place.

But the reduction in restrictions “looks to have supported home-buying activity in June”, CBA economists Kristina Clifton and Nicolas Guesnon said.

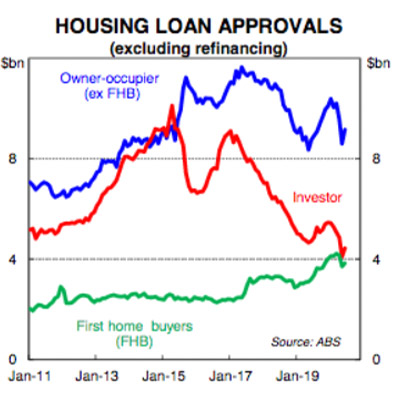

The data showed housing investors returned to the market in force, with loans to investors rising by 8.1 per cent to $4.4bn — the first increase since September. Loans to owner-occupiers rose by 5.5 per cent to $13bn.

By state, growth was underpinned by a boom in Queensland which saw loan growth rise by a “massive” 18.6 per cent, CBA said.

Before its COVID-19 calamity in July, housing activity in Victoria was already lagging the pack as loan growth declined in June by another 5.8 per cent. In addition, Victoria was the only state to report negative growth for the month.

With Australia’s second-largest state economy now on enforced lockdown, Clifton and Guesnon “do not see this month’s data as a turning point in home lending”.

“The reinstatement of stage-four shutdowns in Victoria are likely to weigh on new home lending over coming months,” the pair said.

While the ABS lending data is on a one-month lag, the June figures follow monthly house price data from CoreLogic for July which were released earlier this week.

Combined with the ABS data, the CoreLogic figures showed that a pickup in lending activity was unable to arrest more falls in house prices, as the national market declined for the third straight month in July.

Data from SQM Research earlier this week also showed a sharp pickup in new listings in the Sydney and Melbourne markets in July — a trend typically associated with weaker market conditions.