May Winners Column: Gold is still #1 but uranium casts a warm glow

News

News

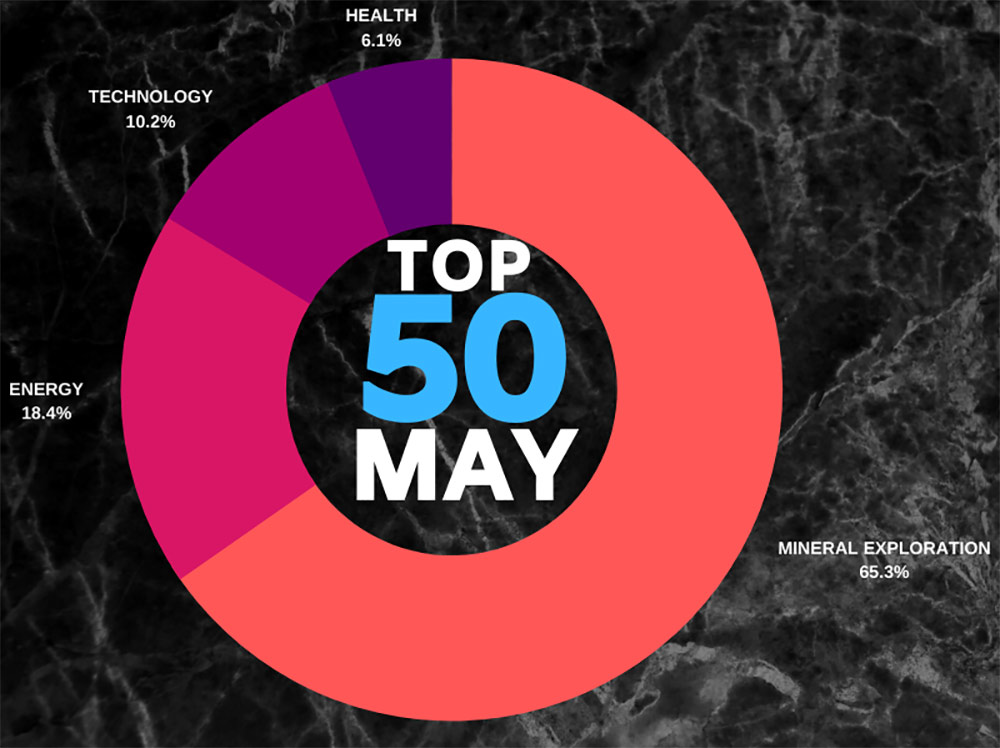

Here are the top 50 small cap stocks for May — a month defined by high flyin’ uranium explorers, lots of gold … and only one hand sanitiser company.

“The stock market is not a proxy for the real economy,” analysts say. It’s an axiom that bears repeating.

Even the US’ proverbial bin fire of an economy did not impede Wall Street’s strong back-to-back monthly gains.

Global markets more generally continued to shrug off the big macroeconomic issues and a smattering of China-US pomposity.

The ASX200 Index posted an 8.5 per cent gain over the month.

Unlike April, there were no +1000 per cent gainers in May. Still, there were plenty of good stories for investors to sink their teeth into, with 58 small cap companies post gains of 100 per cent or more.

HERE’S THE TOP 50 SMALL CAPS FOR THE MONTH OF MAY >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | NAME | TOTAL MONTHLY RETURN % | MARKET CAP |

|---|---|---|---|

| ESK | ETHERSTACK | 1150 | 198.61M |

| NME | NEX METALS EXPLORATION | 525 | 24.09M |

| MCT | METALICITY | 362 | 51.68M |

| IMC | IMMURON | 225 | 46.35M |

| RXL | ROX RESOURCES | 223 | 167.08M |

| AUT | AUTECO MINERALS | 220 | 213.72M |

| DW8 | DIGITAL WINE VENTURES | 208 | 25.20M |

| MGV | MUSGRAVE MINERALS | 200 | 216.11M |

| TAR | TARUGA MINERALS | 200 | 15.23M |

| AUC | AUSGOLD | 200 | 46.46M |

| BPH | BPH ENERGY | 187 | 8.58M |

| ICU | ISENTRIC | 186 | 4.07M |

| GSM | GOLDEN STATE MINING | 178 | 26.63M |

| SUH | SOUTHERN HEMISPHERE MINING | 173 | 3.26M |

| KAI | KAIROS MINERALS | 171 | 58.59M |

| CAD | CAENEUS MINERALS | 167 | 13.99M |

| GTE | GREAT WESTERN EXPLORATION | 165 | 10.12M |

| ELT | ELEMENTOS | 150 | 12.74M |

| SLX | SILEX SYSTEMS | 142 | 133.89M |

| AL8 | ALDERAN RESOURCES | 142 | 37.62M |

| AUR | AURIS MINERALS | 140 | 19.62M |

| SPT | SPLITIT PAYMENTS | 138 | 415.78M |

| RGL | RIVERSGOLD | 136 | 24.40M |

| SUP | SUPERIOR LAKE RESOURCES | 125 | 16.44M |

| SVD | SCANDIVANADIUM | 125 | 11.75M |

| XTD | XTD | 124 | 7.73M |

| FFR | FIREFLY RESOURCES | 122 | 6.40M |

| RAC | RACE ONCOLOGY | 119 | 81.52M |

| NVX | NOVONIX | 112 | 302.94M |

| SCN | SCORPION MINERALS | 105 | 9.20M |

| VPR | VOLT POWER GROUP | 100 | 18.34M |

| MNW | MINT PAYMENTS | 100 | 14.57M |

| MLS | METALS AUSTRALIA | 100 | 6.41M |

| AR9 | ARCHTIS | 98 | 18.55M |

| AYR | ALLOY RESOURCES | 92 | 8.38M |

| WWI | WEST WITS MINING | 91 | 21.49M |

| KP2 | KORE POTASH | 91 | 18.04M |

| CAE | CANNINDAH RESOURCES | 87 | 2.90M |

| HWK | HAWKSTONE MINING | 86 | 13.83M |

| TYM | TYMLEZ GROUP | 85 | 16.83M |

| IP1 | INTEGRATED PAYMENT TECHNOLOGIES | 85 | 6.25M |

| AYS | AMAYSIM AUSTRALIA | 84 | 174.12M |

| HRN | HORIZON GOLD LIMITED | 84 | 35.20M |

| DTM | DART MINING | 83 | 7.06M |

| TLM | TALISMAN MINING | 83 | 30.79M |

| ARV | ARTEMIS RESOURCES | 81 | 59.96M |

| LSR | LODESTAR MINERALS | 80 | 7.68M |

| MRQ | MRG METALS | 80 | 11.11M |

| DLC | DELECTA | 80 | 6.26M |

| REE | RAREX | 77 | 32.63M |

An existing structural supply deficit in the global uranium market, aggravated by ongoing COVID-19 supply disruptions, has sent the uranium ‘spot’ price up +33 per cent year-to-date.

Adding to an already bullish outlook for uranium, the Trump Administration has shown a strong desire to revive the domestic uranium industry.

Investors have been pouring into early stage US uranium explorers like GTI Resources (ASX:GTR) and TNT Mines (ASX:TIN). which were up 231 per cent and 259 per cent, respectively, over the month.

READ: Is this uranium’s renaissance or another false dawn?

WA gold explorers dominated the Top 50.

Minnow Metalicity (ASX:MCT) jumped 200 per cent as it kicked off new drilling at the historic, high-grade Kookynie gold project in the Eastern Goldfields.

Struggling vanadium play Sabre Resources (ASX:SBR) acquired a gold project in WA and immediately jumped 200 per cent.

Sabre’s Beacon gold project is just south of Spectrum Metals’ (ASX:SPX) high-grade Penny West project, which has now been acquired by miner Ramelius Resources (ASX:RMS).

And there’s also plenty of tier 1 project opportunities for ASX-listed companies in the US and Canada, gold-rich countries which have suffered from a lack of exploration in recent years.

In May, investors rewarded US-facing gold stocks like Alderan Resources (ASX:AL8) +253 per cent, Riversgold (ASX:RGL) +237 per cent, and White Rock Minerals (ASX:WRM) +100 per cent.