Market Matters: The 3 Nasdaq names 4 Wall Street’s glass-half-full cycle etc.

Experts

Experts

This series is brought to you by Market Matters. Market Matters provides access to professional money managers, portfolios, and daily market updates so that you can easily tailor your investment strategy to your needs. Sign up here for a full 14-day free trial to learn more.

James Gerrish is Portfolio Manager at the boutique/retail market insights platform Market Matters.

Alongside co-founder macro-analyst Shawn Hickman, previously of Macquarie and Goldman Sachs, he is the lead author of MM’s daily investment reports – mailed directly to members morning and evening, with live alerts sent through the trading day whenever they amend portfolios, providing clear, decisive and actionable market insights in real-time.

In this bloody exciting new series, Stockhead has wrangled unfettered access to Messrs Gerrish, Hickman and the Market Matters analyst team – and their devilishly interactive MM platform.

There is a slew of indicators for confidence. Precious few for bluster.

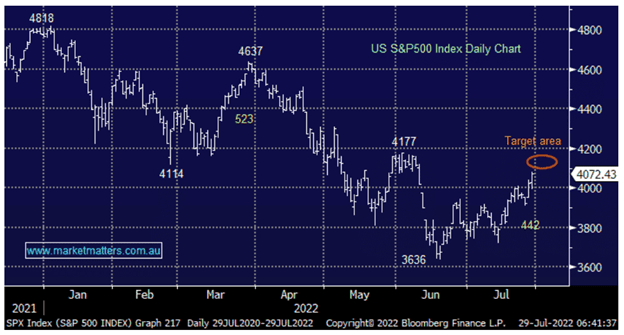

That being said, US share markets secured a precious hat-trick of sessional gains on Friday as the major indices made short work of a huge week – rising in concert for their best month of the year and indeed biggest monthly gains since 2020, a sea-change from the last six months.

Portfolio Manager James Gerrish told Stockhead that US stocks extended their recent gains as traders continued to reduce bets on pending Federal Reserve rate hikes.

“We are clearly in a glass half-full cycle of the market where “bad news is good news” with investors embracing poor economic data as it points to less aggressive tightening.”

Interestingly it was the defensives that sent stocks to a 7-week high with tech quiet before the Apple (AAPL US) and Amazon.com Inc’s (AMZN US) game-turning results.

A few strong tech earnings and the reassurance that a recession isn’t actually a recession had Wall Street eating victory cake with all the fears baked in.

The Dow Jones Industrial Average found nearly 3% and the S&P 500 jumped 4.3%.

The Nasdaq Composite waltzed its way to a gain close to 5% and – although the tech-heavy is still trapless in bear country – it is up roughly 12.5% for July.

The momentum really began when US tech stocks surged over 4% on Wednesday following the not quite dovish, Columbidae-like comments from Jerome Powell after the Fed hiked rates by 0.75% easing investors’ fears around the aggressive pace of interest rate hikes and giving weight to the idea that inflation has perhaps peaked.

“The moves on the sector level in the US made sense because although US 2-year bond yields remain around 3% they look and feel unlikely to surge above the 3.5% area which was being tested in mid-June,” Market Matters said in a note to members last week.

Hence rate sensitive US stocks largely outperformed on Wednesday last:

“Basically, US stocks accelerated the reversal of the main underlying trend which has unfolded through 2022 – i.e., buy defensives, avoid growth and interest rate sensitive names.

“That looks to have been cemented in the mind of investors as the moment Fed Chair Jerome Powell came out Wednesday sounding more dove than hawk,” James said. “This key change has been brewing slowly – probably since mid-June – and indeed MM has been intently tracking the signals of the subtle rotation over recent weeks.”

Think of it like the moment where the villain flips. Vader finally, finally tosses his boss and stops trying to kill everyone. Or perhaps even more articulately described in what the wrestling world calls a Face Turn.

However, there is a secondary, more subtle move afoot that comes with lower bond yields which played out in a major manner on Thursday within the ASX:

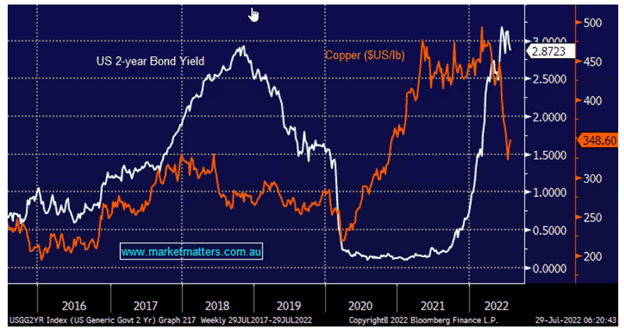

“The copper price often acts as a leading indicator for economic strength and hence bond yields, this was particularly evident through 2020 into 2022 and if this correlation remains on point the copper price is saying bond yields must come lower to avoid a recession.”

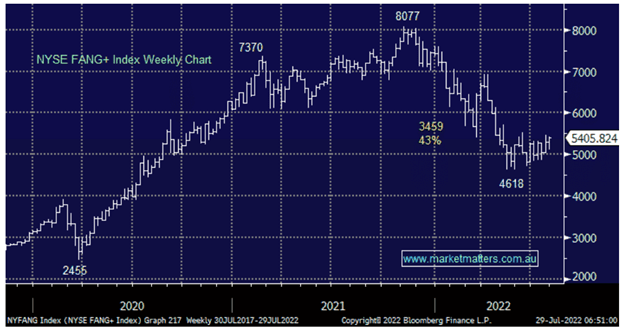

The FAANG stocks – from their extended acronym – compromise of Meta Platforms (META) (previously Facebook), Amazon.com (AMZN US), Apple Inc (AAPL US), Netflix (NFLX US) & Alphabet (GOOGL US).

Together, the FAANG stocks have only recovered ~22% of their losses since their late 2021 high. The relative performance of these 5 stocks illustrates perfectly an underlying characteristic with US tech stocks as a whole:

Analysis tells us: once a tech stock loses its advantage and starts to miss earnings and/or growth targets – for whatever reason – investors are best advised to watch from the sidelines.

“Obviously there will be exceptions as there are to most rules but these have been akin to looking for the proverbial needle in a haystack – an old trader saying of “your first loss is your best loss” has certainly applied to tech stocks over the last 12-months.

“Hence accumulating the quality tech stocks that have been dragged lower by poor sentiment towards anything growth is our preferred path forward – sounds easy but of course in this context “quality” is a big word.”

Three quality US tech stocks in brief (see charts below):

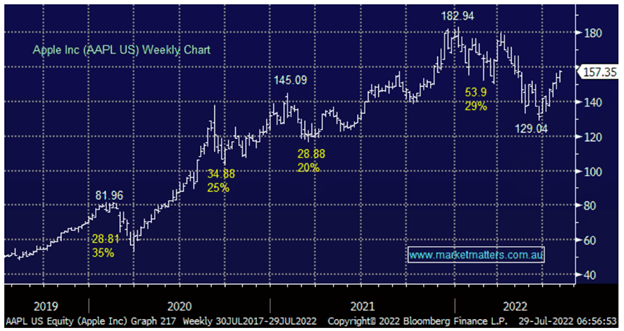

Wednesday morning on wall Street, US markets were transfixed by Apple’s Q3 result which answered any fears supply chain disruptions and the global economy would weigh on earnings.

Revenue rose 2% to $US83bn while earnings equated to $1.20 per share (v $1.16 exp). It’s the little wins.

“iPhone and iPad sales beat estimates while the secondary Macs and wearables fell short of estimates – here we are again the best offerings shine but elsewhere it can be tough even for Apple!”

James says, so far so good for Apple in a smartphone market that’s been struggling of late – the same day chip maker Qualcomm Inc revealed Apple’s demand for devices had slowed.

“When things are tough a new phone can wait until next year and we should take nothing for granted here if we do enter a deep recession.”

“One area of the business that we did particularly like was the +12% growth in digital services such as iCloud, AppleCare & Apple TV+ taking revenue to $US12.6bn.”

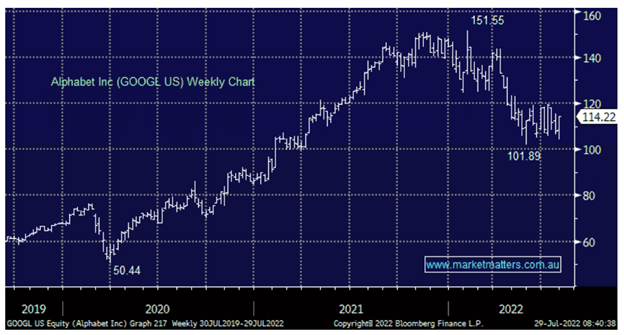

James told Stockhead that Google as Alphabet apparently likes to be called, reported earnings largely in-line with expectations – search’s outperformance offsetting the miss by YouTube.

“Search revenue was a healthy $US40.7bn confirming our conclusions that their core business is performing even as economic conditions toughen – although they, like most stocks are to a certain degree at the mercy of the macro environment.

“The market welcomed the report this week but after many weeks of trading around $US110 it will be interesting to see if buyers embrace a breakout above $US120 if / when it occurs,” Gerrish said.

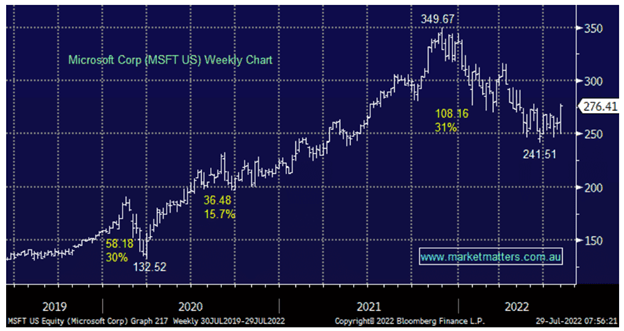

Last week saw Microsoft (MSFT US) miss estimates, yet the stock rallied 5% on positive guidance – another clear illustration that the markets bears/sellers have currently lost control.

“Their revenue and income fell short as revenue from Azure and other cloud services – earnings came in at $2.23 v $2.29 expected while revenue of around $US51.9bn was below the markets’ $US52.44 forecast.

“This was the first time since 2016 that Microsoft missed earnings – moving forward the company reiterated 2023 guidance which feels brave considering the economic uncertainty.”

At the moment our team believes the US tech sector is closer to the end of its decline than its beginning… but with economic uncertainties firmly in play another look lower by the growth names shouldn’t be discounted.

One last thing. While we will see huge short squeezes by underperforming pockets of the sector, as we have locally by the BNPL names, picking these swings is not our domain.

Have a cracking week.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.