M&A: RV provider Apollo Tourism set to be snapped up by NZX-listed competitor

News

News

Five years and one month since listing, RV lessor Apollo Tourism (ASX:ATL) has agreed to an acquisition from NZX listed Tourism Holdings (THL) (NZX:THL).

The latter company will pay in its own shares – one THL share for every 3.68 shares in Apollo.

The deal will see Apollo shareholders holding 25% of THL’s own shares, which will be dual-listed on both sides of the Tasman once the transaction is completed.

The deal is priced at a 32.6% premium to Apollo’s closing price yesterday, but is still a discount compared to Apollo’s $1 listing price in 2016.

Apollo Tourism traded above its listed price for the first two years as a public company. But the stock then declined in the wake of multiple profit downgrades, reaching a low of 11 cents back in March 2020, when tourism demand was virtually wiped out.

While caravan providers recovered better than tourism companies with exposure to international tourism, Apollo continued to be hit by localised lockdowns in Australia even though demand in many Northern Hemisphere markets returned with a vengeance.

Apollo rebounded from its all time lows but never to its pre-COVID highs. It owns a stake in fellow caravan sharing community Camplify (ASX:CHL) – which listed earlier this year and has more than doubled.

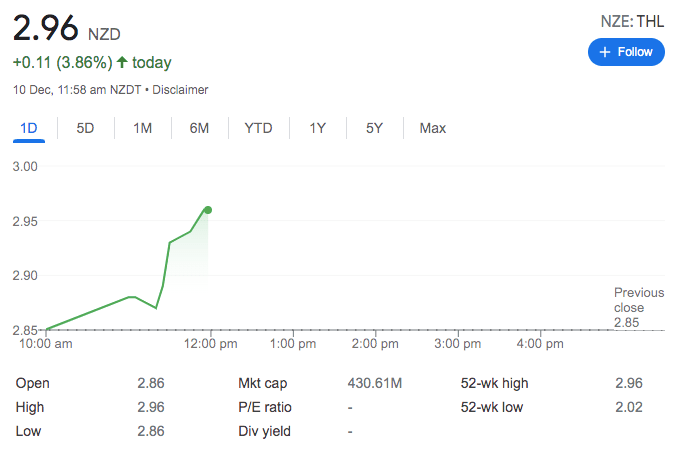

THL’s NZX shares rose as well and the stock has recently surpassed its February 2020 share price, but is off its all time high reached in 2018.

With Apollo bosses and founders Karl and Luke Trouchet owning a majority stake in Apollo Tourism, the deal appears a fait accompli — although it is conditional on THL getting the ASX’s approval to list.

Apollo’s bosses told shareholders the combined group would be financially stronger with significant cost synergies.

“The two businesses have similar operations and like-minded cultures, and we both strongly believe in the potential of the global RV market,” said Luke Trouchet.

“The proposed merger would give us a better platform to meet the ongoing impacts of COVID-19, continue to offer our guests the best combination of products, services and prices possible and better leverage the re-opening of global travel.”

“With a more diverse portfolio or brands, strong presences in the key RV travel markets and a more robust balance sheet, the combined business will be better able to capitalise on near-term growth opportunities as borders re-open and cross-border tourism begins to return to pre-pandemic levels,” Trouchet said.