Lunchtime ASX small cap wrap: Who’s freaking out today?

News

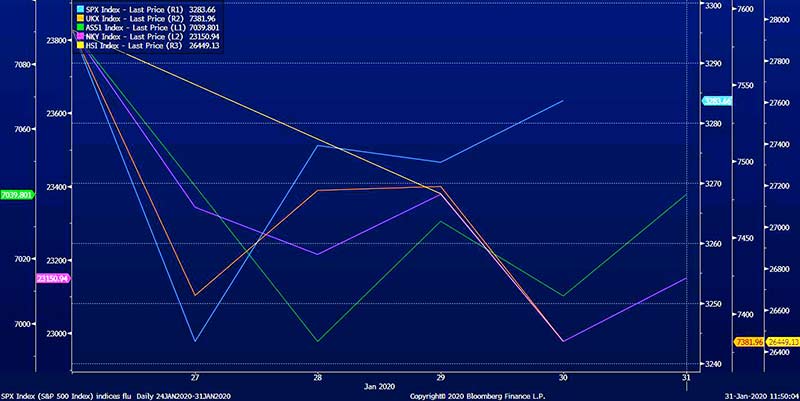

Global financial markets experienced a sharp sell-off this week as coronavirus fears escalated — along with it, concerns about a slowdown in the world’s #2 economy, China.

In the US, earnings season has been a mixed bag. Shares in Facebook dropped 6.1 per cent, but Microsoft, Tesla, and Amazon rose 2.8 per cent, 10.3 per cent and 10 per cent, respectively.

Electric carmaker Tesla is now up +100 per cent over the past three months. Sucks to be you, short sellers.

Today, the ASX200 (+0.4 per cent) and ASX Small Ords (0.52 per cent) had staged a small recovery to 7,036 and 2,994 points, respectively, by lunchtime.

Here are all your key small cap winners and losers in morning trade for Friday, January 31:

Here are the best performing ASX small cap stocks at 12pm Friday January 31:

Swipe or scroll to reveal the full table. Click headings to sort.

| Ticker | Name | Price | % Chg | Market Cap |

|---|---|---|---|---|

| VPR | Volt Power Group | 0.002 | +100.00% | $18.0M |

| AGE | Alligator Energy | 0.003 | +50.00% | $4.2M |

| HHM | Hampton Hill Mining | 0.03 | +40.00% | $8.3M |

| PEK | Peak Resources | 0.05 | +36.11% | $60.0M |

| APG | Austpac Resources | 0.002 | +33.33% | $5.8M |

| DDD | 3D Resources | 0.002 | +33.33% | $2.3M |

| PRM | Prominence Energy | 0.002 | +33.33% | $2.6M |

| MEU | Marmota | 0.04 | +25.00% | $33.8M |

| MTC | MetalsTech | 0.04 | +25.00% | $4.7M |

| RBR | RBR Group | 0.011 | +22.22% | $8.7M |

| MMM | Marley Spoon AG | 0.37 | +21.67% | $54.7M |

| PAN | Panoramic Resources | 0.23 | +21.62% | $167.9M |

| GMC | Gulf Manganese | 0.006 | +20.00% | $31.4M |

| CLZ | Classic Minerals | 0.003 | +20.00% | $21.0M |

| AGD | Austral Gold | 0.09 | +17.28% | $53.1M |

| EQE | Equus Mining | 0.014 | +16.67% | $19.7M |

| PTB | PTB Group | 0.94 | +16.15% | $71.9M |

| STA | Strandline Resources | 0.12 | +15.00% | $42.9M |

The winners column this morning is dominated by small cap resources players who are mostly up on no news.

Minnow 3D Resources (ASX:DDD) jumped 33 per cent after entering into a deal to buy the historic (but recently revamped) Adelong gold project in NSW.

For about $1.1m, 3D gets a bunch of walk-up, high-grade drill targets, a previously operating mine with existing 127,000oz gold resource plus ~$7m worth of plant and equipment.

And while the most recent owners had problems turning the project into a profitable mining operation, 3D is confident it knows where things went wrong.

READ: 3D believes it will succeed at the historic Adelong goldfield where others have failed

Here are the worst performing ASX small cap stocks at 12pm Friday January 31:

Swipe or scroll to reveal the full table. Click headings to sort.

| Ticker | Name | Price | % Chg | Market Cap |

|---|---|---|---|---|

| WNB | Wellness and Beauty Solutions | 0.0075 | -41.67% | $7.2M |

| CCE | Carnegie Clean Energy | 0.001 | -33.33% | $11.1M |

| ADD | Adavale Resources | 0.03 | -26.83% | $4.8M |

| WML | Woomera Mining | 0.014 | -26.32% | $2.6M |

| IME | ImExHS | 0.03 | -26.19% | $36.4M |

| RMI | Resource Mining Corp | 0.007 | -22.22% | $2.1M |

| TYM | Tymlez Group | 0.03 | -20.51% | $4.6M |

| UUV | UUV Aquabotix | 0.002 | -20.00% | $1.0M |

| ROG | Red Sky Energy | 0.002 | -20.00% | $3.3M |

| DLC | Delecta | 0.004 | -20.00% | $2.8M |

| BMG | BMG Resources | 0.004 | -20.00% | $2.3M |

| IP1 | Integrated Payment Technologie | 0.009 | -18.18% | $2.8M |

| DRE | Dreadnought Resources | 0.005 | -16.67% | $8.8M |

| BSM | Bass Metals | 0.005 | -16.67% | $14.0M |

| IHR | intelliHR | 0.1 | -15.65% | $18.6M |

| NTI | Neurotech International | 0.01 | -15.38% | $1.4M |

| PMY | Pacifico Minerals | 0.006 | -14.29% | $17.3M |

| LAA | LatAm Autos | 0.03 | -13.33% | $15.4M |

Wellness and Beauty Solutions (ASX:WNB) plummeted +40 per cent after saying that next quarter’s cash outflows are projected to be higher “due to an associated increase in stock production and costs related with completing rigorous product registration compliance required in international markets”.

On the plus side, sales receipts increased to $3.855m — a 76 per cent increase on the previous quarter.

And ImExHS (ASX:IME) got smacked after admitting that cashflow from operating activities was “not as strong as expected.”

The quarter presented several challenges, with the company learning important lessons on cash flow management “as we manage a fast growing, international business”, says IMEXHS chief exec Dr German Arango.

“We are working diligently to improve our internal controls and processes so that we can capitalise on the strong recurring revenue base we are building.”

READ: Quarterlies: The best and the worst of today’s 4Cs released on the ASX