Lunch Wrap: ASX stays green, MinRes powers ahead after billion-dollar lithium deal

ASX is in the green as MinRes powers on post lithium deal. Pic: Getty Images

- MinRes rockets on $1.2b lithium deal

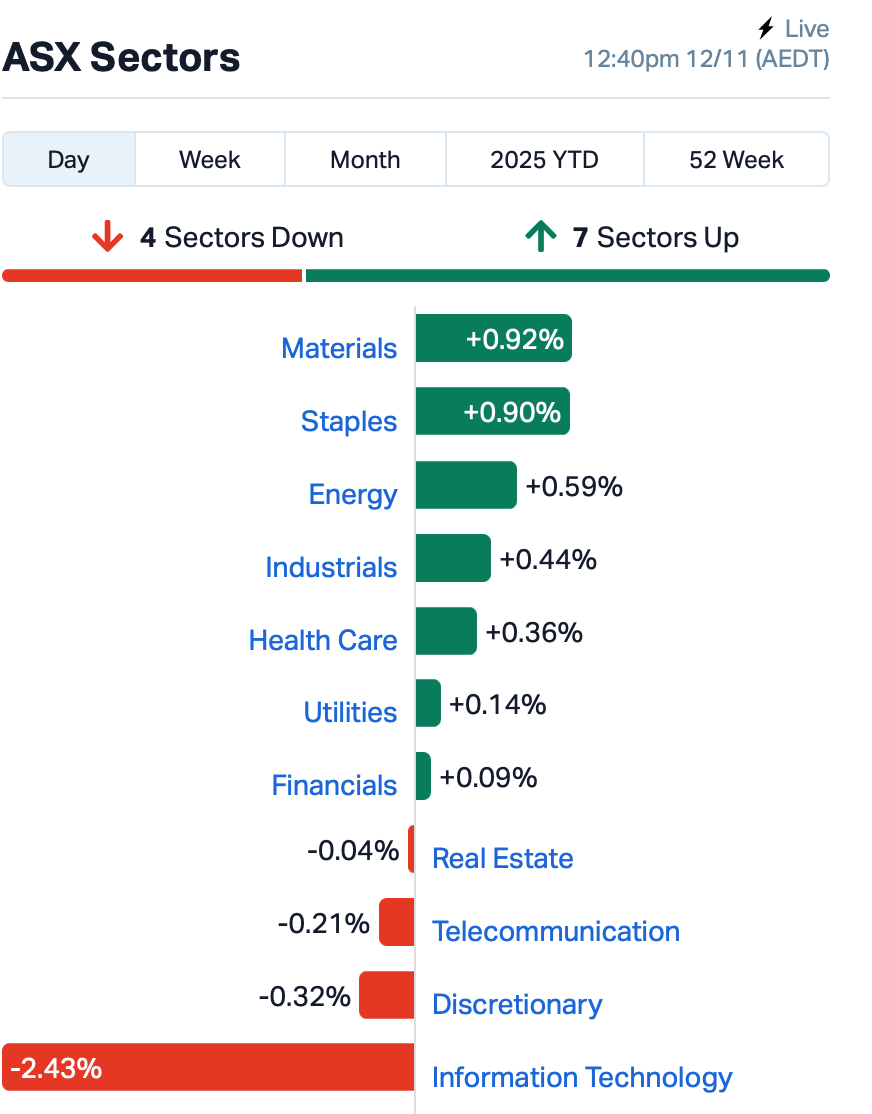

- Tech slips as miners shine

- ASX edges up as traders eye shutdown end

At lunchtime in the east, the ASX was up about 0.25%.

Local traders are clinging to Wall Street’s overnight gains after the US Senate finally voted to reopen government services.

The House is expected to pass its version by Thursday AEDT, which, if it happens, would bring down the curtain on the longest government shutdown in US history.

Back home, it was a role reversal from the previous day, with the tech sector taking the hit, down over 2% to start the day. Mining stocks, on the other hand, kept the market’s lights on, with a weaker US dollar making metals sparkle again.

Gold’s been marching toward US$4130 an ounce, and it gave the local stocks a solid lift this morning.

A small dose of good news also came from CBA’s Household Spending Index, which rose another 0.6% in October, marking 13 straight months of growth.

The large-cap headline belonged to Mineral Resources (ASX:MIN), which rocketed almost 10% after inking a deal with South Korea’s POSCO to offload 30% of its lithium business for about $1.2 billion.

The market loved it, and why wouldn’t it? The deal values MinRes’ Wodgina and Mt Marion stakes at roughly $3.9 billion, or around 45% above consensus. In broker land, that’s what they call “value-accretive”.

Flight Centre (ASX:FLT) also jumped 2% as the travel group guided to a profit of up to $340 million for FY26.

Liontown Resources (ASX:LTR) climbed 5% after teaming with Metalshub to run its first digital spodumene auction for 10,000 tonnes from Kathleen Valley. It looks like a smart move to bring some pricing transparency to the lithium market.

Tech stock Megaport (ASX:MP1) tumbled 3% after completing a $200 million institutional raise to fund its purchase of Latitude.sh and push into India. CEO Michael Reid said the move puts Megaport “at the heart of the hybrid cloud and AI-driven future.”

And… Origin Energy (ASX:ORG) traded flat after long-time exec Greg Jarvis announced his retirement. The company will start the new year hunting for fresh leadership. Shares were up a tick.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SAN | Sagalio Energy Ltd | 0.020 | 233% | 720,014 | $1,227,961 |

| ZNO | Zoono Group Ltd | 0.155 | 63% | 2,173,767 | $38,590,118 |

| NAE | New Age Exploration | 0.004 | 33% | 7,040,750 | $9,923,996 |

| SER | Strategic Energy | 0.012 | 33% | 24,678,640 | $10,025,400 |

| RWD | Reward Minerals Ltd | 0.048 | 26% | 301,603 | $10,344,344 |

| CR9 | Corellares | 0.005 | 25% | 360,742 | $4,113,905 |

| ERA | Energy Resources | 0.003 | 25% | 525,280 | $810,792,482 |

| HAL | Halo Technologies | 0.057 | 24% | 65,527 | $13,429,219 |

| JPR | Jupiter Energy | 0.030 | 20% | 1,727,456 | $32,017,971 |

| SCP | Scalare Partners | 0.120 | 20% | 291,317 | $8,420,587 |

| BLU | Blue Energy Limited | 0.006 | 20% | 421,108 | $15,059,868 |

| BUY | Bounty Oil & Gas NL | 0.003 | 20% | 997,500 | $3,903,680 |

| ABX | ABX Group Limited | 0.125 | 19% | 2,524,608 | $31,291,000 |

| MML | Mclaren Minerals | 0.026 | 18% | 2,588,315 | $4,372,165 |

| MDI | Middle Island Res | 0.040 | 18% | 6,318,419 | $33,727,455 |

| TGH | Terragen | 0.020 | 18% | 100,000 | $8,585,292 |

| BLG | Bluglass Limited | 0.014 | 17% | 574,024 | $31,375,388 |

| ERL | Empire Resources | 0.007 | 17% | 1,218,328 | $8,903,479 |

| GED | Golden Deeps | 0.058 | 16% | 514,041 | $11,070,356 |

| CMB | Cambium Bio Limited | 0.585 | 16% | 979 | $11,598,982 |

| BMR | Ballymore Resources | 0.185 | 16% | 456,146 | $32,989,271 |

| AXP | AXP Energy Ltd | 0.015 | 15% | 587,317 | $4,886,540 |

| SGI | Stealth Grp Holding | 1.265 | 15% | 243,063 | $143,062,798 |

| 1AD | Adalta Limited | 0.004 | 14% | 1,414,470 | $6,622,686 |

| DTR | Dateline Resources | 0.325 | 14% | 10,978,335 | $987,511,075 |

Sagalio Energy (ASX:SAN) has been paused after its share price rocketed more than 200%, with the company preparing an announcement to explain the sudden surge.

Zoono Group (ASX:ZNO) also jumped more than 60% before going into a trading pause.

Reward Minerals (ASX:RWD) has signed a binding deal to acquire the Copper Lance project on Newfoundland Island, Canada – an underexplored region known for its rich VMS copper potential.

Historic sampling returned assays of up to 42% copper, and the project sits near infrastructure with easy access and a long field season. Reward has also teamed up with Northex Capital Partners to fast-track exploration, with soil sampling set to kick off on November 17.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MEM | Memphasys Ltd | 0.003 | -25% | 4,781 | $9,686,236 |

| NTM | Nt Minerals Limited | 0.003 | -25% | 18,330,382 | $4,843,612 |

| CBL | Control Bionics | 0.059 | -20% | 4,668,966 | $26,160,343 |

| YAR | Yari Minerals Ltd | 0.010 | -17% | 311,714 | $10,073,566 |

| AFA | ASF Group Limited | 0.063 | -15% | 35,441 | $58,637,418 |

| SHO | Sportshero Ltd | 0.035 | -15% | 25,000 | $33,378,834 |

| EMT | Emetals Limited | 0.006 | -14% | 3,488,426 | $5,950,000 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 641,603 | $19,628,890 |

| PLC | Premier1 Lithium Ltd | 0.006 | -14% | 5,920,419 | $5,616,248 |

| VBS | Vectus Biosystems | 0.380 | -14% | 153,135 | $23,466,666 |

| HYD | Hydrix Limited | 0.013 | -13% | 277,001 | $4,091,533 |

| SRJ | SRJ Technologies | 0.013 | -13% | 234,076 | $20,687,176 |

| DTZ | Dotz Nano Ltd | 0.048 | -13% | 119,220 | $35,796,045 |

| FAU | First Au Ltd | 0.007 | -13% | 2,235,862 | $20,971,878 |

| MPR | MPR Australia Ltd | 0.007 | -13% | 300,000 | $2,749,626 |

| TMS | Tennant Minerals Ltd | 0.007 | -13% | 179,926 | $8,527,123 |

| NIM | Nimyresourceslimited | 0.066 | -12% | 7,725,489 | $26,509,509 |

| ZEU | Zeus Resources Ltd | 0.011 | -12% | 17,514 | $8,967,958 |

| GRL | Godolphin Resources | 0.015 | -12% | 842,777 | $11,834,663 |

| XPN | Xpon Technologies | 0.015 | -12% | 4,780,883 | $8,336,058 |

| A1N | Arn Media Limited | 0.480 | -12% | 94,750 | $169,829,827 |

| AUR | Auris Minerals Ltd | 0.024 | -11% | 802,683 | $14,799,236 |

| MRQ | Mrg Metals Limited | 0.004 | -11% | 200,000 | $12,269,334 |

| RWL | Rubicon Water | 0.205 | -11% | 22,000 | $55,359,873 |

IN CASE YOU MISSED IT

Nimy Resources’ (ASX:NIM) ambition of becoming a key supplier of gallium and rare earths has reached a key milestone after defining a high-grade resource within its Mons project in WA.

Alterity Therapeutics (ASX:ATH) has presented promising phase II trial data of lead compound ATH434 in multiple system atrophy at an international symposium.

Brightstar Resources’ (ASX:BTR) assays from extensional drilling at the Second Fortune and Fish underground mines of its Laverton Hub show potential for mine life extensions.

StepChange Holdings (ASX:STH) has locked in $11 million in new debt facilities with Westpac, strengthening its balance sheet.

LAST ORDERS

Neurotech International (ASX:NTI) has secured a research and development tax refund for the 2025 financial year, adding $4.73 million to its coffers.

NTI intends to channel the funding into developing its clinical pipeline, aimed at the treatment of paediatric neurological disorders.

Alterity Therapeutics (ASX:ATH) MD David Stamler will be delivering a corporate update at the Bell Potter Healthcare Conference, a virtual event showcasing Australia’s best healthcare companies.

The presentation will take place on Wednesday, November 19, 2025, at 1:30 pm AEDT and can be viewed by webcast on the Bell Potter website.

At Stockhead, we tell it like it is. While Neurotech and Alterity are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.