Kick Back: The biggest stories you might have missed on Stockhead this week

News

News

Well, that was a curly one.

It started out well with this kangaroo on a surfboard celebrating Australia’s GDP growing by 3.1. per cent in the fourth quarter of 2020, smashing market expectations of 2.5 per cent.

Federal Treasurer Josh Frydenberg said we were “world leading”!

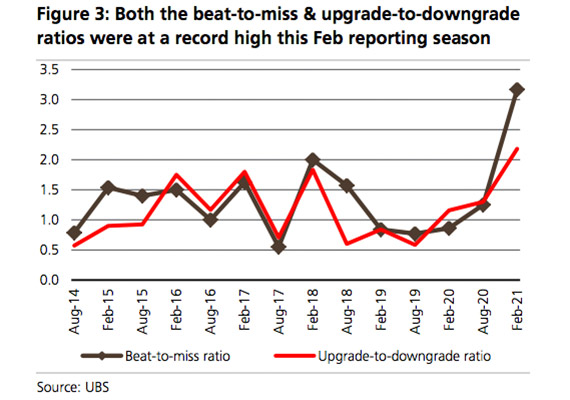

The same day, UBS confirmed the Februrary reporting season should lead to “bullish” expectations for ASX stocks.

The ratio of companies with earnings beats compared to an earnings miss was 3.3 to 1; easily the highest number going back to at least 2014:

Wow! AND HERE WE GO!

Yep. That was followed by several days of not-quite calamitous falls on US markets, most notably the Nasdaq. The rotation away from technology to cyclical stocks gathered pace, exacerbated by Federal Reserve’s Jerome Powell call to be patient in increasing interest rates from near zero levels.

Nope. Not a good week for stocks with… ambitious… valuations.

| Code | Company | Price | %Day | %Wk | %Yr | MktCap |

|---|---|---|---|---|---|---|

| FFG | Fatfish Group | 0.11 | -4 | -24 | 1471 | $107.9M |

| APT | Afterpay Limited | 114.16 | -4 | -15 | 244 | $33.7B |

| SZL | Sezzle Inc. | 8.49 | -6 | -15 | 464 | $919.9M |

| IOU | Ioupay Limited | 0.49 | -2 | -15 | 4800 | $275.7M |

| OPY | Openpay Group | 2.5 | -7 | -13 | 150 | $222.9M |

| Z1P | Zip Co Ltd. | 9.48 | -6 | -13 | 267 | $5.6B |

| SPT | Splitit | 1.06 | -7 | -11 | 115 | $520.6M |

| PYR | Payright Limited | 0.865 | 0 | -9 | -29 | $51.3M |

| HUM | Humm Group Limited | 0.97 | -2 | -8 | -36 | $490.3M |

| LBY | Laybuy Group Holding | 1.28 | -2 | -8 | -9 | $227.6M |

| ZBT | Zebit Inc. | 1.12 | -2 | 11 | -29 | $107.7M |

Let’s see where that leaves us.

Timing is everything. And that applies to when it’s time to post posts about “When to call time on a stock” as much as it does to calling time on a stock.

Stock like, say… Afterpay?

Do you really feel something can be great forever?

Do we have to mention Nic Cage?

It’s OK to say no to sticking with your golden goose if it’s losing its shine.

Kenny Rogers said it best, but Marketech’s in-house team say it pretty well here too, in this post, with charts and everything.

After all, even Afterpay’s directors bailed on a whole lot of their own stock when it was in the mid-$60s…

Anyway, if charts are your thing, Steve Collette has one here on the Nasdaq action that might put it into perspective. The green line (200-day moving avg) shows it has a habit of bouncing back quickly, and strongly:

But just in case, here’s the case for that trend coming to an end.

With GameStop now on the move up again, the case gets a little bit stronger for exactly how much social sentiment can be market-moving.

So much so that VanEck is launching an ETF that will track the 75 most-favourably mentioned companies on the internet – the VanEck Vectors Social Sentiment ETF (NYSE:BUZZ).

Dave Portnoy, the founder of pop culture blog Barstool Sports, is backing it – ADAPT OR DIE:

The old guard is crying in their soup before we even launched. Apparently only the suits are allowed to discuss stocks on CNBC. Adapt or die $buzz

Day-trading Reddit-readers nearly crashed the stock market. Now they’re in an ETF. – MarketWatch https://t.co/PUJ0bfOLbb

— Dave Portnoy (@stoolpresidente) March 2, 2021

But there weren’t a lot of takers on its debut, and with top 10 holdings like Twitter, Ford, Facebook, Amazon and Tesla, it’s probably not as radical as Portnoy likes to think.

Back here in Australia, the eight top performing ASX ETFs in 2021 are either focused on banks or offer exposure to global assets:

| Code | Name | 30D Vol | YTD Rtn |

|---|---|---|---|

| IJR | iShares Core S&P Small-Cap ETF | 9.83k | +16.98% |

| ASIA AU | BetaShares Asia Technology Tigers | 542.09k | +13.69% |

| MVB AU | VanEck Vectors Australian Bank | 23.59k | +12.70% |

| FUEL AU | Betashares Global Energy Companies | 434.53k | +11.70% |

| VVLU AU | Vanguard Global Value Equity | 14.48k | +11.59% |

| FOOD AU | BetaShares Global Agriculture | 20.45k | +11.25% |

| BNKS AU | BetaShares Global Banks ETF - | 53.14k | +11.21% |

| IJH AU | iShares Core S&P Mid-Cap ETF/A | 1.38k | +10.09% |

| QFN AU | BetaShares S&P/ASX Financial S | 41.31k | +9.54% |

| IAA AU | iShares Asia 50 ETF/AU | 20.17k | +8.99% |

| OZF AU | SPDR S&P/ASX 200 Financials Ex | 42.92k | +8.92% |

| GGUS AU | BetaShares Geared US Equity Fu | 72.31k | +8.88% |

| FANG AU | ETFS FANG+ ETF | 131.35k | +8.66% |

| VISM AU | Vanguard MSCI International Sm | 5.44k | +8.26% |

| ROBO AU | ETFS ROBO Global Robotics and | 10.35k | +7.99% |

| MOAT AU | VanEck Vectors Morningstar Wid | 6.10k | +7.06% |

| VGMF AU | Vanguard Global Multi-Factor A | 1.06k | +7.01% |

| PAXX AU | Platinum Asia Fund ETF | 111.79k | +6.90% |

| QUS AU | BetaShares S&P 500 Equal Weigh | 28.39k | +6.81% |

| PIXX AU | Platinum International Fund ET | 171.30k | +6.69% |

| ZYUS AU | ETFS S&P 500 High Yield Low Vo | 33.89k | +6.69% |

| EMMG AU | Betashares Legg Mason Emerging | 32.52k | +6.69% |

| VHY AU | Vanguard Australian Shares Hig | 61.94k | +6.46% |

| IZZ AU | iShares China Large-Cap ETF/Au | 6.81k | +6.29% |

| VAE AU | Vanguard FTSE Asia ex-Japan Sh | 18.76k | +6.18% |

| QRE AU | BETASHARES AUSTRALIAN RESOURCE | 131.26k | +5.91% |

| QOZ AU | BetaShares FTSE RAFI Australia | 101.99k | +5.78% |

| EMKT AU | Vaneck Vectors Msci Multifacto | 12.99k | +5.34% |

| ACDC AU | ETFS Battery Tech and Lithium | 30.79k | +5.33% |

| ILC AU | iShares S&P/ASX 20 ETF | 36.71k | +5.31% |

| YMAX AU | BetaShares Australian Top 20 E | 80.57k | +5.18% |

| WEMG AU | SPDR S&P Emerging Markets Fund | 4.79k | +5.14% |

| VGE AU | Vanguard FTSE Emerging Markets | 19.08k | +4.96% |

| OZR AU | SPDR S&P/ASX 200 Resources Fun | 29.39k | +4.79% |

| VLC AU | Vanguard MSCI Australian Large | 9.39k | +4.75% |

| MSTR AU | Morningstar International Shar | 18.72k | +4.73% |

| IHWL AU | iShares Core MSCI World All Ca | 16.74k | +4.67% |

| ESPO AU | VanEck Vectors Video Gaming an | 87.81k | +4.61% |

| FEMX AU | Fidelity Global Emerging Marke | 140.41k | +4.56% |

| LPGD AU | Loftus Peak Global Disruption | 153.23k | +4.27% |

| SFY AU | SPDR S&P/ASX 50 Fund | 33.36k | +4.26% |

| IHVV AU | iShares S&P 500 AUD Hedged ETF | 24.98k | +4.18% |

| UMAX AU | BetaShares S&P 500 Yield Maxim | 11.37k | +4.11% |

| CETF AU | Vaneck Vectors FTSE China A50 | 2.49k | +4.10% |

| RDV AU | Russell Invest High Div Aust S | 12.45k | +4.03% |

| IEM AU | iShares MSCI Emerging Markets | 68.64k | +3.96% |

| REIT AU | Vaneck Vectors FTSE Internatio | 25.84k | +3.87% |

| WXHG AU | SPDR S&P World ex Australia He | 5.43k | +3.83% |

| TECH AU | ETFS Morningstar Global Techno | 11.51k | +3.77% |

| HETH AU | Betashares Global Sustainabili | 34.48k | +3.75% |

| VGAD AU | Vanguard MSCI Index Internatio | 85.07k | +3.75% |

| IWLD AU | iShares Core MSCI World All Ca | 9.14k | +3.68% |

| WDIV AU | SPDR S&P Global Dividend Fund | 34.19k | +3.59% |

| IHOO AU | iShares Global 100 AUD Hedged | 1.75k | +3.56% |

| HEUR AU | BetaShares Europe ETF - Curren | 13.53k | +3.53% |

| NDIA AU | ETFS-NAM India Nifty 50 ETF | 2.09k | +3.53% |

| WDMF AU | iShares Edge MSCI World Multif | 5.57k | +3.50% |

| A200 AU | BetaShares Australia 200 ETF | 69.49k | +3.43% |

| IVV AU | iShares Core S&P 500 ETF/Austr | 19.28k | +3.43% |

| SWTZ AU | Switzer Dividend Growth Fund | 52.65k | +3.38% |

| VAS AU | Vanguard Australian Shares Ind | 278.86k | +3.30% |

| IOZ AU | iShares CORE S&P/ASX 200 ETF | 0 | +3.27% |

| CURE AU | ETFS S&P Biotech ETF | 6.00k | +3.13% |

| INIF AU | Intelligent Investor Aus Equit | 24.07k | +3.13% |

| HNDQ AU | Betashares Nasdaq 100 ETF - Cu | 21.33k | +3.01% |

| EIGA AU | eInvest Income Generator Fund | 18.28k | +2.97% |

| DJRE AU | SPDR Dow Jones Global Real Est | 47.37k | +2.94% |

| HJPN AU | BetaShares Japan ETF - Currenc | 25.35k | +2.79% |

| STW AU | SPDR S&P/ASX 200 Fund | 247.04k | +2.77% |

| E200 AU | SPDR S&P/ASX 200 ESG Fund | 2.70k | +2.75% |

| WXOZ AU | SPDR S&P World ex Australia Fu | 3.09k | +2.67% |

| VGS AU | Vanguard MSCI Index Internatio | 85.65k | +2.49% |

| IKO AU | iShares MSCI South Korea ETF/A | 1.65k | +2.48% |

| AGX1 AU | Antipodes Global Shares EQMF E | 2.78k | +2.43% |

| IOO AU | iShares Global 100 ETF/AU | 38.32k | +2.42% |

| ETHI AU | BetaShares Global Sustainabili | 443.89k | +2.40% |

| F100 AU | Betashares FTSE 100 ETF | 90.17k | +2.25% |

| EINC AU | BetaShares Legg Mason Equity I | 5.68k | +2.19% |

| NDQ AU | BetaShares NASDAQ 100 ETF | 393.73k | +2.16% |

| VESG AU | Vanguard Ethically Conscious I | 17.79k | +2.06% |

| AUST AU | BetaShares Managed Risk Austra | 37.12k | +2.00% |

| AASF AU | Airlie Australian Share Fund - | 22.13k | +1.77% |

| INCM AU | BetaShares Global Income Leade | 3.73k | +1.66% |

| VETH AU | Vanguard Ethically Conscious A | 5.80k | +1.56% |

| SSO AU | SPDR S&P/ASX Small Ordinaries | 3.94k | +1.50% |

| MOGL AU | Montgomery Global Equities Fun | 51.15k | +1.49% |

| VMIN AU | Vanguard Global Minimum Volati | 1.97k | +1.46% |

| GOAT AU | VanEck Vectors Morningstar Wor | 3.73k | +1.44% |

| WRLD AU | BetaShares Managed Risk Global | 70.82k | +1.36% |

| QMIX AU | SPDR MSCI World Quality Mix Fu | 10.18k | +1.31% |

| CNEW AU | Vaneck Vectors China New Econo | 95.80k | +1.28% |

| QHAL AU | Vaneck Vectors MSCI World ex A | 23.93k | +1.26% |

| RBTZ AU | BetaShares Global Robotics And | 97.27k | +1.25% |

| HQLT AU | Betashares Global Quality Lead | 6.37k | +1.02% |

| MHG AU | Magellan Global Equities Fund | 298.24k | +0.98% |

| SELF AU | SelfWealth SMSF Leaders ETF | 446.87 | +0.98% |

| ISO AU | iShares S&P/ASX Small Ordinari | 60.00k | +0.89% |

| VDHG AU | Vanguard Diversified High Grow | 63.32k | +0.84% |

| MVW AU | VanEck Vectors Aus Equal Weigh | 93.82k | +0.81% |

| RARI AU | Russell Invest Aust Responsibl | 12.58k | +0.73% |

| WCMQ AU | WCM Quality Global Growth Fund | 87.40k | +0.67% |

| IJP AU | iShares MSCI Japan ETF/AU | 12.57k | +0.63% |

| VSO AU | Vanguard MSCI Australian Small | 19.22k | +0.56% |

| ESGI AU | VanEck Vectors MSCI Internatio | 11.55k | +0.51% |

| VDBA AU | Vanguard Diversified Balanced | 22.90k | +0.44% |

| VEQ AU | Vanguard FTSE Europe Shares ET | 59.35k | +0.43% |

| IIGF AU | Intelligent Investor Aus Equit | 38.99k | +0.36% |

| VDGR AU | Vanguard Diversified Growth In | 18.97k | +0.35% |

| IVE AU | iShares MSCI EAFE ETF/AU | 6.37k | +0.31% |

| ESTX AU | ETFS EURO STOXX 50 ETF | 2.01k | +0.29% |

| AUMF AU | iShares Edge MSCI Australia Mu | 2.26k | +0.24% |

| SYI AU | SPDR MSCI Australia Select Hig | 26.35k | +0.21% |

| IEU AU | iShares Europe ETF/AU | 53.97k | +0.11% |

| QUAL AU | Vaneck Vectors MSCI World ex A | 109.51k | +0.06% |

| HVST AU | BetaShares Australian Dividend | 34.67k | -0.02% |

| DRUG AU | BetaShares Global Healthcare E | 48.74k | -0.05% |

| MCSE AU | Magellan Financial Group Core | 5.40k | -0.29% |

| MGOC AU | Magellan Global Fund/Open Clas | 919.61k | -0.41% |

| VDCO AU | Vanguard Diversified Conservat | 9.51k | -0.46% |

| EX20 AU | BetaShares Australian Ex-20 Po | 33.73k | -0.54% |

| MCSG AU | Magellan Financial Group Core | 6.03k | -0.58% |

| INES AU | Intelligent Investor Ethical S | 62.51k | -0.62% |

| QLTY AU | BetaShares Global Quality Lead | 26.06k | -0.80% |

| IIND AU | Betashares India Quality ETF | 27.31k | -0.88% |

| SMLL AU | BetaShares Australian Small Co | 26.82k | -0.91% |

| MVR AU | VanEck Vectors Australian Reso | 18.57k | -0.92% |

| IHD AU | iShares S&P/ASX Dividend Oppor | 90.47k | -0.95% |

| MVOL AU | iShares Edge MSCI Australia Mi | 66.14k | -0.97% |

| GRNV AU | VanEck Vectors MSCI Australian | 24.48k | -1.44% |

| VBLD AU | Vanguard Global Infrastructure | 12.32k | -1.49% |

| MSUF AU | Magellan Sustainable Fund - Ma | 1.87k | -1.60% |

| IFRA AU | VanEck Vectors FTSE Global Inf | 70.20k | -1.71% |

| IXJ AU | iShares Global Healthcare ETF/ | 18.40k | -1.79% |

| MVS AU | VanEck Vectors Small Companies | 7.30k | -1.99% |

| IMPQ AU | eInvest Future Impact Small Ca | 26.43k | -2.03% |

| FAIR AU | BetaShares Australian Sustaina | 184.68k | -2.18% |

| MVE AU | Vaneck Vectors S&P/ASX Midcap | 10.83k | -2.30% |

| WVOL AU | iShares Edge MSCI World Minimu | 91.72k | -2.35% |

| MCSI AU | Magellan Financial Group Core | 5.94k | -2.37% |

| ZYAU AU | ETFS S&P/ASX 300 High Yield Pl | 33.85k | -2.43% |

| RINC AU | BetaShares Legg Mason Real Inc | 24.84k | -2.49% |

| MICH AU | Magellan Infrastructure Fund - | 458.77k | -2.95% |

| HLTH AU | VanEck Vectors Global Healthca | 24.01k | -3.11% |

| HACK AU | BetaShares Global Cybersecurit | 337.57k | -3.40% |

| BEAR AU | BetaShares Australian Equities | 59.05k | -3.50% |

| VAP AU | Vanguard Australian Property S | 48.47k | -4.46% |

| MVA AU | VanEck Vectors Australian Prop | 92.55k | -4.53% |

| SLF AU | SPDR S&P/ASX 200 Listed Proper | 83.72k | -4.56% |

| ATEC AU | BetaShares S&P/ASX Australian | 59.38k | -4.82% |

| IXI AU | iShares Global Consumer Staple | 4.05k | -7.75% |

| BBOZ AU | BetaShares Australian Equities | 2.46M | -8.13% |

| BBUS AU | BetaShares US Equities Strong | 4.70M | -10.16% |

| MNRS AU | Betashares Global Gold Miners | 59.23k | -13.47% |

| GDX AU | VanEck Vectors Gold Miners ETF | 28.17k | -17.39% |

But if you’re determined to let cheesball-munching basement dwellers tell you how to spend your retirement fund, at least consult some kind of research.

Research like that conducted by redditor drfreshbatch who’s tracking the peformance of Australia’s top two stockpicking subreddits, r/asx_bets and r/ausfinance.

They have very different philosophies. One takes a long-term conservative stance, the other “a meme-filled, hype centre where users shitpost about their massive wins and losses that happened overnight”.

Can you guess who’s winning in 2021?

We need to preface this by letting you know Nick Sundich has a raw, untamed passion for being in or near a plane. We know, because when he (unnervingly often) blags a Business Class seat, we get the selfies and it’s clear he is experiencing The Rapture.

So it’s been a tough 12 months for Nick, despite him still squeezing a lazy 12 domestic flights in. And the best flight of all, the “Flight to Nowhere” in October.

Nick’s second passion is collecting Qantas points, also tough in times of restricted travel. Or is it?

He managed to pull 27,800 points from his domestic flights. But get this – Nick’s total Qantas points haul for the past 12 months is a whopping 200,805 points.

Sorcery! How did he do it?

This is an epic tale of extraordinary commitment, going to bed early, and buying three reusable fruit bags “just to get over the line”.

The 2010s haven’t been kind to Myer. They started well with a $3.60 peak (Oct 2010) and it’s been a steady disintegration since – $3.00 (April 2013), $1.72 (Feb 2015), $1.38 (Dec 2016) and entering small cap status at 70 cents (April 2019).

The retail giant hit a low of just 14 cents as the Covid lockdown hit in March last year, and a valuation of around $120 million. About half a week’s pay for Twiggy Forrest that year.

Covid, huh. Suddenly, Myer has shed 10,000 employees, collected $51 million in Jobkeeper payments, cut operating costs by $80 million, and seen online sales grow by 71% to $287.6 million.

And guess what? The retailer that was worth $120 million a year ago just reported a statutory net profit after tax of $43 million, up by 76 per cent from the previous corresponding period.

Investors… don’t care. But maybe they should, because according to the latest Stockhead IPO watch, almost all retail debutantes in the last 12 months are above their IPO price.

It’s 1985, and you’ve just spent three hours programming your BBC Micro, hit return and just like magic… “Pod can jump”.

Congratulations. Here’s your rock-star reception:

So you go home and tell your mum that all those 0s and 1s could one day be sold for a couple of billion dollars a year, and she reassures you that she’ll still always love you no matter what.

Only now it 2021, and your Australian-owned and operated tech hardware, software and cloud distributor’s total revenue just surpassed $2 billion for the year.

Congratulations, Dicker Data (ASX:DDR), for sticking with the sector that’s about as sexy as a weekend in a privately hosted staging environment configuring Mark Zuckerberg’s endpoint.

DDR’s share price has rocketed by 70% in the last 12 months. In fact if you’d laid money down on its IPO 10 years ago, you’be enjoying a near 60-fold increase today.

And no, Dicker’s not the only Australian data services play enjoying a stellar run right now.

Handout Watch – who had February 26 in their trading diaries as the day Health Minister Greg Hunt handed out goodies from the Medical Research Future Fund grab bag?

About $100 million worth, in fact, and three small cap biotechs were very glad they suffered the paperwork.

Micro-X, 4D Medical and EMVision collected $8 million, $8 million, and $28.9 million respectively. All are in the medical imaging business.

EMvision shares rose 20 per cent and Micro-X shares rose 9 per cent on the news. 4D shares popped a little to $1.83, but crumbled to $1.65 after the company immediately announced a Proposed Issue of Securities at $1.55 each.

Still, the feds know how to back a winner.

4D has still more than doubled since its IPO last August, EMvision is up over 500 per cent in two years, and MicroX is up 350 per cent since June.

Let’s stop fannying about and keep it simple.

These are the best performing ASX small caps for February. No arguments, because numbers don’t lie.

And the biggest fish was a whopper – Canberra Casino owner Aquis Entertainment, which rose something 1000 per cent in a day.

Why? In Reuben Adams’ words – “dunno”.

It was a decent month, February. There are 31 other more ASX small caps that at least doubled their share price.

So your lithium stocks are still making life very cushy for your nest egg?

It was certainly almost a very good week for Piedmont Lithium fans – the ASX “Tesla” stock. It put on a good 20 per cent, boosted late in the week by news the WA Supreme Court was cool with it asking shareholders if they’d like a primary listing to the US for PLL.

But then, because for some reason lithium stocks seem tied to tech routs, the rug got pulled:

High-flying lithium-ion battery maker Magnis Energy Technologies (ASX:MNS) reported exciting results in its testing of the fast-charging battery cells. It reckons the capacity retention of its batteries survived 600 cycles with 30 minutes discharge and charge. And it’s closing in on delivering an 85% charge in six minutes.

But wait, wait – advances in batteries have the price of an average pack has fallen from $US290/kWh in 2014 to $US110/kWh, and if we can hit $101/kWh, we can build, sell and make just as much profit from EVs as we can from internal combustion vehicles.

Unless, of course, we all get so frothy about lithium stocks that we just end up financing demand for the stuff, rather than the supply of it.

Nissan’s global head of energy has something serious to say about that. And you better take him seriously, because his name is Zoltan.

This is the catalytic converter inside your car’s exhaust:

Crack it open, and you’ll find this:

It’s like a sweet, sweet nut, except it’s filled with PGEs like platinum, palladium and rhodium.

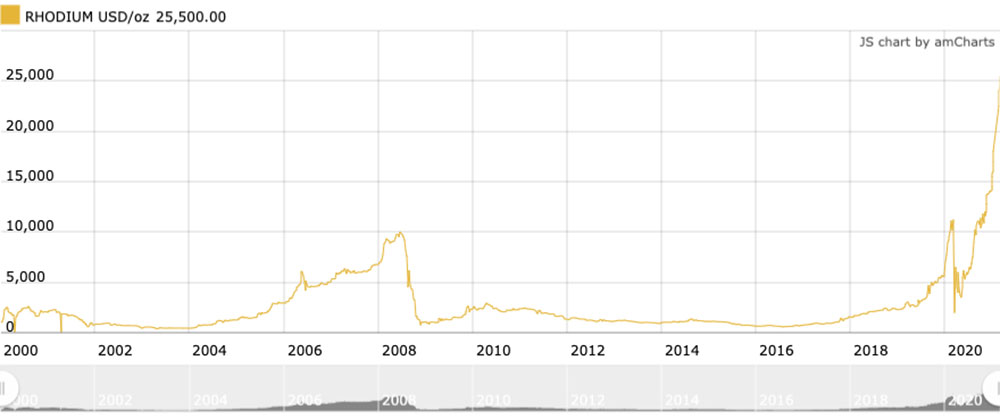

Here is the 20-year price chart for rhodium:

Here is the bull case for palladium prices hitting prices 10x what they were a decade ago.

And here’s how to legitimately get your hands on PGEs like platinum, palladium and rhodium without rummaging around under your neighbour’s LandCruiser at 2am. And experimenting with acid leaching or molten fire.

That’s it for this week. Good bye, and good luck.