Kick Back: The 10 biggest stories you might have missed on Stockhead this week

News

News

It’s Friday and well, now, it’s been some kind of a week.

Time to sit back and enjoy The Don enjoying his victory:

No, really. That’s quite enough US election coverage for one week/year/life. And we reached Peak 2020 on Wednesday when North Dakotans gave one of their seats to a guy who died from COVID-19 a month ago.

So let’s just get back to the money. Here’s what you could well be forgiven for having missed this week on Stockhead:

Is the buy-now-pay-later boom a bubble?

Maybe, when you consider this – BNPL stocks on the ASX have risen anywhere from 145% to 1,688% since March 23.

Crivens.

There are one of two mildly rational reasons for that though. One, they were coming off a low base driven down when Covid hit. And two, they’re kind of a new thing. And Dean Fergie from Cyan Investments (an early investor in Afterpay) says that rush to market is a relevant factor in assessing the BNPL bubble.

Yes, we got a couple of experts to help us here, because with BNPL services still only applied at less than 20 per cent of Oz retailers, this run could go on for a while yet.

Fergie has now relegated himself to “market watcher” in the BNPL, as has Equitable Investors fund manager Martin Pretty. Why?

“If you look at Afterpay’s valuation, it’s indicating fairly extreme long-term sales growth,” he said. “Pretty constant margins, no blowouts in bad debt, not much in terms of significant competitor behaviour.

“So it’s really optimistic…”

You can read more about their case for a BNPL bubble here.

Our new shiny thing comes from a trader who exists somewhere in the shadowy realm between “high-flying LSE wunderkind” and “happy to blag a $20K trading account to muck around in ASX small caps”.

We only know him as “Bottom Picker”. But in his first week, he turned in a handy hypothetical $400 and case of Toohey’s New with a series of sharply executed trades on FMG as it bounced around.

This week, the pickings could only be described as slim to negative. But there’s a lot to be learned here from a pro about damage control, working a watch list and why $20 is nothing to be sneezed at.

Especially if it means steak in your sandwich for lunch instead of cheese.

It’s called Confessions of a Day Trader, and it’s edge-of-your-seat stuff.

October is over and we all know what that means, right?

Yes! It’s time for another list of ASX-listed small caps posting gains of 100 per cent or more in the month!

And this time it’s a bit rubbish. Only 25 small caps cracked the tonne – a big drop from July (58), August (51), and September (35).

There were a couple of unexpected surprises, though. An exploration wave delivered at least five legit mineral discoveries, including spectacular nickel-copper-PGE bearing sulphides intersected at Estrella Resources’ (ASX:ESR) flagship Carr Boyd project which gave the stock 10-bagger status. (That’s “up 1015%”.)

The other big riser was Douugh (ASX:DOU), the wealth management platform that entered the ASX early in October through the reverse takeover of Ziptel (ASX:ZIP). It now sits up 741%, and we’ve only just begun to tap our supply of bread-related puns.

Enough nonsense – here’s the October scoresheet.

This is a biohacker’s electric dream:

Not a B-grade movie scene. That’s actually circuitry printed on a real human’s hand, and it provides real data in real time to real researchers from China and the US.

They found a way to apply silver to skin at a temperature that doesn’t, well, take the skin off, even when you remove it again.

Basically, your Fitbit levelled up. But for Not Gold fans out there, it’s yet another use we’ve found for silver, which already doesn’t need a leg up. Investor holdings in silver Exchange Traded Products have nearly tripled year on year in the September quarter.

And yep, you guessed it – here’s our rundown on ASX silver stocks enjoying the sun in 2020.

There was a good time once before the big sites stole all the Google juice when a journo could write “peak oil” in a headline, send it out to the cyberweb and log off for a very long lunch, knowing the day’s traffic targets were taken care of.

But that was back when a Tesla wouldn’t make it through a Sydney commute. Now we’ve got one whizzing past Mars, and “peak oil” refers to oil demand, rather than an apocalyptic vision of what happens when it costs more to extract from the Earth than anyone can feasibly pay for it.

The short version is, the impact of the phrase “peak oil” has changed, because people have changed, which is actually a thing worth noting.

And Norwegian energy intelligence firm Rystad Energy has just pulled its projection for when we reach peak oil (demand) back two years to 2028. And there’s a very modern reason why that nobody would have predicted 12 months ago.

Hello?

Fine, here’s another quick US election update then:

In the most 2020 week of 2020 – so far – even the Reserve Bank of Australia found a way to make the front page. We all stopped briefly for the big race, then returned to our desk to find our central bank had announced something unprecedented. To wit:

What does it mean? If you have to ask, you’re probably much better off not waiting for the answer and just keep enjoying life as it rolls.

Generally though, a weaker Aussie dollar, and increased borrowing. That potentially means a lot of bad businesses get the chance to stay open and lose money a bit longer, instead of going bust as evolution intended.

But that’s great news for these ASX stocks in the lending sector, obviously, and certain tech stocks.

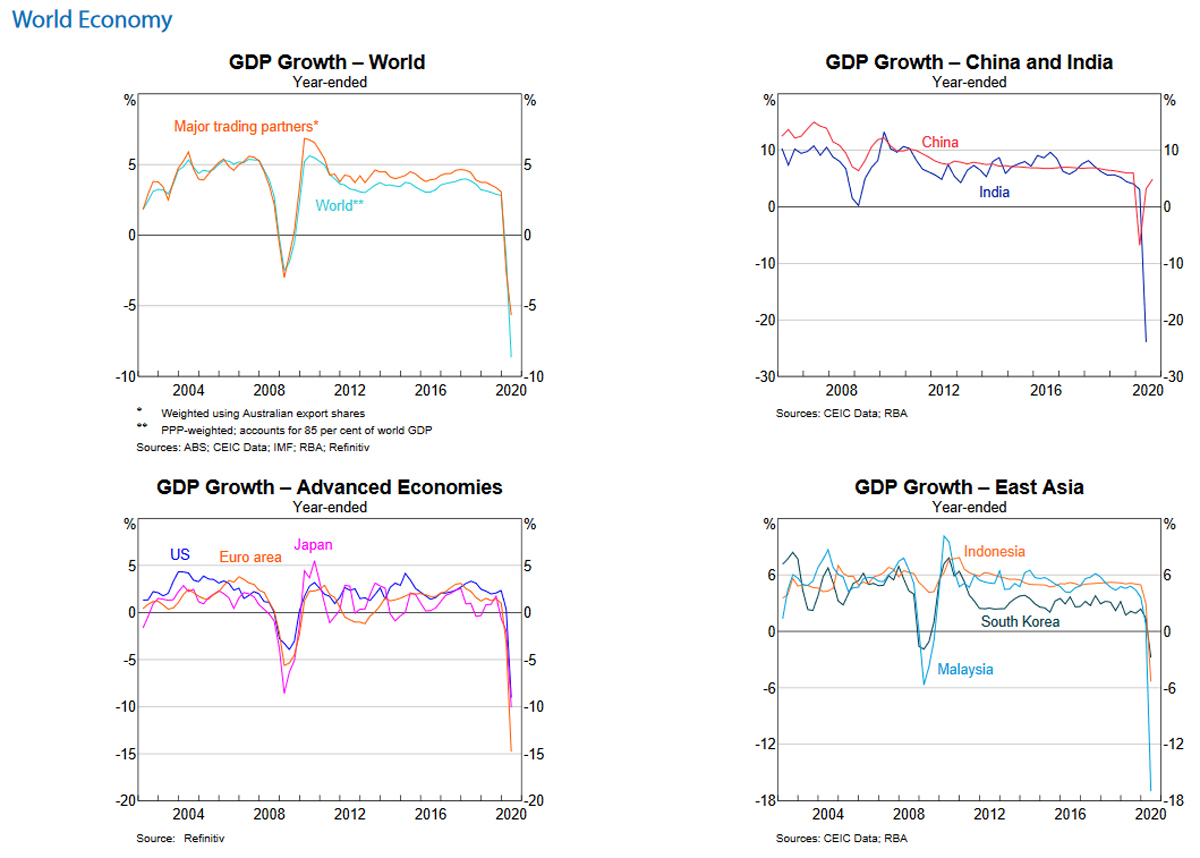

BONUS: The RBA’s chart set that accompanied the rate cut announcement also opened with this cheery set:

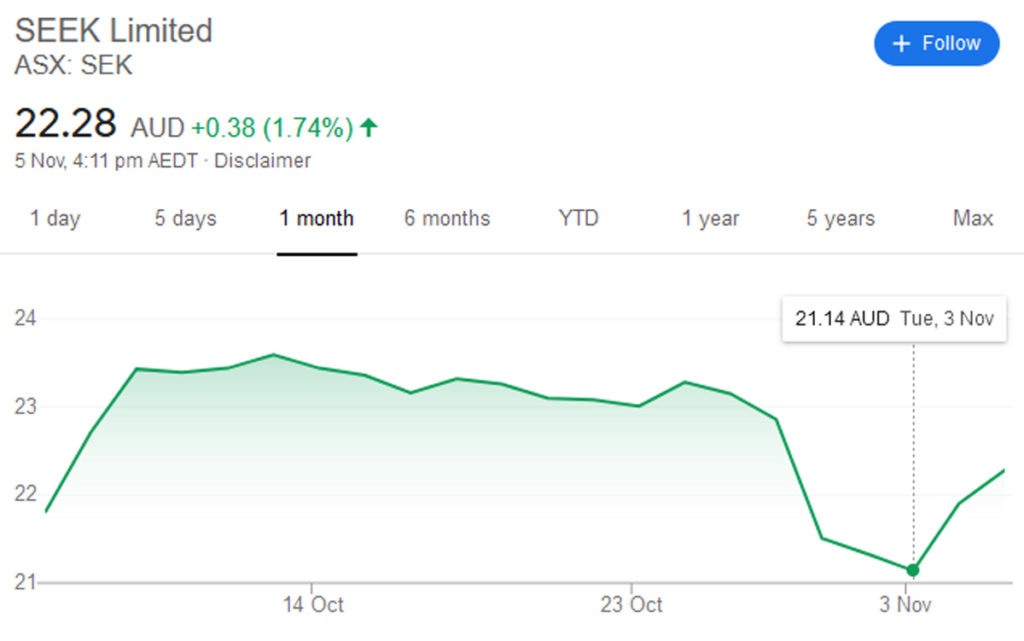

While we’re doing charts, here’s one to strike fear into the most seasoned Moon Patrol pro:

That crater belongs to short-seller Soren Aandahl. You might know him better from such hits as the one he laid on Blue Sky in 2018, causing it to drop from at $1 billion valuation all the way into receivership.

Aandahl now has his own short-selling firm, Blue Orca Capital, and it has released two reports against Seek. Here’s why he reckons Seek is only worth $7.20 per share – approximately only a third of its current price.

Come December 4, we probably still won’t know who’ll be leading the US for the next four years. We may have a COVID-19 vaccine, but even if we do, you can bet your children on it that Paleo Pete and the Crackpot Karens will ensure a deep genetic pool of liabilities will always keep lockdown on the radar somewhere for the rest of us.

We already know cash is as cheap as it gets. And we also know that in 2020, the telehealth industry has exploded because lockdown laws and anxieties over physical consultations have left patients with little or no other choice.

So it’s hard to see the December 4 IPO of UK-based telehealth specialist Doctor Care Anywhere – whose consultations grew 292 per cent in the past 12 months – being anything less than… popular.

Timing. Is. Everything.

Here’s everything you need to know about the ASX’s second telehealth IPO of 2020 following Intelicare (ASX:ICR), which listed in May. And here’s exactly how good 2020 has been for ASX telehealth stocks:

| Code | Company | Price | Market Cap | %SixMth | %Yr |

|---|---|---|---|---|---|

| GLH | Global Health Ltd | 0.41 | $19.4M | 183 | 165 |

| RSH | Respiri Limited | 0.175 | $118.7M | 150 | 106 |

| HMD | Heramed Limited | 0.135 | $14.9M | 35 | -18 |

| 1ST | 1St Group Ltd | 0.037 | $14.9M | 23 | -41 |

| RMD | ResMed Inc. | 29.11 | $10.6B | 22 | 36 |

| LVT | Livetiles Limited | 0.245 | $216.5M | 9 | -20 |

| ICR | Intelicare Holdings | 0.26 | $10.2M | 0 | 0 |

| ADR | Adherium Ltd | 0.026 | $14.9M | -10 | -43 |

| ONE | Oneview Healthcare | 0.044 | $7.5M | -24 | -82 |

| PCK | Painchek Ltd | 0.088 | $96.9M | -41 | -67 |

| RAP | Resapp Health Ltd | 0.083 | $65.2M | -50 | -72 |

We’re kind of close to Joe Biden becoming the next US President, which kind of means fiscal stimulus and the spending will probably increase. That, according to director of Perth-based financial services provider RM Corporate Finance, Guy Le Page, will put a lot of pressure on the US dollar and probably continue to drive up gold.

Generally, Le Page feels the stars are aligning again for gold, but as we track slowly towards some certainty, opportunities are opening up in iron ore and nickel.

So Le Page, who is a geologist as well as a stockbroker, and should know about such things, has picked out a couple of solid performers in small cap resources, who are suddenly looking a bit undervalued.

Not many in coal, though. Mike Cooper ran the ruler over a bad week for black diamond stocks, which has turned into an even worse outlook. But there are some showing all hope is not yet lost.

Score! The Secret Broker went for a steak sandwich and left his laptop on again! That means we get to raid his inbox for replies to emails from hopeless stock forum addicts, bad gamblers and confused mistresses.

Obviously we don’t trawl too deeply. That would be unethical and very likely dangerous for our mental health.

But a couple of the rare safe for work ones were floating around the top, so here’s another peek into his delightful, sometimes unsettling, relationship with TSB fans.

Thanks for listening. Let’s see what Monday looks like.

…

Okay, one more:

A quick recap of all the highlights from today.#USElection #USElection2020 #CricketWorldCup99 pic.twitter.com/T3nxCKRr4e

— David Moore (@morteinmooie) November 5, 2020