You might be interested in

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

Mining

Rock chip revelation: New gold zone at Mako’s Tchaga North returns up to 76.10 g/t

Mining

News

The world is rocking an “end of days” vibe as mass panic buying gets out of control, with this week’s product of choice being… toilet paper?

It’s got so bad that one man was robbed at knife point in Hong Kong just so someone could acquire 600 rolls of toilet paper!

It doesn’t end there… toilet paper is dominating the headlines, with the Australian media reporting things like this: “Coronavirus: Truckload of toilet paper catches fire in Brisbane”.

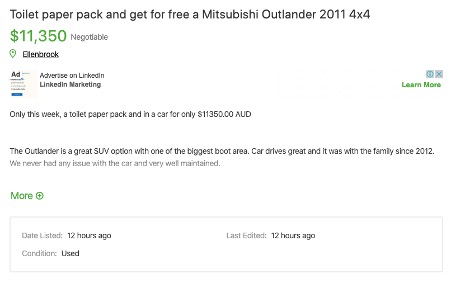

And then there’s the opportunists:

Insanity! Time to stock up on canned goods and ammo.

Now, here’s what you might have missed on Stockhead this week, but everyone else didn’t, and liked the most.

Anything with coronavirus in the header is definitely clickbait for readers right now. Or could this just be the battery metals fans getting a whiff of hope that they made the right punt?

Industry players say Chinese lithium chemical demand will increase in 2020, despite the growing impact of coronavirus on global markets.

A survey done by S&P Global Platts included 15 battery metals producers, three traders, four consumers and three investors … and a partridge in a pear tree (sorry wrong song!).

And good news for those who have sunk a lot of cash in battery metals — about 75 per cent of respondents expected lithium demand to increase in China, the world’s biggest market.

Read on to see just what else S&P found out in its survey.

Gold is still top of investors’ minds, and the offer of seven potential moneymaking opportunities didn’t slip past our savvy readers.

With the gold price breaking a few new Aussie dollar records recently, the small cap gold players nearing production have started to look mighty attractive to investors.

So why is gold such a good thing to have in times of crisis?

What’s so hot about the Youanmi I hear you ask… Well it all comes back to Spectrum Metals (ASX:SPX) launching into the stratosphere late last year after hitting bonanza gold grades at the historic Penny West gold mine in WA.

And it just so happens Rox Resources (ASX:RXL) is in the very same neighbourhood.

All eyes are on Rox as it waits to find out just what it is sitting on in the Youanmi.

We thought our readers might want to know what all the fuss about porphyries is – after all just about every junior explorer seems to be chasing one. Ok maybe not every junior but a fair few of them want a big porphyry payday.

And why wouldn’t they? These things can be massive and can be company makers.

Reuben Adams runs through everything you need to know about porphyries.

Investing in the current panic-fuelled market is like playing a game of chess – investors want to know what their next move should be, so they don’t end up hearing “checkmate”.

Last week the markets took its heftiest beating since the global financial crisis. Translation: not good for listed companies and their share prices.

But there is a silver lining, in the form of stocks making money from coronavirus.

See for yourself which stocks bucked the pull of the dragging market.

Gold, gold and still more gold. Though, this time it’s about another really hot gold jurisdiction – PNG.

Gold Mountain (ASX:GMN) chief executive officer Tim Cameron told Bevis Yeo this week that the top five discoveries in the country average about 20 million ounces of gold and/or 20 million tonnes of copper equivalent in global resources. Impressive.

So just what is so great about it?

The shift towards ethical investing has recently become a much more prevalent concept in financial markets.

But the lucky ones are going to be the ones who were way ahead of their time and are now just kicking back and cruising along as the rest of the stragglers struggle to catch up.

Listed small cap Australian Ethical Investment (ASX:AEF) is one company that isn’t arriving late to this party – it started ethical investing 34 years ago.

And it is racing ahead in what is now a $30.7 trillion industry.

As a trusted safe haven in times of economic crisis, gold usually rallies amid nasty stock selloffs like this one. So it seemed like this week’s drop in gold and gold-facing equities was a strange thing to happen.

But there’s nothing like some sage words from a prominent figure to reassure us all will be well in gold for a long time.

“If you look back to 2008 yes, gold sold off immediately [which] scared many of the faithful – but then it came back very, very, very strongly,” renowned investor Rick Rule said at this week’s Prospectors and Developers conference (PADC) in Toronto, Canada.

Find out what else he had to say and the week’s winners and losers.

Our readers clearly want this coronavirus debacle to end and news of a possible vaccine in just three months has obviously sparked their interest.

Of course, not long after news broke that the Israelis could have a vaccine in 90 days, the Americans stepped up to say they are working on a vaccine too… but theirs will take 18 months.

Israel had a four-year head start on the Americans, but they were trying to cure chickens.

Read all about how they think their chicken vaccine can help humans.

Investment bank UBS revealed this week how it thought the coronavirus would hit stock earnings and economic growth – and even the base case was not pretty.

Bad news people — negative growth expected this quarter and possibly next quarter if things don’t improve.

Doomsday preppers are likely in full prep mode now with the ‘R’ word being mentioned more often these days.

Nick Sundich runs through just what will cause this negative growth.

We hope the zombies don’t start turning up! Have a good weekend!