Investors ditch airlines, big pharma for old energy, anything Elon-related: Likeable eToro analyst

News

News

Around the world, retail investors are spitting out their meds and ditching their A380s amid a second quarter global exodus from a rich choice of underperforming majors.

That’s the word from eToro’s approachable, intelligent but ultimately professionally distant Australian analyst, Josh Gilbert.

Mr Gilbert, from Cornwall in the Old Country and possibly dressed casually in an open necked Paul Smith with matching cuffs, has been poring over eToro’s growing cache of quarterly stocks data from the social investing network’s platform.

Also, I think they’re sponsoring the Wallabies. (How’s that for risk-on behaviour!)

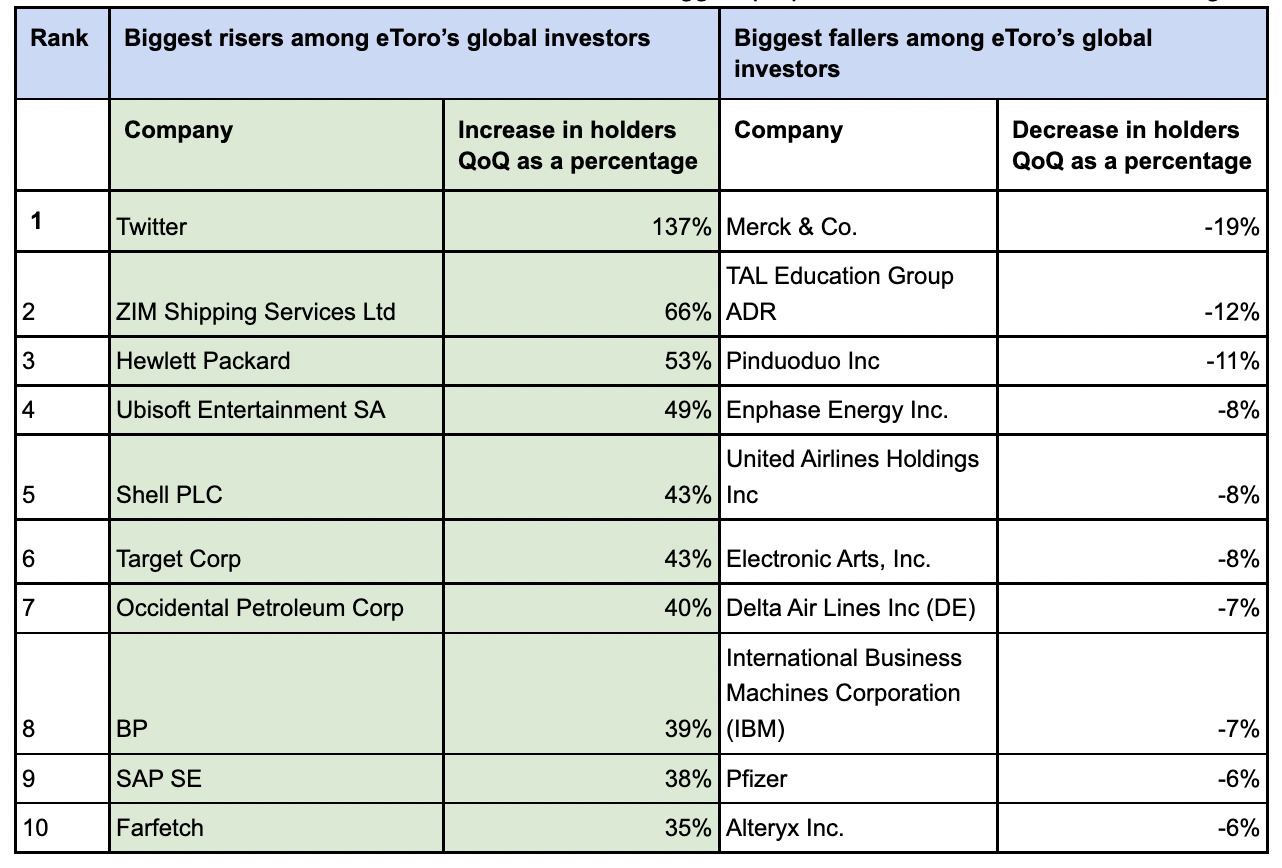

Analysing the largest proportional increase and decrease in stockholders over a torrid second quarter for investors, Mr Gilbert – no relation to the ball, and who is almost certainly lithe and athletic this morning after his weekly regimen of investment data and pure mathematics – says eToro investors gave up positions in airlines in their droves between April 1 and June 30.

Like rats deserting a falling plane, United Airlines lost 8% of global investors on the previous quarter, Delta Air Lines, 7% and American Airlines Group, 6%. All making the unwanted list of worst performers.

That’s bad luck for the International Air Transport Association which just made a song and dance about how the airline industry will return to profit next year “as pent-up demand for travel sustains bookings even as the global economy tightens”.

The trade bloc even reckons sectoral losses this year are only going to amount to US$9.7bn – that’s not even double figures!

It is, however, a better score than the $11.6bn deficit predicted at the last hoo-ha in October ’21.

“Industry-wide profit should be on the horizon in 2023,” a really, really upbeat IATA boss Willie Walsh told airline chiefs on Monday at the annual meet in Doha.

Anyway.

Also abandoned – the pharmaceutical giants Merck & Co (-19%), and Pfizer (-6%) and Bayer AG (-6%).

Here in Australia, Josh notes the highest pharma falls in Australian holders were Merck & Co (-10%) and Moderna (-6%), while AstraZeneca sorted out its COVID-stuff and saw holders pile in, lifting by 49%.

At the other end of the spectrum, the biggest riser QoQ was Twitter, which saw a near 140% jump in holders.

That’s on the back of Elon Musk’s dalliance and public declaration of intent to buy the thing back in mid-April.

Also winning friends and influencing portfolios, Shell and BP – both of which enjoyed significant increases in popularity amid the worsening energy crisis and consequent global surge in gas and oil prices.

Josh says the number of eToro investors holding these stocks jumped 43% and 39% respectively.

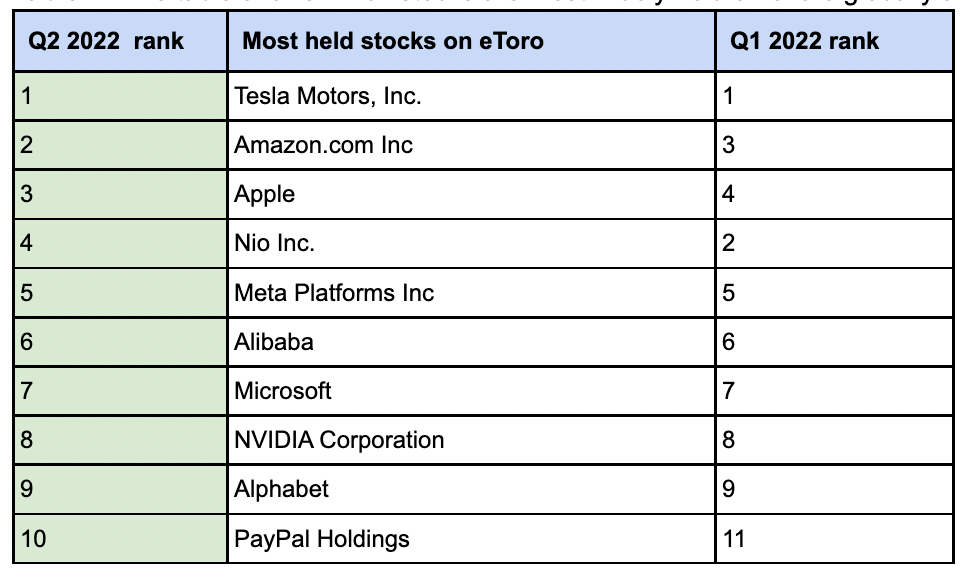

Despite the recent market sell-off, the most popular stocks remain tech-dominated.

Amazon and Apple, Meta, Microsoft and Alibaba were well above Alphabet, further down the list.

But the day belongs to Tesla.

As reported by this stunning publication, Tesla reported lower-than-expected Q2 vehicle deliveries over the weekend, snapping a two-year streak of gains.

The world’s largest EV manufacturer delivered 254,695 vehicles worldwide, a more than one quarter increase year-on-year, but falling short of Wall Street estimates and significantly lower than the previous quarter’s record.

“This report is as closely watched as its earnings, as it effectively gives us insight into its financial performance,” Josh says. “Certainly, these figures do not provide a complete picture of Tesla’s Q2 earnings coming up on July 20th, but it doesn’t paint a pretty picture.”

The Cornish Conundrum says strict lockdowns in China, where Tesla has a huge production facility in Shanghai, likely impacted capacity.

“This low delivery number may help the bear narrative case against Tesla, however, bears shouldn’t get too excited.”

The problem for Tesla Josh reckons, is Elon’s broom-broom is just too damn popular.

“Demand is significantly outstripping supply.”

Tesla is already trying to address this by increasing production at its Berlin and Austin factories – giga-hubs or something like that, they’re called.

“This’ll likely result in greater deliveries during the second half of 2022 and into 2023. In spite of that, these factories are coming at a huge cost, with Musk noting they have pumped billions into the new sites.”

Tesla shares are shook down about 35% this year; a victim of the broader tech sell-off, rising recession fears, and Elon Musk’s prospective Twitter takeover. The bottom line is that this was a pretty bleak delivery number from Tesla, Josh says.

“Despite this, markets may focus on the outlook for the rest of the year, which from its statement, seems optimistic. Demand remains elevated and will likely only continue to grow given record-high fuel prices globally.”

Meanwhile, Gilbert adds: “Investors have also taken the long view and held onto their ‘big tech’ favourites even as many have been battered in the stock markets this year. This may ultimately be rewarded as they are still growing strongly, with high profit margins, and have fortress balance sheets.”

Showing the local sensitivity to Musk power, Australian holders went totally nuts for Twitter, which literally tripled in popularity.

Ubisoft Entertainment (90%), Unilever (81%), BP (80%), and Shell (73%) all enjoyed outsized gains.

Josh, unflappable at the best of times, was totally unmoved by the result.

“It is no surprise that Twitter had the biggest increase amongst Australian investors amid its high profile take over from Elon Musk. This news has significantly captured investors’ attention, with many feeling the world’s richest man could be exactly what Twitter needs to take it to the next level.”

He says we’re also increasingly adding defence assets to our portfolios.

“From consumer staples in Unilever, to healthcare in AstraZeneca. Investors down under are staying confident for the eventual upturn in markets as we can see from the consistency of the top 10 most held assets, but are adding defensive stocks to their portfolio to help to better manage risk.”