Interest in upcoming bitcoin halving hits all-time high

Coinhead

Coinhead

Bitcoin (BTC) recovered midweek losses, spearheaded by a 6.8 per cent gain in value on Thursday.

BTC dropped 2.6 per cent over the course of the week with a late rally on Thursday. Alt-coins Ripple (XRP) and Litecoin (LTC) followed, moving down 3.2 and 7.9 per cent respectively over the same period.

Reports of institutional investor inflows rallied the Ethereum (ETH) market with gains of 1.6 per cent overall thanks to its 13.1 per cent increase on April 16.

Despite the recent price declines, digital assets are still outperforming the S&P ASX Small Ordinaries index (XSO) this year. ETH is leading with a substantial 47.6 percent year-to-date gain.

| Asset | Percentage change between April 10th - 17th | YTD return (Jan 1st - April 17th) |

|---|---|---|

| Bitcoin (BTC) | 0.0971 | 0.1032 |

| Ethereum (ETH) | 0.0162 | 0.4755 |

| Ripple (XRP) | -0.0324 | 0.1038 |

| Litecoin (LTC) | -0.0787 | 0.155 |

| S&P ASX Small Ordinaries (XSO) | 0.054 | -0.2035 |

Source: BTC Markets

As a result of the week’s price movement, the total mark capitalisation for digital assets is down. It moved from $333bn to $320bn after hitting a seven-day low of $295bn, according to Coin Market Cap.

BTC’s volume declined along with its price. This suggests the slight price slump could be short lived. Its recent uptick on April 16 was made on above average volume. This indicates latent strength in the market.

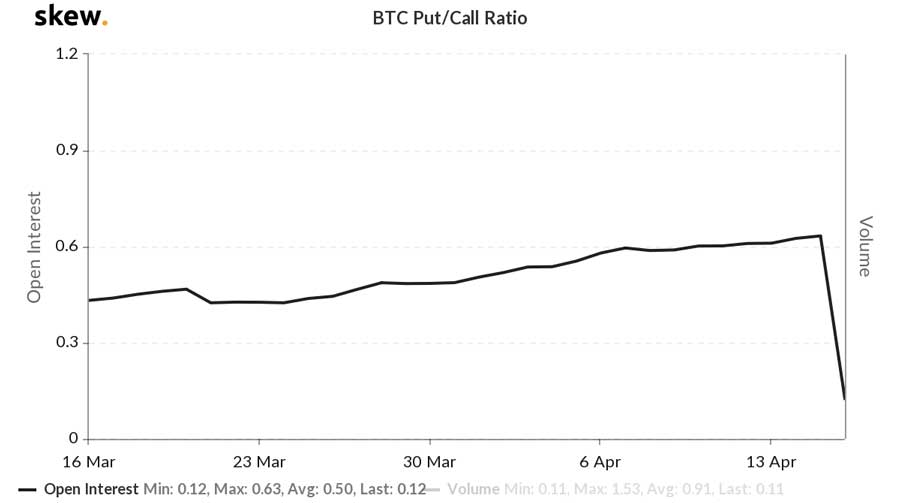

BTC’s put:call ratio had been steadily increasing over the past week from 0.59 to 0.63. However, it shot to 0.12 in a single day after BTC’s recent price gain. This can be considered a strong bullish signal.

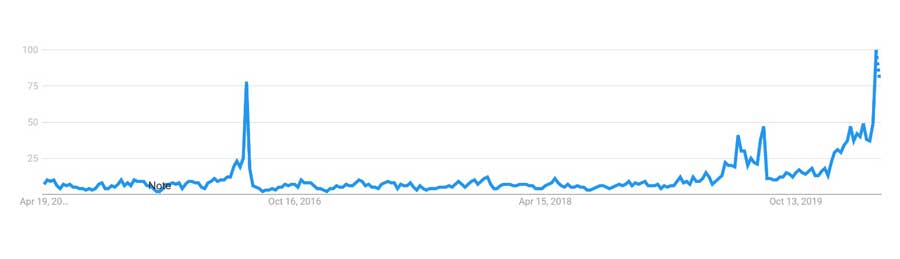

Global interest in the upcoming BTC halving has hit an all-time high. Halving is a process built into the code of BTC which halves the mining reward every 210,000 blocks mined.

The below chart shows search interest on Google for the term “halving” over a given period. A value of 100 shows peak interest in that search term.

The previous spike was from June 2016, the last BTC halving. Despite the current world health and financial crises, the interest in BTC remains strong. The timing may be due to the previous bull-run as a result of the 2016 event.

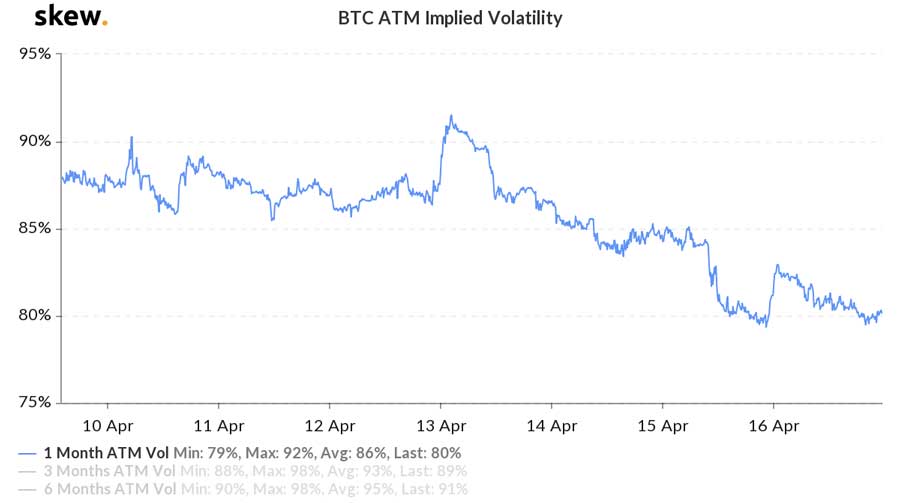

BTC’s one-month implied volatility is once again moving down, hitting a new low of 79 per cent on April 15. Further increased price stability can be expected as the index continues to move lower. It currently sits at 80 per cent.

By comparison, the S&P ASX200 VIX volatility index has increased since last week, moving from 30 per cent to 33.