Here are the top 10 ASX investment funds for the 2020 financial year

News

News

Healthcare and tech were fund-manager favourites in the 2020 financial year, Mercer’s latest ASX investor survey shows.

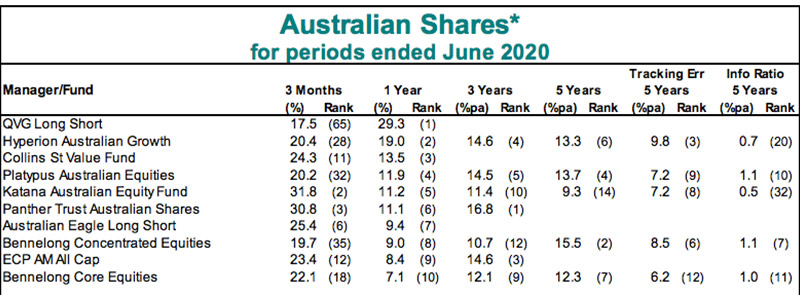

QVG Capital’s long/short fund came in first place out of 138 funds, posting an annual return of 29.3 per cent.

That included a gain of 17.3 per cent in the June quarter, where the barnstorming market rally proved to be a rising tide that lifted the performance of fund managers across the board.

Forager’s Australian Value fund topped the Q4 rankings with a gain of 39.6 per cent — except it was still down 17.3 per cent for the year.

Here’s the Top 10 for 2019/20:

Mercer’s Ronan McCabe said that by sector, healthcare and IT were already leading the way before the COVID-19 disruption.

But since March, the pandemic has also given rise to additional tailwinds.

“Stocks in Healthcare and IT have performed very well as the market has focused on healthcare solutions” along with a “favourable view towards online and remote working products and services”, McCabe said.

“It is reasonable to expect this trend to continue for the foreseeable future.”

He added that the unprecedented spike in volatility this year has also provided an opportunity for active money managers to establish their value proposition, after a decade of steady growth and low interest rates when active strategies struggled to outperform the market.

Along with healthcare and IT, consumer staples stocks (such as supermarkets) also outperformed, while financial stocks lagged alongside energy and real estate companies.

Mercer said said funds which deployed what it called a “targeted volatility” strategy had the least-worst result, posting an annual loss of four percent.

Across the board though, all funds management sectors on the list recorded a negative return over the past 12 months. QVG, the market leader, offset some steep falls by competitors in the long/short investment category, which posted a median loss of 5.9 per cent.

The median loss for “long only” funds, which make up the vast majority of funds in the survey, was -7.7 per cent.

But after a rocky year, those returns will still enough to outperform the broader ASX300 index by around three per cent.

“Investment styles often explain a large part of the relative performance of investment managers, and this was the case in this recent period,” McCabe said.

“We have seen time and time again that the benefits of active management are most evident in more challenging markets and this continues to be the case.”