Going viral: Don’t go catching falling knives

News

Welcome to our wrap for investors of the key coronavirus news this week.

Australian cases: 2,676

Australian deaths: 11

Global cases: 471,060

Global deaths: 21,283

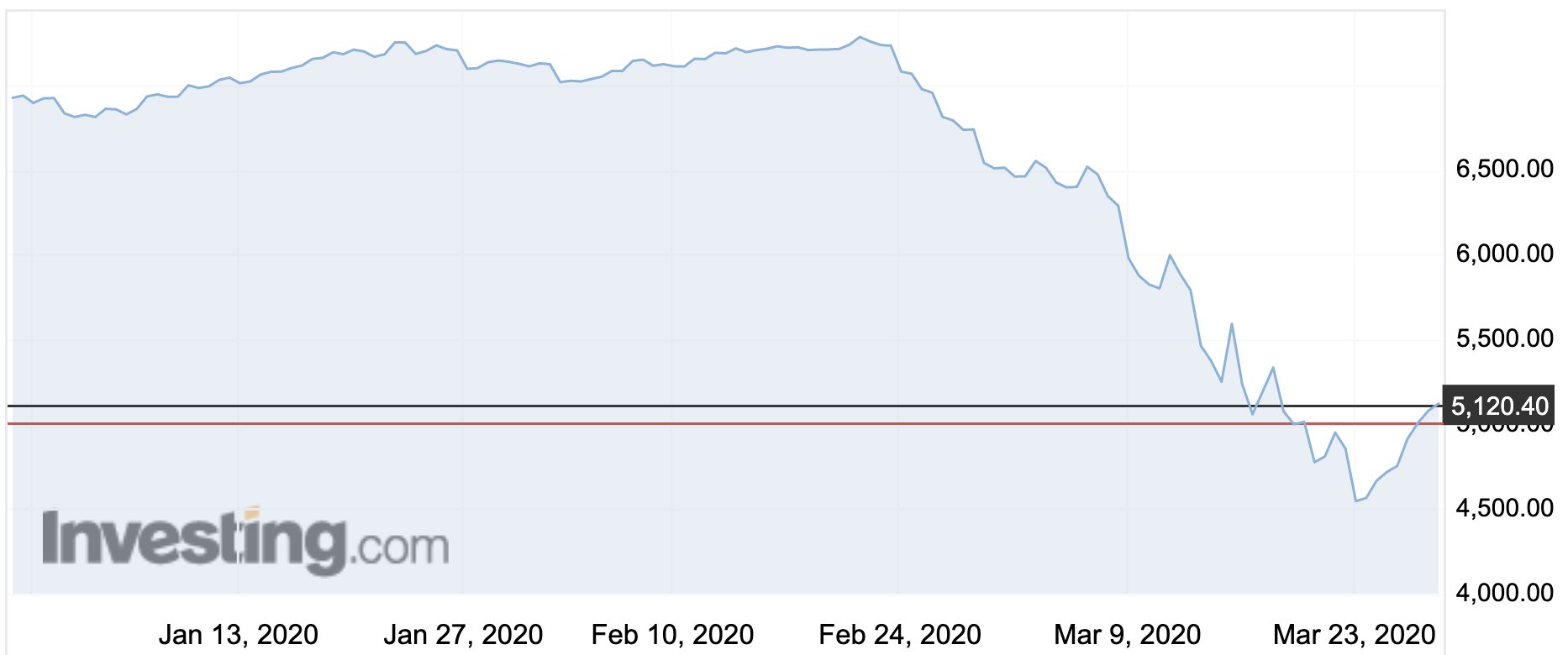

The ASX All Ordinaries closed up 2.28 per cent on March 26 at 5,120.40 points.

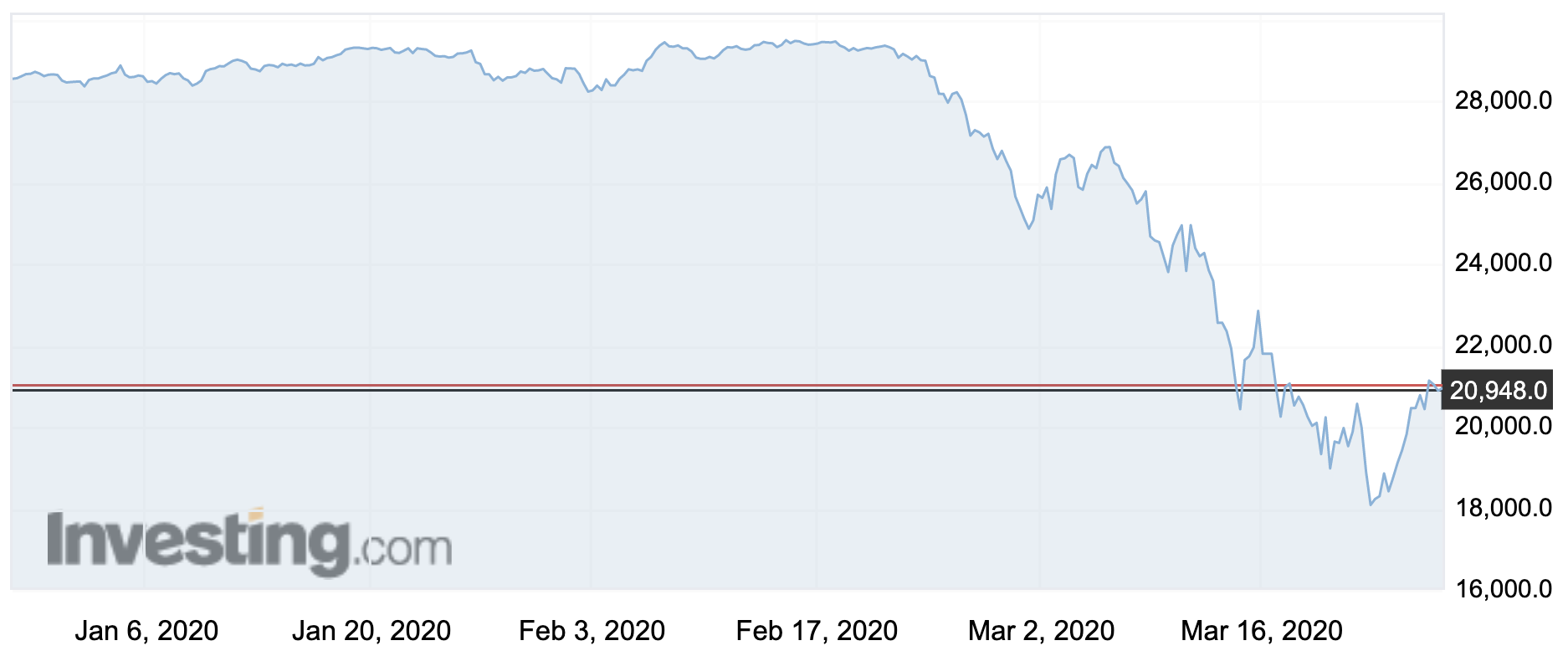

The Dow Jones 30 futures was down 0.36 per cent at 4.10pm on March 26 to 20,949.5 points.

Around the world governments and their central banks have been throwing money at the coronavirus problem, having learned from multiple crises in the past that the more money you put in at the start, the less damaging the economic hit.

In Australia, the federal government has committed to spending a total of $141bn as it puts the economy on a “war footing”.

The RBA has spent about $50bn in the five business days following its announcement about COVID-19 support measures on March 19.

Australia is officially at stage two restrictions, but Victoria, NSW and the ACT are considering stage three lockdowns. Queensland, South Australia, Tasmania and Western Australia have already closed their borders to interstate travel.

No one is quite sure of what a “lockdown” in Australia looks like as the federal government and states have differing ideas. So here’s a guide from New Zealand as to what you might be able to expect in the days ahead.

And following the WA restrictions on booze purchases, Dan Murphy’s and BWS have also brought in rationing, although the limitations are still fairly generous as you can now buy on one trip a total of:

| Categories | Dan Murphy limits | BWS limits | ||

|---|---|---|---|---|

| Bottles Of Wine | 18 | 12 | ||

| Cask Wine | 3 | 3 | ||

| Bottles Of Spirits | 6 | 4 | ||

| Cases Of Beer | 3 | 4 | ||

| Cases Of Cider | 3 | 4 | ||

| Cases Of Premix | 3 | 4 |

Market analysts at DBRS Morningstar say advanced economies, such as Australia, are in good enough shape to weather a season of coronavirus shutdowns. However, economists are saying a recession is inevitable and Westpac (ASX:WBC) believes unemployment will hit 11 per cent.

The bellwether Dow Jones has been swinging wildly, with an unexpected 11 per cent spike this week coming on the back of a US government $2.2tn stimulus plan and the US Federal Reserve’s quantitative easing that now goes ‘to infinity’.

But in any downturn there are still investors wanting to catch a bargain — even if right now they still look like falling knives.

Private equity is gearing up for some bargains, L1 Capital is specifically looking at a range of companies that include a hotelier, Coles (ASX:COL), and gold contractor Perenti (ASX:PRN), and Pac Partners is reconsidering ag stocks.

But brokers spoken to by Stockhead believe the only people who are going to do well out of this crisis for the next few weeks are stockbrokers, as companies realise they quickly need to raise capital.

KPMG’s Hoda Nahlous says companies need to raise more than they think they’ll need and must do it soon, before nervy investors are tapped out.

Most of the ASX’s 2000-plus companies have released COVID-19 news by now, but only a few have profited from it.

Stockhead follows these small caps.

| Ticker | Company | Price March 26 | 6 month return | 1 week return | Market cap |

|---|---|---|---|---|---|

| LSH | LIFESPOT HEALTH LTD | 0.064 | -11 | 96 | $1.9M |

| HCT | HOLISTA COLLTECH LTD | 0.097 | 43 | 13 | $25.6M |

| UCM | USCOM LTD | 0.32 | 135 | 13 | $34.4M |

| GSS | GENETIC SIGNATURES LTD | 1.09 | -10 | 8 | $151.1M |

| MPH | MEDILAND PHARM LTD | 0.15 | -50 | 7 | $34.4M |

| NET | NETLINKZ LTD | 0.046 | -73 | 0 | $92.5M |

| JAT | JATENERGY LTD | 0.037 | -38 | -3 | $33.6M |

| EHH | EAGLE HEALTH HOLDINGS LTD | 0.15 | 0 | -3 | $53.4M |

| FOD | FOOD REVOLUTION GROUP LTD/TH | 0.073 | 19 | -5 | $50.0M |

| ZNO | ZOONO GROUP LTD | 1.46 | 1453 | -6 | $207.4M |

| DEM | DE.MEM LTD | 0.15 | -51 | -8 | $21.0M |

| BIT | BIOTRON LTD | 0.075 | 15 | -12 | $52.6M |

| AEI | AERIS ENVIRONMENTAL LTD | 0.45 | 88 | -14 | $96.2M |

| MX1 | MICRO-X LTD | 0.125 | -63 | -14 | $26.3M |

| WSP | WHISPIR LTD | 0.97 | -52 | -23 | $74.7M |

| WNB | WELLNESS AND BEAUTY SOLUTION | 0.005 | -62 | -29 | $5.2M |

Whispir (ASX:WSP) is the breakout small cap of the week after the Victorian Department of Health and Human Services (DHHS) said it would use Whispir’s software to send interactive messages to COVID-19 sufferers, and monitor their daily health and check compliance with self-isolation requirements.

Daigou (‘buy on behalf of’) retailer Mediland Pharm (ASX:MPH) finally cracked and issued a coronavirus announcement last week, saying it had indeed moved into the hand sanitiser industry.

Food Revolution Group (ASX:FOD) says it still plans to hit full-year guidance of $40m in revenue.

De.Mem (ASX:DEM) says it has $8.2m in cash available to deal with any crunch, but orders for its water treatment technology are still coming in strongly.