Global execs from more than 2,000 companies remain gloomy on the 2020 economic outlook

News

News

From mid-March to mid-April, stocks rebounded and coronavirus growth rates started to edge lower.

However, economic sentiment among global executives continued to worsen over that time, according to the monthly survey from consulting firm McKinsey.

Data from the survey was collected between April 6-10, with responses from over 2,000 executives representing “the full range” of regions, industries and company sizes, McKinsey said.

By then, two thirds of respondents expected the coronavirus to result in either a “moderate or significant contraction”, defined as a recession or depression.

And further emphasising the pessimistic tone, over one quarter (27 per cent) of that group was forecasting depression-level economic conditions — up from just 5 per cent the previous month.

The timing of the survey is noteworthy, because it came after the first huge fiscal stimulus announcement from the US government in late March, which proved to be the primary catalyst for a rebound in share prices.

Respondents were also “nearly twice as likely as they were one month ago to say that the profits of their companies will decrease in the next few months”, McKinsey said.

“At 61 per cent, that is the largest share to report a negative outlook on profits since we began asking the question, in the wake of the 2008 financial crisis.”

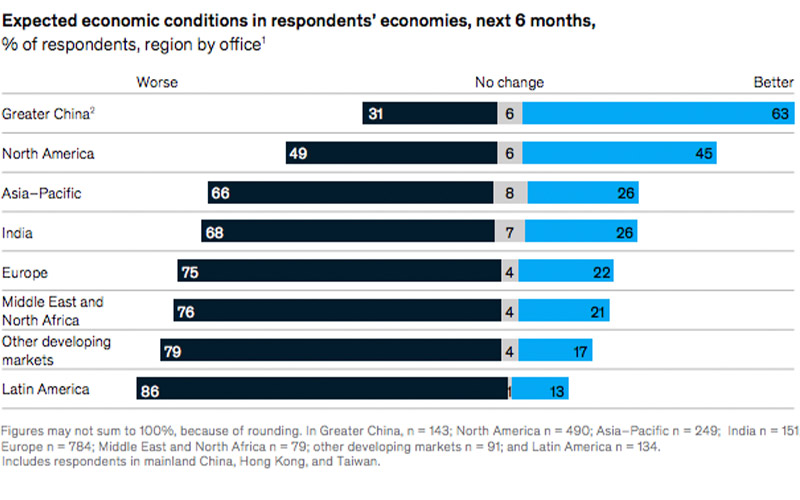

And while the US now accounts for the largest proportion of new COVID-19 related deaths, executives in North America took a more positive view about the near-term outlook than most other regions.

Forty-five per cent of North American respondents expect economic conditions to be better than they are now in six months, while 49 per cent think they will be worse.

By region, that breakdown lags only China, where 63 per cent of those surveyed expect conditions to improve by October.

Although a sense of optimism was in short supply in the latest survey, responses took a slightly more positive skew with regard to how the virus will be contained.

However, the largest group of respondents (31 per cent) expect that pockets of virus recurrence will be the most likely scenario, rather than “virus containment”.

Physical distancing will therefore continue (regionally) for the next “several months”. And in terms of the economic impact, respondents expect to see “slow long-term growth” with a “muted world recovery”.