You might be interested in

Experts

MoneyTalks: Pointsbet exits US business, will gain market share in Australia says broker

News

Closing Bell: Geopolitical tensions, China's economy roil the ASX as Aussie dollar trades below US65c

News

News

Australia’s Future Fund bosses are positioning for a challenging and volatile environment after its first annual loss since 2009.

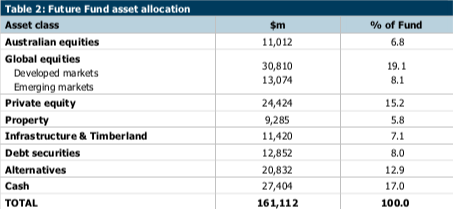

The Australian Future Fund is Australia’s sovereign wealth fund that invests to strengthen the government’s long-term financial position. It holds over $161bn in total assets.

This morning, the Future Fund reported a 0.9 per cent retraction in the 12 months to June 30, 2020.

The fund fell victim to a battering from the global market selloff earlier in the year.

It has 34 per cent of its holdings in equities both at home and abroad and another 15 per cent in private equity.

Although markets have been recovering since, Future Fund executives warn it’ll be far from smooth sailing.

Chairman and former federal Treasurer Peter Costello said the fund was priming itself for a different future.

“The board is focused on positioning for what will be a challenging and volatile environment in the future,” he said.

“The factors that have fuelled strong performance in the past may not be there any longer. We will need to be ever more strategic in how we pursue long-term returns in the future.”

CEO Dr Raphael Arndt provided a similar warning, stating the fund was conscious of its obligation to avoid “excessive risk”.

However, the Future Fund is still in positive territory over the longer term. In the last 10 years it returned 9.2 per cent, exceeding the fund’s target.

Dr Arndt said that while the way the fund invested may be different in future, its long-term objective wouldn’t change.

“We remain sharply focused on our long-term objective. Everything we do, every decision we make is focused on investing for the benefit of future generations of Australians,” he said.

“We were well positioned to navigate a path through the recent dislocations and are ready to manage through an investment environment which remains uncertain.”

Moves the fund made in recent months involved selling certain unlisted assets, including its stake in Gatwick Airport, and rebalancing its private equity portfolio.

The Future Fund also stated it had been deploying capital into next generation infrastructure, including data centres.