Economies are rebounding strongly from crippling COVID-19 lockdowns … but it comes at a price

News

News

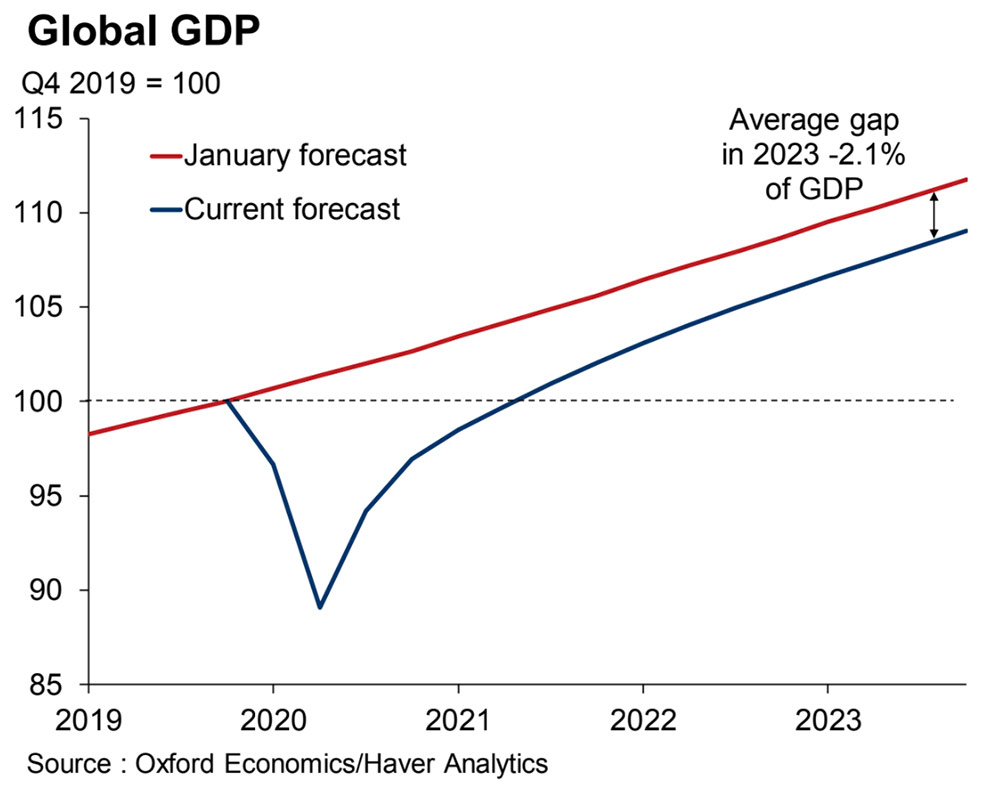

Economies may be bouncing back from COVID-19 lockdowns faster than expected, with Oxford Economics envisaging stronger growth in Q3 than it estimated a month ago.

While stronger than expected growth in Q3 is a good thing, Oxford Economics says this is because global GDP has contracted more sharply than anticipated.

“The dire start to Q2 – for instance US and UK GDP estimates for April show monthly falls of about 11 per cent and 20 per cent respectively – have prompted us to revise up the likely pace of contraction in Q2 in both the advanced economies and, particularly, emerging markets,” Ben May, director of Global Macro Research at Oxford says.

Over the year to date, GDP has fallen by 16 per cent in the US and by 25 per cent in the UK.

Gross Domestic Product (GDP) is the value of all goods and services produced within a specified period.

It’s mostly used as a broad assessment of the health of an economy — did an economy grow or contract compared to the previous period?

May says the upward Q3 revision “partly reflects our belief that the hit to the economy from lockdowns will be bigger, which, all else being equal, points to a bigger rebound as measures are relaxed”.

“In addition, signs that restaurant bookings in Germany and Australia have recovered more quickly than we had envisaged perhaps indicate that in some sectors the recovery in activity may be more ‘front-loaded’ than we previously thought was likely,” May says.

But this front loaded, faster than anticipated global expansion in Q3 comes at a price, according to Oxford — downward revisions to growth in the final quarter of 2020 and the whole of 2021.

“We think that this development merely brings forward some spending which we had expected to be delayed until later in the year. Indeed, we have downgraded our forecast for 2021,” May says.

“This reflects our view that consumer spending in particular may pick-up more slowly than we had previously assumed, in part because of lower rehiring of workers by firms.

“Despite lockdowns, the hard data and anecdotal evidence suggest that firms are continuing to shed jobs.

“These developments have led to our global GDP growth forecast for 2021 to be revised down by 0.5 percentage points to 6.5 per cent.”