Could turquoise hydrogen’s by-product could be the commercial carrot for the industry?

News

News

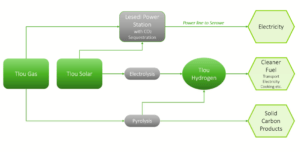

You’ve heard of green hydrogen (from renewable sources) and blue hydrogen (from fossil fuels) but what about the middleman, turquoise hydrogen?

This method generates hydrogen from natural gas (like methane) which is passed through molten metal and produces solid carbon as a by-product.

This solid ‘black’ carbon means there’s no need to invest in carbon capture facilities or storage.

Plus, it’s a valuable material with current prices around US$1237.032 per tonne.

And it has some useful industrial applications, including in the production of car tyres, coatings, plastics, and batteries – so it’s considered a critical raw material.

The hydrogen market needs a major boost in Australia to become cost competitive, so could turquoise hydrogen be the commercial carrot for companies considering the hydrogen pathway?

As a bonus, the process also uses electricity, which means it could run off renewables – something Tlou Energy (ASX:TOU) is considering at its Lesedi power project in Botswana.

This is what they have in mind.

Last month the company announced a binding Heads of Agreement (HOA) with Synergen Met – a hydrogen developer using plasma technology.

The companies plan to construction a hydrogen and solid carbon prototype at the Lesedi project.

Tlou general manager Solomon Rowland said the company was already using solar at its project when it started looking at entering the hydrogen space – and saw the opportunity with its assets.

“We were looking at doing carbon sequestration through converting the farms where we’re operating into carbon sinks for vegetation,” he said.

“Then we were looking to get into the hydrogen space, because we’re close to the Orapa diamond mine where they’re researching hydrogen in a big way.

“And because with our assets, and our power purchase agreements with the Botswana Power Corporation we saw multiple ways of monetizing our project.”

Synergen Met have already built a first‐generation working prototype developed in conjunction with the University of Queensland that has produced hydrogen and sodium cyanide for a gold mine.

“They were looking to develop this next generation of prototypes so instead of just doing it in a university setting, we’ve offered them the opportunity to do it in an industrial setting in our project in Botswana to see whether it’s commercially viable or not,” Rowland said.

Rowland said the prototype will be constructed and tested in Queensland prior to transport to Botswana in 1Q 2022.

Tlou said that carbon as carbon black and graphite have well established markets.

Carbon black is used as a tyre input (wear resistance and pigment), while graphite is the single largest input to lithium (and many other) batteries.

And battery manufacturing is progressively shifting towards use of synthetic graphite because of contamination issues with natural graphite.

In fact, around 95% of battery production now uses synthetic graphite.

This presents a solid market opportunity for carbon black and graphite produced from turquoise hydrogen projects.

Producing a saleable by-product is also a good example of a hydrogen strategy with more than one commercial opportunity.

And Tlou is keen to diversify its products and customer base – and sees huge expansion potential in Africa beyond the successful prototype.

“From an economic point of view, it’s great to also have another potentially saleable product in the form of carbon,” Rowland said.

“If the prototype is successful and we can produce hydrogen – then it’s another avenue for our gas to be to be sold.”

It isn’t a new concept, and a few commercial turquoise hydrogen plants using methane splitting already exist in the US – the challenge now is to prove the technology works at scale.

But it’s worth mentioning Tlou are not first movers – and it’s not Synergen’s first rodeo.

Earlier this year Synergen partnered with Pure Hydrogen (ASX:PH2) to build a prototype adjacent to the Venus CSG pilot in Queensland.

It’s expected to have a production capacity of around 1,400kg of hydrogen and 4,200kg of carbon black from the second half of 2022.

And then there’s TNG Limited (ASX:TNG) who last year partnered with German-based SMS Group to develop turquoise hydrogen at the Mount Peake vanadium-titanium-iron project in the Northern Territory.

Plus, just last week two German companies Wintershall Dea and VNG AG announced plans to build a facility to produce turquoise hydrogen.

The pilot facility will be operational in 2023 with a capacity of 400kg of hydrogen per day.

And in the US Monolith Materials already runs a commercial-scale emissions-free production facility that can produce hydrogen and around 14,000 metric tonnes of carbon black per year.

Mitsubishi Heavy Industries (MHI) Group has invested in the company – along with start-up C-Zero which is focused on producing hydrogen and sequestering solid carbon, rather than producing a high-end product like carbon black.