Confessions of a Day Trader: What’s the inflation mystery bag got in store?

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Yet another short week but this time I’m walking into a weaker Wall Street and having missed a trading day, today will be interesting.

Look at the opening and then again just before 11am and can’t trust any bounces… which turns out to be a wimpish state of mind!

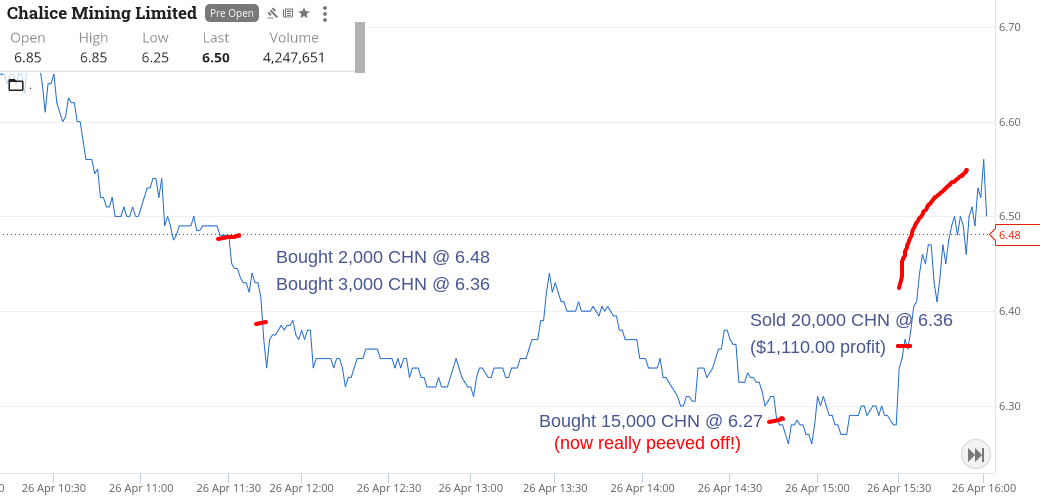

So this mental block costs me money and annoys me. Only one on my watch list behaving as I want is CHN.

So have a nibble and then another nibble and then they really start to annoy me. They were trading at $7.40 on 20 April and today they are nudging $6.25ish and I’m thinking come on, this is crazy stuff.

So I roll up my sleeves and up the attack to make a total of 20,000 and wait.

Eventually they do recover a bit and seeing that every 1c move is plus or minus $200 to my bottom line, I wave them goodbye and watch them go another 20c higher!

A profit is a profit is what I say and up $1,110 for the day.

Recap

Bought 2,000 CHN @ 6.48

Bought 3,000 CHN @ 6.36

Bought 15,000 CHN @ 6.27

Sold 20,000 CHN @ 6.36 ($1,110.00 profit)

Another fall overnight in NASDAQ and Dow 30 ahead of the Australian inflation number due out at 11.30am today. Have no clue what it will come in at, so will just be grazing until then… or so I thought.

Decided to just hedge my bets and bt 500 RIOs at 11.15ish as not too sure how the inflation figure will affect a mining company. CPI comes out and CBA etc tank. So do RIOs but then start to recover, so double up plus some.

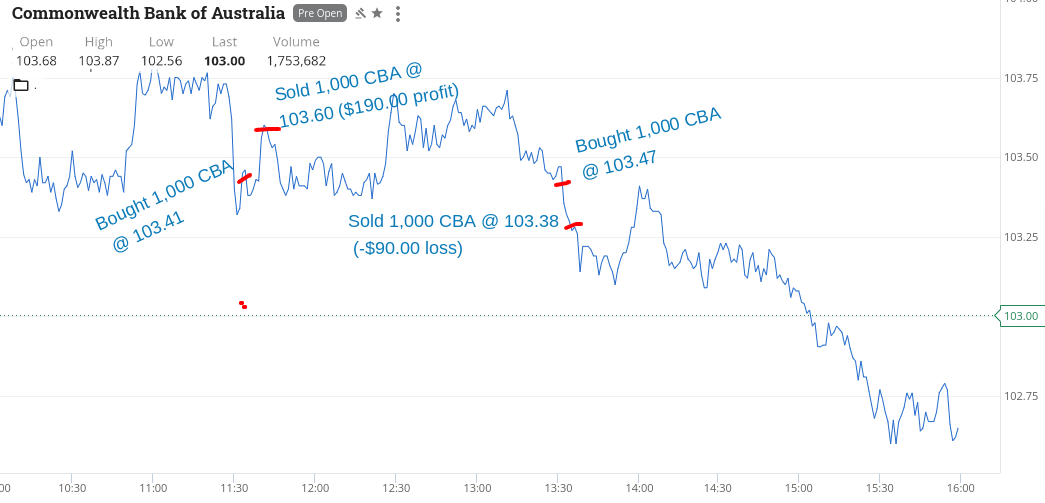

Then have a pop at CBA because I figure that all the bad news is out and we may see some short covering. Pick up 1000 at $103.41 and sell them at $103.60 and watch them keep going up.

Next out go the RIOs and they also keep going up!

Have another go at CBA but cut them for a small loss and watch them go higher and then lower.

Ranges weren’t that big today but their movements were very volatile.

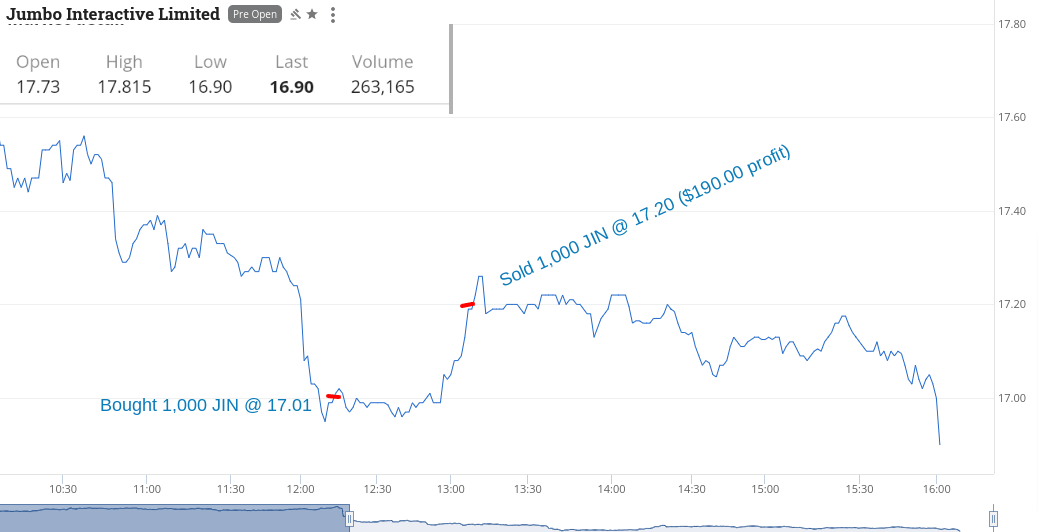

JIN pop up as a faller after a presentation announcement and I chase them from $16.95 upwards before locking them in at $17.01. They get pushed higher and I make back more than I lost on my last CBA trade.

Up $690 after the CBA loss and now waiting to see what happens overnight.

Recap

Bought 500 RIO @ 107.94

Bought 1,000 RIO @ 107.51

Bought 1,000 CBA @ 103.41

Sold 1,000 CBA @ 103.60 ($190.00 profit)

Sold 1,500 RIO @ 107.92 ($400.00 profit)

Bought 1,000 CBA @ 103.47

Sold 1,000 CBA @ 103.38 (-$90.00 loss)

Bought 1,000 JIN @ 17.01

Sold 1,000 JIN @ 17.20 ($190.00 profit)

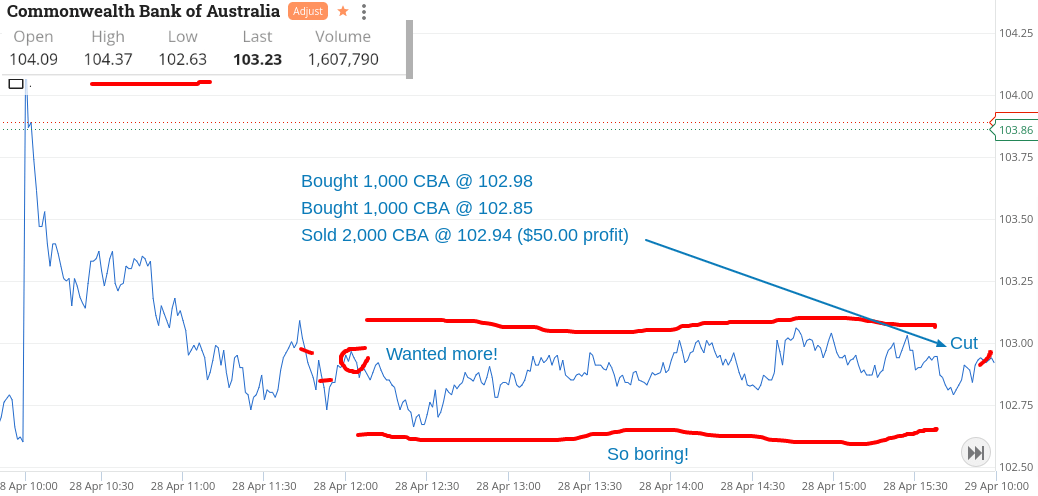

I have to say that today, I must have put on the most boring trade ever. It started with CBA where they had a high of over $104, which when I picked up the first 1000 at $102.98, I thought it was a given. Had to double down and waited till the death to close them out at a wee profit.

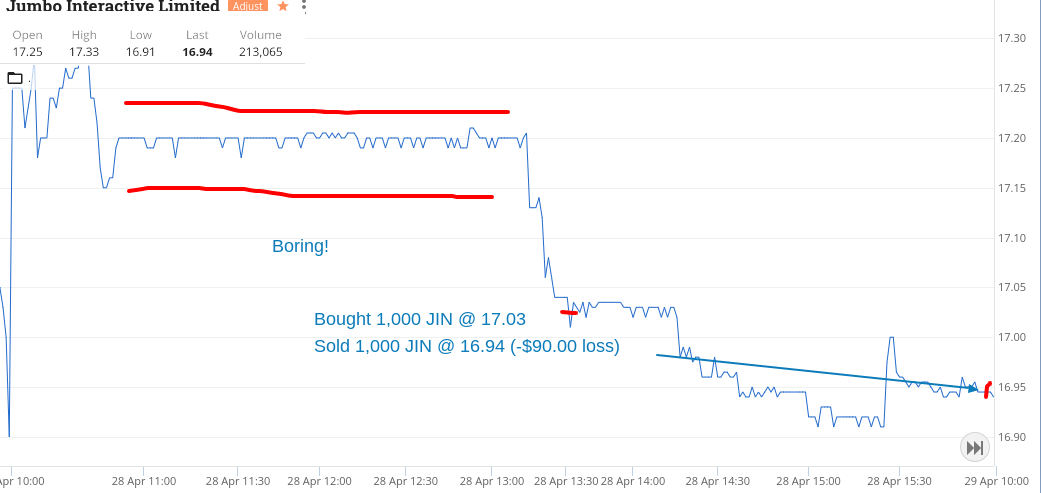

Same for JIN. Just above $17.00 and close them also at the death and also thought they were a given.

Could have sold the CBA at $103.10 but wanted more and paid the price. Their price range has got smaller but their volatility hasn’t. Loss for the day $40.

Recap

Bought 1,000 CBA @ 102.98

Bought 1,000 CBA @ 102.85

Bought 1,000 JIN @ 17.03

Sold 2,000 CBA @ 102.94 ($50.00 profit)

Sold 1,000 JIN @ 16.94 (-$90.00 loss)

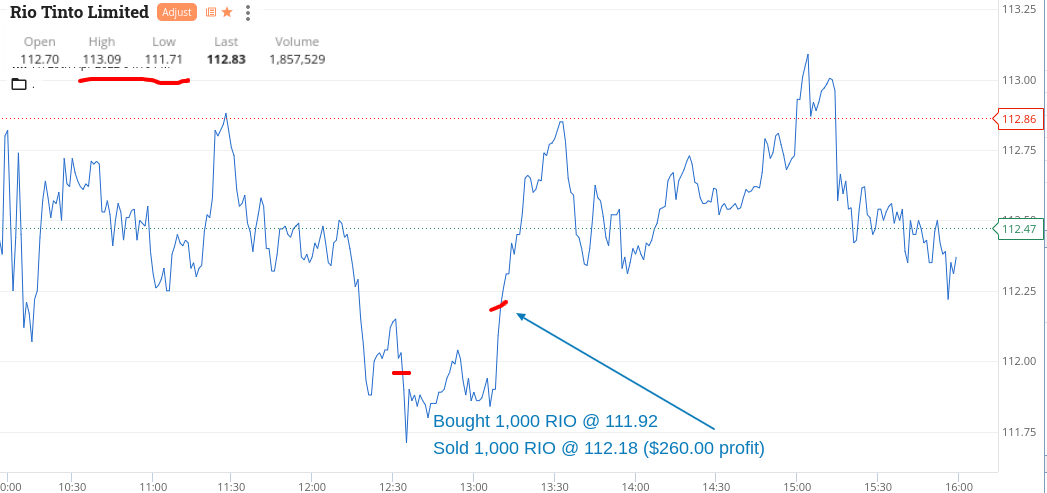

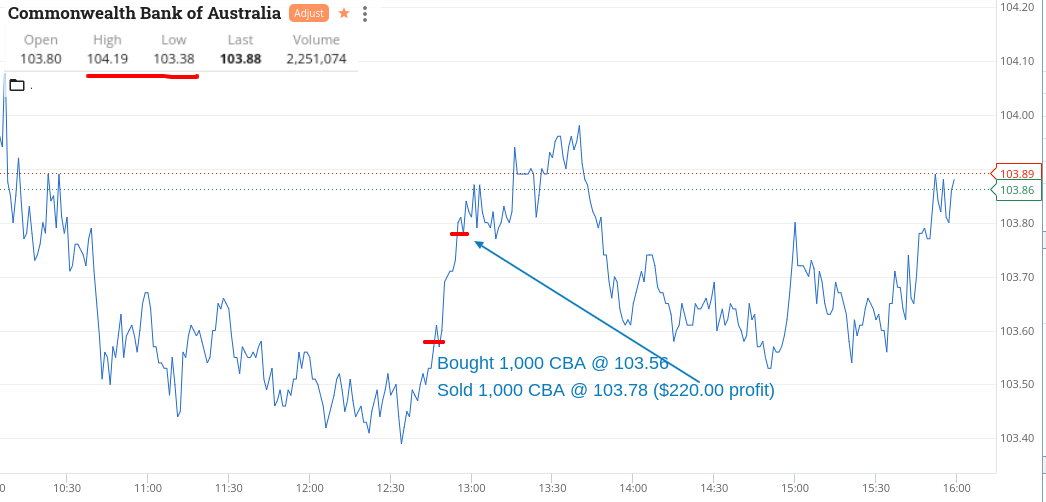

As the range on CBA is getting smaller, changed tactics a bit and bt 1000 just because they looked like they would rally, rather than breaking a key support or time level. Same for RIO.

Seems to have worked better than yesterday’s effort, so will have a look and study this week’s chart snapshots, to see if I need to adjust my previous tactics a bit.

Hope it’s just pre-election blues that has changed their patterns a bit – especially CBA.

Up $480 today, $2240 gross for the week and $1387 net and that’s the third four-day trading week in a row!

Recap

Bought 1,000 CBA @ 103.56

Bought 1,000 RIO @ 111.92

Sold 1,000 RIO @ 112.18 ($260.00 profit)

Sold 1,000 CBA @ 103.78 ($220.00 profit)