Confessions of a Day Trader: What happens when you turn it off and turn it back on again?

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

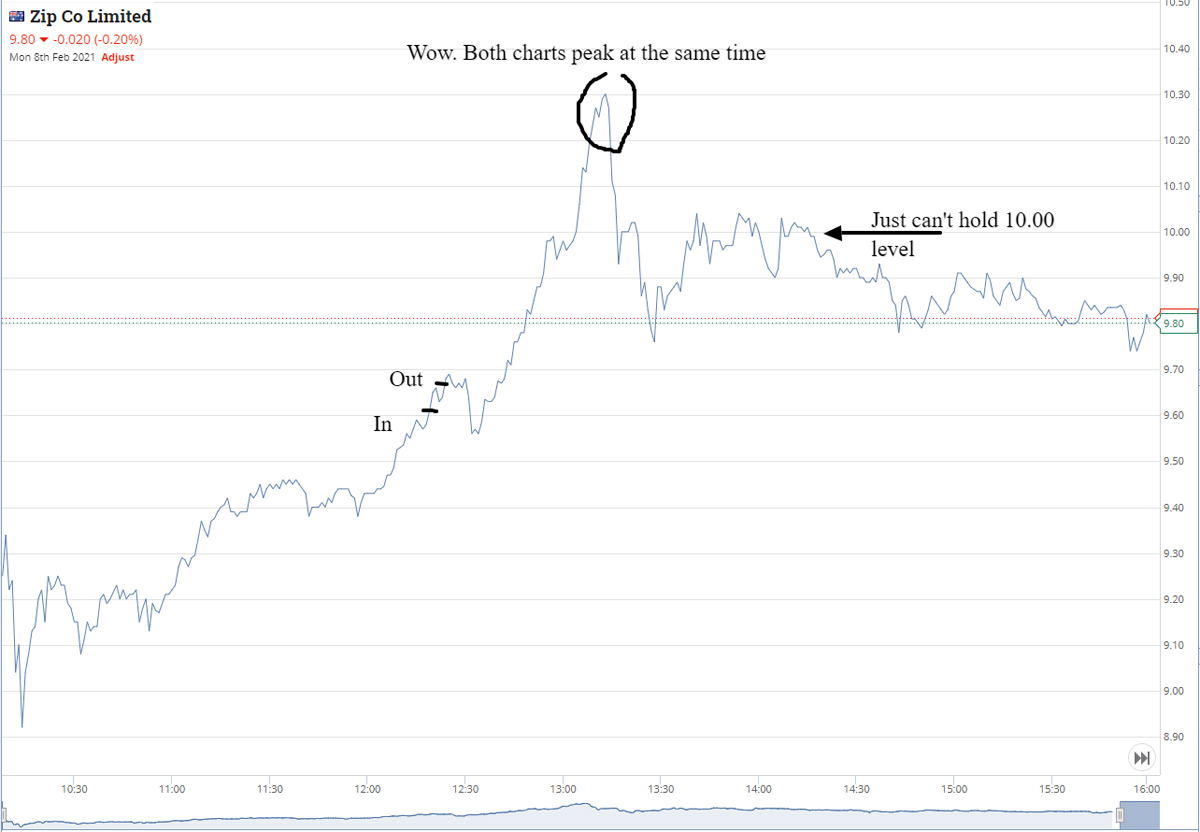

Bit of bullish noise on iron ore and Z1P looking to dual list in USA coming out pre-market. I’m away till lunchtime and see Z1P are up 10% to 9.68 and study them for a few minutes, close my eyes and buy 2500 at 9.64.

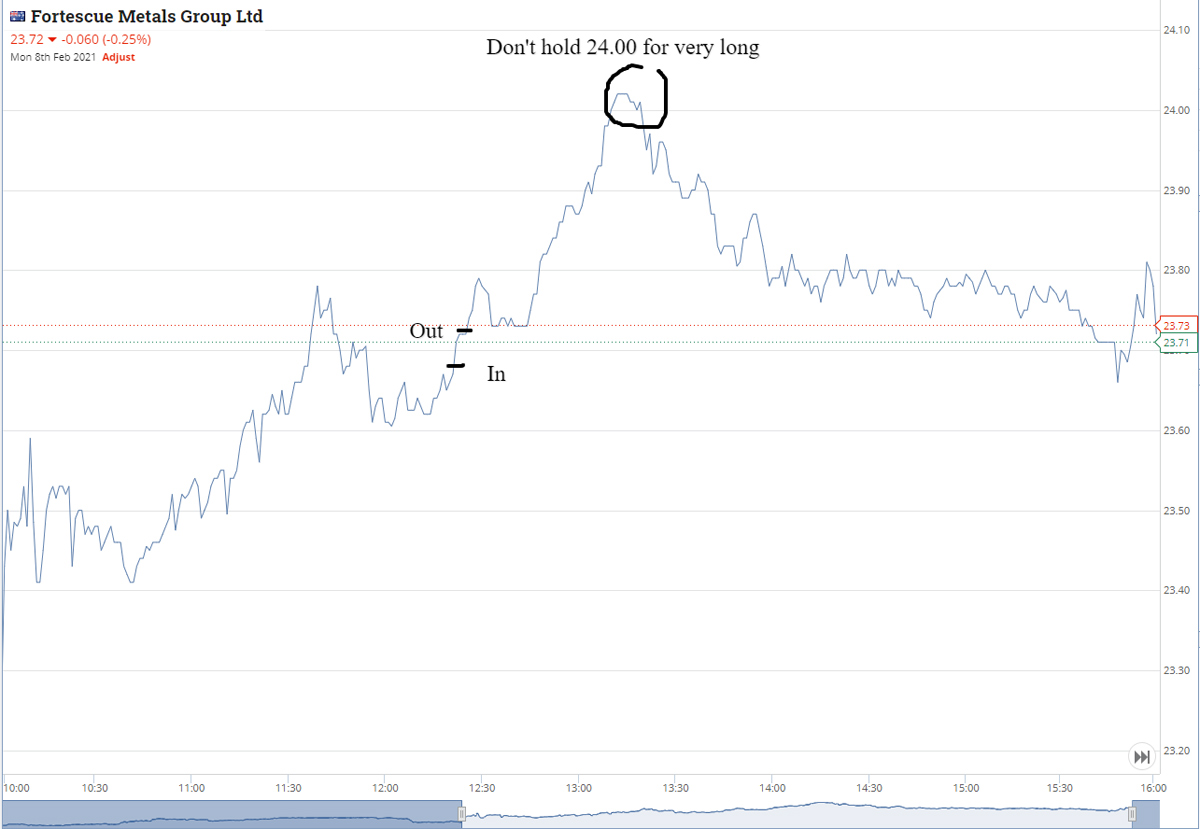

Time is 12.23pm. One min before this I buy 3000 FMG at 23.67. I am out of both positions at 12.25pm and make a total of A$250. FGM sold at 23.72 for A$150 profit and Z1P sold at 9.68 for a A$100 profit.

At bang on 1.01pm, Z1P hit the magic 10.00 level and at 1.11pm FMG hit 24.00 and Z1P touch 10.29. Both close off their highs.

Tomorrow may be interesting. APT hit an all time high of 156.50 and closed at 153.46.

+2500 Z1P at 9.64, -2500 Z1P at 9.68, Profit A$100 (FOMO)

+3000 FMG at 23.67, -3000 FMG at 23.72, Profit A$150 (FOMO)

I’m out and about and check my phone and notice CGF are down 8% and buy 2000 at 6.45. I then get distracted and check them again. Average down for another 2000 at 6.26. Time is 10.36am.

Now I get engrossed in something and miss my profit and then have to start averaging down. At one point I’m down A$1300 because of my lapse. All in all end up long 16000 at 6.20375 and watch and watch and keep adjusting a higher limit order down until we all meet at 6.22. Profit A$260.

Dying to buy some silver exposure so buy and sell 10,000 S32 for a 1 cent turn. Time 2.20pm.

Then buy 2000 NST and 2500 Z1P. NST I cut for a A$60 loss and Z1P I try and average myself out of but run out of time and cut them for a nasty A$725 loss.

Overall I finish down A$425 for the day. Kick myself over CGF, as changed my whole thinking for the rest of the day.

+2000 CGF at 6.45, +2000 CGF at 6.26, +4000 CGF at 6.20, +8000 CGF at 6.13, -16000 at 6.22, Profit A$220 (was down A$1300)

+10000 S32 at 2.58, -10000 S32 at 2.59, Profit A$100 (quick 2 min job)

+2000 NST at 11.94, -2000 NST at 11.91, Loss A$60 (not thinking straight)

+2500 Z1P at 9.70, +2500 Z1P at 9.61, +5000 Z1P at 9.55, Cut 10,000 at 9.53, Loss A$725 ( ran out of time an averaging tactic)

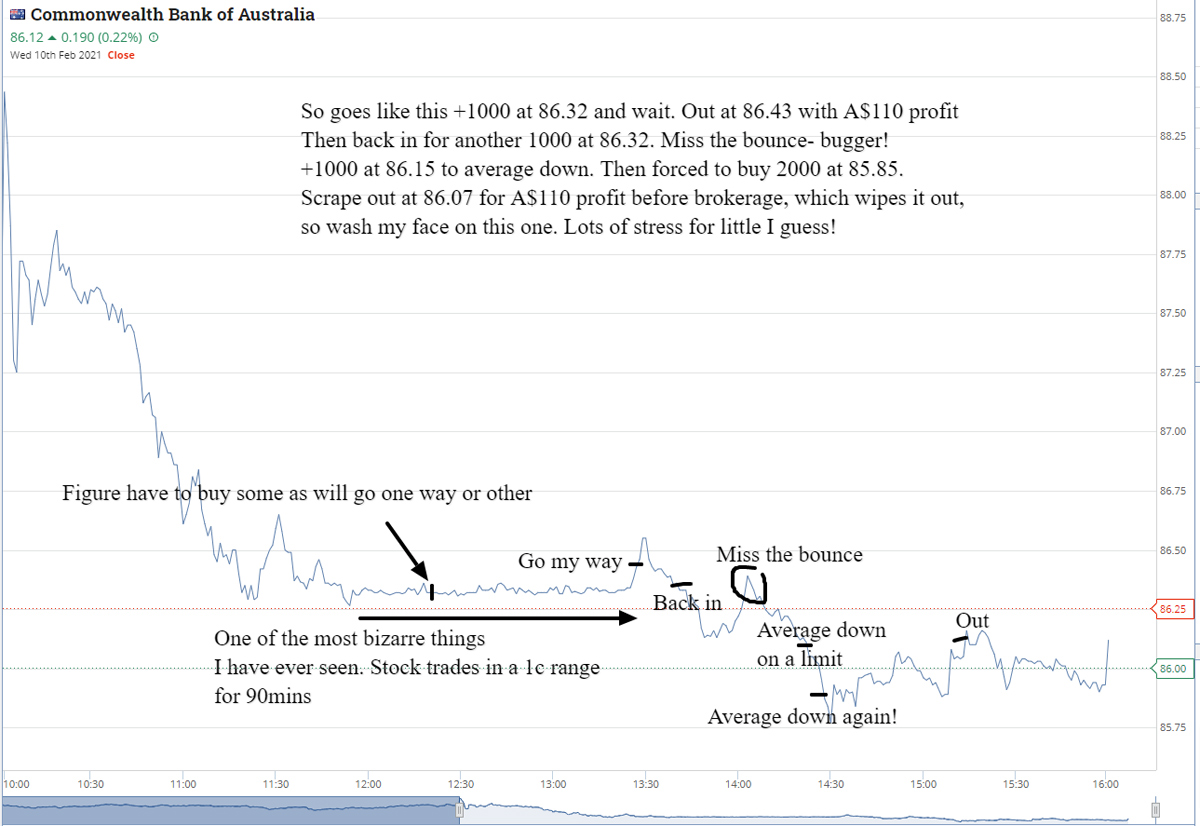

CBA figures out before market. Div looks ok, let’s see what the stock does! At around 12.00pm, it moves in a 1c range for 90 min, which I have never seen before. See graph.

Buy 1000 @86.32 in that 90 min to see what happens. Goes my way and out at 86.43. They fall back to that same range again and I’m back in.

Miss the bounce (have a builder here and he unplugged my internet by mistake). When back on I have to average down twice. Another 1000 at 86.15 and then 2000 at 85.85. When they finally bounce I’m out at 86.07 for a A$110 profit, which brokerage wipes out. Was down A$1000 at one point.

Turn over 13,000 FMG over the day for a buy 5000 twice at 23.77 and make a total A$445 profit on them. Overall up A$665 for the day.

+1000 CBA at 86.32, +1000 at 86.32, +1000 at 86.15, +2000 at 85.85, -1000 at 86.43, – 4000 at 86.07, Profit A$220 (scary stuff at one stage down a grand)

+3000 FMG at 23.85, +5000 at 23.77, +5000 at 23.77, -3000 at 23.89, -5000 at 23.80, -5000 at 23.81, Profit A$445 (range is slowing down so upped the amount of shares)

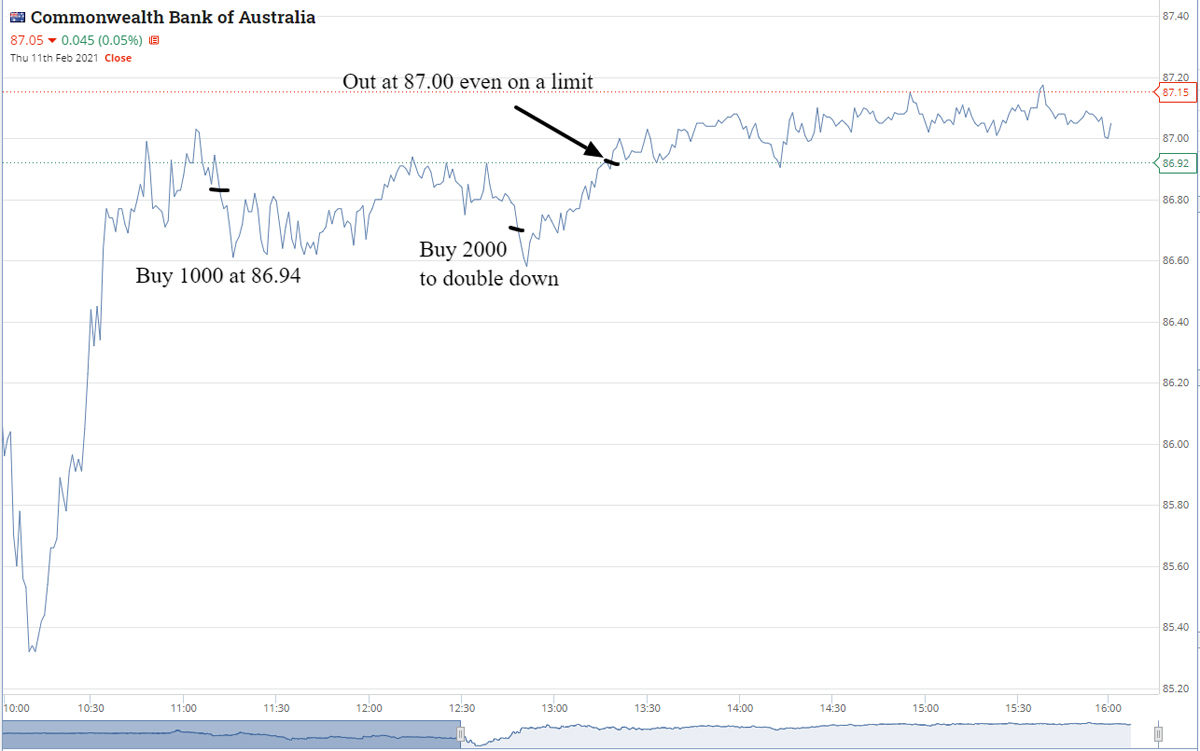

Have a few computer problems, which I finally fix at 11ish and there has been a bit of volatility going on. APT open high and fall back and CBA hover around the 87.00 mark. FMG open up and also come back down. Manage to buy and sell 200 APT at 155.50 for a 50c profit and when they come back down to 155.50, I have another go for 200.

Forced to double down at 155.00 for 400 and at 154.63, I close my eyes and buy 600. End up making A$100 first time and losing A$34 second time.

Buying at the same level works on FMG as able to buy 2500 at 23.77, like yesterday. Out at 23.81 for A$100 profit.

Best fun and games for me in CBA. Buy 1000 at 86.95 and then 2000 at 86.74 and put them on a limit sell at 87.00, which gets taken at 1.30pm for a A$585 profit. Up A$751 for the day and got out of jail on APT.

+2500 FMG at 23.77, -2500 FMG at 23.81, Profit A$100

+200 APT at 155.50, +200 at 155.50, +400 at 155.00, +600 at 154.63, -200 APT at 156.00, -1200 at 154.87, Profit A$66 (if still in CBA, would not have gone back into this one)

+1000 CBA at 86.94, +2000 at 86.74, -3000 CBA at 87.00, Profit A$585 (day trading the third biggest company on ASX – woohoo!)

No matter how much I try today, I just can’t find a trade and as the day goes on am worried that some book squaring at the end of the day may halt any rallies, so nervous to do anything after 2pm.

Have had an interesting week and feel that there is more chance of losing money than creating it today. Have added some charts to give you a feel.

FMG looks more dramatic than it was as it only trading in a 30c range, compared with bigger ranges on previous days. APT also goes lower with smaller bounces.

Gross profit: A$1241

Brokerage: A$550

Net profit for week: A$691

Least satisfying: Z1P A$725 loss

Most satisfying: CBA A$585 profit