Confessions of a Day Trader: Was that the Red Sea we just saw parting?

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Dark clouds rumbling above the exchange today. In the paper they highlighted a new IPO on Friday which didn’t do very well, so I added them to my watch list.

Bingo. They fell even more and I got a 7c turn on 3000. C79 was the code, which apparently is the mineral table name for gold. Gold for me but not for the stags!

ANZ was the only bank not recovering, so had a go but had to double down at $25.86 and ended up cutting them at a loss after closing out two other profitable trades.

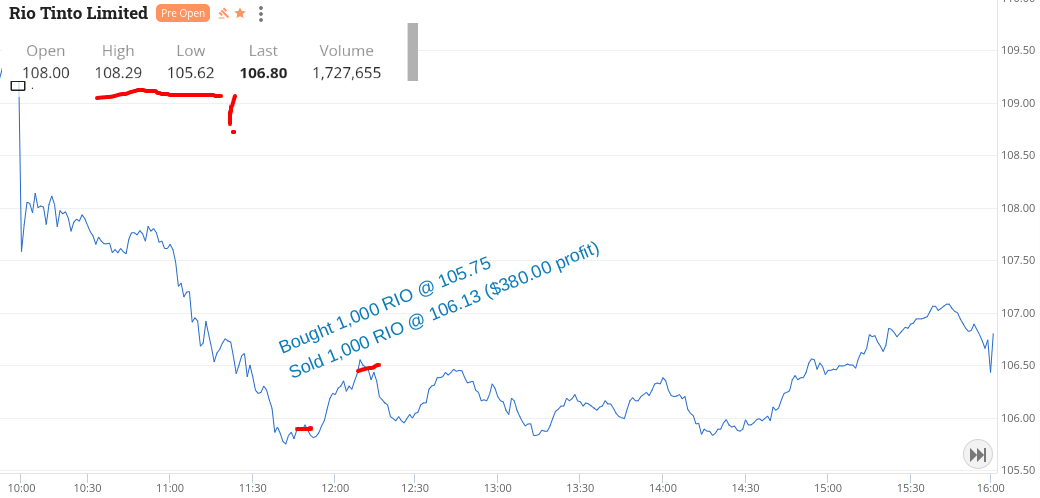

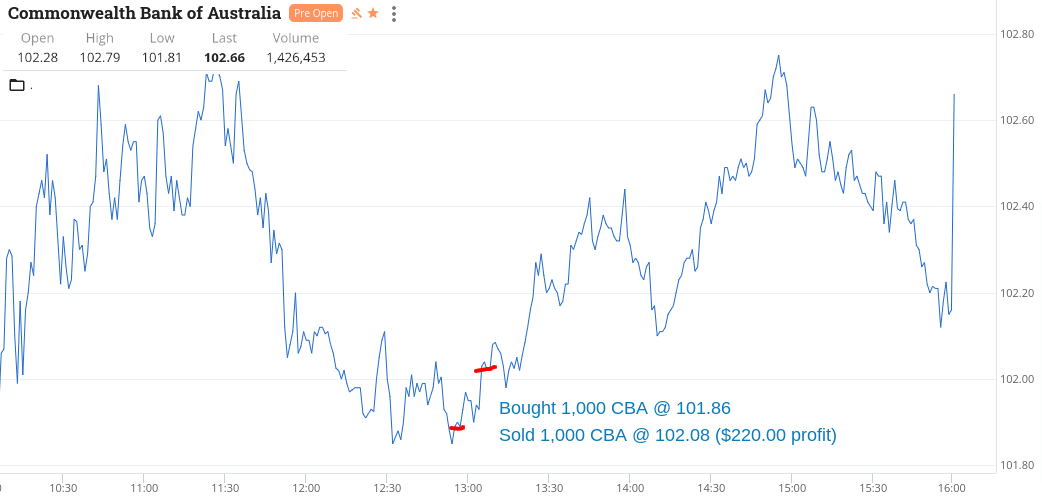

RIOs were below $106 and CBA was below $102.

Both looked like they wanted to nudge up a bit and I was in the supermarket checkout queue having a look at my watchlist. Took a screenshot of CBA so you could see what I saw.

Got out of RIOs after adjusting my limit order down.

CBA did break back above $102.00 and out they went.

Happy to scrape through today with a profit. Did leave a bit on the table but who cares.

I don’t. Up $750.

Recap

Bought 3,000 C79 @ 3.67

Sold 3,000 C79 @ 3.74 ($210.00 profit)

Bought 2,000 ANZ @ 25.95

Bought 2,000 ANZ @ 25.86

Bought 1,000 RIO @ 105.75

Sold 1,000 RIO @ 106.13 ($380.00 profit)

Bought 1,000 CBA @ 101.86

Sold 1,000 CBA @ 102.08 ($220.00 profit)

Sold 4,000 ANZ @ 25.89 (-$60.00 loss)

More overnight falls and just waiting for the morning trading to settle down. Pick up some ABB at a flukey low of their day. Occasionally this happens!

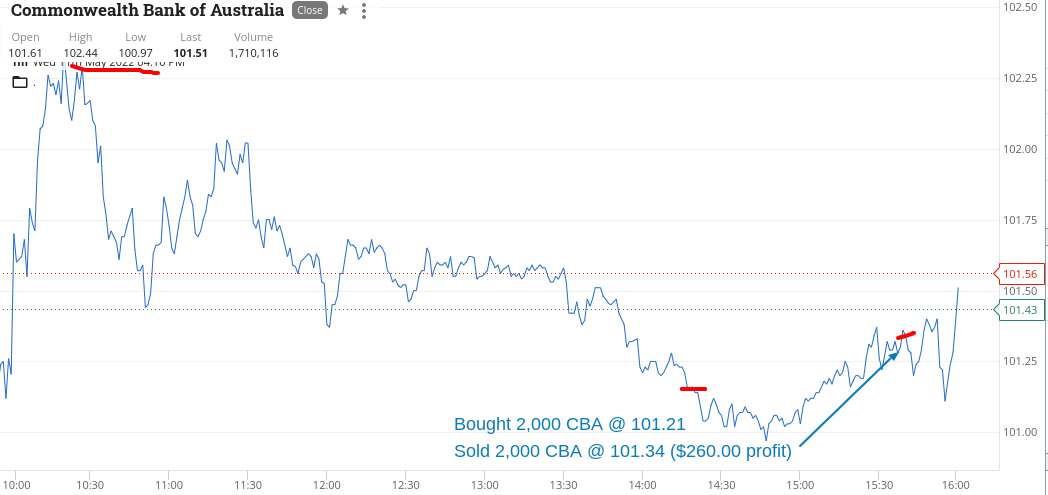

Then went again like yesterday at 11.15am-ish and went into CHN, C79, NAB and CBA.

Had to double down on CBA, but if you look at ABB, CHN and C79, not much capital was involved to throw out $970 profit.

Geared them up a little bit and expected to have to have doubled a bit on more than just CBA.

Too many trades to show all the charts but have included some phone screenshots.

I spent too long staring at screens to realise that you need a break or even a nap (if you can do it). If you don’t you tend to make too many knee-jerk reactions.

Up $1,475 and the day started with my watch list a sea of red.

Recap

Bought 2,000 ABB @ 3.73

Bought 2,000 CHN @ 5.82

Bought 3,000 C79 @ 3.47

Bought 1,000 NAB @ 31.19

Bought 1,000 CBA @ 101.05

Sold 2,000 ABB @ 3.92 ($380.00 profit)

Bought 1,000 CBA @ 100.80

Sold 2,000 CHN @ 6.01 ($380.00 profit)

Sold 1,000 NAB @ 31.30 ($110.00 profit)

Sold 3,000 C79 @ 3.54 ($210.00 profit)

Sold 2,000 CBA @ 101.12 ($390.00 profit)

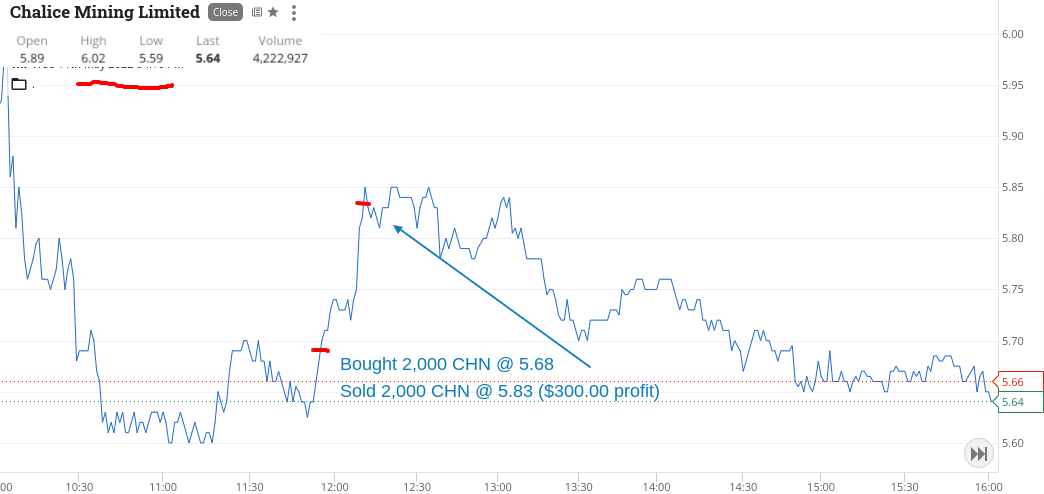

Some nervous Nellies out there. Stop losses going off left, right and centre.

Managed to catch a bit of the selling and then watch the recoveries come through.

Both are being exaggerated because everyone’s investment moods are moving so fast and the election headlines don’t help anyone.

Glad today was over. Finished up $760 but didn’t enjoy it as it could have easily gone the other way for me.

Recap

Bought 2,000 CHN @ 5.68

Sold 2,000 CHN @ 5.83 ($300.00 profit)

Bought 2,000 ANZ @ 25.30

Bought 2,000 CBA @ 101.21

Sold 2,000 CBA @ 101.34 ($260.00 profit)

Sold 2,000 ANZ @ 25.40 ($200.00 profit)

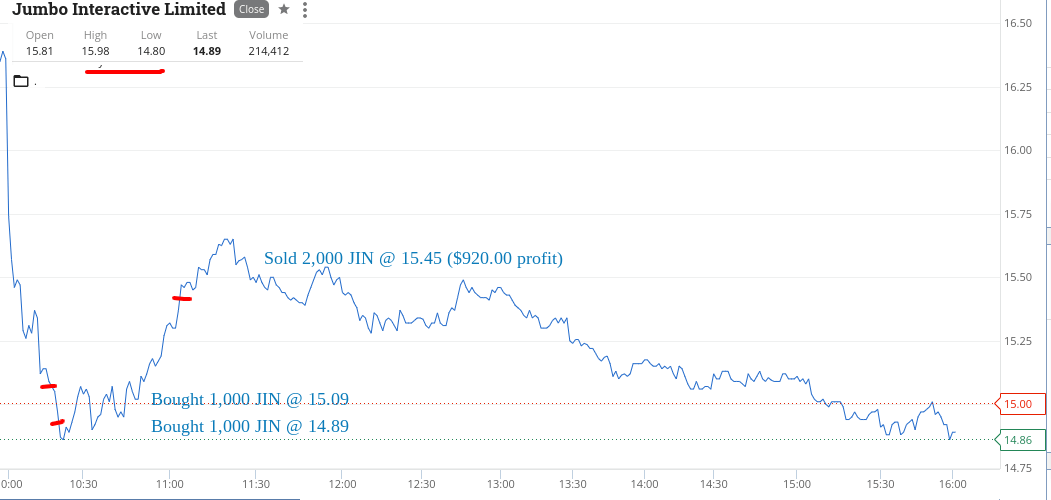

JIN popped up today, early. Volume is not that big in the stock, so it needed a bit of patience to get set, not once but twice.

The jump in the stock price recovery seems to back up my theory.

Anyway a profit of $920 from one stock did me for the day and nothing else mattered. CBA had some results out and up they went.

I feel they may continue tomorrow, as we are due a bounce in the market. Even if it is Friday 13th.

Recap

Bought 1,000 JIN @ 15.09

Bought 1,000 JIN @ 14.89

Sold 2,000 JIN @ 15.45 ($920.00 profit)

And we are off… European markets stronger and some of the NASDAQ selloffs come back to life.

So, everything was not really happening for me until CBA decided to take a dive and fall below $102.00. As had done nothing all day and seeing that they had been 50c plus higher, doubled up on starting size.

Put them on a limit to sell at just below $102.00, which got taken.

They then fell again and I had a look and thought they may fall below $101.00, but they quickly bounced.

Feel sorry for some of those crypto traders, as what happened to them is pretty brutal.

Up $4265 for the week and $3798 net, as the volatility gave us a few more opportunities than usual.

Recap

Bought 2,000 CBA @ 101.81

Sold 2,000 CBA @ 101.97 ($320.00 profit)