Confessions of a Day Trader: Thin volumes and silly season swings

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Covid outbreaks, schools out and raining non-stop. All happening as we come towards 25th Dec. Trading volumes will start to peter out so going to be a long day searching for a few trend lines.

Just after 1.00pm, I notice NST have nudged 13.00, so buy 1000 at 12.96. Time is 1.05pm. This move triggers them to fall, so am forced to average down 6 mins later and buy another 1000 10c lower. Also buy 100 APT around the same as A$5.00 below today’s high.

Three hours later , I finally see a profit in NST and sell 2000 at 22.96 and cut the APT for a A$28 loss. Overall +A$72 for the day.

(People always ask me how I know a stock is going to fall and I tell them that’s very easy to do. I just buy them and this triggers them to fall.)

+1000 NST at 12.96; +1000 NST at 12.86; -2000 at 12.96; Profit A$100

+100 APT at 112.19; -100 APT at 111.91; Loss A$28

Wake up to the news that iron ore has gone to U$176 a tonne and think that FMG will be A$25 today. To my shock they open below 25.00 and I take some time pondering to buy 2000. By the time I decide on 1000 and hit the button, I manage to get them at 24.04.

As I’m putting on a limit sell order at 24.15 they touch 24.13 and I think, I’ll take that and book in a quick A$90.

Leave in a limit order to buy some Z1P at 4.85, which never happens. Leave everything else well alone as seeing FMG not do what I thought they would has left me a bit spooked. Also see the graph of NST.

Welcome to the silly season!

+1000 FMG at 24.04; -1000 FMG at 24.13; Profit A$90

Noticing the turnovers coming down and I am gingerly looking around. Lower volumes can create opportunities which may not always work out the same as the tactics I usually rely on.

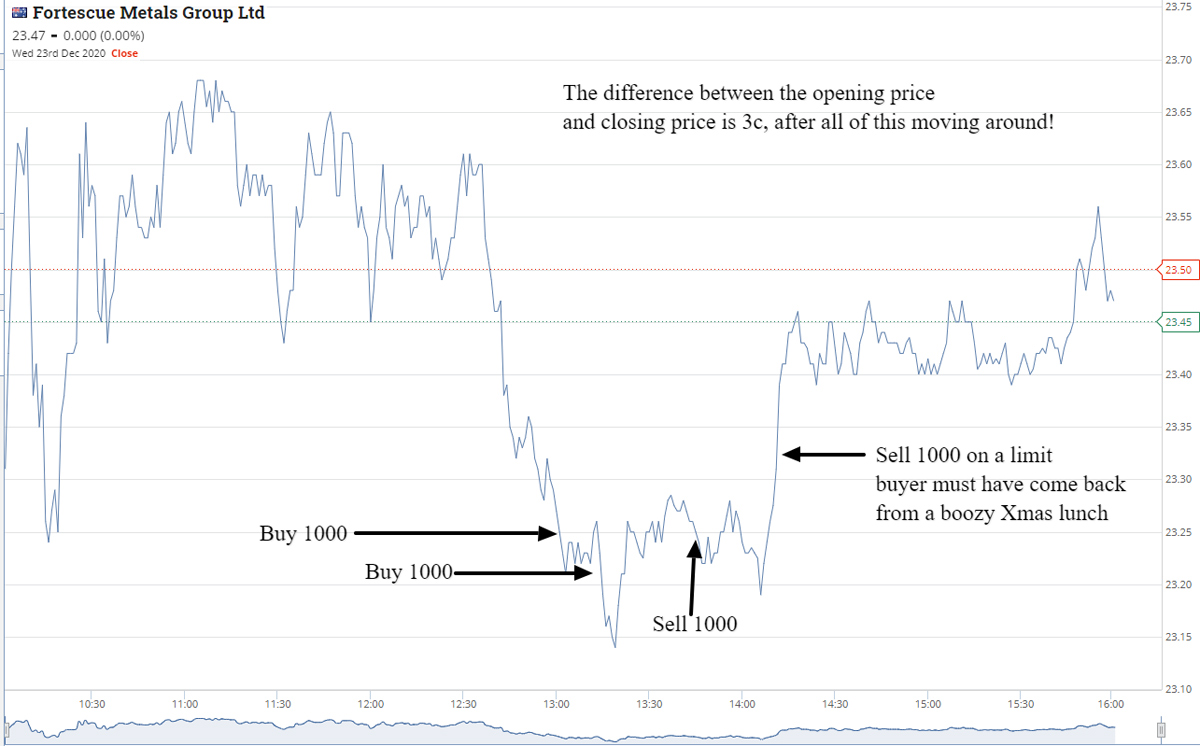

After watching the opening rounds, decide to come back at 12ish. Buy 1000 FMG at 23.31 at 12.56pm. Buy another 1000 at 23.215, 14 mins later. So now long of 2000.

At 1.37pm I sell 1000 at 23.28 and sell the balance on a limit of 23.33 at 2.11pm. Total profit out of FMG is A$85.

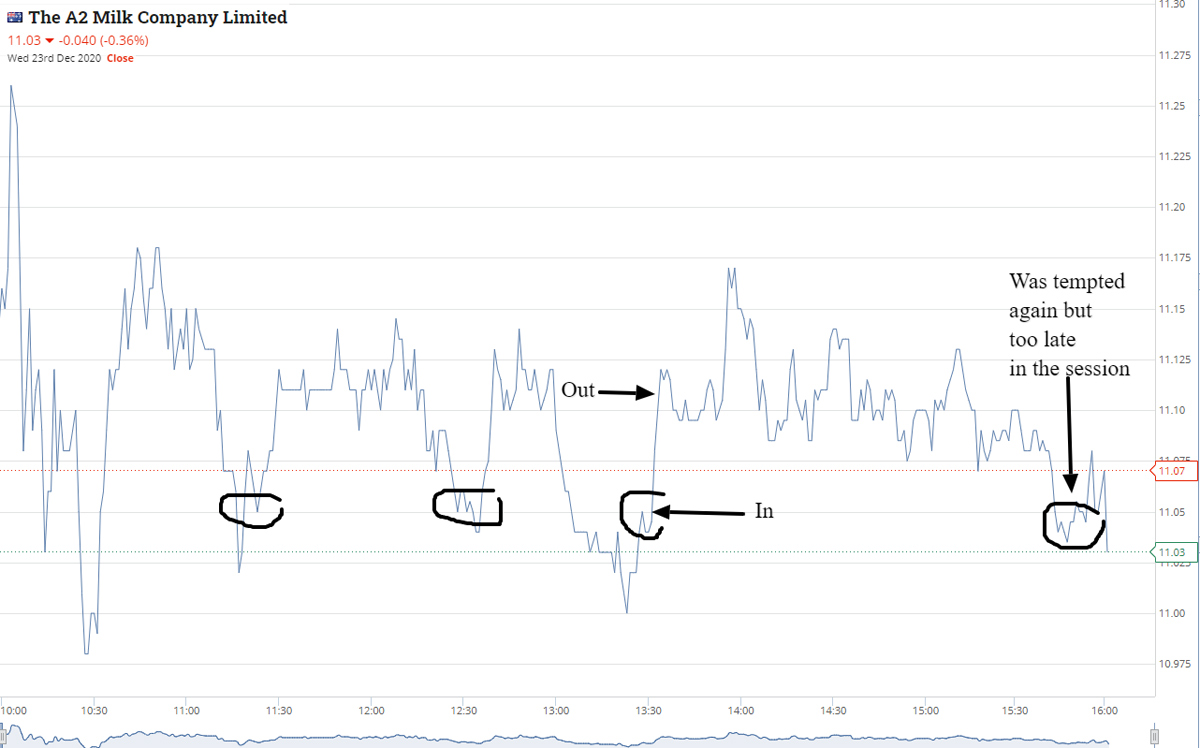

In-between all of this I notice that A2M are bouncing off 11.04, so buy 1000 at 11.05 at 1.30pm and sell them at 11.10, 4 mins later. So all up profit of A$135 for the day.

+1000 A2M at 11.05; -1000 A2M at 11.10; Profit A$50 – in 4 mins!

+1000 FMG at 23.31; +1000 FMG at 23.215; -1000 FMG at 23.28; -1000 FMG at 23.33; Profit A$85 (split the sell order up as being Xmas cautious)

Half day today, which could be interesting but I decide to leave everything alone, as short days have caught me out before.

Hope everyone had a great Christmas and the weather held out for you all. See you for the short week!

Profit for week: $297

Brokerage: $65

Net profit: $232