Confessions of a Day Trader: Taken to tasks? Enjoy your Instant Profit Oysters!

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

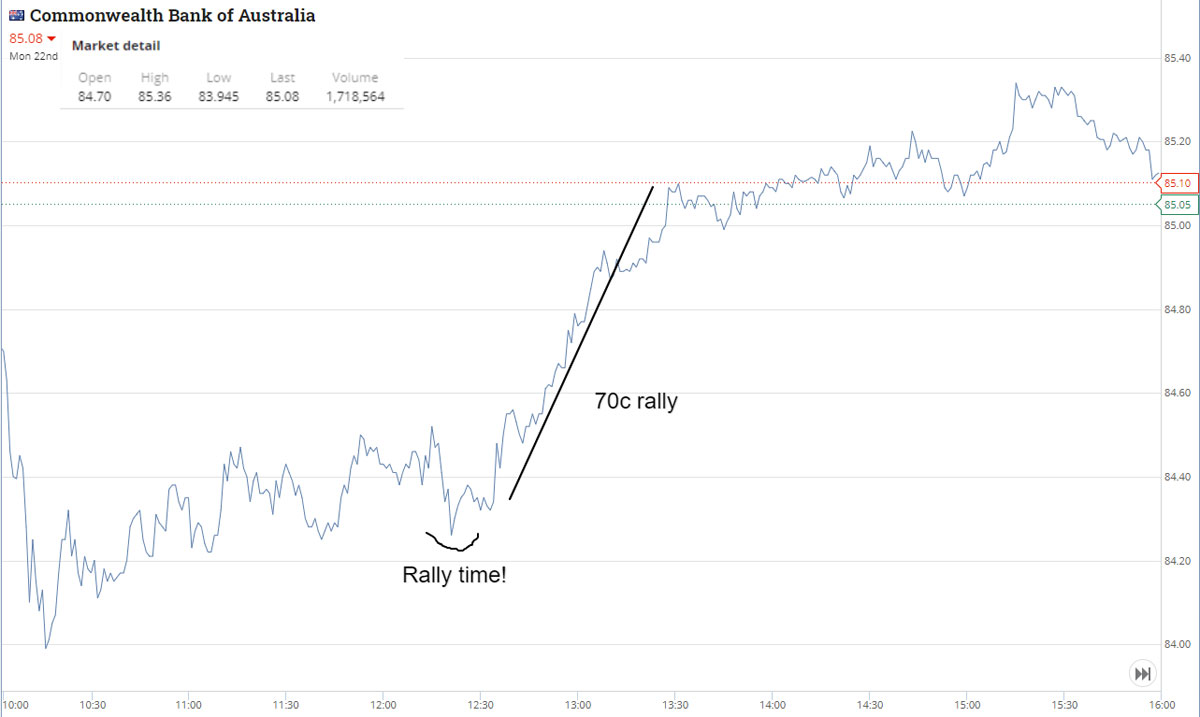

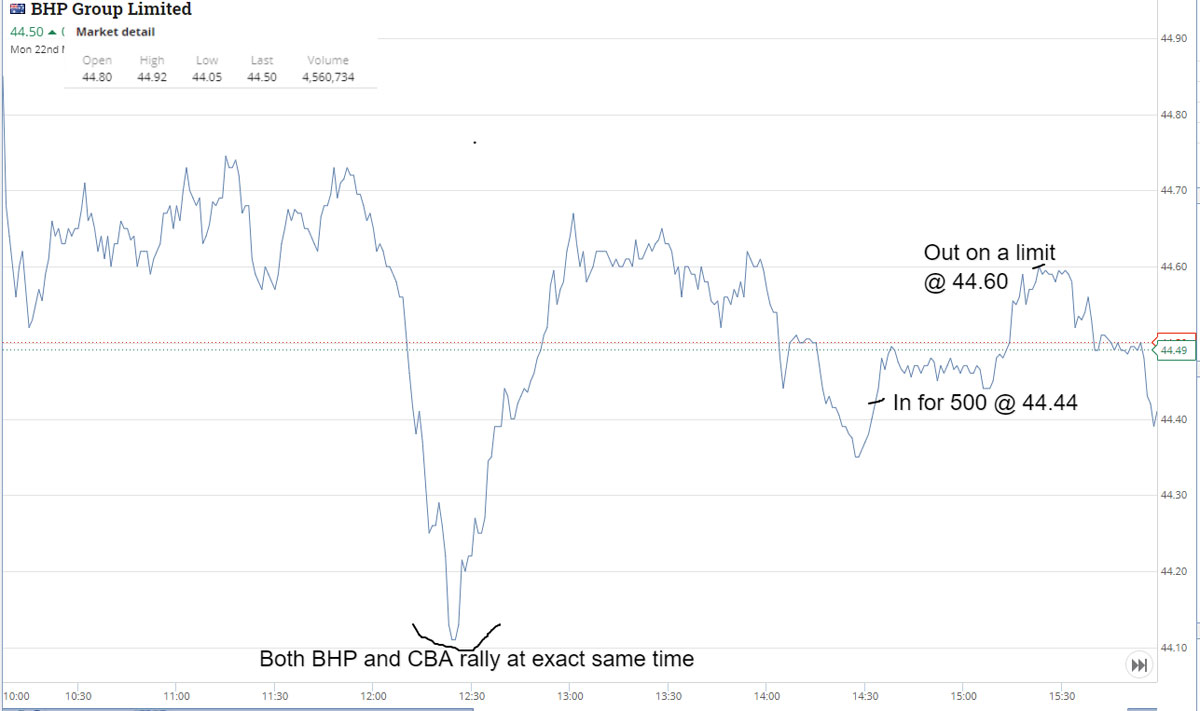

I’m out for most of the morning. Sit down at about 12.15pm and by fluke, it’s at the bottom of the market for BHP and CBA which I wasn’t aware of then.

Put in some lower cheeky limits and way too far out. CBA rallies hard and BHP not so hard, so buy 500 at 44.44 at 2.34pm (what a price!) and wait and wait. Out at 3.23pm for a A$80 profit.

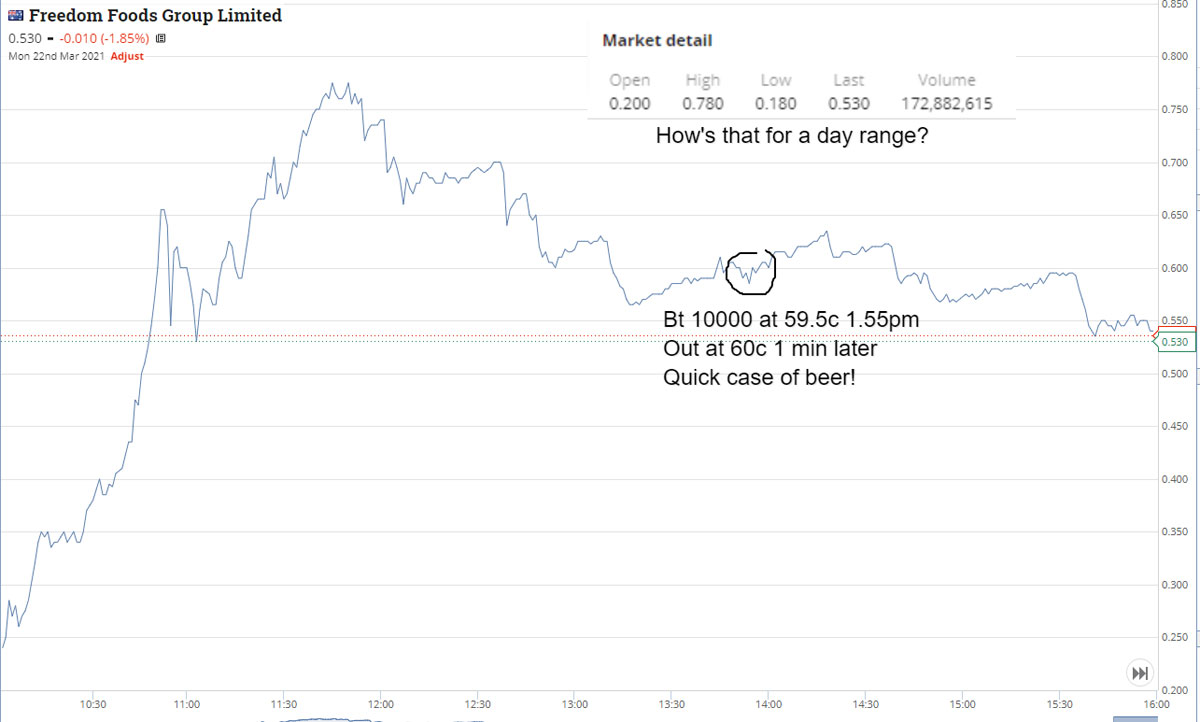

Whilst waiting, buy 10000 FNP as down about 75% from a long suspension. Just very quickly in at 59.5c and out at 60c. Not interested in trying to be a hero.

Later, MIN pop up as a big market cap faller. Buy 1000 at 37.18. Time is 3.12pm.

Six mins later out at 37.30pm. Their high for the day was 39.37! Up A$250 for the day which is a surprise, as had done nothing in the morning.

+500 BHP at 44.44; – 500 BHP at 44.60; Profit A$80

+10,000 FNP at 59.5c; -10,000 FNP at 60c; Profit A$50

+1000 MIN at 37.18; -1000 MIN at 37.30; Profit A$120 (all good news built in)

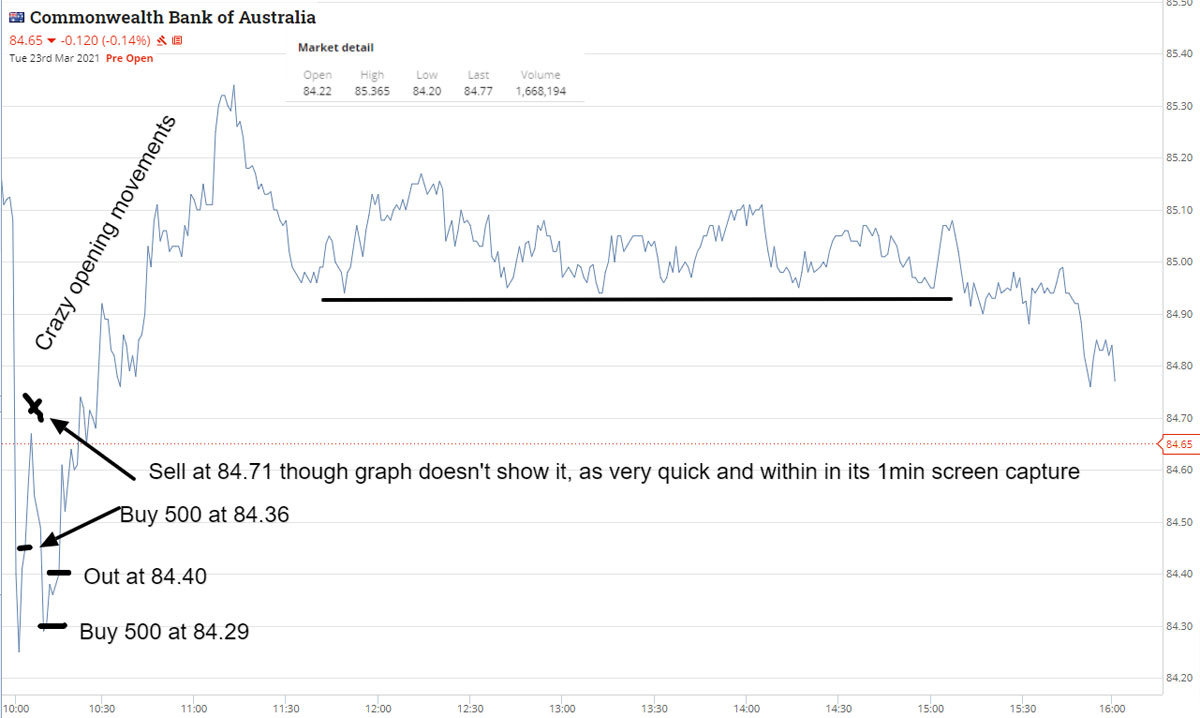

Decided to be ready for the opening today and at 10.04am, CBA is trading at 84.36, down from 85.10 close. Buy 500 and 4 mins later out at 84.71. Then four mins later they are 84.29! Buy 500 and sell them two mins later at 84.40.

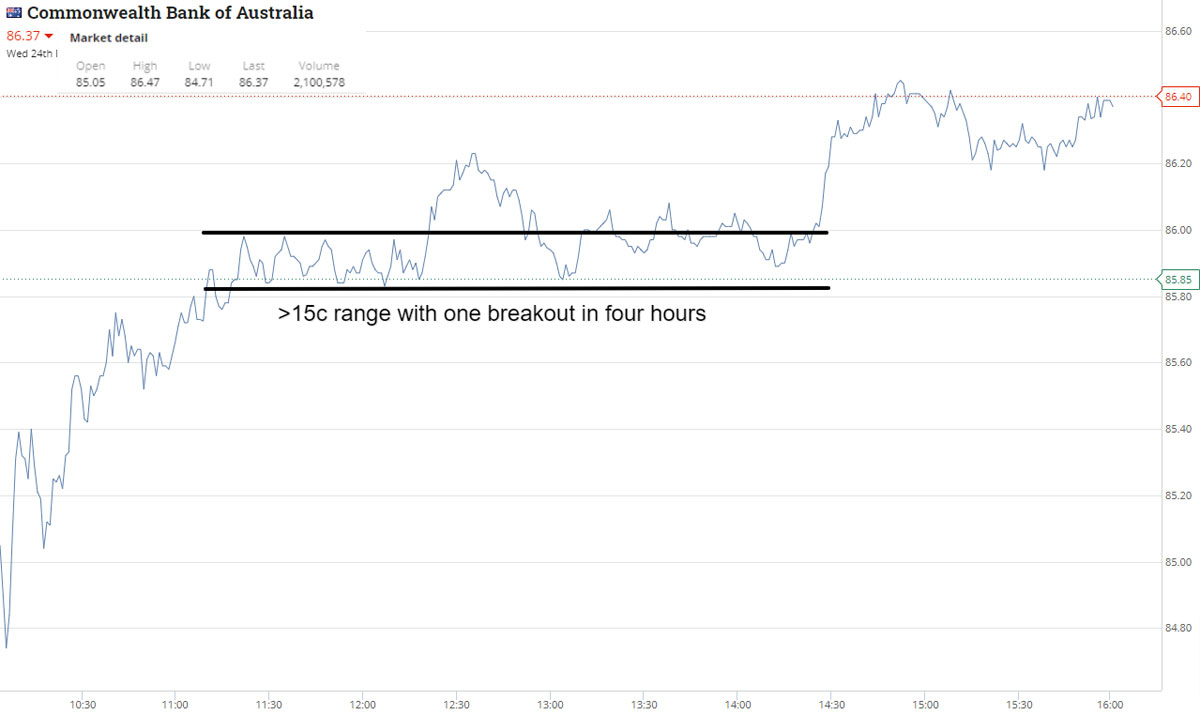

Time is only 10.14am and I have completed four trades and made A$230 from CBA. Why it is moving around so fast, I don’t know but gee it’s fun. See graph.

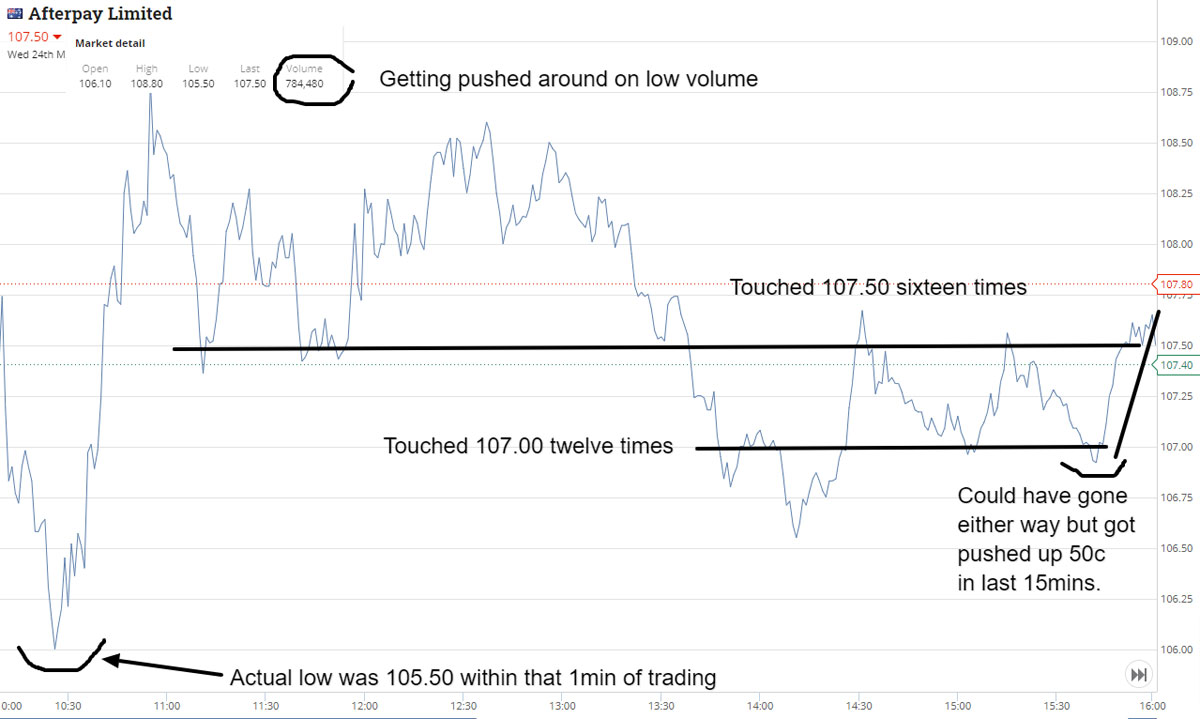

Later in the day APT fall from their high of 111.96 through 108.00 and bounce around there. Buy 100 APT at 108.12. Time is 1.55pm. Double down at 2.17pm for another 100 at 107.77. Avg price is now 107.945 for 200.

They bounce and then fall again so buy 400 at 106.90. Avg is now 107.25 for 400. Time is 2.47pm. Then they go wild on swings and I just miss out selling them for 107.66 limit and well, see chart for result.

Both trades were fun and exciting today. Have added chart of Z1P as they didn’t collapse like APT. All up plus A$165.

+500 CBA at 84.36; -500 CBA at 84.71; +500 CBA at 84.29; -500 CBA at 84.40; Profit A$230 ( all within 10 mins. What a range!)

+100 APT at 108.12; +100 at 107.77; +400 at 106.90; -600 at 107.14; Loss A$65 (average in price became 107.25)

One of those days that, whenever you take a look, they were either trading in tight ranges, with lower than usual volume and not much volatility, or breaking out on quick spurts that fizzle back out. So, even though frustrating, it reminds you that it is OK to not trade.

I looked at a few trades at the end of the day, like APT at 107.00 but with only 15 mins to go, it would be more of a hero trade and disciplined enough today to wait and see what Thursday brings. No moments of weakness today!

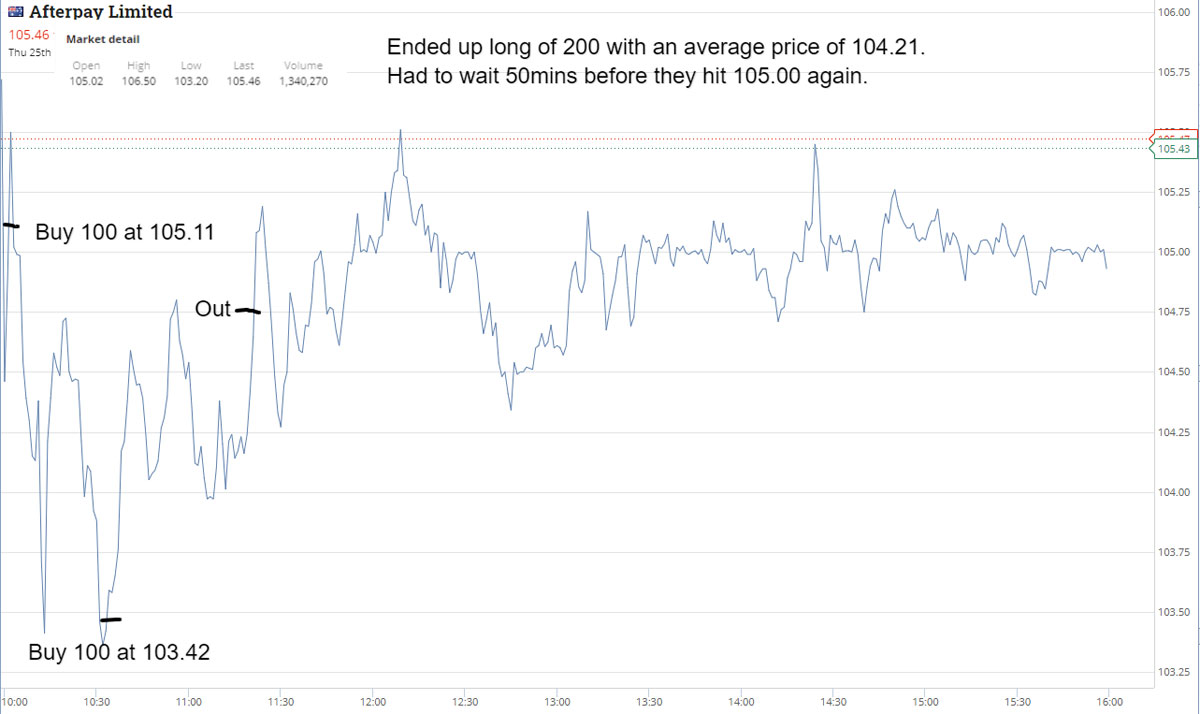

Like a madman possessed, I am into the market within 5 mins of the opening, hoping that I am making the right call. Buy 500 CBA at 85.88 and 100 APT at 105.11. Time 10.05am.

Out of CBA at 86.15, seven mins later but APT not behaving the same. They bounce around and am able to double down at 103.42. Time 10.32am. Now long of 200 APT at an average of 104.21.

NWL appear on the red radar, down 15%. Announcement not that bad, so buy 1000 at 13.68. They fall 20c and then recover to above 13.70 and I’m out at 13.72. Small turn but never traded them before.

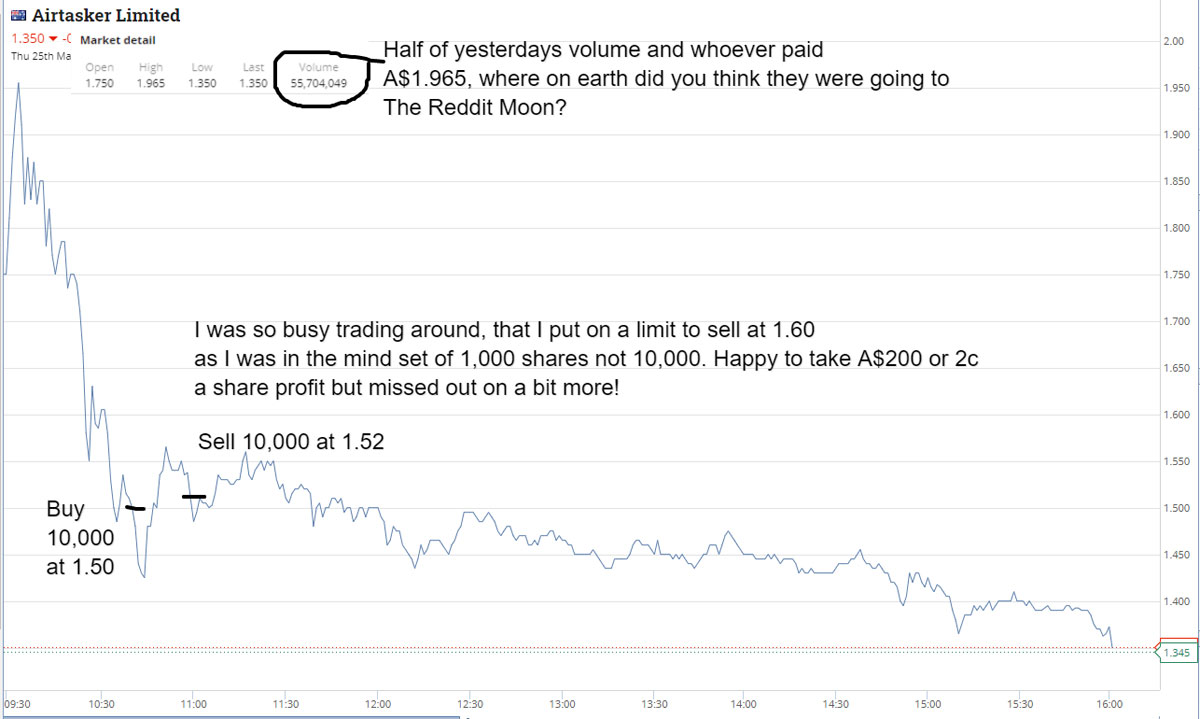

ART are settling around 1.50, so buy 10,000 there and put on a limit to sell at 1.60. In all the excitement, my mind is thinking that would be A$100 profit not A$1000, so when I realise that is too high an expectation, they are at 1.48. Finally get out at 1.52. Time 10.49am.

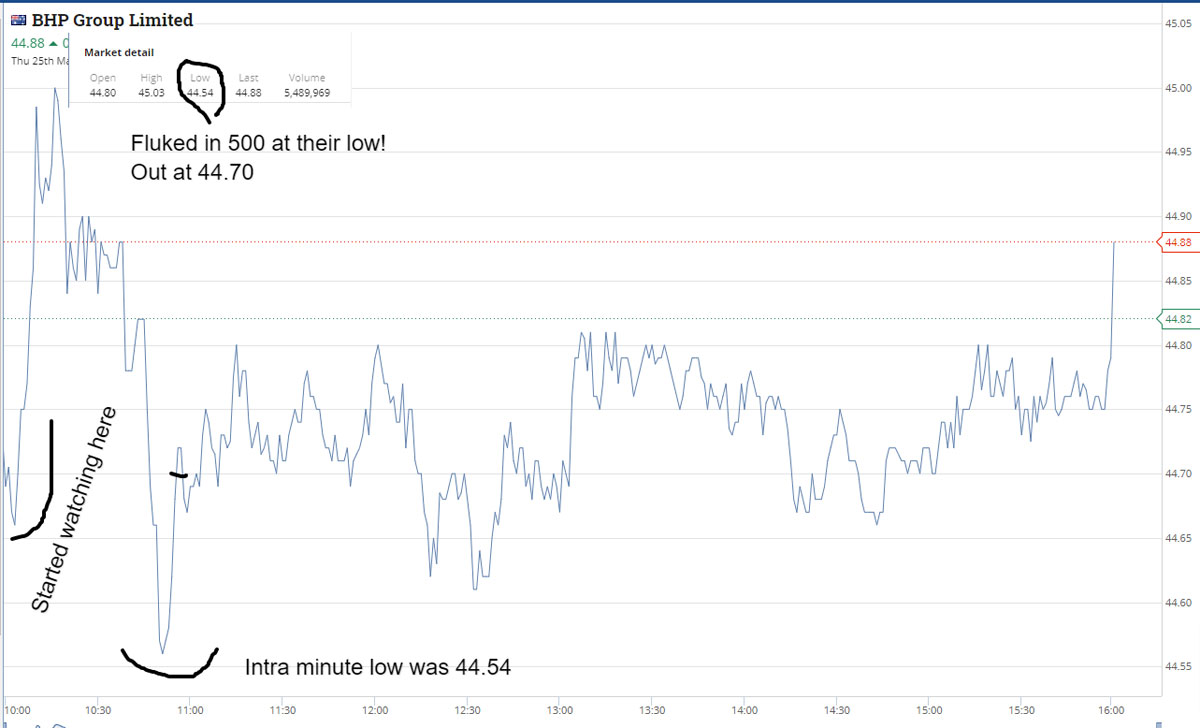

Then buy 500 BHP at 44.54 and sell them at 44.70 five mins later. Managed to fluke the buy at the day’s low. 1 in 1000 trades event.

Lost money on Z1P again. Over all, up A$483 for the day.

+1000 NWL at 13.68; -1000 NWL at 13.72; Profit A$40

+10,000 ART at 1.50; -10,000 ART at 1.52; Profit A$200 (nice!)

+500 BHP at 44.54; -500 BHP at 44.70; Profit A$80

+100 APT at 105.11; +100 APT at 103.42; -200 at 105.00; Profit A$158 (average came in at 104.21)

+500 CBA at 85.88; -500 CBA at 86.15; Profit A$135

+1000 Z1P at 7.70; -1000 Z1P at 7.58; Loss A$130

Expecting some falls in the APT and Z1P’s today. See graph for APT. They open weak and then recover quicker than my thinking, so never get a chance to bottom pick.

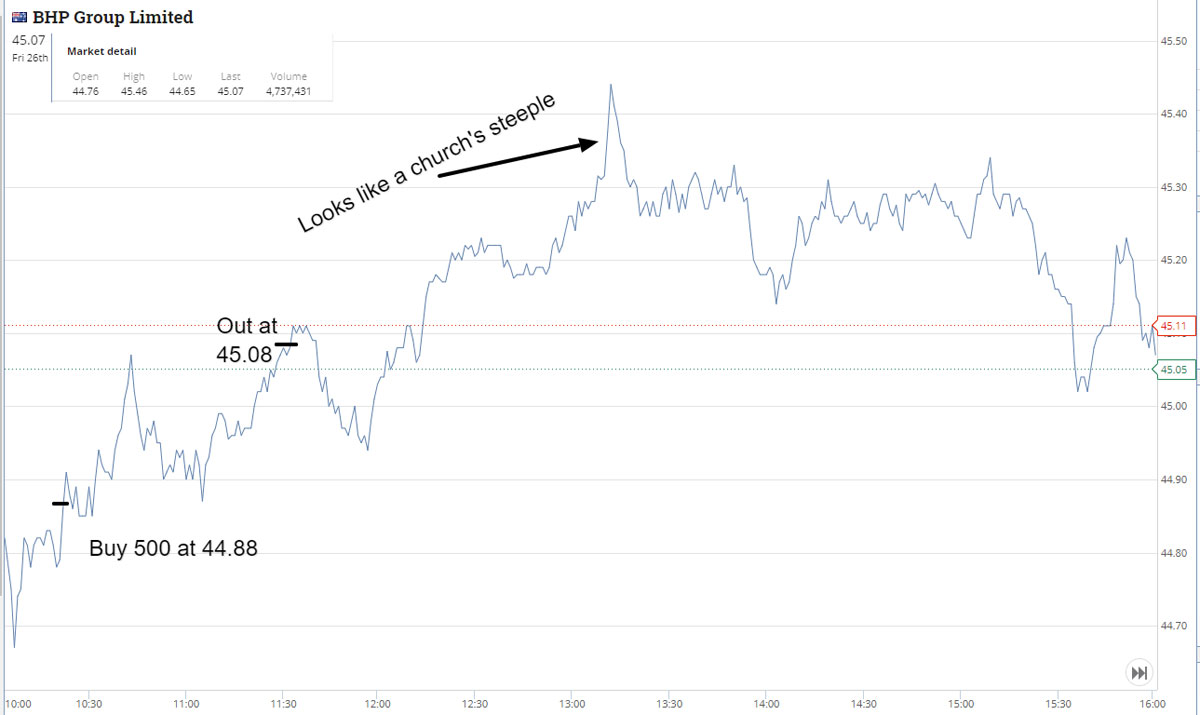

Buy 500 BHP @10.22am as marked down a bit heavy. In at 44.88 and out at 45.08. Time 11.30am.

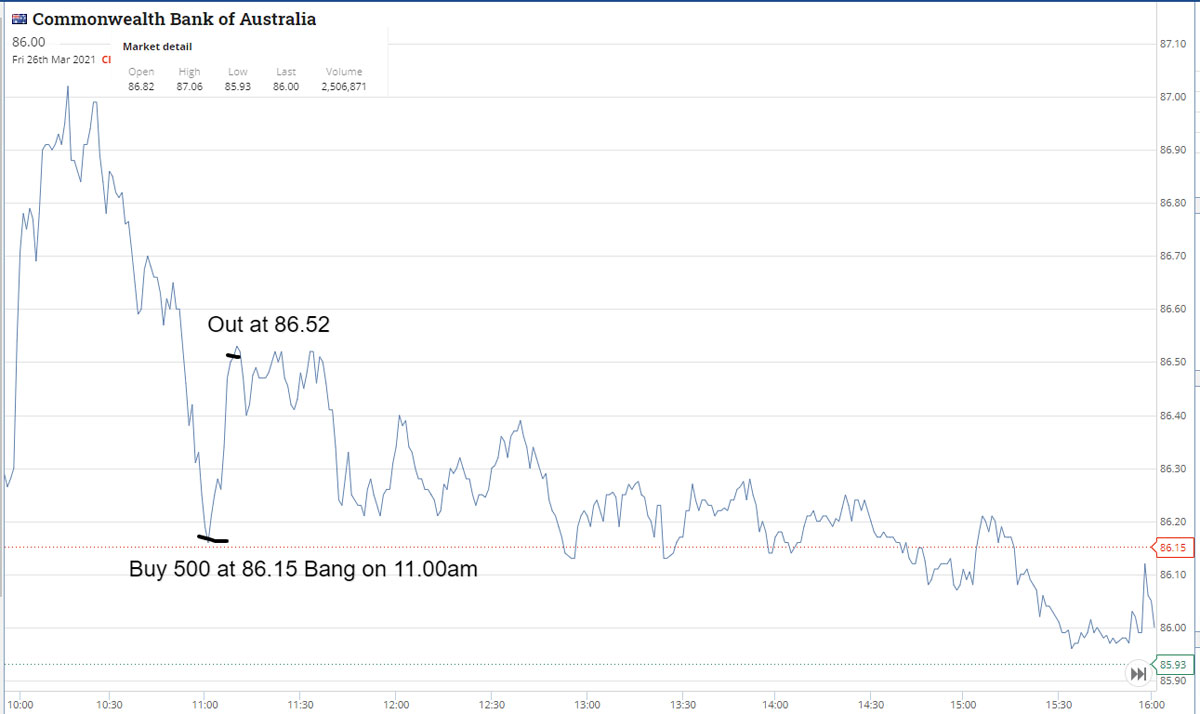

Before this, at bang on 11.00am I buy 500 CBA. They were falling very fast and I started to get my order in at 86.20 but got them at 86.15 by the time I hit the buy button. Hold on to them for 8 mins and out they go at 86.52. The 11.00 o’clock bell came in good on this one today.

Finish early and up A$285 for the day and long of only wine and oysters for the weekend. No shares, no worry!

+500 BHP at 44.88; -500 BHP at 45.08; Profit A$100

+500 CBA at 86.15; -500 CBA at 86.52; Profit A$185 (11 o’clock rocks)

Gross profit for week: A$1183

Less Brokerage: A$178

Net Profit: A$1005

Most Satisfying: ART

Least Satisfying: APT (Tuesday)