Confessions of a Day Trader: Snapping up some Monday specials

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

These are the days I love because it allows me to shine with my trading strategies: Always go home square and in cash. Friday saw a big fall on Wall street and our market is expected to follow suit and fall 1.5% or so. I love to be at the opening because after a sharp fall, some shares will get marked down more. So, I am expecting to see three waves of directions over the day.

First Wave

A sharp mark down on the opening, with some shares overreacting on the down side. So from the opening till around the 11.00am mark.

Second Wave

A bounce in the oversold, due to short covering or just funds buying, which will lift the market from its lows. So from 11.00am till about 2.30pm, should see a bounce and then sideways, or sideways and drifting lower.

Third Wave

Drifting gets stronger because from around 2:30pm to the 4.00pm close, the thoughts will be what will happen overnight. Maybe it will continue. Reading the press headlines will probably create more negative sentiment because they are react not proactive.

I.e. they need to make headlines and assumptions to attract readers. People only ask me how I am doing, when they see headlines like ‘$40bn wiped off equities’. They never ask when they see ‘$40bn added to equities’

As I work off always starting and finishing the day in cash, I arrive at my computer screen, with a clean trading sheet and have all the tools I need already set up.

I have my trading account, my cash management requirements, my computer and phone all connected and synced correctly. I have two different data providers set up, in case one goes down.

These are all things that you have to have in place, ready for when these days come along. You also have to have the confidence to stay with your gut feelings over your emotional feelings, as some positions will hurt before they go to where they should be.

CBA proves today’s classic, as does BHP. Both are Top 20 companies, yet both react like they are a Bitcoin clone, trading wise.

So, I sit down at 9.58am with coffee, computer and phone, wait for the opening and…Bang!

BHP opens down from 46.66 to 45.82, which is a fall of 1.8%. They then fall to 45.76, where I make the day’s first buy of 2000. Seven minutes later they are 45.90, where I sell and make A$280 in seven minutes. Confidence rises a little.

After buying BHP, I have a quick $60 turn via 3,000 CHN. In at $6.93 and out at $6.95 in 60 seconds. They were down 3% or so from Friday, almost double Wall St’s fall. After the BHP sale, I buy 2000 NAB at $26.29 at 10.09am. They were $26.90 on Friday, so that’s about 3.6% down.

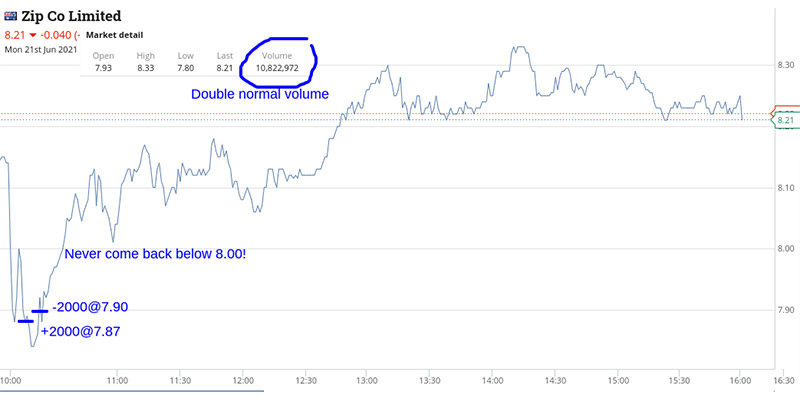

CBA fall below 100.00, so buy 1,000 at $99.90 and also buy 2,000 Z1P at $7.87. Time is now 10.11am.

2mins later out go the CBA at $100.20 and out go the Z1P for $7.90. That’s $360 made in two minutes. NAB are sold at $26.34 for a 5c turn. Time is now 10.19am. CHN fall below $7.00 again, and they give me a 3c turn from $6.97 to $7.00.

All up, I make $860 in the first 30 minutes of trade, and finally go and have a shower ahead of the 11.00am bell.

Here’s my chart analysis for the price action in CBA and BHP:

Come back and watch CBA falling again. I buy 1,000 at $99.89, then another 1,000 (2 minutes later) at $99.75 and then finally 2,000 at $99.61 at 11.11am.

Not until 12.24pm can I lock in a profit and sell the 4,000 at 99.89. That’s $700 out of them. Then back in for 2,000 at $99.12. Time is 12.37pm.

I buy another 2,000 at 98.89. Time is 12.39pm. Out they go at 12.41pm at 99.12. That’s another $460. Finish off the day at just after 1.30pm.

Gross profit: $2,650

Less brokerage: A$546

Net Profit: A$2,104

Given the profitable trading conditions, I call time early on this week’s trading activities and make hay while the sun shines (and before broader NSW goes back into lockdown).

I’ll be back to my usual five-day trading routine next week.

Here’s the breakdown of my chart details for CHN, Z1P, NAB and FMG: