Confessions of a Day Trader: Old and busted – Betting on the Cup. New hotness – RBA sure things

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

A bit of a could ‘ave, should ‘ave day today. Some of the things I was looking at and had lower buy limits in and on (RIOs and FMG), just by me looking at them sends them higher. See chart on RIOs and also CBA for some insight.

The only luck I had in getting set in was WBC but that was only when they looked like a rally was on, so paid 10c too much. Still made $160 by buying 1000 at $24.07 and then very quickly selling them at $24.23.

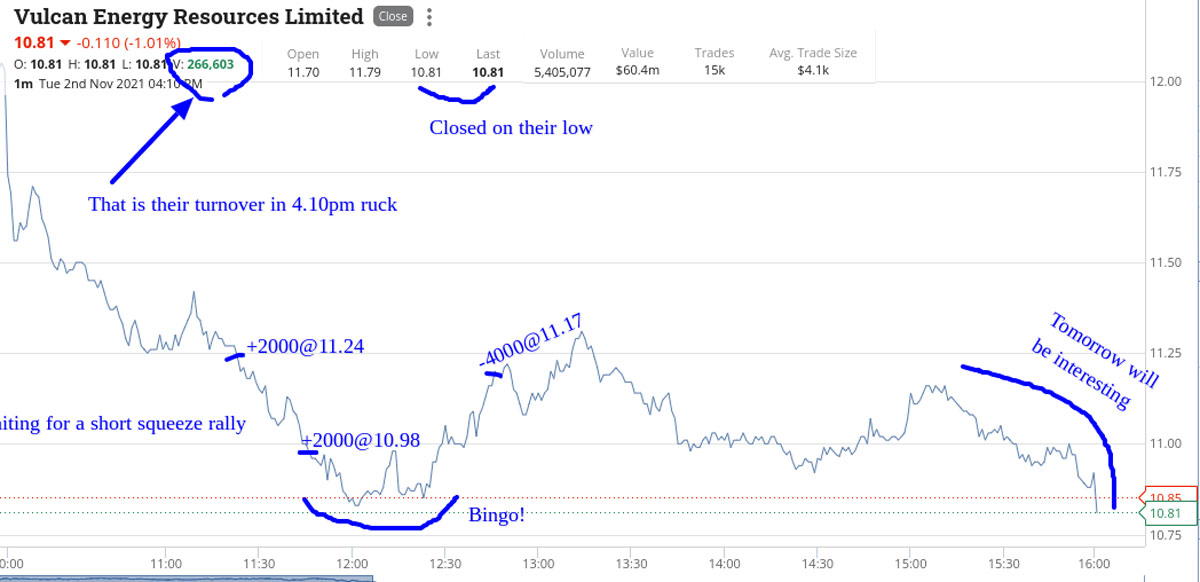

They were the biggest faller in the majors today and finished at their low or down 7.36% for the day, after being smacked hard in the 4.10pm ruck. Will be interesting to see them open tomorrow.

I don’t know if it was pre Melbourne Cup trading volume today though, it might explain the movements in RIO and CBA. Should be even quieter tomorrow and maybe a 3.00pm punt on the market instead of the Cup maybe the way to go.

Let’s see!

And we’re off… to a poor start by the market ahead of a pre Melbourne Cup announcement on interest rates from the RBA due at 2.30pm.

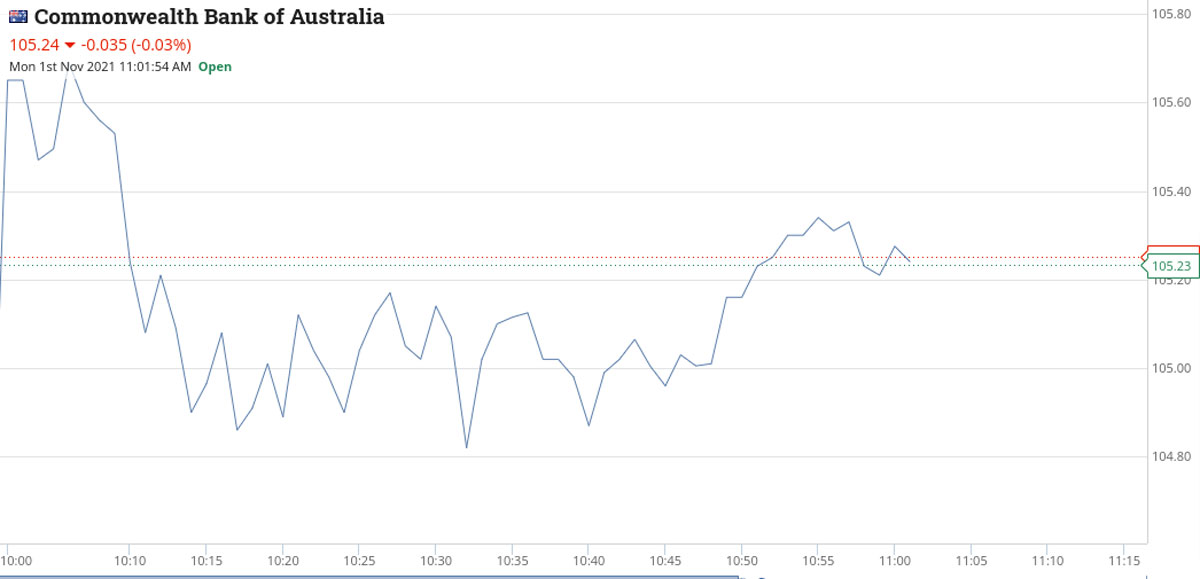

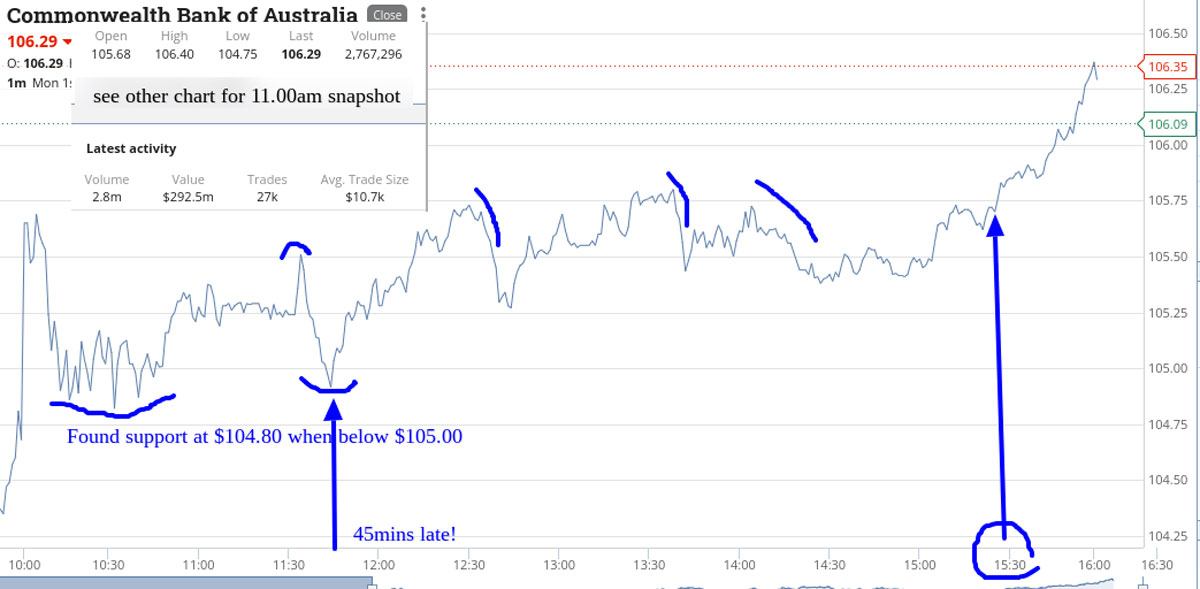

VUL have been the target of a short seller and today I try and find a short squeeze, but before that I buy 1000 CBA at $105.48 for 11.00am action.

They manage to reach $105.07 before coming round the bend and galloping into the RBA announcement.

Same for WBC. Bt 2000 at $23.03 and they also rear up at 2.30pm. Sell them at $23.15 (+$240) and sell the 1000 CBA at $106.04 (+$560).

Who needs a Melbourne Cup winner when you have the RBA!

Back to VUL. Put on my Spock ears at 11.45am and bt 2000 at $11.28 and wait for the short squeeze. Buy another 2000 at $10.98 and wait for the short squeeze.

Bingo! They move out from the rails and put in a winning spurt for me and out they go at $11.17 (also +$240) before they close at their low of the day at 4.10pm. See chart.

Up $1040 and didn’t have to get dressed up or mingle with any frocked up people. Nice!

A few sore heads I imagine are around the place today but not here. Bright-eyed and bushy-tailed and up early to see how the o’seas markets went.

At 5.42am the AFR is calling the market up 1% but iron ore takes a 7% tumble. BHP down 3% in NY trading and RIO are down 2.4%.

Ouch!

Mmmm, they open a bit lower then rally, so have a pre 11.00am punt on RIOs as maybe the falling A$ gives them a lift, but decide a few margin calls may be the reason. Buy 1000 at $88.91 and bang on 11.00am, bingo. Off they go and out at $89.28 (+$370).

A few months ago this would be a $130,000 trade and now it’s a $89,000 trade!

Also CBA have an 11.00am spurt, go above $107 again and come back down in the afternoon.

Being very cautious, I buy 750 at $106.40 and watch them fall before an afternoon rally and out they go at $106.73 (+$247). See chart.

Up $617 and only really did the CBA trade as something to do, as could have gone either way. But worked out better than I thought it would.

Bloody Hell! CBA sailed past $108 just after the opening and then pulled back heading to the potential 11.00am setup.

Sneak in 1000 at just before 11.00am at $107.38 and close my eyes. See chart as it’s a classic.

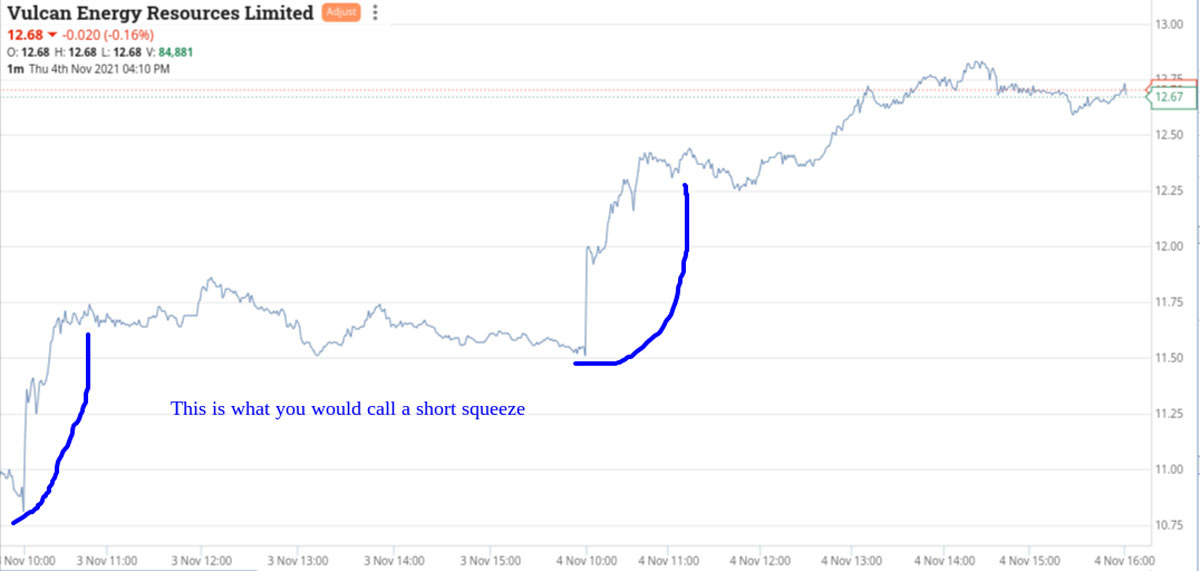

Sell them $107.99 (+$610) on a limit and that’s it. Can’t find anything else. Even VUL have kept going up, so included a chart for the record.

Having paid $10.98 on Tuesday today, they closed at $12.68 or up 10.1% for the day, so some shorters have had their pips squeezed, big time. Suspect they will come back tomorrow. Let’s see!

Will there be fireworks today? Er, nowhere for me, but for CBA holders it was a good day as they reached an all time high. The opposite for WBC holders.

They opened down, after CBA opened high, so bt 2500 at $22.60. Thought twice that a rally was on but had to cut them at the close for a 5c loss or $125.

After the WBC purchase gave MIN a bit of attention thinking a pre-lunch rally may come on. Bt 1500 at $38.08 and then another 1500 at $37.86.

Also got that one wrong as well as had to cut them at the death at $37.88.

So, Friday manage to lose $395 and come out up $2032 gross or $1797 net, and that’s a week with Melbourne Cup fever and nationwide hangover included.

Included a chart on CBA, just for the record and highlighted some new Marketech features on the MIN graph.

They didn’t help me today but they did during the week and hopefully they will help me next week. Ciao.