You might be interested in

News

ASX Small Caps Lunch Wrap: Inflation a little higher than expected, but then so is the ASX

Mining

Bulk Buys: Why the big Pilbara producers say returns are going to slide in iron ore

Mining

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Still in lockdown and getting a bit of cabin fever and trying to avoid just looking at my screen all day.

On the opening there are a few big fallers and they are household names who appear to have missed their profit targets. Super (Cheap) Retail Group (ASX:SUL) are down from Friday’s close of $12.80.

So, I buy 2000@$12.01, then 2000@$11.84 to average down. Sell them at $12.01 and watch them instantly rally! Great. Up $340 but left more than a set of wheels on the table. Oh well.

Now over to NIB (ASX:NHF).

I buy 1000@$7.49 early on. Then [email protected]. Then 2000@$7.11. Then 5000@$7.18 to get my gearing up, as seem to have found a level. Sell them all at $7.24.

Then later, they have a sudden drop and I catch 5000@$7.10 and knock them out on a 4c turn at $7.14.

RIO – how could I resist them at below $106? They opened at $108 and I gingerly pick up 1500@$105.96, just before 3.30pm.

Will they rally or won’t they rally like Friday’s trading?

Well, they do and I kiss them goodbye at $106.36. So up $1,430 for the day. BHP are too erratic today and FMG just feel horrible. They broke through $20.00 and never recovered.

Mask up and go for a cabin fever relief walk.

Ansell (ASX:ANN) are marked down 10% on the opening after their results.

Get to trade them eight times today as they gyrated around the $37 level and then broke down below.

First buy and sell was a 1000 at $37.00 and then out at $37.16.

Then they fell back towards $37.00. Bought 1000 at 37.05 and then they broke down. Buy another 1000 at $36.83 before selling both parcels at $37.07.

Then they really break down below $37.00 and I buy 1000 at $36.42 and then another 1000 at $36.14 – ouch!

Finally the rubber company bounces and sell the 2000 on a limit at $37.40. Up $680 from all eight trades.

Couldn’t resist a pre-11am trade in FMG. Buy 1000 at 19.46 and sell them at 19.61. Felt like I was trading in the years when relo’s were born! +$150 and first dipping of the toes back into iron ore plays.

Also SUL fell pre-11am, so bought 1500@$12.15 and sold them @$12.47 whilst at the bottle recycling bank and waiting in the queue. Got $2.60 back in bottles plus $480 in SUL.

NHF presented two chances today. Early on they fall below $7.00 and I buy 2000 at $6.79 (they were $8.00 two days ago) and then 4000 at $6.66 (I used to buy Z1P at this price). Out they go at $6.74 and then back in for 1500 only (as not sure if they will fall more) at $6.67 and also sell them at $6.74.

All up plus +$1,635 and amazed that both SUL and NHM keep sharing their love with me today.

Today seems very drawn out and a bit of a hump day. NHF open lower and I buy some – 2000 at $6.46. Then I buy another 2000 at $6.39 on a limit, before selling all 4000 at $6.46, to make $140. They promptly rally to $6.65 and I wince.

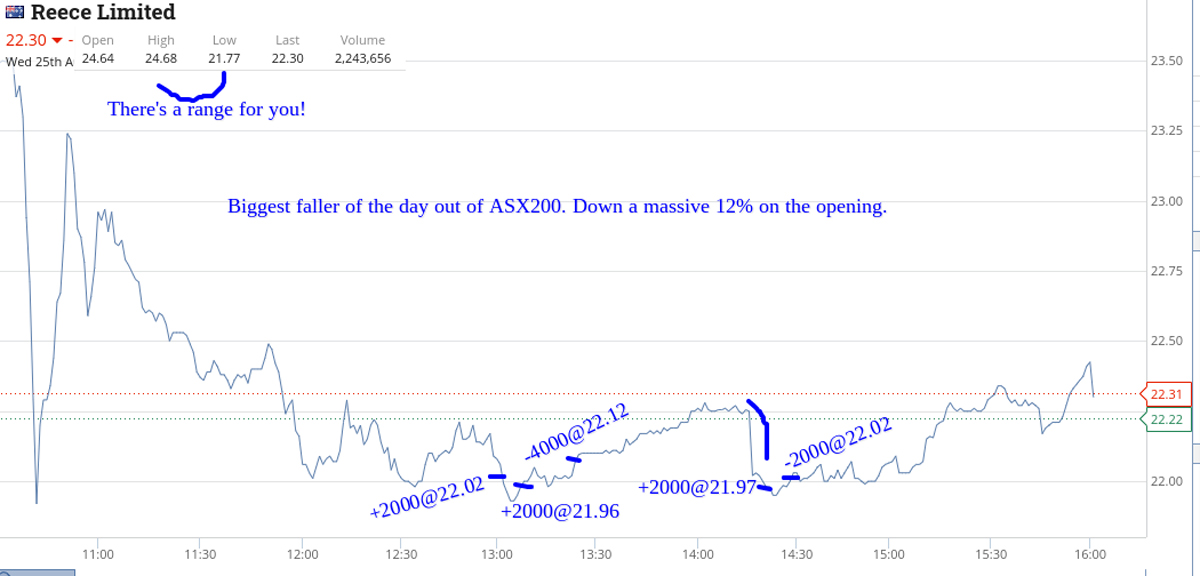

Reece (ASX:REH) are the biggest faller, down 12% on the pre-market results. Buy 2000 at $22.02 and within a second they fall below $22 and hit $21.90.

As quick as I could, I buy another 2000 at $21.96 and within 30 seconds they shoot back above $22.00 and I sell them at all at $22.12 and make $520.

Later on I’m allowed back in at below $22.00 after they hit a high of $22.80 and buy 2000 at $21.97 and sell them at $22.02. See graph.

RIO finally appear back in my ledger, having opened up 5% higher and they soar to $112.67 before coming back down to land.

Buy 1000 at $111.46 and sell them at $111.66. Then back in for 1000 at $111.27 and out at $111.64.

Later in the day, just after a nana nap I buy 1000 at $110.75 (it’s 3.30pm) and with 5 mins trading left I sell them at $110.90 and watch them touch $111.20 with one min to go.

Overall up $1,475 today and $4,540 for the week so far. Still in lockdown land and NSW cases still going up.

A2M are marked down after their results. When down 10%, I buy 1000 at $6.27 and sell them at $6.35. Then back in at $6.20 for 1000 and out at $6.28. They close the day down 11.3% at $6.06 and feel they will fall more on Friday.

RIO just keep on giving and have a day’s range of a massive $3.00.

Lots of opportunities today and manage to book in a profit of $1,350 overall.

Start the day buying and selling 1000 for a 24c turn. In at $109.85 and out at $110.09.

Then 30 mins later buy 1000 at $109.56. Then another 1000 at $109.18 and then grit my teeth and buy 3000 at $108.80.

Sell all 5000 at $109.25 and then walk away from them as I don’t want to push my luck.

REH also marked down at the start of trading and do well in them before it all goes a bit pear-shaped in the afternoon and I wish I had walked away like in RIO, but just couldn’t help myself.

First trade in them was for 1500 at $21.46. Then another 1500 at $21.35 before selling the 3000 for $21.63.

That’s a nice $675.

Later they are down to $20.80, so buy 1500. Then 1500 at $20.75. Then 3000 at $20.64. Then 6000 at $20.64 and I’m still drowning and lose $450 when cutting them at $20.64, as they just don’t feel right.

They go down to $20.53 just before the close. They were $25.80 on Monday! Plus $1,730, overall today, even after the REH loss.

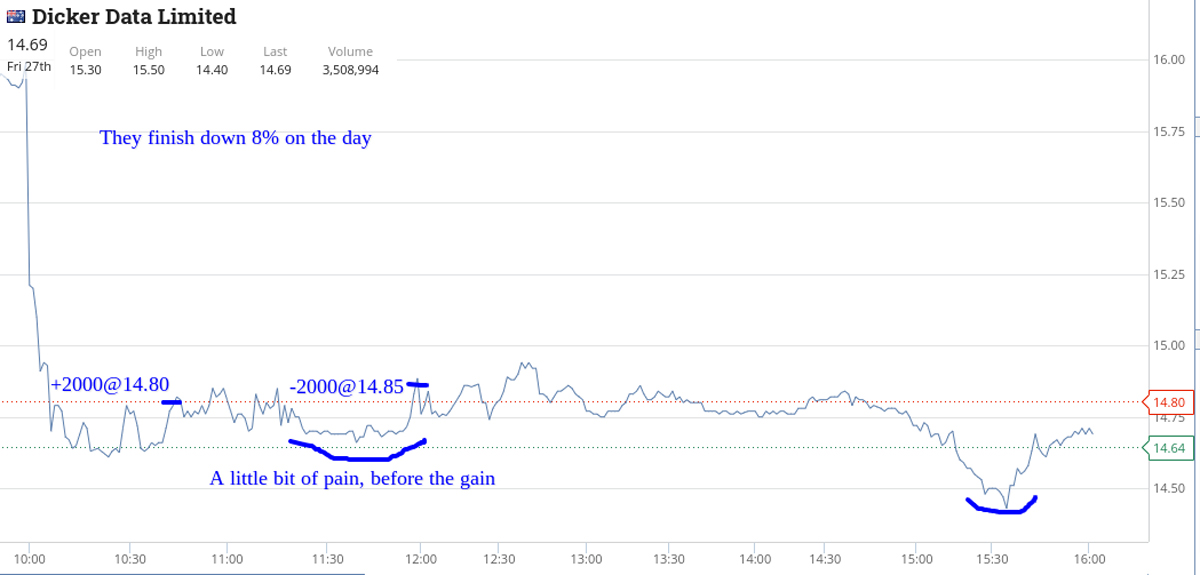

I could only find one trade today and that was in Dicker Data (DDN). Bought 2000 at $14.80 and sold them at $14.85, though they did fall to $14.65 before they gave me a rally.

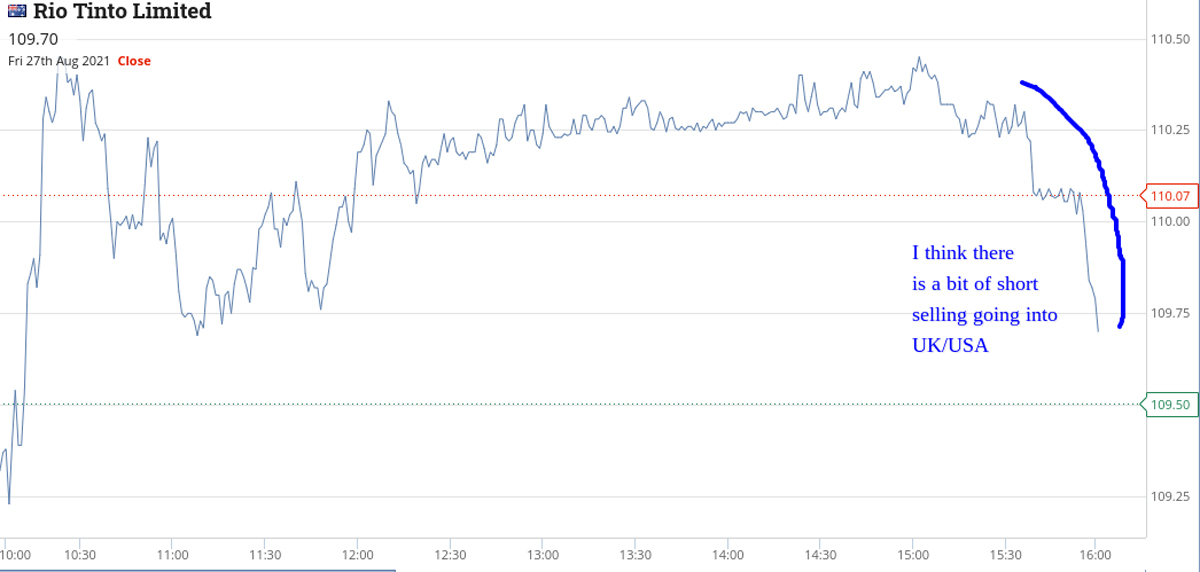

I could not find any other trades today. Have added the chart for RIO, as they got sold down aggressively towards the close. I think that is some professional shorting, with covering taking place in London and New York trading.

Up $6,375 for the week gross or $5,547 net as lockdown continues for me and lots of others.