You might be interested in

Mining

Monsters of Rock: Northern Star defends hedges as gold prices spike; Metals Acquisition bats off M&A talk

News

ASX Small Caps Lunch Wrap: Arise Sir Risk-On, as punters leave gold to flail and oil to ail

Mining

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

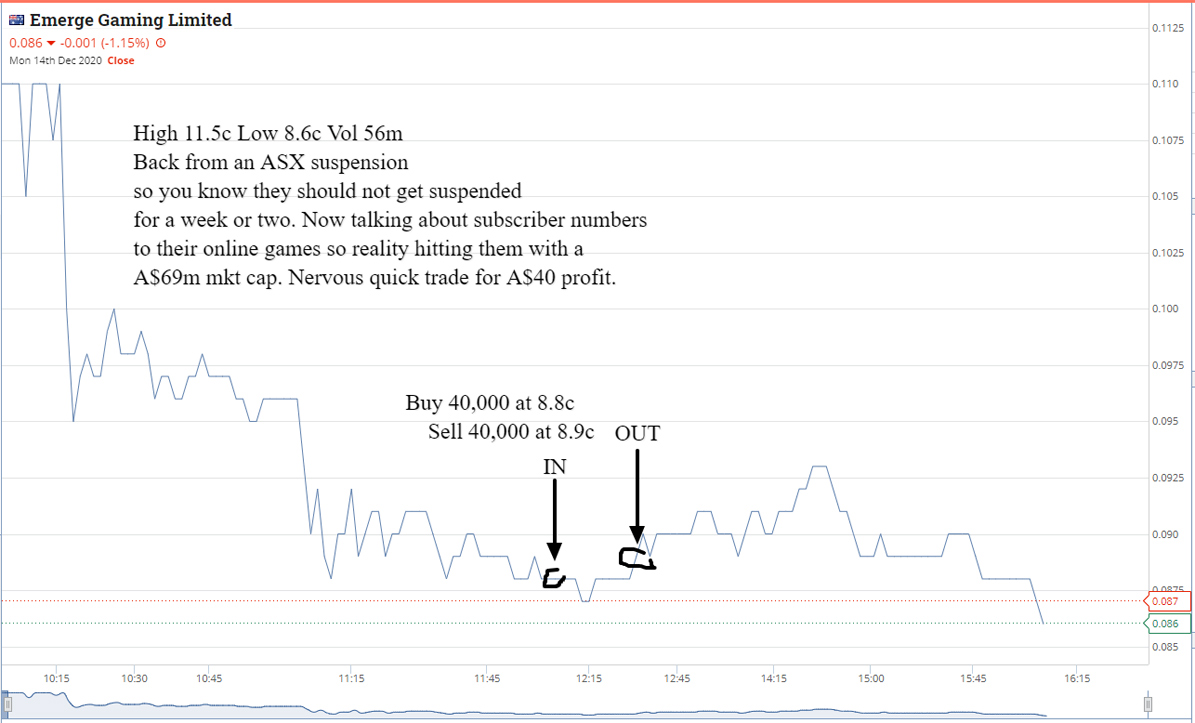

Have a busy day finishing and delivering a website to a client today and nothing on the watchlist tickles my fancy till around 12.00, when I buy 40,000 EM1 at 8.8c having seen them as high as 11.5c on 40 odd million being traded. They had been suspended by the ASX and recently came back on.

Stick to 40,000 as I know each 0.1c movement means A$40 + or – to the P/L account. It’s not the amount of money I look at when trading but the gearing and leaving a bit of wriggle room to average down if needed.

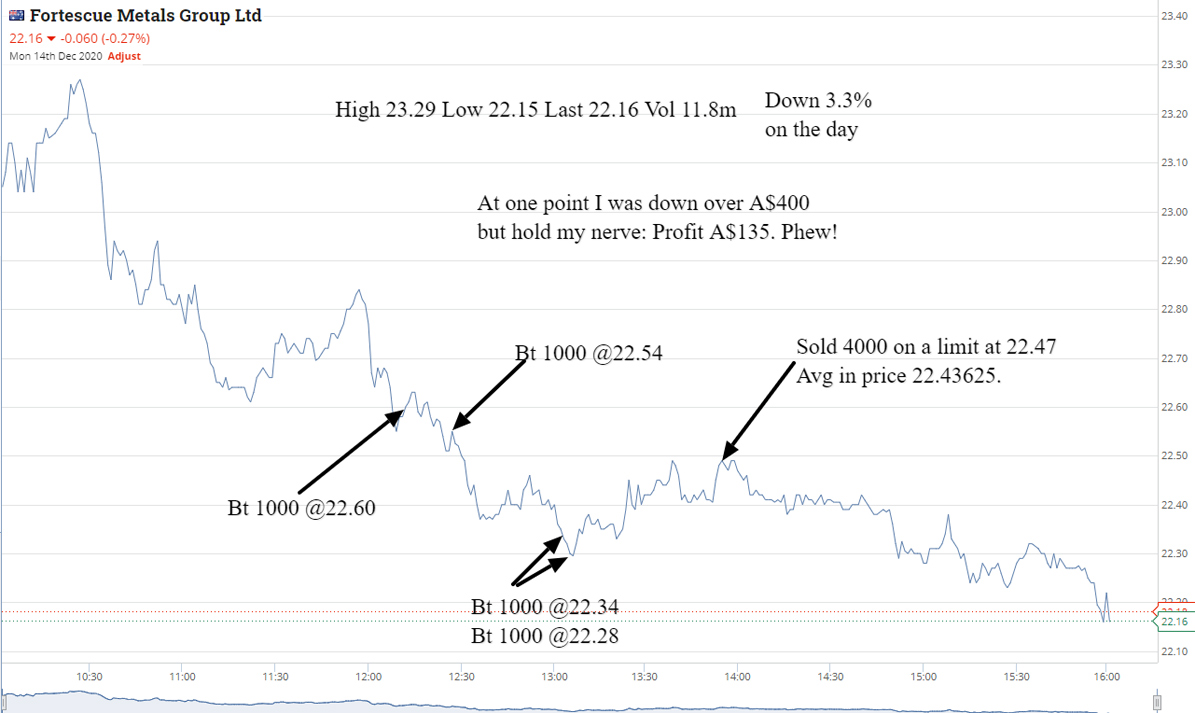

The other stock looking volatile today is FMG as you will see from the chart. Watch them open above 23.00 and see them at 22.66, so put on a limit buy at 22.60. Get filled in and then I am forced to average down another 3 times as they keep falling.

At one point I am down over A$400 and at 1.44pm I put on 4000 to sell at 22.47 on a limit and go and have a nanna nap. Come back to the screen and see that I have been taken out for a A$135 profit. And client happy! Not a bad result all round. Profit A$175.

+40,000 EM1 at 8.8c; -40000 EM1 at 8.9c; Profit A$40

+1000 FMG at 22.60; +1000 FMG at 22.54; +1000 FMG at 22.34; +1000 FMG at 22.28; -4000 FMG at 22.47; Profit A$135 (the last two buys were 2 mins apart, that’s how fast they were falling)

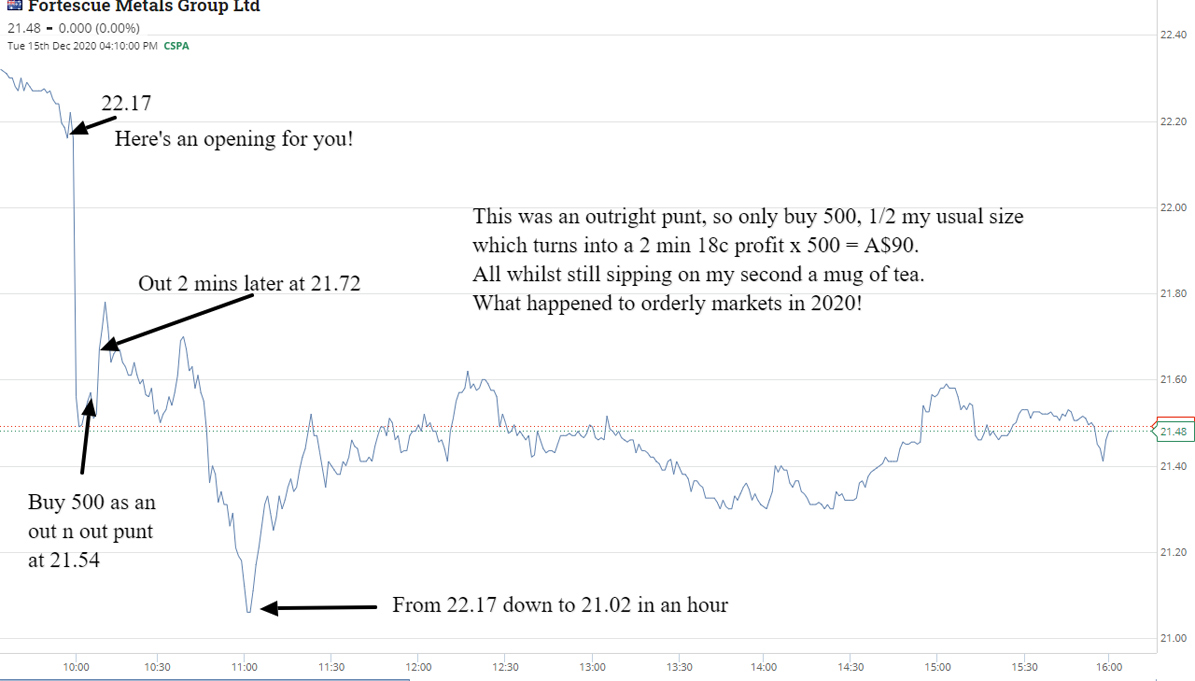

Just settling down into my chair with a mug of tea and bang, FMG are down. So, thinking worth a punt, I buy half my usual size as it’s so early.

At 10.09am buy 500 for 21.54 and two mins later sell them for 21.72. That’s a A$90 profit whilst tea is still warm. Now what shall I do, dear diary?

Got 6 hours left. Do I walk away or keep going? At lunchtime I come back for a look around. NST are hovering around the 12.00 level. Limit in to buy 1000 at 11.96. Get hit and they keep falling so average down at 11.90. Gah.

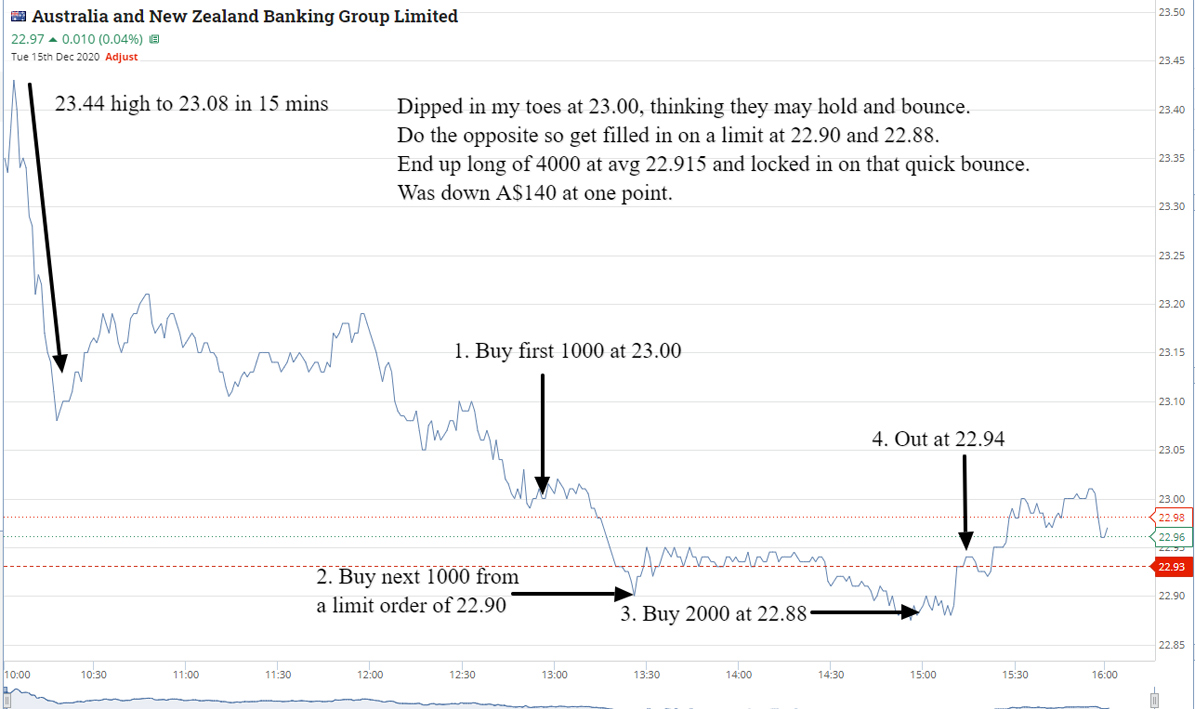

Time 1.31. Have a limit order in to buy 1000 ANZ at 23.00 and get filled in at 1.02pm. Next buy another 1000 at 22.90 and then another 2000 at 22.88. The 2000 was on a limit and took ages to reach there (see graph).

Now chilling out on the couch on my mobile refreshing my position page and close out NST at 11.97 for A$80 profit. Win!

ANZ is giving me trouble in the wallet department until bang, they jump and I’m out of jail and book A$100.

Tip: Never buy your full size in one go. Using the averaging down method got me out of a spot in ANZ as 23.00 down to 22.88 was a A$120 loss on 1000. The next purchase became 22.95 average and the last 2000 gave an average 22.915. This allows for a smaller move upwards to turn a profit.

All up +A$260 profit.

+500 FMG at 21.54; -500 FMG at 21.72; Profit A$90 (½ normal size as 10.10am)

Buy 1000 NST at 11.96; Buy 1000 NST at 11.90; Sell 2000 at 11.97; Profit A$A$80

Buy 1000 ANZ at 23.00; Buy 1000 ANZ at 22.90; Buy 2000 ANZ at 22.88; Sell 4000 at 22.94; Profit A$100 (averaging down method worked this time!)

Couldn’t find anything in the morning and it wasn’t until lunchtime that FMG settled down around the 22.00 level. Z1P just kept moving up slowly, so it appears that most of the escrow stock has been soaked up and APT are now around the 114.00 level.

Buy 1000 FMG at 22.045 at 1.15pm and get taken out on a limit at 22.09. Then out of boredom I buy back in at 22.015 at 2.46pm. I put them on to sell at 22.04 but they just don’t feel right and I keep adjusting the limit down 1c at a time. Eventually I sell them at 22.01 for a A$5 loss.

It’s 3.00pm and I walk away for the day up +A$50. They close around the 21.97 level and so that was the right idea in taking a small loss.

+1000 FMG at 22.045; -1000 FMG at 22.09; Profit A$55

+1000 FMG at 22.015; -1000 FMG at 22.01; Loss A$5 (shouldn’t have bought back in)

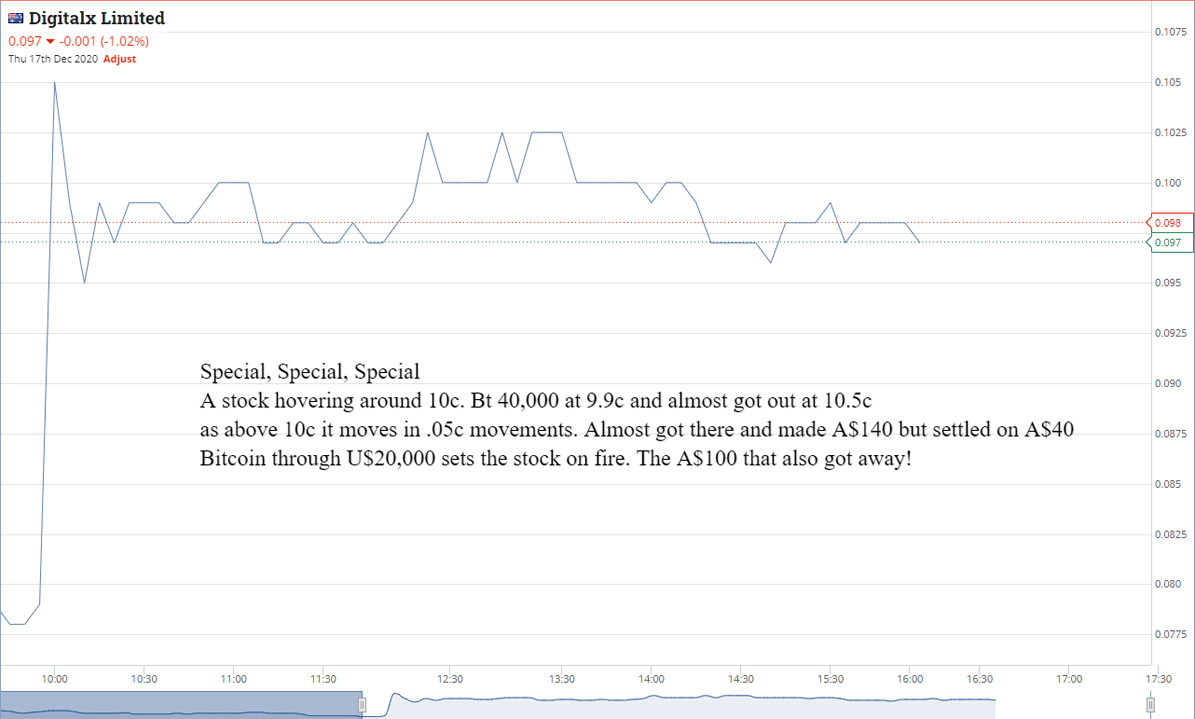

Bitcoin breaks through U$20,000 so DCC comes out up 30% or so. Buy 40,000 at 9.9c – if they break through 10c next trade will be 10.5c, so put on a limit there. Will be a A$140 profit if they do but they don’t!

Sometimes this trick works but today it didn’t so settle for A$40 profit.

Time12.07pm. NCM are moving around the 27.00 level and buy 1000 at 26.96 at put on a limit sell at 27.02. They slowly get there and I pocket A$60 at 12.28pm. See chart for a weird 1.00pm to 3.00pm trading pattern.

The one that got away was Z1P as I saw it touch and bounce off 5.55 twice. Put on a limit there and this made them take off, so when they reached 5.72, I cancelled it. Overall up A$100 for the day on two stocks that I haven’t traded for some time.

+1000 NCM at 26.96; -1000 NCM at 27.02; Profit A$60

+40,000 DCC at 9.9c; -40,000 DCC at 10c; Profit A$40 (almost made it A$140)

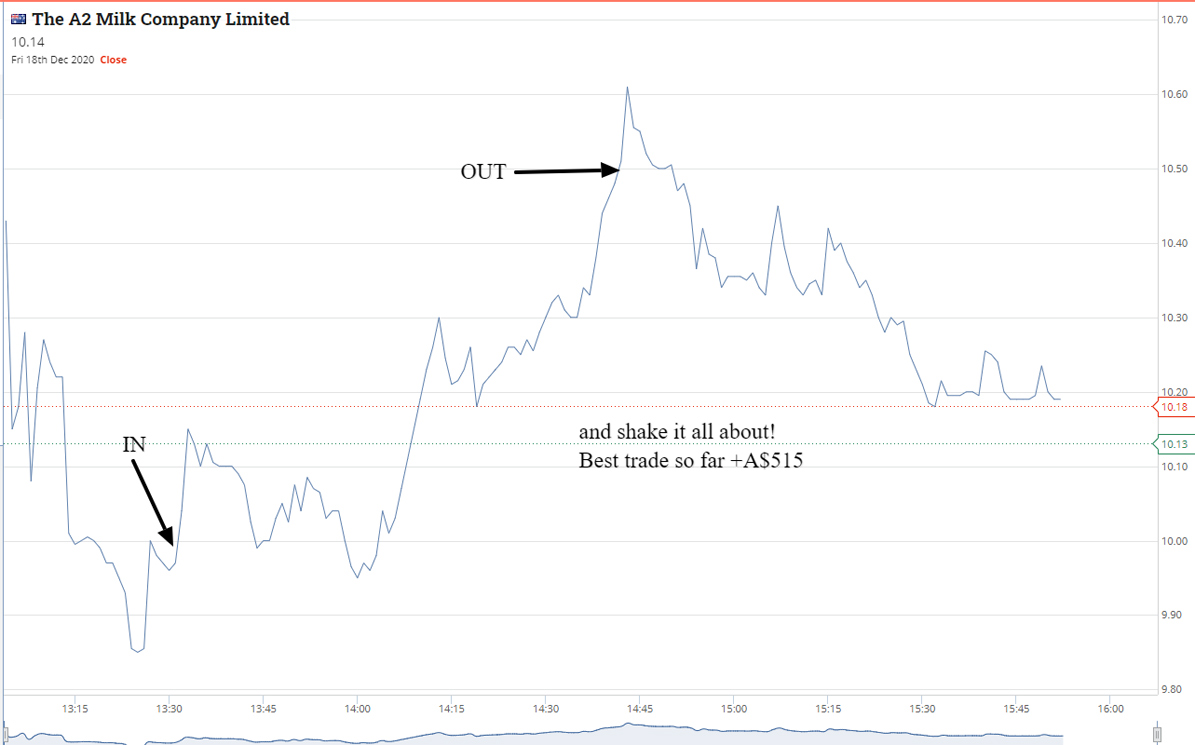

Looking forward to today, as I have A2M added to my watch list as they are in a trading halt and should come back on at some point. China – Milk – exports. Gonna be a downgrade and I want to be ready for them on their return.

Buy 1000 Z1P at 5.35, which is 1c above their A$120m placement price. Last time I tried this was with MMM and got horribly caught out. Let’s see.

Time 11.28am. Shaws and Partners doing their job and supporting Z1P and at 12.01pm, I’m out at 5.41 for a A$60 profit.

Running around with a few things to do and it’s hot. So grab an ice cream and sit in car and check the market. A2M are back on and heavily marked down. I buy 1000 at 9.985 and it’s 1.30pm. Off to some meetings and when I come out A2M are at 10.50. I quickly lock that in and I’m out.

Time is 14.41pm. Profit A$515. Best so far. Upgrade dinner from hamburgers to fillet steak and cask to a $20 bottle of Bygone Era McLaren Shiraz 2019.

All up, locked in A$565 and no positions carried forward over the weekend. Yay!

+1000 Z1P at 5.35; -1000 Z1P at 5.41; Profit A$60

+1000 A2M at 9.985; -1000 A2M at 10.50; Profit A$515 (not crying over spilt profits)

Best Trade: A2M +A$515

Worst: FMG -A$5

Gross Profit for week: A$1160

Brokerage: A$170

Net tally: +A$3466.60 net after seven weeks