Confessions of a Day Trader: It’s a new year and even Zip’s turned green

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

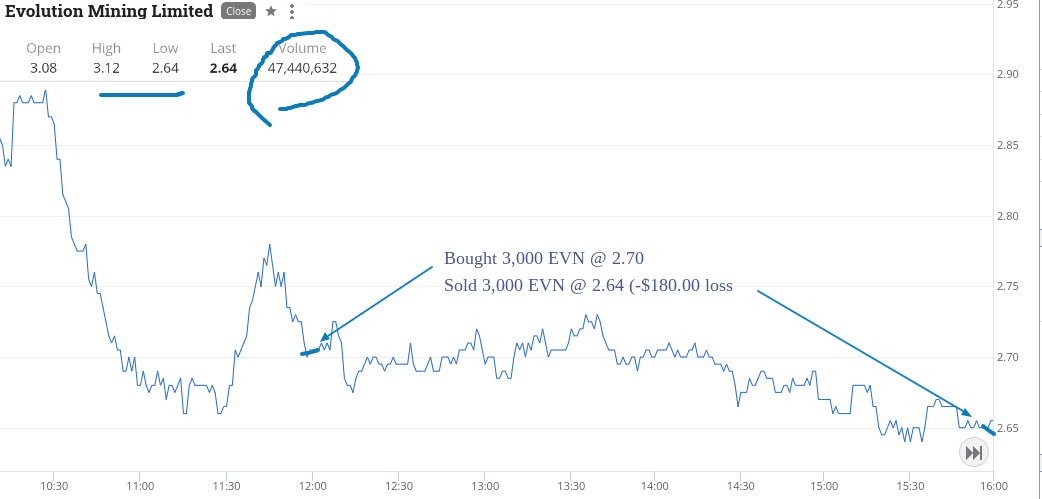

Go slightly off piste today as nothing showing up on my watch list.

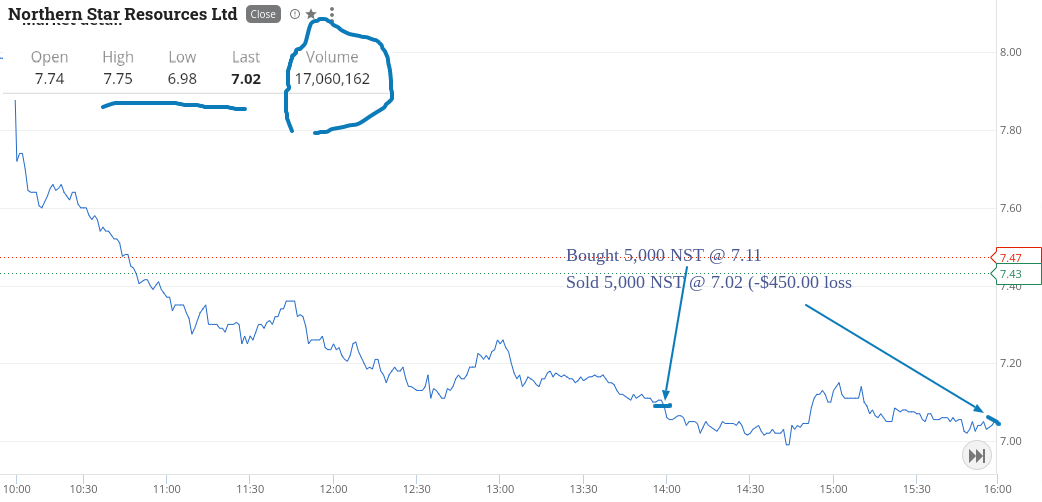

Both NST and EVN are marked down, so try and have a go in both by leaving what I thought were cheeky limits.

Turned out they weren’t.

Results are not what I hoped, as I think the year-end fun and games are happening and catching me out.

Manage to lose a total of $630 on the day, having cut both positions in the 4.10pm ruck.

Bring on July 1st!

Recap

Bought 3,000 EVN @ 2.70

Bought 5,000 NST @ 7.11

Sold 5,000 NST @ 7.02 (-$450 loss)

Sold 3,000 EVN @ 2.64 (-$180 loss)

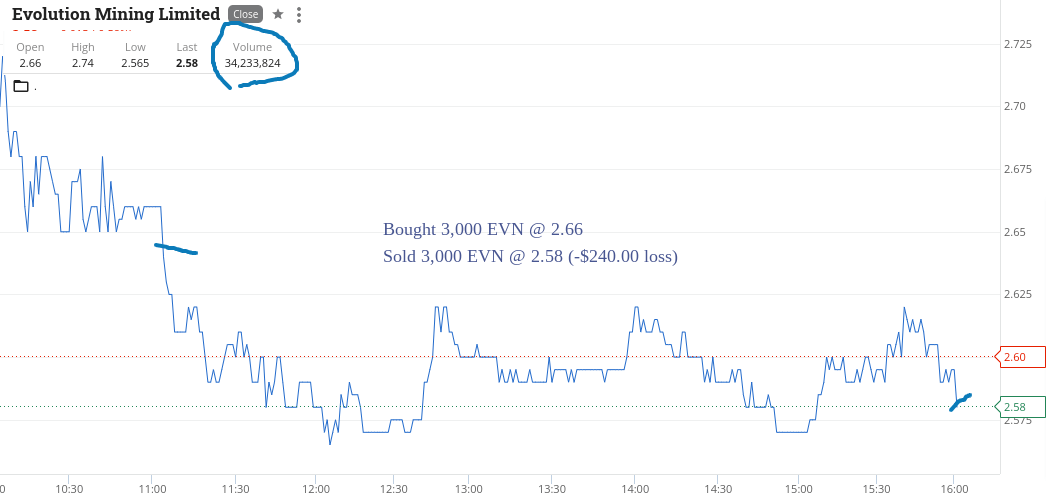

NST take off on the open, as I thought oversold. Having said that I thought EVN were also oversold yesterday.

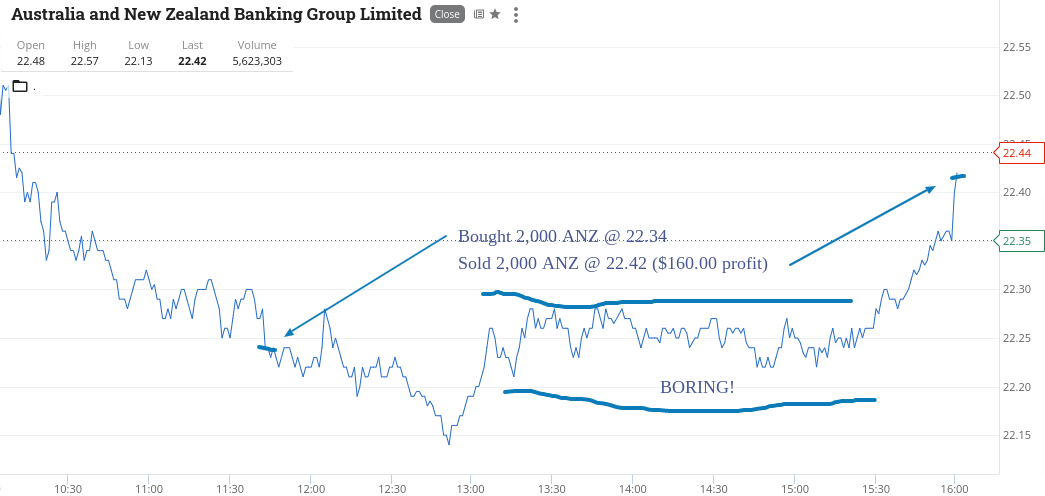

Get back on the horse and manage to lose on them again, however had better luck in ANZ but also had to wait till the death.

ANZ and all the other banks became boring though a late rally saved them all.

Not giving up on EVN, so will have another go tomorrow. BWX were down 40% but too far down the valuation scale to show up on my fallers list.

Could be on for tomorrow.

Overall down $80 for the day!

Recap

Bought 3,000 EVN @ 2.66

Bought 2,000 ANZ @ 22.34

Sold 2,000 ANZ @ 22.42 ($160 profit)

Sold 3,000 EVN @ 2.58 (-$240 loss)

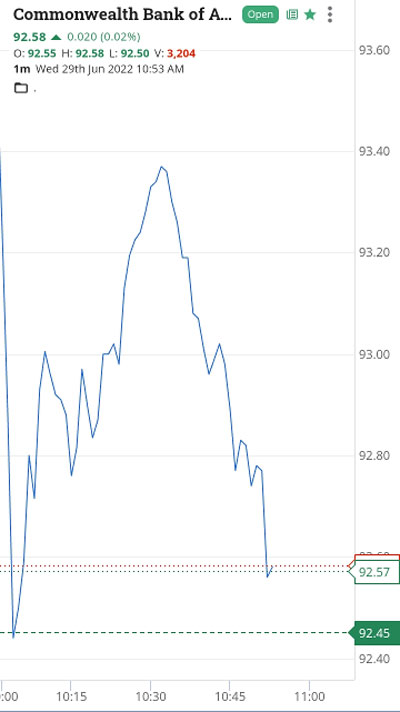

Watching CBA and giving up on the others at the moment as fun and games going on over which I have no control.

CBA have the pre-11am wobbles and stick in a limit buy order at $92.45, which I then adjust to $92.44 as less of a round number.

Here is a screen shot from me waiting:

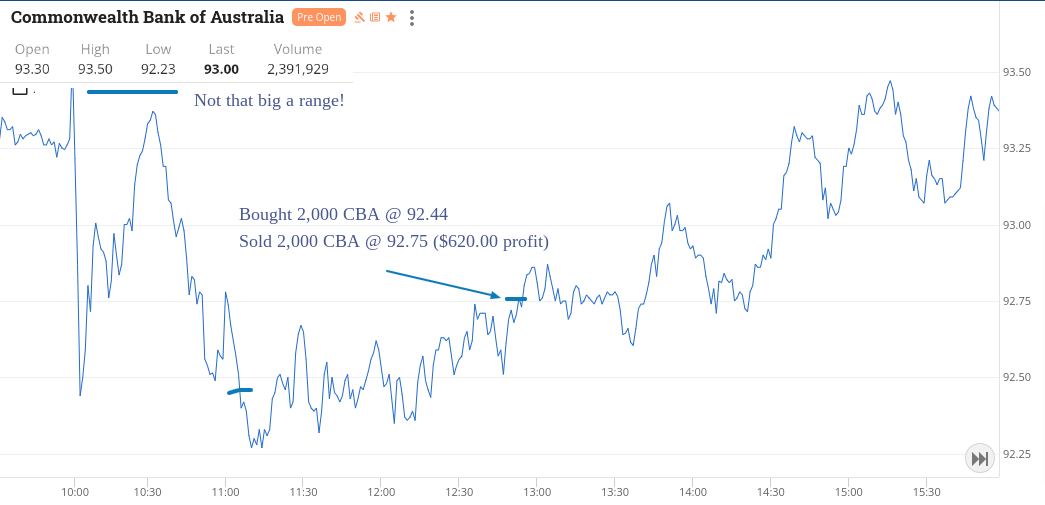

Finally get there and then cause a bit of pain but I hang on in there for a nice profit. Was determined to see this one through. Of course, after I sold them they kept on going up but happy to claw back some previous losses.

Up $620 and not too bad for a hump day.

Recap

Bought 2,000 CBA @ 92.44

Sold 2,000 CBA @ 92.75 ($620 profit)

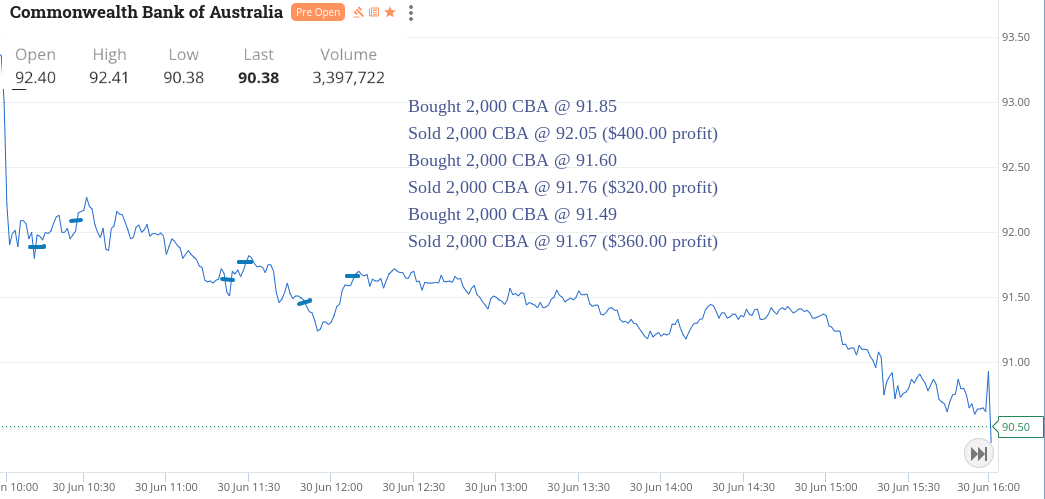

Having watched CBA yesterday, I noticed they keep having short sharp rallies but keep falling further below those starting rally prices.

This gives me three goes, which I can’t really believe every time I came back to recheck their price. Leave them alone after the three goes as I don’t want to push my luck.

There is always tomorrow!

Up $1280 on the 30th June. Yippee.

Recap

Bought 2,000 CBA @ 91.85

Sold 2,000 CBA @ 92.05 ($400 profit)

Bought 2,000 CBA @ 91.60

Sold 2,000 CBA @ 91.76 ($320 profit)

Bought 2,000 CBA @ 91.49

Sold 2,000 CBA @ 91.67 ($360 profit)

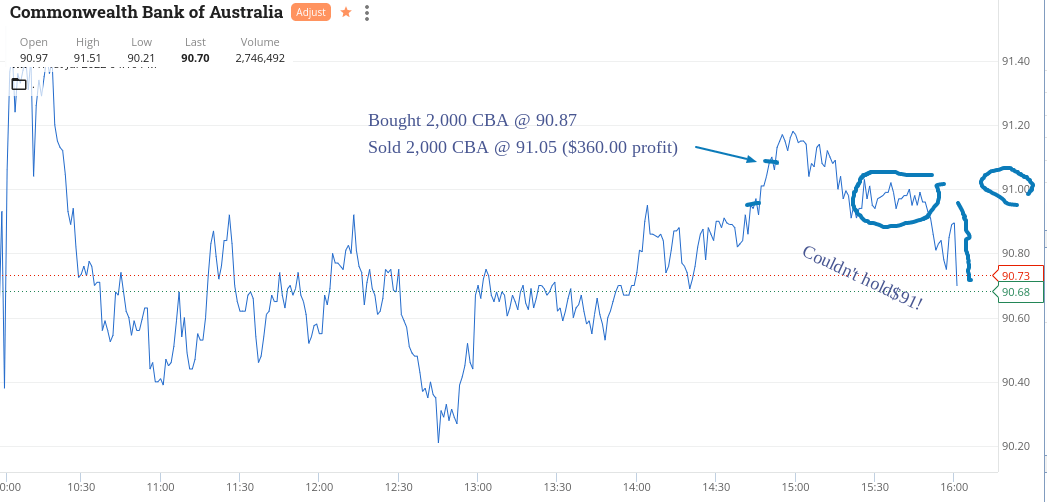

First day of the new financial year and not sure what that means but it all feels a bit off, to me.

Iron ore stocks get marked down and banks marked up. Even ZIP manage a rally after June 30th slaughtering.

Have to wait around a long time and maybe out of boredom, decide that CBA may actually rally through the $91 level. Pick some up on the climb and watch them soar through the $91 level, which they can’t hold at the end of the day.

Finish up $360 on CBA again! So up $1550 gross and $1313 net, which is a few to many 13s for me.

See you Monday!

Recap

Bought 2,000 CBA @ 90.87

Sold 2,000 CBA @ 91.05 ($360.00 profit)