Confessions of a Day Trader: Dead or alive, on a steel horse I ride

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

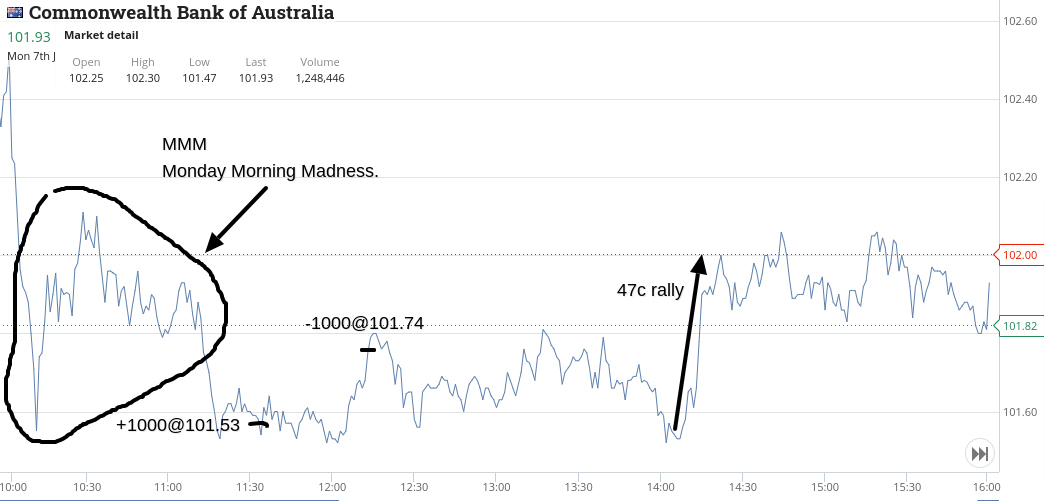

Heeere we go! CBA have a high of 102.30 and a low of 101.52 in first 15mins of trading. At 11.00am they are 101.79.

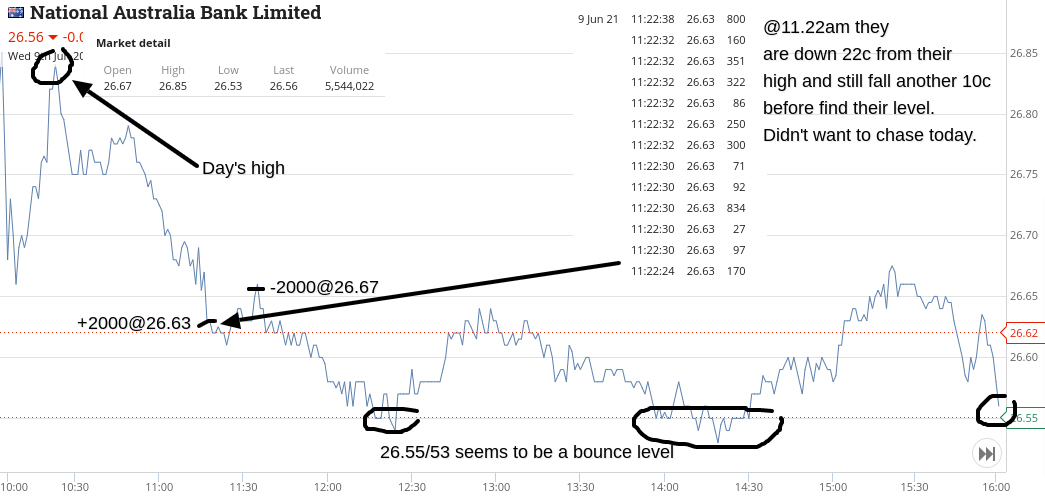

NAB got marked down on an announcement. Buy 1500 at 26.85 (time 10.34am) and another 1500 at 26.66 (time 10.43am). Got to love three 6s in a row.

Buy 3000 Z1P at 6.88, then 1000 CBA at 101.53 and then 300 APT at 95.96. APT are first out the door at 96.60, followed by CBA at 101.74 and then the Z1P at 6.95. NAB are not behaving as I thought so double down and buy another 3000 at 26.60.

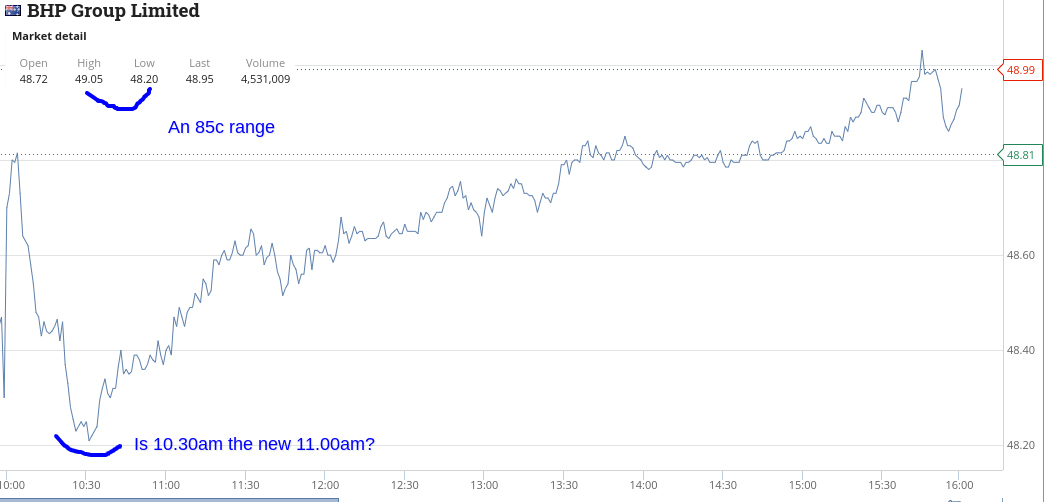

FMG fall below 23.00 and buy 2000 at 22.87. BHP are below 49.00, so buy 1500 at 48.97.

Finally sell the 6000 NAB at 26.70 into a blip rally. Forced to buy another 2000 FMG at 22.77. The 1500 BHP are sold at 49.07 but FMG never rally, so cut the 4000 at 22.72, which is a A$400 loss and wipes out a few of my profits.

Overall, up A$497 and still cursing FMG!

+1500 NAB at 26.85; +1500 at 26.66; +3000 at 26.60; -6000 at 26.70; Profit A$135 (Could be an 11.00am trade tomorrow morning?)

+3000 Z1P at 6.88; -3000 at 6.95; Profit A$210

+1000 CBA at 101.53; -1000 at 101.74; Profit A$210

+300 APT at 95.96; -300 at 96.60; Profit A$192

+2000 FMG at 22.87; +2000 at 22.77; -4000 at 22.72; Loss A$400 ( No rally to save me, just constantly heading south. Ouch)

+1500 BHP at 48.97; -1500 at 49.07; Profit A$150

Wait till bang on 11.00am to buy 1000 NAB at 26.81. Not because I should but because I said I would.

They rally 4c and then fizzle out and then drizzle out and touch a low of 26.59 around 2.00pm. Eventually they climb back and I am able to sell them at the exact same price with 5 mins of trading left. Not my finest of trades.

Turns out that today was a very difficult day to predict and on most positions I was sitting on losses. At one stage all my buys were showing red.

Made the mistake of buying 3000 Z1P at 6.90, which I cut at the end of the day at 6.83 for a loss of A$210. Also lost A$30 on BHP.

Don’t get me wrong, I walked away with a profit but don’t think I have had so many losses in the same day for some time.

CBA’s volatility (see chart) caused a few anxious moments. Gained A$480 on them plus a few grey hairs. Today was not easy but ended up A$520.

+1000 NAB at 26.81; -1000 26.81; ZERO (Not my finest of trades)

+2000 FMG at 22.63; -2000 at 22.68; +2000 at 22.62; -2000 at 22.66; +2000 at 22.42; -2000 at 22.47; Profit A$280 (Not an easy one to pick today)

+1000 BHP at 48.57; -1000 at 48.54; Loss A$30

+3000 Z1P at 6.90; -3000 at 6.83; Loss A$210 (a painful cut as did not play this one at all well today)

+1000 CBA at 101.60; -1000 at 101.30; +1000 at 100.73; -1000 at 101.51; Profit A$480 (was long of 2000 and sold 2x 1000, just to be safe)

Not going to be at desk all day, as on the road. Buy 2000 NAB at 26.63 at 11.22am before heading out and sell them quicker than I thought I would at 26.67.

CBA turns from a short trade to a long one, before booking A$110 profit (see chart). Finding them to be very erratic and difficult to read. Down 57c when I buy, they fall another 40c to below 101.00 and then bounce.

Just happened to be looking on my phone when BHP fell to its low. Bt 1000 at 48.69 before selling 10c higher. All whilst sitting in traffic.

Not a big profit day plus A$290. APT crack the 100.00 level, even with negative press.

+1000 CBA at 101.34; -1000 at 101.45; Profit A$110 (very erratic and hard to trade recently)

+2000 NAB at 26.63; -2000 at 26.67; Profit A$80

+1000 BHP at 48.69; -1000 at 48.79; Profit A$100 (fluked the days low)

The stars of the show today are BHP and FMG. Both give trades out which, until you see the charts, you won’t believe.

Z1P does the usual and allows a few trades with 2 cent turns, and everyone gets marked down at the end of the day.

CBA have a high of 102.12 and APT manage a high of 99.98! Can’t make the ton today.

Overall FMG give me eight good trades and BHP came out with six ins and outs. Total profit was a nice A$920 from a total of 18 buys and sells.

Need a lie-down!

+2000 FMG at 22.30; -2000 at 22.37; +2000 at 22.30; -2000 at 22.34; +2000 at 22.30; -2000 at 22.33; +5000 at 22.30; -5000 at 22.34; Profit A$480 (fingers hurt!)

+2000 BHP at 48.20; -2000 at 48.30; +2000 at 48.21; -2000 at 48.27; +2000 at 48.29; -2000 at 48.35; Profit A$320 (eyes hurt!)

+5000 Z1P at 6.76; -5000 at 6.78; +5000 at 6.75; -5000 at 6.77; Profit A$200 (watched them for hours before pouncing)

It’s always hard going into a long weekend, as most of the local professional traders will want to square their books up by the end of the day. Normally you may see a sell off in the last 15/30 mins before everyone heads off.

Having said that, there were some amazing moves today, especially by APT. Having bounded back above 100.00 (Monday 96.00) they reach above 105.00 before falling back to close at 103.52 I end up watching in frustration at some of today’s early moves.

Relax a bit when reflecting over this week’s trading. End the week up A$2,227 and mentally I can float into next week’s battle, not caring about Wall Street and what the papers say.

Gross for week: A$2,227

Brokerage: A$670

Net Profit: A$1,557

Most satisfying: FMG (thurs)

Least satisfying: FMG (mon)