Confessions of a Day Trader: At this rate, you’ll be… at t’pub every Friday

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

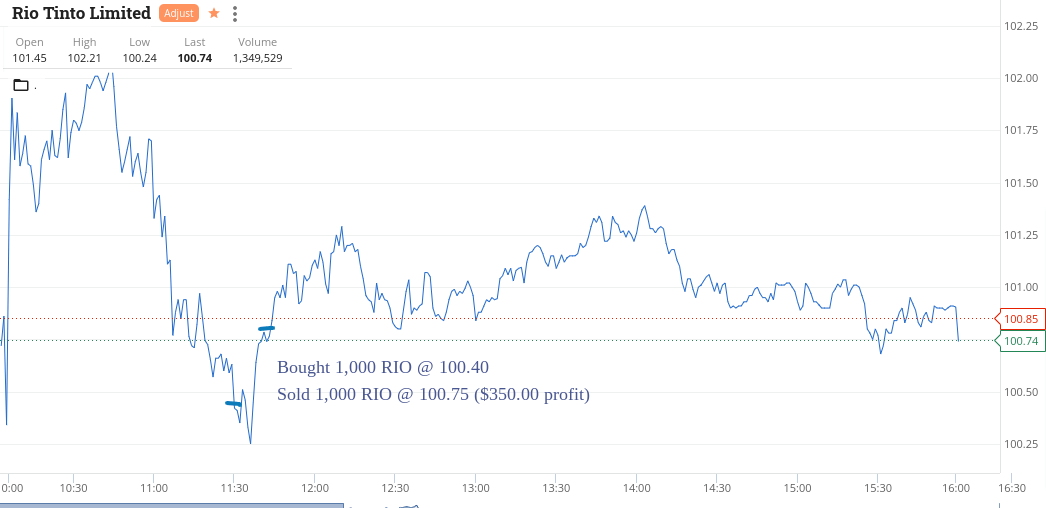

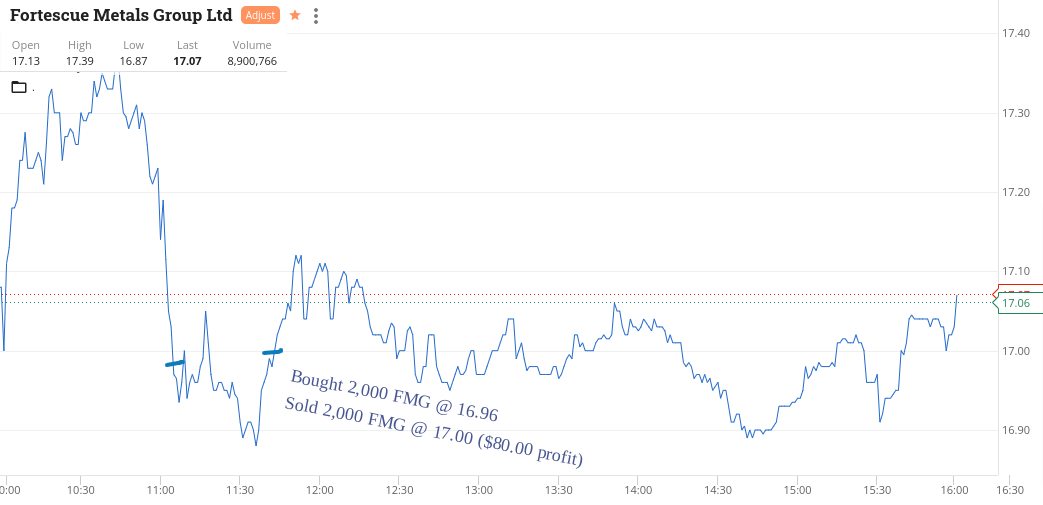

Went all rusty iron ore today. They all got marked down and I thought, what with Wall Street closed tonight there is a chance that they will bounce a bit.

Rio bounced a bit more than I thought and with FMG hanging around the $17.00 level there may be a trade.

Everything lined up quicker than I thought, so I locked in RIOs then BHP and then finally FMG.

Watchlist was green for most of the day and happy with $570 profit and the FMG trade basically covering off the commission.

Expecting no lead from the USA tonight, so unless something like Bitcoin takes a real bashing, it should all be steady Eddie tomorrow, ahead of a rate rise.

PS Have a look at BHP’s volume… 11m plus!

Recap

Bought 2,000 FMG @ 16.96

Bought 2,000 BHP @ 39.52

Bought 1,000 RIO @ 100.40

Sold 1,000 RIO @ 100.75 ($350.00 profit)

Sold 2,000 BHP @ 39.59 ($140.00 profit)

Sold 2,000 FMG @ 17.00 ($80.00 profit)

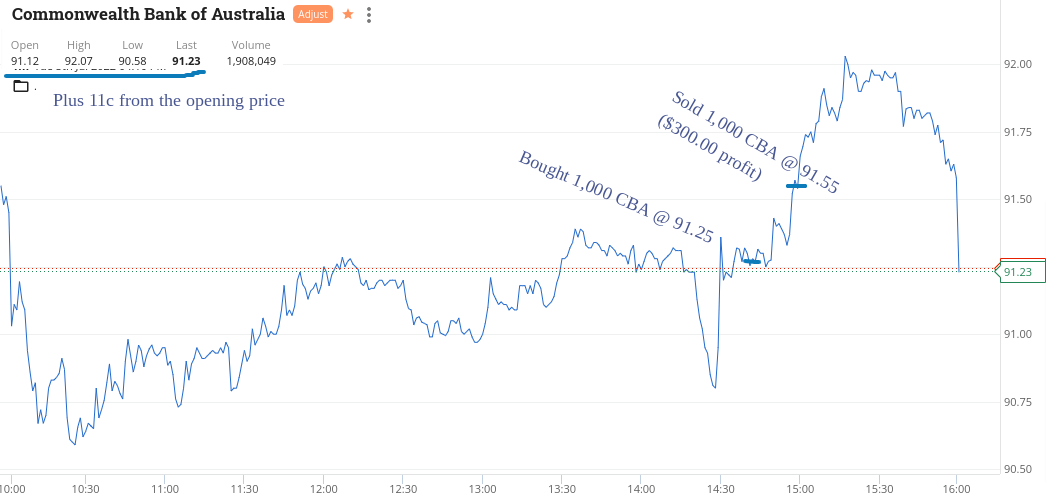

Rate rise coming in today at 2.30pm, which means I am sitting on my hands till then.

When it comes in as expected, this is what CBA does:

And this gave the chance for a trade, as all was as expected.

A $300 profit on a rate rise day. Gotta be happy with that!

Recap

Bought 1,000 CBA @ 91.25

Sold 1,000 CBA @ 91.55 ($300.00 profit)

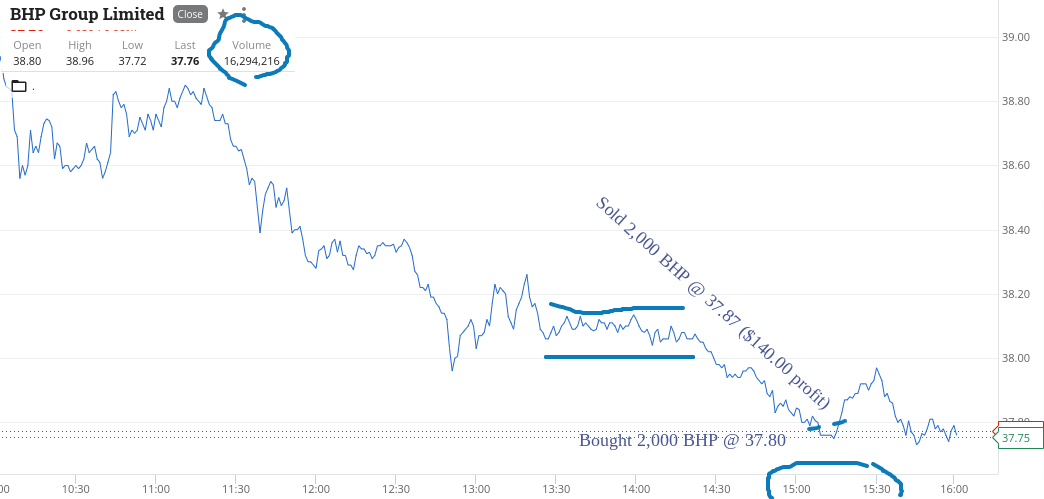

Come in this morning and some of the commodities have been bashed a bit, namely oil and iron ore, on fears of a slowdown in economies, according to the headlines.

I thought this was obvious but with Wall Street closing for the day, things seem a bit exaggerated.

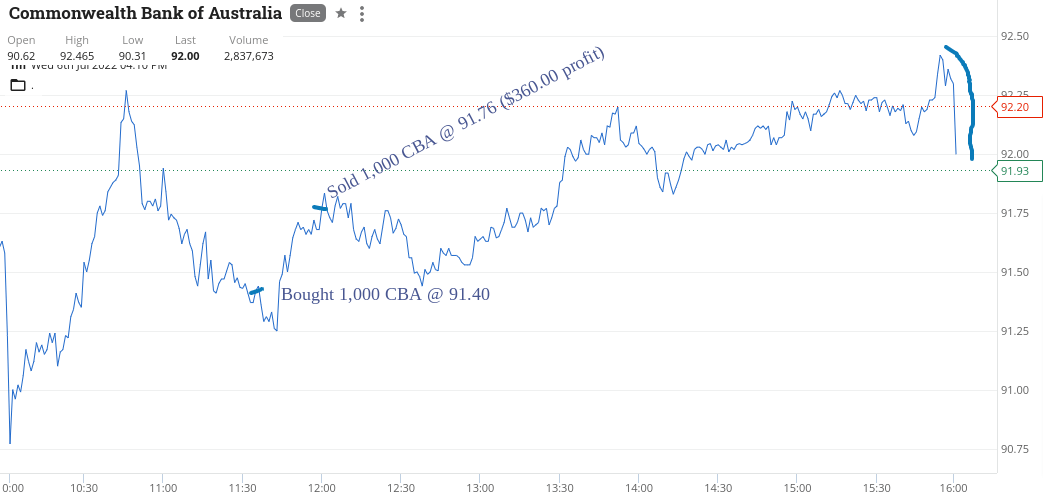

So, banks up and FMG, RIO and BHP down in the first few hours. CBA is a bit volatile and does this:

This gives me an opportunity and a bit of pain before locking in the gain! Buy 1000 at $91.40 and sell them at $91.76.

Next it was BHP’s turn. They were hovering around the $38.00 level, so put in a limit buy at $37.80. Eventually got hit and happy to take a quick 7c turn, as anything could happen plus a bit later in the trading day.

Up a round $500 for the day.

Recap

Bought 1,000 CBA @ 91.40

Sold 1,000 CBA @ 91.76 ($360.00 profit)

Bought 2,000 BHP @ 37.80

Sold 2,000 BHP @ 37.87 ($140.00 profit)

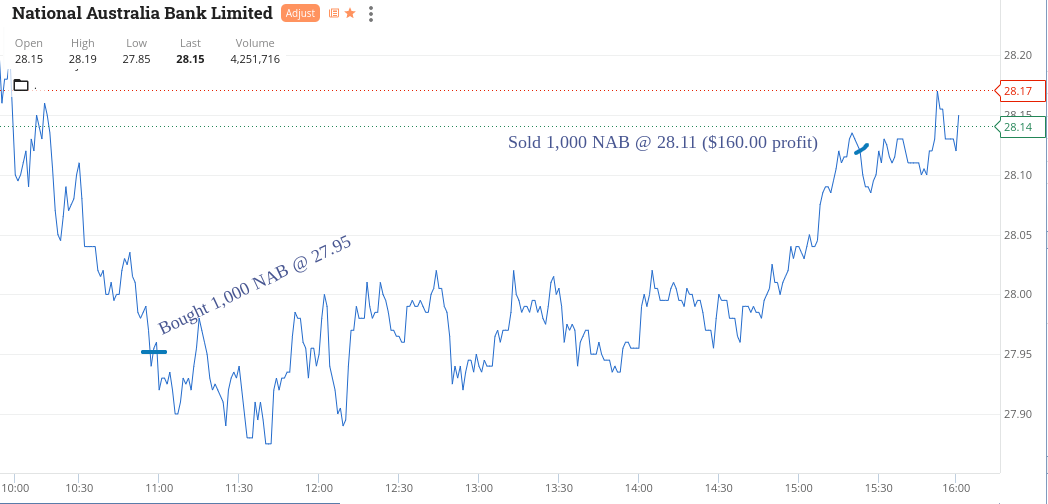

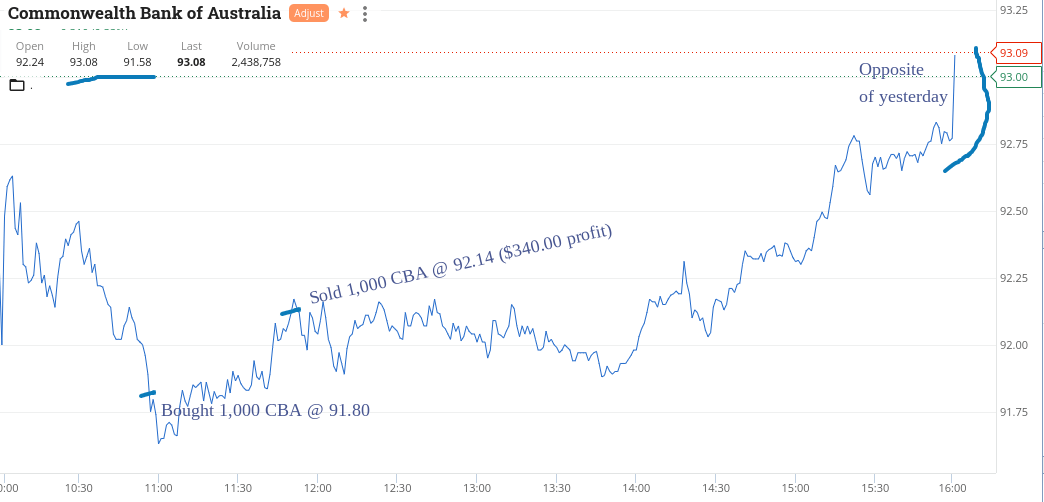

Today becomes a bit of a b-b-b-bounce day which gave me one quickish 11am trade and one a bit longer.

Had CBA on a limit below $92 which got hit at $91.80 and of course kept moving on down!

And then this:

NAB took a little bit longer to get there but eventually they managed an afternoon spurt.

That makes it plus $500 for two days in a row. Getting a bit toey for a big one tomorrow. Either a blow-up or a pi$$-up trade.

Recap

Bought 1,000 CBA @ 91.80

Bought 1,000 NAB @ 27.95

Sold 1,000 CBA @ 92.14 ($340 profit)

Sold 1,000 NAB @ 28.11 ($160 profit)

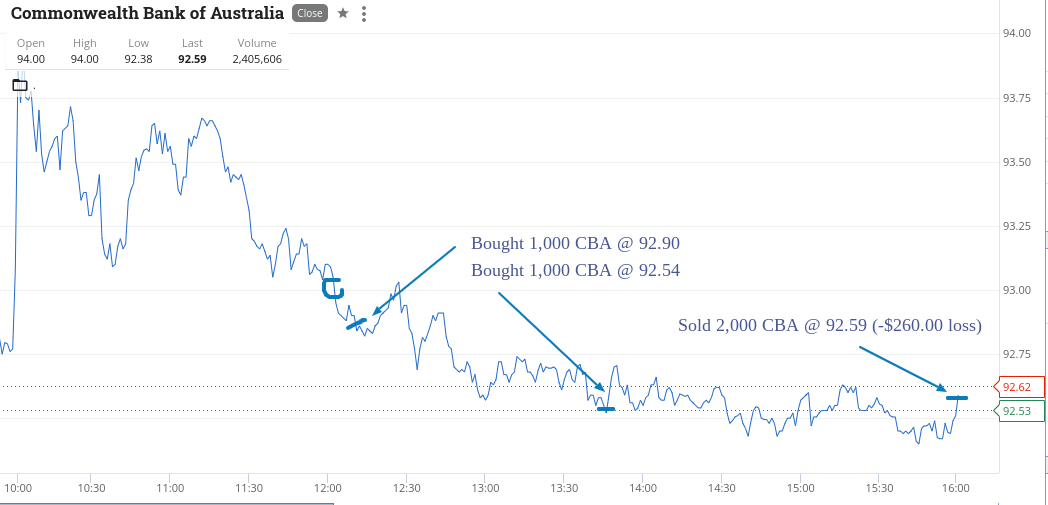

Mmm… looking around and everything looking green on the watchlist and then I think I can get a winner in CBA. They had a high of $94 and then broke down below $93.

Had a go at $92.90. They bounced a small amount and then carried on going down. Waited for like ages and doubled down at $92.54 and that was it. Losing trade all day and had to cut in the 4.10pm ruck.

They bounced from their 4.00pm close a bit so the loss came back in from $600 back to a $260 loss for the day.

Leaves me up $1610 gross for the week and $1307 net. Not too bad for a week that had an interest rate rise. Next week all eyes on USA inflation figures. Off to pub.

Recap

Bought 1,000 CBA @ 92.90

Bought 1,000 CBA @ 92.54

Sold 2,000 CBA @ 92.59 (-$260.00 loss)