Confessions of a Day Trader: All that glisters is… well, gold actually

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

The trading day kicks off with ANN being marked down 16% or so after their figs come out pre-market. So, again with these situations, all the bad news is out, so looking for some short covering to give them a bounce.

As always, you never know when they will bottom out, so you have to ride their trend and know there will be some pain before a potential gain.

So had to go twice at them and wait. In at $24.60 and at $24.10 and out at $24.64 for a +$1700 trade. They did go higher but who cares?

Next got into NVX for a technical bounce and then it was over to CBA and FMG for some bread and butter trades.

Up $3245 but very wary of Russian troop tension, with a chance of an invasion whilst holding a trade, as a risk to factor in ATM. So far so good.

Recap

Bought 2,000 ANN @ 24.60

Bought 3,000 ANN @ 24.10

Sold 5,000 ANN @ 24.64 ($1,700.00 profit)

Bought 2,000 NVX @ 7.01

Sold 2,000 NVX @ 7.10 ($180.00 profit)

Bought 1,000 CBA @ 94.50

Sold 1,000 CBA @ 94.69 ($190.00 profit)

Bought 1,000 CBA @ 94.03

Bought 2,000 FMG @ 19.37

Sold 1,000 CBA @ 94.20 ($175.00 profit)

Sold 2,000 FMG @ 19.87 ($1,000.00 profit)

After yesterday’s heroic effort, today’s effort was very low indeed, with only BHP giving me what I thought was an opportunity, as they hovered around the $45.00 level.

However, this trade resulted in a $50 loss plus brokerage and could have been worse, if not for a favourable 4.10pm trading session. They finished the day down 3% at $44.93 on 21m, which is higher volume than usual.

Recap

Bought 2,000 BHP @ 45.09

Bought 3,000 BHP @ 44.84

Sold 5,000 BHP @ 44.93 (-$50.00 loss)

Starting to like this reporting season.

AMC were marked down and had to go three times before they recovered and gave me a $620 profit for the day.

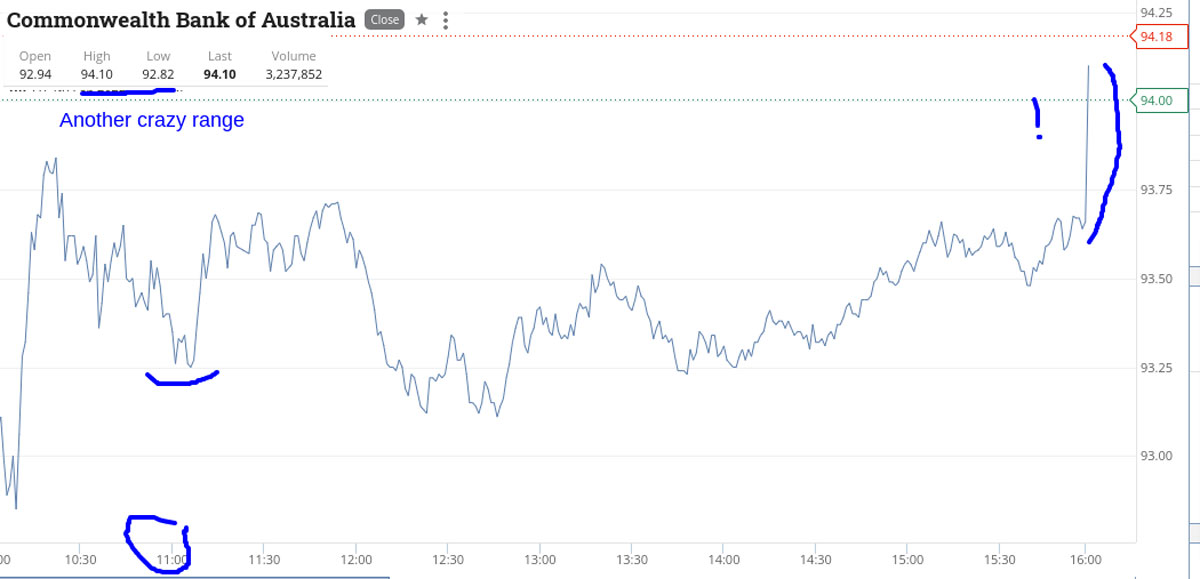

Everything else was marked up or not showing any key breakout levels. Yesterday and today, CBA had highs of $94.99 but never broke them, until later on today, but only by 7c and they seem to be held back before their figures, due out next Wednesday. See chart.

Recap

Bought 1,000 AMC @ 16.47

Bought 2,000 AMC @ 16.30

Bought 5,000 AMC @ 16.27

Sold 8,000 AMC @ 16.38 ($620.00 profit)

Didn’t play today too well, as even though CBA started out the day on a wild move down, then up and then down again, once settled it got boring. Managed to lose $180 by holding on to the bitter end and the chart will tell you the story.

Tech stocks got smashed whilst the major miners glistened all day and the banks just remained steady. Hopefully tomorrow offers more opportunities.

Recap

Bought 1,000 CBA @ 93.56

Bought 1,000 CBA @ 93.50

Sold 2,000 CBA @ 93.44 (-$180.00 loss)

Come in today and see that (Boral) BLD have been marked down 46%, after going ex a capital return of $2.65.

So manage to pick some up and get a 10c turn and then for some reason, NAB fell over 20c very quickly. They fell from $27.82 to $27.58 and I grabbed some on the way down, as just happened to be watching my watchlist at the time.

They took longer to recover than I thought they would, so after half an hour or so, I stuck them on a limit. They still have their buy back on, so I thought the move was very strange.

Eventually got taken out and then watched all the banks shoot up in their 4.10pm sessions.

Plus $475 today, taking the week to plus $4110 gross and $3716 net.

Meta (Facebook) didn’t recover overnight from their massive drop in value, so Monday should be interesting in the techs. Also, CBA’s results should give us some guidance on the economy.

Recap

Bought 3,000 BLD @ 3.78

Sold 3,000 BLD @ 3.88 ($300.00 profit)

Bought 2,500 NAB @ 27.62

Sold 2,500 NAB @ 27.69 ($175.00 profit)