Confessions of a Day Trader: All aboard the 11am Special? Let it ride!

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

War still raging and Australian 10-year treasury bonds hit a yield of 2.9%, ahead of the pre-election budget coming up tomorrow night.

With this background, you would think things should be coming back a bit, so still gingerly walking around the screens, looking to pounce onto something for a good quick in and out.

CBA doesn’t fail on this today with a cracker of a 11am special, but I couldn’t find much else, though it wasn’t from lack of trying.

BHP and RIOs all up and steady and things like Z1P just drifting in a small range but on reasonable volume.

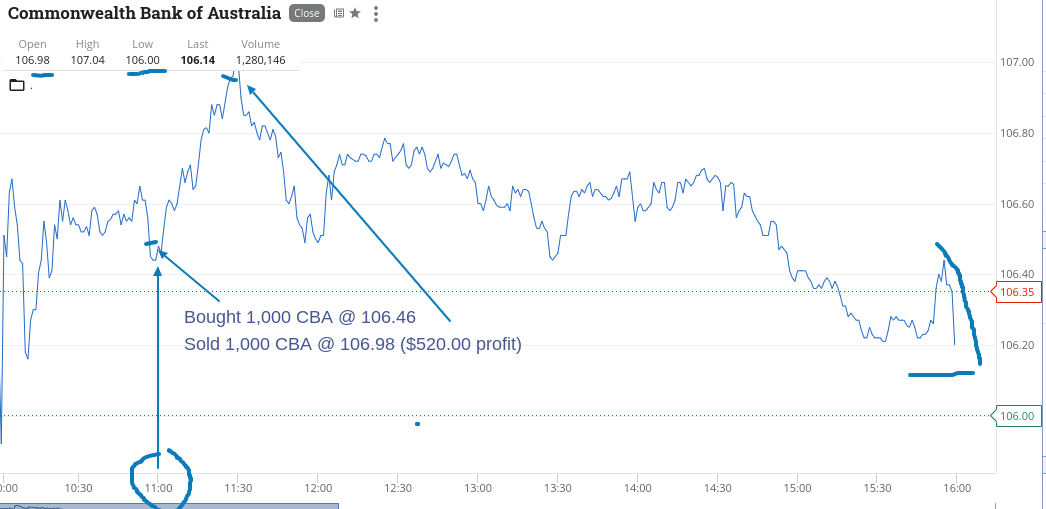

Up $520 which I think I will give back at some point this week!

Recap

Bought 1,000 CBA @ 106.46

Sold 1,000 CBA @ 106.98 ($520.00 profit)

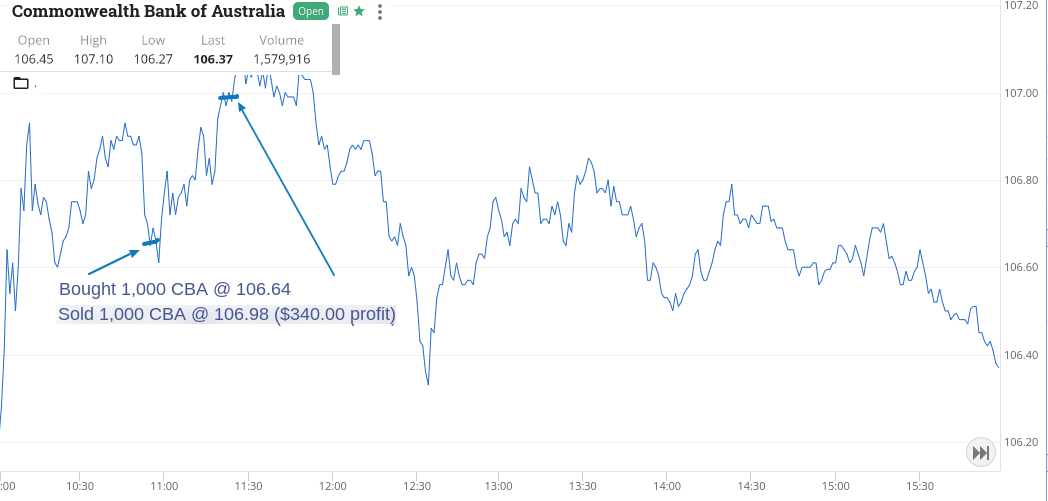

Pre-election trading day, though everything seems to be leaked out, so bit of slow one.

CBA came through again – 11am special again which is a bit scary for me for tomorrow as can’t keep happening!

Maybe tomorrow will bite me. Let’s see.

Plus $340 for the day.

Recap

Bought 1,000 CBA @ 106.64

Sold 1,000 CBA @ 106.98 ($340.00 profit)

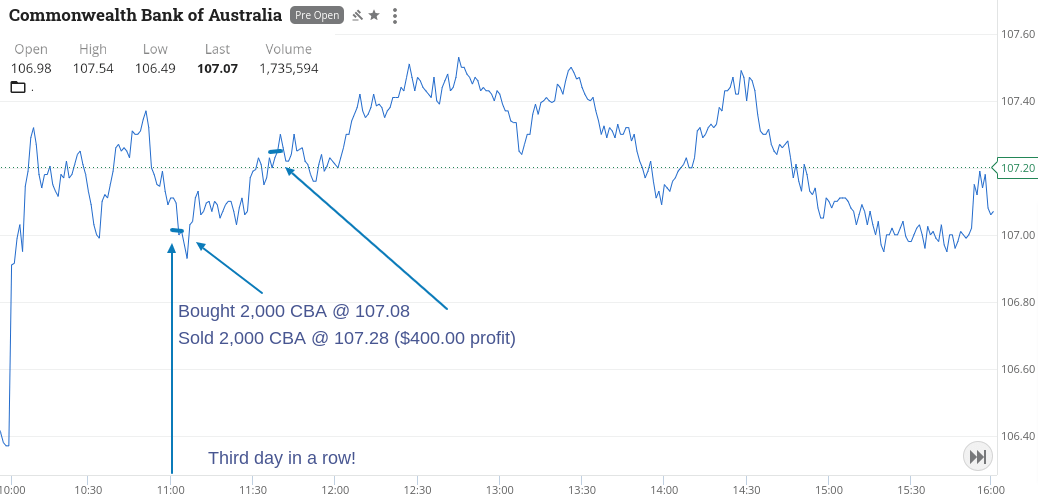

Well, a sea of up stocks on my watch list, just after the opening! CBA managed to come through for the third day with an 11am special. This must be some kind of record.

I doubled up the size today, as I thought if it does happen again, it would be short and sweet. Felt a bit of pain before the gain.

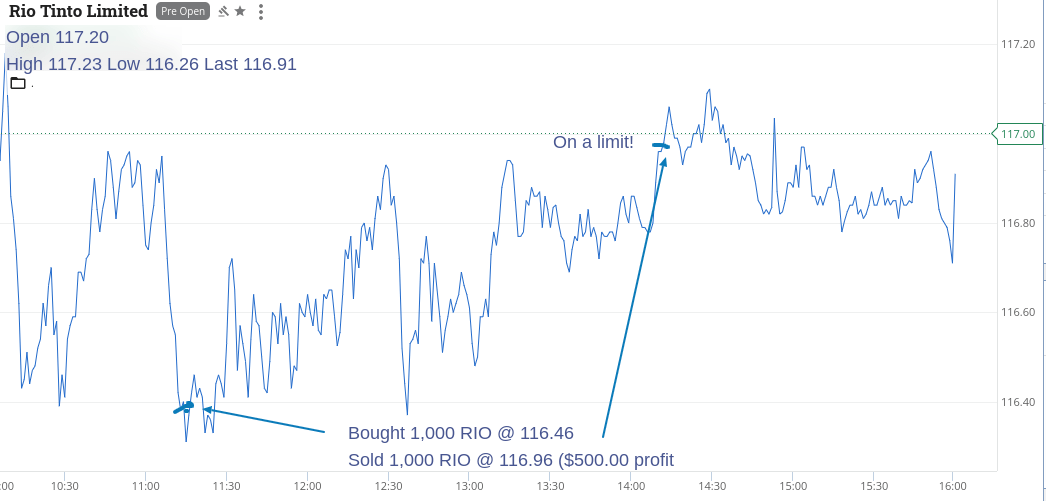

The RIOs were acting a bit strange compared to the others on my watch list.

Picked up 1000 and left them on a limit just below $117, which they managed to hit as they headed up towards that price.

So all up plus $900 today and now await till 11am tomorrow, where I suspect I will do my arse!

Maybe. Let’s see.

Recap

Bought 2,000 CBA @ 107.08

Bought 1,000 RIO @ 116.46

Sold 2,000 CBA @ 107.28 ($400.00 profit)

Sold 1,000 RIO @ 116.96 ($500.00 profit)

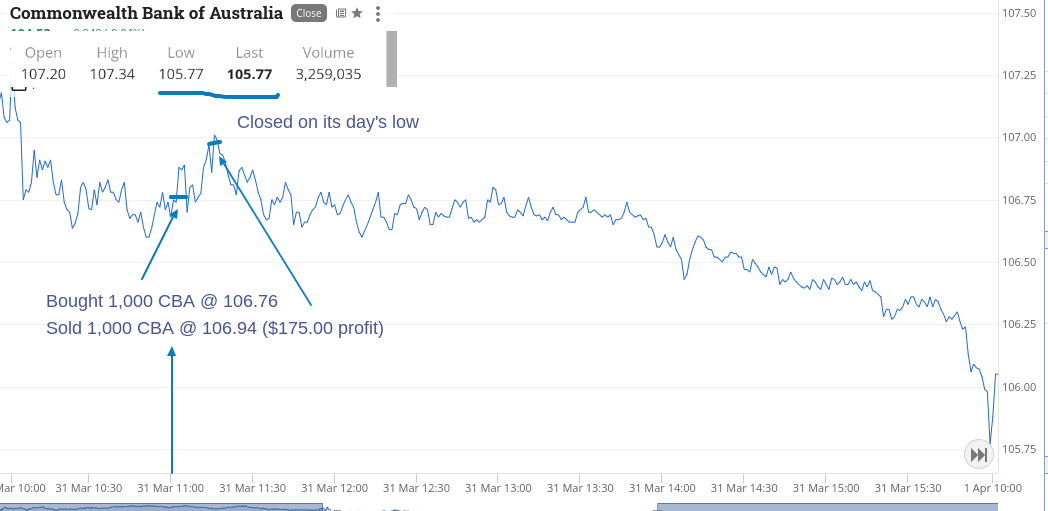

Really am pushing my luck today, so a very small turn on CBA with an – you guessed it – 11am special. Feels like black coming in four times in a row on the roulette table.

Just had to have a go and it worked yet again.

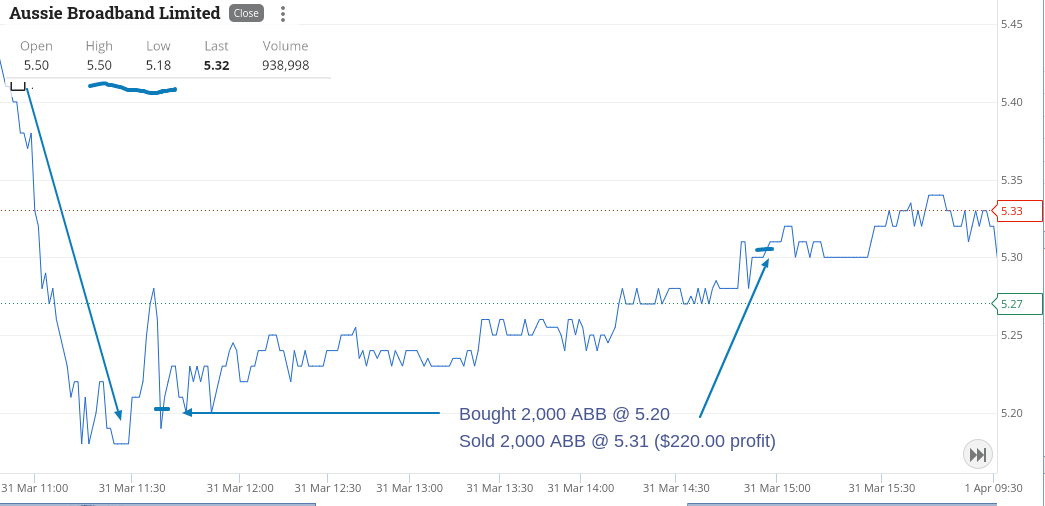

ABB popped up as a big major faller and all news seemed out, so bought a couple of thousand and they gradually climbed up to give me an 11c turn.

Getting a bit harder to find anything on my watch list to have a go at.

Up $395 for the day.

Recap

Bought 1,000 CBA @ 106.76

Sold 1,000 CBA @ 106.94 ($175.00 profit)

Bought 2,000 ABB @ 5.20

Sold 2,000 ABB @ 5.31 ($220.00 profit)

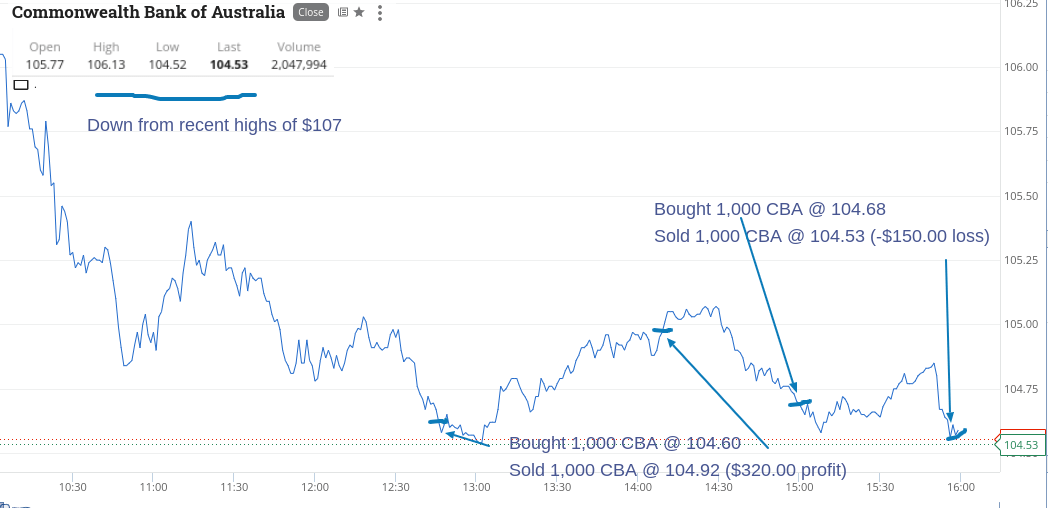

I left everything alone and didn’t even try for the 11am special in CBA. It did happen but I was elsewhere.

Five days in a row is something that I can’t remember ever seeing before.

When I saw them below $105, I thought I just had to have a go. Did push my luck and against all the rules of being a Friday and everyone’s book squaring, I just couldn’t help myself from having one last go.

That move cost me $150 plus brokerage, but hey we all have a weak moment.

This left me up $170 for the day but after brokerage, I roughly broke even.

Up $2,325 gross for the week and $1,975 net which really is not too bad a result and mainly all thanks to CBA. I bet Monday won’t see an 11am special in them! Let’s see.

Recap

Bought 1,000 CBA @ 104.60

Sold 1,000 CBA @ 104.92 ($320.00 profit)

Bought 1,000 CBA @ 104.68

Sold 1,000 CBA @ 104.53 (-$150.00 loss)