Closing Bell: ASX goes up (actually down) in flames; oil spikes

A spike in crude oil prices was the only spot of relief for a market in deep retreat, moving lower for a third week. Pic: Getty Images

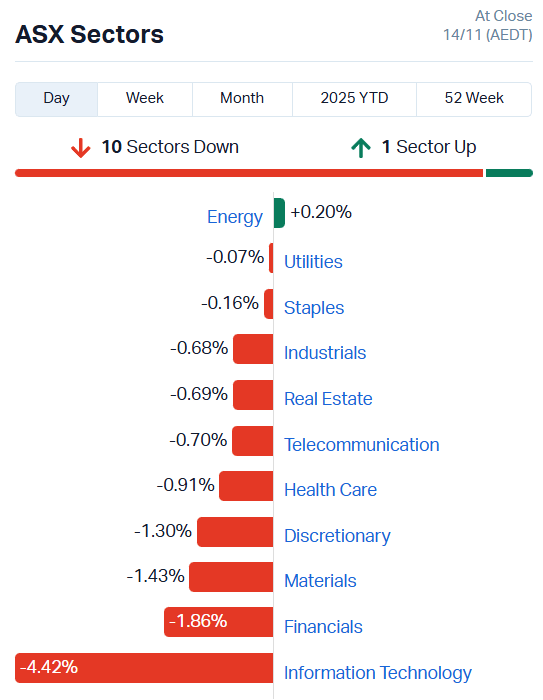

- ASX burns through 118 points or 1.36%

- Energy only sector in green after crude oil gains

- Broad retreat after three straight weeks of losses

ASX falls three weeks in a row

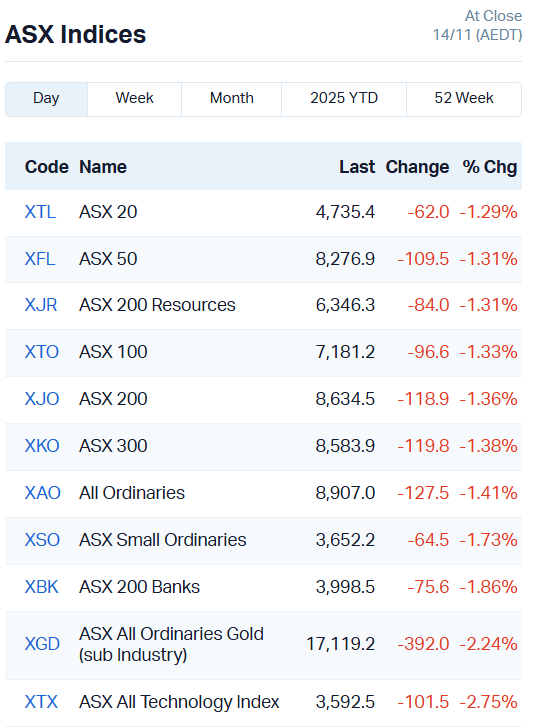

It was a day of bloodletting on the ASX 200 today, plummeting 118 points or 1.36% to 8634.5.

After three weeks of declines, the market has reset to July 16 levels, last seen about 5 months ago.

An eye-watering 153 of 200 stocks on the core market lost ground in trade today, and that number likely would’ve been higher if not for an escalation in Ukraine’s attacks on Russian oil infrastructure.

More on that in a moment.

Several stocks stood out simply because they made any ground at all, mostly in defensive sectors.

Webjet (ASX:WJL) has partially recovered from yesterday’s -17.2% pummelling, up 9.03%.

PYC Therapeutics (ASX:PYC) has been gaining steadily over the last week against the market’s grain, adding 5.69% today and 19.74% over the last 5 trading days.

The biotech’s VP-001 drug candidate has demonstrated a meaningful improvement in vision for patients suffering from Retinitis Pigmentosa type 11, a blinding eye disease of childhood caused by a mutation in a single gene.

The company is preparing to engage the US FDA on a pathway to registration for the drug, with the meeting scheduled for some time in Q1 2026.

Immutep (ASX:IMM) joined its biopharmaceutical brethren on the green side of the balance sheet, up 5.77%.

Much like PYC, IMM had some clinical success yesterday, hitting study endpoints for a trial targeting resectable soft tissue sarcoma and “significantly exceeding the study’s level of pathological response rates”.

In other words, the trial was a success and the researchers involved believe IMM’s treatment could be used for applications beyond advanced or metastatic cancer.

There was also a smattering of resource stocks on the up, mostly gold and lithium companies.

Ukraine hits Russian oil infrastructure… again

Ukraine has kept up a constant barrage of long-range missile and drone attacks on Russian energy infrastructure this year, causing fuel shortages in huge swathes of Russia.

The latest salvo appears to have hit the Russian Black Sea port of Novorossiysk, home to a sizeable oil depot as one of Moscow’s major export ports.

Local authorities say drone wreckage struck three apartment buildings, a trans-shipment oil depot and nearby coastal facilities.

The price of crude oil surged in response, adding 1.38% during Aussie trade to hit US$63.88 a barrel of Brent Crude.

With US sanctions on two of Russia’s largest oil exporters poised to take effect, the burning oil depot has fuelled a sharp spike in crude prices – at least in the short-term.

Ironically, that’s provided some support for an otherwise flaming ASX, bumping the energy sector into the green and lifting utilities toward neutral.

Karoon Energy (ASX:KAR) is up 2.3%, Santos (ASX:STO) added 1.61%, Invictus Energy (ASX:IVZ) gained 3.34% and Woodside (ASX:WDS) edged up just 0.38%.

The renewed visibility of drone warfare also supported defence-related stocks.

Droneshield (ASX:DRO) added 2.67%, Elsight (ASX:ELS) 2.74% and Electro Optic (ASX:EOS) 0.95%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUK | Aumake Limited | 0.003 | 50% | 3252 | $6,046,718 |

| BMO | Bastion Minerals | 0.0015 | 50% | 6093578 | $2,236,450 |

| AXP | AXP Energy Ltd | 0.018 | 38% | 926973 | $4,886,540 |

| APL | Associate Global | 0.15 | 36% | 51859 | $6,318,667 |

| TMKDD | TMK Energy Limited | 0.15 | 36% | 732896 | $23,794,766 |

| CAV | Carnavale Resources | 0.005 | 25% | 1732989 | $24,463,982 |

| CNJ | Conico Ltd | 0.01 | 25% | 709339 | $2,177,166 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 666808 | $16,059,721 |

| QXR | Qx Resources Limited | 0.005 | 25% | 126759 | $7,370,653 |

| HAR | Harangaresources | 0.1675 | 24% | 5999915 | $49,895,319 |

| CHR | Charger Metals | 0.105 | 24% | 2039961 | $6,580,721 |

| MTB | Mount Burgess Mining | 0.0135 | 23% | 899420 | $9,498,466 |

| RCR | Rincon | 0.017 | 21% | 10091905 | $4,417,874 |

| OLI | Oliver'S Real Food | 0.012 | 20% | 456778 | $5,407,319 |

| FBM | Future Battery | 0.062 | 19% | 2715449 | $35,082,373 |

| LGM | Legacy Minerals | 0.25 | 19% | 932303 | $35,279,415 |

| KFM | Kingfisher Mining | 0.09 | 18% | 350846 | $6,537,553 |

| GAS | State GAS Limited | 0.027 | 17% | 335933 | $9,035,570 |

| NXD | Nexted Group Limited | 0.41 | 17% | 866684 | $77,860,903 |

| AHK | Ark Mines Limited | 0.525 | 17% | 109135 | $31,119,620 |

| CRR | Critical Resources | 0.0105 | 17% | 17216020 | $26,644,144 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 185435 | $16,824,763 |

| EMU | EMU NL | 0.051 | 16% | 961925 | $10,875,284 |

| OM1 | Omnia Metals Group | 0.022 | 16% | 3464038 | $5,276,617 |

| BGE | Bridgesaaslimited | 0.015 | 15% | 222082 | $2,598,170 |

In the news…

Bastion Minerals (ASX:BMO) has successfully raised $475,000 in a share placement at $0.001 each.

The funding will go to potential project acquisitions, supporting ongoing due diligence activities, exploration planning, tenement maintenance and working capital costs.

AXP Energy (ASX:AXP) has confirmed the presence of oil and gas in flowback from the Charlie #1 well, part of the company’s interest in Noble County, Oklahoma.

AXP has just fitted the well with a pump jack after completing fracturing and stimulation. The recovery of the hydraulic fracking fluid is progressing as planned, with early signs showing a stable 300 psi of pressure in the well head – a good initial sign of reservoir response.

Rincon (ASX:RCR) has struck broad gold and copper mineralisation in 12 of 14 holes drilled at the Telfer South gold project’s Hasties Main deposit.

The drilling program was looking to grow the deposit’s current resource of 870k tonnes at 0.96g/t gold and 0.26% copper.

Management says hits of up to 13m at 1.06g/t gold from 64m and 28m at 0.95% copper from 31m are highly encouraging, and is already drawing up plans to undertake more drilling to feed into a resource update.

Magnum Mining and Exploration (ASX:MGU) has kicked off an extensive auger drilling program at the Azimuth REE project, with plans for 333 holes over 1,665m.

The company designed the program to define rare earth element targets, derived from geophysical data and geological observations. MGU intends to follow up any areas returning high levels of REE mineralisation with grid-based drilling to get a better idea of size and scale potential.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ZNO | Zoono Group Ltd | 0.097 | -37% | 3786919 | $62,962,823 |

| HLX | Helix Resources | 0.001 | -33% | 1001 | $8,019,436 |

| 1AD | Adalta Limited | 0.003 | -25% | 432243 | $7,568,784 |

| CT1 | Constellation Tech | 0.0015 | -25% | 1250000 | $2,949,467 |

| ROG | Red Sky Energy. | 0.003 | -25% | 1639324 | $21,688,909 |

| SPX | Spenda Limited | 0.003 | -25% | 1132409 | $19,459,433 |

| CMG | Criticalmineralgrp | 0.135 | -21% | 218932 | $15,392,542 |

| RWD | Reward Minerals Ltd | 0.039 | -20% | 287350 | $13,338,759 |

| PKO | Peako Limited | 0.004 | -20% | 208794 | $7,438,710 |

| RKB | Rokeby Resources Ltd | 0.004 | -20% | 5720564 | $9,132,806 |

| SAN | Sagalio Energy Ltd | 0.016 | -20% | 70000 | $4,093,203 |

| 8IH | 8I Holdings Ltd | 0.018 | -18% | 220894 | $7,659,539 |

| NVA | Nova Minerals Ltd | 1.19 | -18% | 2586699 | $595,965,685 |

| IRI | Integrated Research | 0.3 | -17% | 2242451 | $65,013,049 |

| SHP | South Harz Potash | 0.03 | -17% | 285576 | $4,644,397 |

| BLU | Blue Energy Limited | 0.005 | -17% | 399165 | $18,071,842 |

| RAN | Range International | 0.0025 | -17% | 2781299 | $5,355,341 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 13371106 | $7,482,954 |

| REC | Rechargemetals | 0.016 | -16% | 1792797 | $4,882,809 |

| BLG | Bluglass Limited | 0.011 | -15% | 769366 | $33,990,004 |

| RXL | Rox Resources | 0.3875 | -15% | 8933375 | $343,456,984 |

| SGI | Stealth Grp Holding | 1.25 | -14% | 415639 | $189,883,350 |

| RON | Roninresourcesltd | 0.15 | -14% | 28341 | $7,065,627 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 6482447 | $25,714,246 |

| BNL | Blue Star Helium Ltd | 0.006 | -14% | 1111554 | $25,220,197 |

In Case You Missed It

Infill soil sampling has enabled TG Metals (ASX:TG6) to expand a soil anomaly and improve the definition of gold targets at Gold City prospect, part of the larger Van Uden project in WA.

Locksley Resources (ASX:LKY) is set to leverage new technical director Ian Stockton’s antimony expertise to progress development of its Desert Antimony mine.

Trigg Minerals (ASX:TMG) has consolidated its control over the entire Tennessee Mountain tungsten mineralised system in Nevada.

Redcastle Resources (ASX:RC1) has started drilling across its Morgan’s Castle East and Sligo gold targets at its namesake project.

Trading halts

3D Energi (ASX:TDO) – update on drilling operations

Airtasker (ASX:ART) – cap raise

Cobre (ASX:CBE) – strategic placement

Etherstack (ASX:ESK) – cap raise

Forrestania Resources (ASX:FRS) – cap raise & proposed acquisition

Mayne Pharma (ASX:MYX) – proposed acquisition

Stakk (ASX:SKK) – new customer contract

Unico Silver (ASX:USL) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.