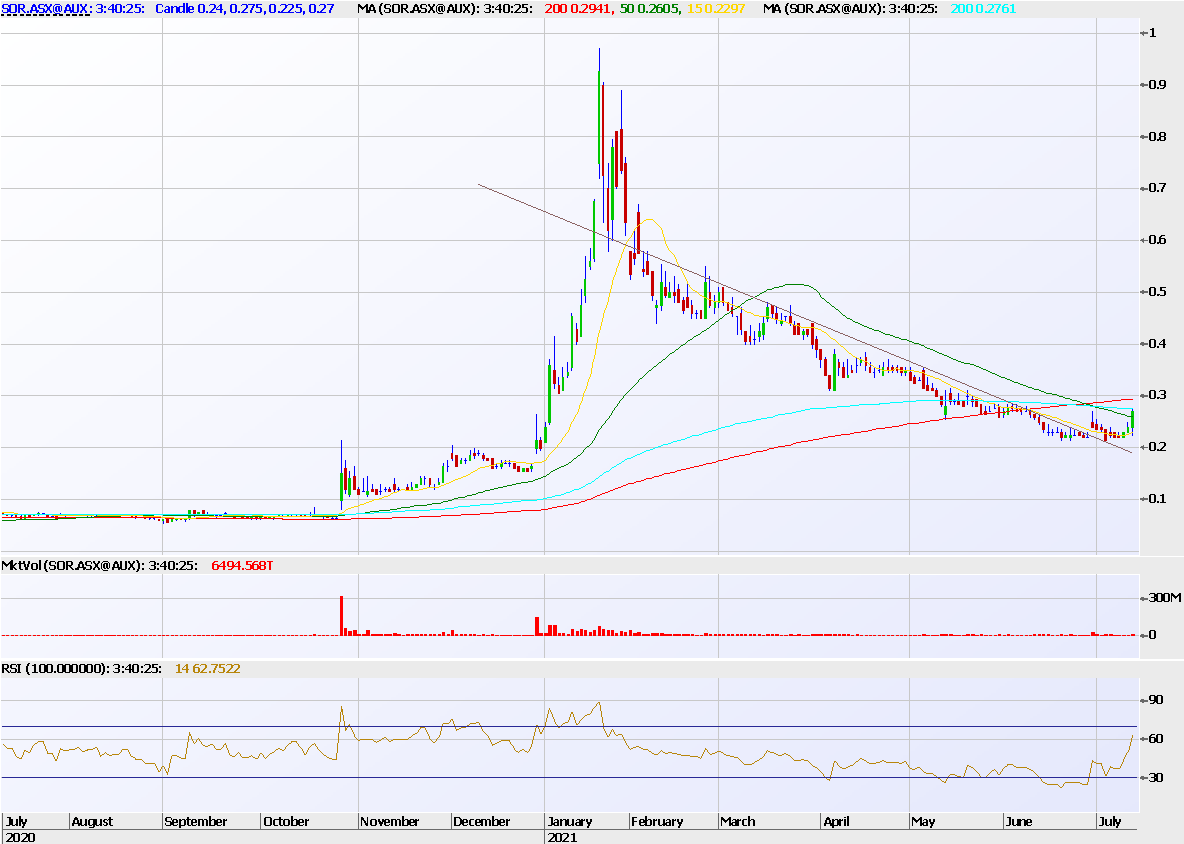

Chart of the Day: Could Strategic Elements bounce back after falling 73pc from 52-week high in January?

News

News

Strategic Elements Limited (ASX: SOR) is one of my favourite names, and it was one of our best performers in FY21, so full disclosure there.

In part because we didn’t fall in love with it, but rather sold it incrementally as the market really got a taste for it, and dusted the last bits off once the stock moved below a trailing profit stop we had calculated.

Whether that was good luck or good management, it’s one of the better charts you’ll see.

And so after the full scale exponential blow off complete with gap that came on the 20th of January this year to levels just shy of a buck, the stock has continued to fall, all the way back now to levels toward 20c.

I’m interested, and I’ve been buying it today.

I won’t be holding it south of 20c, as there is still a decent cap awarded to the stock at around $95m, but given that I do like the risk / return.

As might be expected, all the medium-term averages are converging around the current price action.

The rate of loss is moderating whilst supports have thus far held at 21-22c.

We can also see that nominal peer AXE is re-testing recent highs today, and emerging heavyweight BRN is also stirring from the deep.

I have not read a more sensational list of endeavours than that which SOR purports to be part of.

My favourite is the self-charging battery ink technology that generators electricity from humidity in the air.

SOR also operates as a Pooled Development Fund, meaning that if you are fortunate enough to make a profit from owning the shares, capital gains tax may not apply.

Worth a look.

At Stockhead we tell it like it is. While Strategic Elements is a Stockhead advertiser, it did not sponsor this article.

Steve Collette of Collette Capital Pty Ltd (ABN 56645766507) is a Corporate Authorised Representative (No. 1284431) of Sanlam Private Wealth (AFS License No. 337927), which only provides general advice.

Collette Capital only makes services available to professional and sophisticated investors as defined by the Corporations Act, Section (s)708(8)C and 761G(7)C.

The Collette Capital Wholesale IMA Strategy has returned +24.57% p.a. net of all fees as at the end of February 2021 since inception in January 2015 (using the Time Weighted Return method of calculating returns).

Learn more at www.collette.capital