Buy the Dip: ASX stocks finally bounce back and the outlook is ‘promising’, expert says

News

News

Last week the market boosters switched on after a few weeks of solid declines, with the Dow Jones Industrial Average up 6% and the techno-boosted Nasdaq finding 7%.

The S&P/ASX Emerging Companies (XEC) index was 5.3% stronger and the ASX 200 eked out 2.2% for the week.

Several stocks broke out of their freefall downtrends, confirming that the selloff has run its course for the time being, says Far East Capital analyst Warwick Grigor.

“Those who deliberately, or fortuitously bought near the bottom when everyone else was selling, will have the opportunity to take profits out of movements that might just prove to be rallies,” he said in a weekend note.

“Volumes have been low due to the tentative nature of the recovery with most people sitting on the sidelines until their confidence levels start to improve.

“However, by the time they recommit, they may have lost what has been a good trading opportunity.”

Frequent comments on the charts this week were “rallying, but about to meet resistance line” and “breached steepest downtrend”, Grigor says.

“That means we have seen the worst of it for the time being, but we are not out of the woods yet.”

In the past, China’s appetite for all commodities has been a major factor in buoying their markets, and therefore share prices of companies supplying those commodities.

China is still very important but the aggressive growth in GDP is now a thing of the past due to Xi’s efforts to eliminate COVID, Grigor says.

“The multi-decade period of extraordinary growth seems to over,” he says.

“China has caught up with the rest of the world, and some, and markets are now reverting to the norm.

“Some of China’s appetite is being satisfied by Russia and that is taking the heat out of commodity prices for the time being, with the stronger US$ also being a factor.”

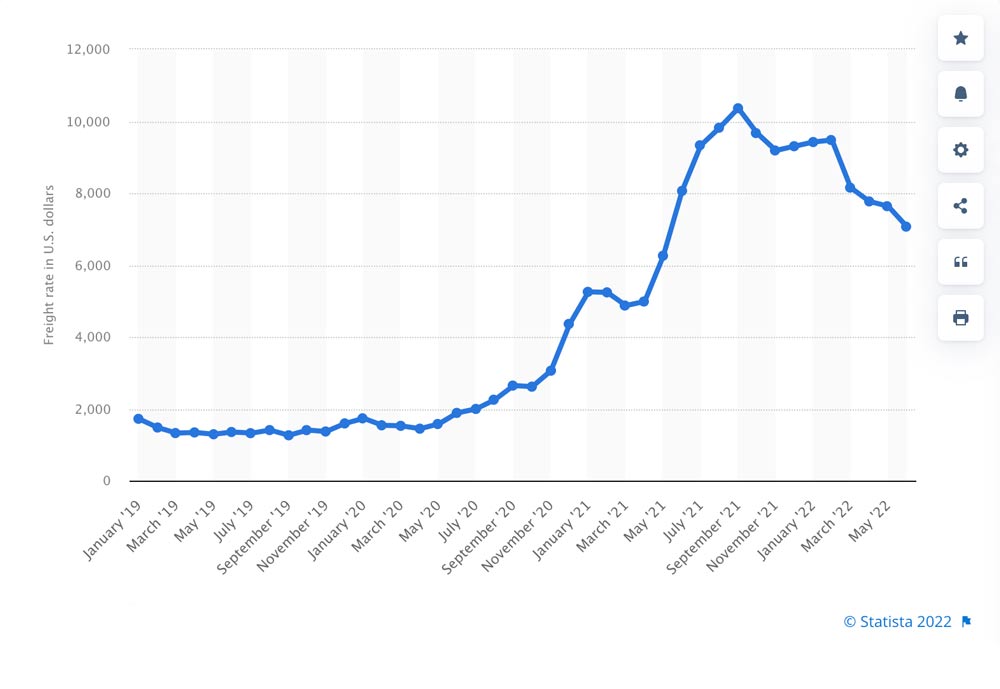

On the bright side of the China slowdown, we are seeing its freight rates fall by 20%, Grigor says.

From January 2019 container freight prices shot up in dramatic fashion. The spark was COVID, but years of underinvestment in the sector certainly didn’t help.

Eyewatering shipping costs meant inflated product prices at best, or, at worst, not receiving the product at all.

The worst could now be behind us, Grigor says.

“Average [freight] prices have fallen from >US$4,000 in Europe in August 2021, to US$3,455 in Hamburg and US$2,741 in Rotterdam in June,” he says.

“Prices have dropped from nearly US$5,500 to US$3,788 in Los Angeles over the same period.

“Average prices at the three major Chinese ports, Shanghai, Qingdao and Ningbo for a 40-foot standard high cube container have fallen to between US$3,900 and US$4,200 from US$6,000 over the past 10 months.”