Bitcoin recovers ‘Black Thursday’ losses to hit 2-month high

News

News

Bitcoin (BTC) has soared this week to its highest price in two months.

The digital asset rallied 12 per cent on April 29, moving from $12,004 to $13,462. Its market value closed comfortably back into a price range last seen in early March.

Losses sustained from the March 12 crash, dubbed Black Thursday, have now been completely recovered.

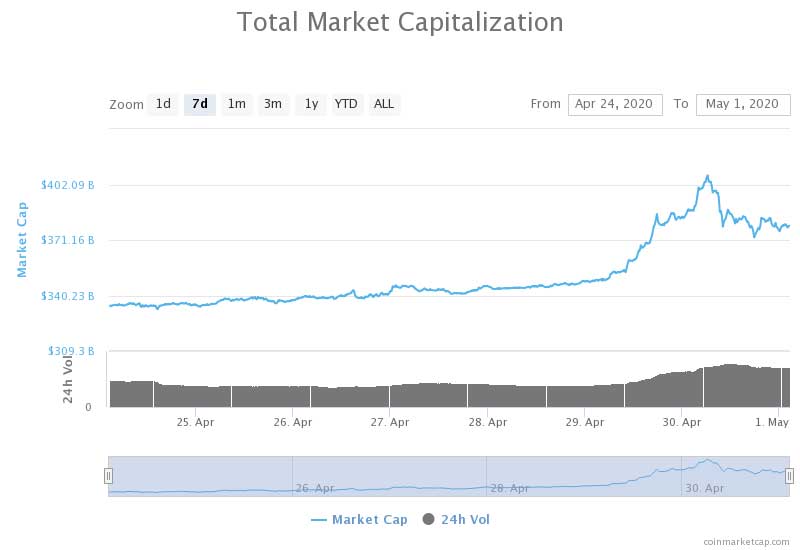

The rally has seen digital asset total market capitalisation increase $55bn over the past week, from $324bn to $379bn. This peaked at $407bn on Thursday.

BTC’s market dominance has increased 2 per cent and currently sits at 65.5 per cent.

BTC is up 13.4 per cent this week, largely thanks to Wednesday’s rally. Prior to this, the digital asset had gained 1.84 per cent.

As a result, BTC’s implied volatility – the likelihood of changes in price – increased from 68 to 81 per cent across Wednesday.

Thursday’s price reached a high of $14,444 to settle at $13,364. BTC Markets processed a trading volume of 616 BTC, up from 430 BTC the previous day.

BTC’s year-to-date (YTD) gain is 30.48 per cent. By comparison, the S&P ASX Small Ordinaries has taken on a YTD loss of 20.39 per cent.

Wednesday’s gain may be spurred on by the bullish sentiments surrounding BTC’s upcoming halving. This will see BTC mining rewards halve from 12.50 BTC to 6.25 on May 12.

This procedure restricts the supply of new BTC tokens entering the market. As the asset becomes scarcer over time, demand and therefore value should increase.

Read our simple explanation of the halving by clicking here.

Historically, BTC has experienced large price rallies after a halving. After BTC halved in July 2016, prices climbed 2924 per cent over one-and-a-half years.

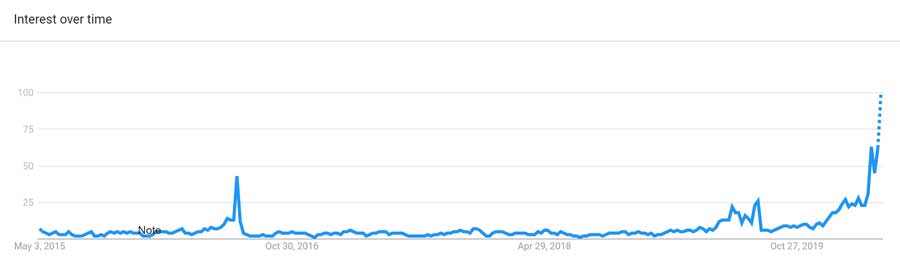

As the event approaches, global search interest is reaching new all-time highs. The below chart from Google trends shows the search interest over time including 2016.

All eyes will be on how the price reacts once mining rewards halves.