BetaShares CRYP ETF rallies 25% as moves advance to regulate crypto sector

News

News

Investors in Betashares Crypto Innovators ETF (ASX:CRYP) can probably thank a bit of government intervention for a ~25% rally in the past two weeks to ~$6.37.

BetaShares CRYP invests in listed companies in the crypto economy, such as exchanges, Bitcoin miners and infrastructure companies. It broke an ETF record when it listed on the ASX on November 4, 2021, attracting more than $8 million within 45 minutes.

But it hasn’t been smooth sailing for early investors, with the ETF price dipping ~43% since its early highs.

Cryptocurrency and tech stocks have been rallying higher as investors come to terms with the US Fed’s inflation-busting interest rate hikes.

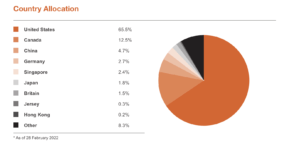

BetaShares CRYP’s major holdings are mostly North American based, benefiting from the recent rebound.

Investors have been snapping up beaten-down shares across global markets. The tech-heavy Nasdaq is up ~3.63% for the month.

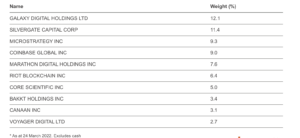

CRYP’s top three holdings are all having stellar performances. Galaxy Digital (TSE:GLXY) is up 49.06% in the past month, trading at ~CAD$24.

Silvergate Capital (NYSE:SI) is up ~26.95% in March to ~US$153, while MicroStrategy Inc (Nasdaq:MSTR) is up ~19.49% in the period to ~US$484.

Meanwhile, the price of leading cryptocurrencies have been steadily recovering with Bitcoin up ~1.81% for March so far to ~US$43,969, after a 12.18% rally in February to recover from a few months of heavy losses coming off highs of ~US$61k in October 2021.

It’s been a similar story with Ethereum, which is up ~7.20% for March so far to ~US$3182 after surging 8.72% in February to start to recover from losses. It is yet to return to its November 2021 highs of ~US$4628.

The rise in the CRYP also comes as Australia moves towards regulating cryptocurrency. Treasurer Josh Frydenberg and Financial Services Minister Jane Hume have jointly described “the most significant reforms to Australia’s payment systems in more than 25 years, capitalising on opportunities being created by new payment and crypto technologies.”

The government is seeking the industry’s feedback by the end of May on proposed new crypto asset licensing and custody requirements. A taxation system for cryptocurrency, protections for investors from unscrupulous dealers and ways of regulating digital banks, crypto exchanges and brokers are all being considered under proposed changes.

The federal government has hinted at favourable tax treatment for cryptocurrency businesses, releasing a terms of reference for a review by the Board of Taxation.

In a joint statement Frydenberg and Hume said the board would look into “the appropriate policy framework for the taxation of digital transactions and assets such as crypto.”

“The review is being conducted on the basis it will not increase the overall tax burden,” the statement said.

The Board has been asked to complete its review by 31 December 2022.

Senator Andrew Bragg (who chaired the Senate Select Committee on Australia as a Technology and Financial Centre last year) said he didn’t want to see Australia miss its chance to become a cryptocurrency or blockchain hub.

ETF Securities plans to launch Bitcoin (EBTC) and Ethereum (ETH) in the coming months, with the company providing an update to say it is working with the relevant regulatory bodies to secure final approval.

ETF Securities, which focuses on thematic ETFs, has partnered with Swiss based global crypto ETP provider 21 Shares on the crypto ETFs and a “best-in-class blockchain research and education centre”.

21 Shares has ~US$3 billion in assets under management inside its 20 European crypto ETPs and a total of 80 listings, creating the world’s first physically-backed crypto ETP in 2018.