Bargain Barrel: This explorer has two multi-commodity resources and potential for near-term cash flow

News

News

It is at the bottom of the ASX barrel that punters sometimes find some absolute gems that, with a little polishing, could truly shine. In this column, we examine companies with market caps around the $10m mark that may well be a bargain hunter’s fondest dream.

Nearly 700,000 tonnes of zinc metal, over 600,000 ounces of gold and over 70 million ounces of silver — that’s the contained resources present in White Rock Minerals’ Mount Carrington project in New South Wales and the Red Mountain project in Alaska.

Along with the lead resources at Red Mountain, that translates to a combined value equivalent of 3.5 million ounces of gold, a respectable haul by any standards.

Managing director Matthew Gill believes that investors have yet to cotton on to the company’s projects or the advanced stage that they are at.

“It is complicated because we are multi-commodity, I think that confuses people who are pure gold, pure silver or pure zinc,” he told Stockhead.

The company’s Red Mountain project already has a high-grade resource of 9.1 million tonnes (Mt) grading 5.8 per cent zinc, 2.6 per cent lead, 157 grams per tonne (g/t) silver and 0.9g/t gold, or about 12.9 per cent zinc equivalent.

This is contained within a broader resource of 16.7Mt at 8.9 per cent zinc equivalent.

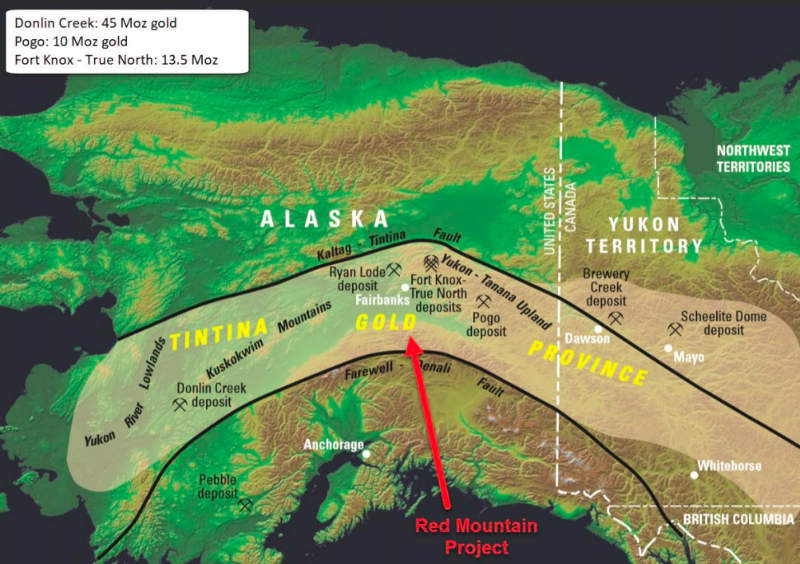

In January, White Rock also identified a 15sqkm large gold anomaly in the Tintina gold province that hosts giant gold deposits such as Donlin Creek (45 million ounces) and Fort Know (13.5 million ounces).

To top it off, Sandfire Resources (ASX:SFR) is currently footing the bill for exploration at Red Mountain under the farm-in agreement that was reached in March last year.

“We are discussing what the 2020 exploration program might be. It is winter in Alaska at the moment, so we are doing the necessary planning not just for zinc and silver VMS but also now to test this gold anomaly we have discovered,” Gill said.

“Get on the ground probably around May, so that will generate some news flow as we get around to exploring, hopefully drilling this season as well.”

Meanwhile, the Mount Carrington gold-silver project could bring cash flow to the company within two to three years.

Gill explained that the project already had a reserve of 159,000oz of gold, resources of 341,000oz of gold and 23.2 million ounces of silver along with a pre-feasibility study in play.

White Rock currently has a rights issue shortfall that is available for any qualified interested shareholder or investor.

“That use of funds is to take Mt Carrington through to the approvals process, complete the definitive feasibility study and be shovel ready within 12 to 18 months,” Gill said.

“From there it is only a year to build it and we will be in cash flow positive production in like three years.”

Helium is one of the rarest resources on Earth and ASX-listed explorers that are focused on finding it are equally rare.

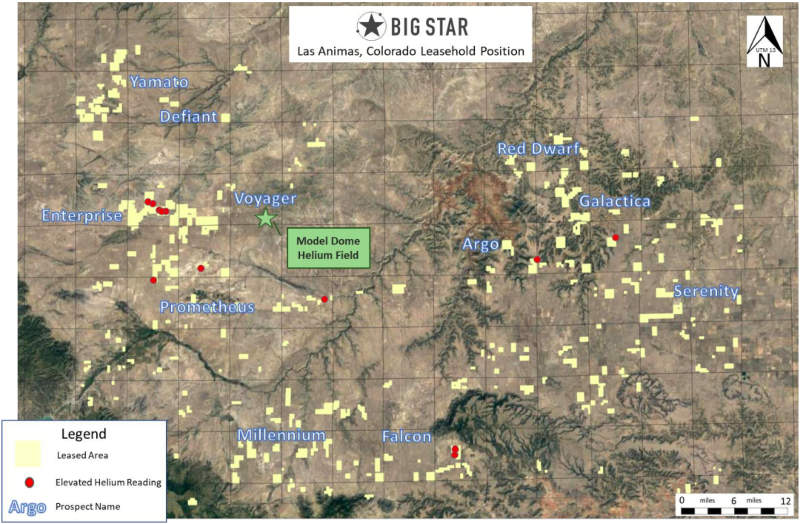

Big Star Energy spent the latter third of 2019 building up its acreage holding in Colorado, US, and has now reached a dominant position in the targeted Las Animas County.

The company currently has a lease position of 92,443 gross (50,692 net) acres.

“We are ready now to move forward with our drilling plans and project approvals, moving forward to a drilling program somewhere near the middle of the year,” managing director Joanne Kendrick told Stockhead.

“The elements we are looking to put together before drilling in terms of the key milestones are permitting for five well locations, another technical program aimed at prospect-scale soil gas surveys, prospective resource estimates by an independent resource certifier and arrangements with a helium buyer subject to the drilling program being successful.”

Big Star will also continue to consolidate its land position and more to the prospects it already has.

Once exploration has proved up the company’s helium resources, it will then proceed with its development plans.

These are centred on securing a surface processing kit, which would take six to seven months to mobilise to site.

“While that is happening, we can get the development drilling done and all the other supporting work,” Kendrick explained.

Each processing facility will be fed by four to five additional development wells with helium sold at the plant gate.

Kendrick believes the company’s small market cap and low cost work projects grant it very high leverage to the helium market, which is struggling to keep up with demand.

“There is about 10 per cent gap in the market between supply and demand and that looks to be growing at the moment,” Kendrick noted.

“Because old supplies are all contracted, new supplies are going to be the ones which get the most benefit from the lift in value in helium.”