Bargain Barrel: These two companies are taking flight in very different ways

News

News

In this week’s edition of the Bargain Barrel, we look at a gold explorer that is embarking on an ambitious drilling campaign and an up and coming specialist insurer that is on track towards becoming cash flow positive.

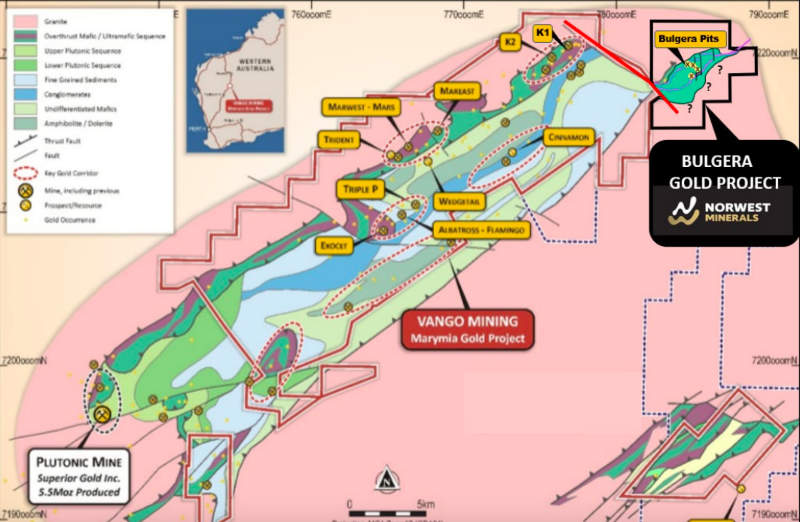

Norwest Minerals (ASX:NWM) holds the shallow, easy to mine Bulgera gold project about 200km north of Meekatharra that already has a resource of 2 million tonnes grading 1.03 grams per tonne (g/t) gold, or 65,500 ounces of contained gold.

Bulgera was originally mined for its near-surface oxide ore to feed the Plutonic gold project, which is just 50km to southwest, before operations ceased in 2004.

Since then, there had been no work at Bulgera until Norwest acquired the project in July this year from Accelerate Resources (ASX:AX8) for $220,000, a price which managing director Charles Schaus described as a steal.

However, it is Bulgera’s proximity to Vango Mining’s (ASX:VAN) Marymia project that has Schaus excited.

“The Bulgera gold project is actually a geologically offset extension of the Marymia mine sequence, which is being explored and developed by Vango Mining, who are forming a partnership with a large Chinese company,” he told Stockhead.

Vango has enjoyed considerable success at Marymia with recent holes returning up to 10m at 22.6g/t gold from 50m while previous drilling at depth had intersected 7m at 15.7g/t gold from 144m.

The excellent results from deep drilling is what really excites Norwest given that just 140 of the 422 historical holes at Bulgera extend below 50m depth, while a paltry eight were drilled below the 100m mark.

To address the lack of deeper holes, the company has embarked on a 8,700m program of reverse circulation drilling targeting multiple near-surface gold lodes adjacent to and extending below the four historical, shallow open cut pits.

“The premise behind this drilling program is to increase that resource (at Bulgera) significantly. We will certainly like to see it double in size and hopefully the deeper drilling will be bringing us higher grade,” Schaus said.

“The reason I say that is if you look at the deep drilling in what is virtually the same set of rocks at Vango’s project, they are returning fantastic results.

“So we are hoping that the fact that we are drilling in the same rock sequences and the fact that we are drilling deeper now will give us similar returns.”

The company also plans to start a shallower 14,200m aircore drilling program in February next year to test targets along the 5km northeast to southwest strike of the Bulgera greenstone package.

“We will be chasing geophysical targets and some soil anomalies as there is fairly thick, transported cover that makes any soil sampling in the area where the cover exists basically useless because it has masked what is below it.

“So we are going in with an aircore rig to penetrate that and test the bedrock below it.”

The drilling programs are likely to be followed by resource upgrades that could drastically change the project.

“We think that Bulgera could prove to be the company-making deposit for us and the fact that we got it for such a low price, it has so much upside and because there is so much infrastructure in the area we can see it getting it into production sooner rather than later,” Schaus said.

He noted that the current development option would be to truck ore up the existing haul road to Plutonic for toll treatment.

Vango’s move to develop its Marymia project could also open up a second toll treatment option.

Schaus added that while the fairly large upfront capital cost of a heap leach development was currently off the table, it could be brought back as an option if the company managed to grow its resource, particularly the near-surface softer ore that could come from the aircore drilling.

>> Now listen: The Explorers Podcast with Barry FitzGerald: Norwest Minerals

Read more:

Norwest unveils ‘bonus’ 65,500oz gold resource, accelerates low cost production options

Our second bargain barrel candidate is Ensurance (ASX:ENA), a specialist insurance agency operating in the UK and Australia for the construction and engineering sectors.

The company recently recorded a fifth consecutive quarter of revenue growth in the September 2019 quarter in what has historically been the lowest quarter each year due to season trends.

This includes a strong quarter of premiums from the UK business, with Ensurance saying the annual policies written continue to build a strong case for future renewals with a strong renewal rate of over 85 per cent.

Ensurance is a virtual insurer that receives underwriting capacity from big insurers such as Lloyds Partnerships, Zurich, Munich and Swiss Reinsurance Company.

It does not provide retail insurance, dealing rather with brokers or directly with large clients, something the company is quite happy to stick with.

Executive chairman Tony Leibowitz, who was formerly the chairman of Pilbara Minerals (ASX:PLS), told Stockhead that he liked the insurance model, where between 80 and 90 per cent of annual revenue just keeps renewing.

“(When) we bought into this business two years ago, it had no revenue in the UK,” he said.

“We are currently achieving huge year-on-year growth and hope to continue this over the next few years. We are arguably one of the fastest growing MGS’ in the UK and hope to capitalise on the substantial base and reputation that has been built.

“We will be cash flow neutral by the end of this financial year, 2019-20, and all our ducks and eggs are very well placed to get some massive accretion in value. We will be starting to go into profitability.”

Ensurance expects further growth to come from its Terrorism and Sabotage insurance product that was launched in May.

It recently secured additional underwriting capacity from Lloyds which will allow it to sell the product in Australia and the US.

“These will be run out of our UK office as this is where the large policies are generated from. We see Australia as a microcosm of the UK insurance market,” Leibowitz explained.