Australian house prices just rose again, but ‘divergences’ are emerging

News

News

Australian house prices continued to rise in December, according to the latest monthly data from CoreLogic.

But the fallout from COVID-19 will see “divergences” emerge through the course of 2021, CBA says.

CoreLogic’s national home value index showed Australian house prices rose by another one per cent in December, to cap their third straight month of gains.

The quarterly rise of 2.3 per cent helped the market close out 2020 with a three per cent gain in a volatile year, which included a 2.1 per cent drop between April and September.

Commenting on the results, CoreLogic’s head of research Tim Lawless attributed the rebound to a “spectacular rise” in consumer confidence, which rose to a 10-year high as Australia’s economy emerged from the pandemic in Q4.

Also, the RBA has clearly indicated it expects interest rates to stay where they are (practically zero) for the next three years.

“Record low interest rates played a key role in supporting housing market activity,” Lawless said.

“Containing the spread of the virus has been critical to Australia’s economic and housing market resilience.”

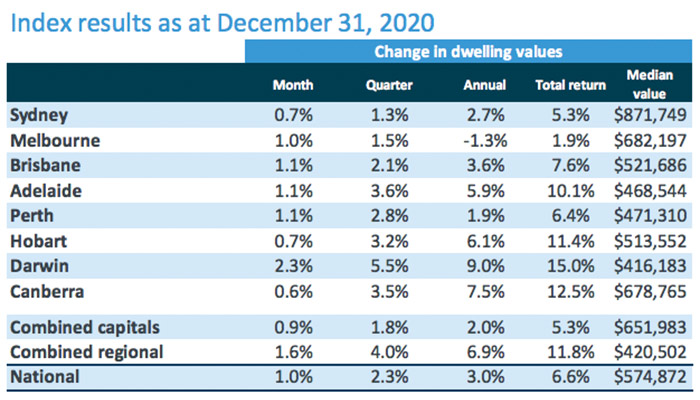

Here’s the breakdown of 2020 house price returns across all capital cities:

As a measure of the 2020 volatility, Lawless highlighted that home sales slumped by a massive 40 per cent during the first COVID-19 wave in April.

But a second-half surge in activity saw year-end sales volume eclipse the previous year by almost eight per cent.

And within that unusual trading activity, some unique pandemic-related themes emerged.

Melbourne — a property front-runner with Sydney since the 2008 financial crisis — was the only capital city to post an annual fall.

While the combined capital cities posted an annual gain of 5.3 per cent, the total return across regional areas more than doubled that, at 11.6 per cent.

Lawless said that result reversed a trend which had been in place for most of the last decade, as regional areas lagged the capital cities.

“As remote-working opportunities became more prevalent and demand for lifestyle properties and lower density housing options became more popular, regional areas of Australia saw housing market conditions surge,” CoreLogic said.

Regional Tasmania topped the pops in 2020 with an 11.9 per cent gain, followed by regional NSW (+8.3pc) and SA (+8.1pc).

In her analysis of the December results, CBA economist Kristina Clifton also flagged ongoing outperformance in “some regional areas” as a trend to watch in 2021.

She added that CBA expects ultra-low interest rate settings to support Australian house prices into the new year.

However, the Christmas COVID-19 outbreak in Sydney may put the brakes on early 2021 gains for Australia’s largest property market.

While the rollout of vaccines will also help with a rising property market tide, CBA says it won’t necessarily lift all boats.

“We are likely to see divergences within the property market this year,” Clifton said.

In particular, detached dwellings are likely to extend their performance buffer over apartments.

“The shift to working from home is increasing demand for detached properties,” Clifton said.

Conversely, “low international student inflows are reducing the demand for apartments, particularly those located close to universities”.

Looking ahead, Lawless shared the CBA view that the outlook for Australia’s market is looking broadly positive heading into 2021.

However, he said one “wildcard” is the complex picture emerging for international travel as the global economy tries to rebound from the pandemic.

That’s particularly relevant for Sydney and Melbourne, where “overseas migration has historically comprised a larger portion of overall population growth”.

In that context, Australia’s two largest housing markets would be “impacted the most by prolonged border closures”, Lawless said.