ASX Small Cap Lunchtime Wrap: Warren Buffett smashed the S&P 500 in the second quarter

News

News

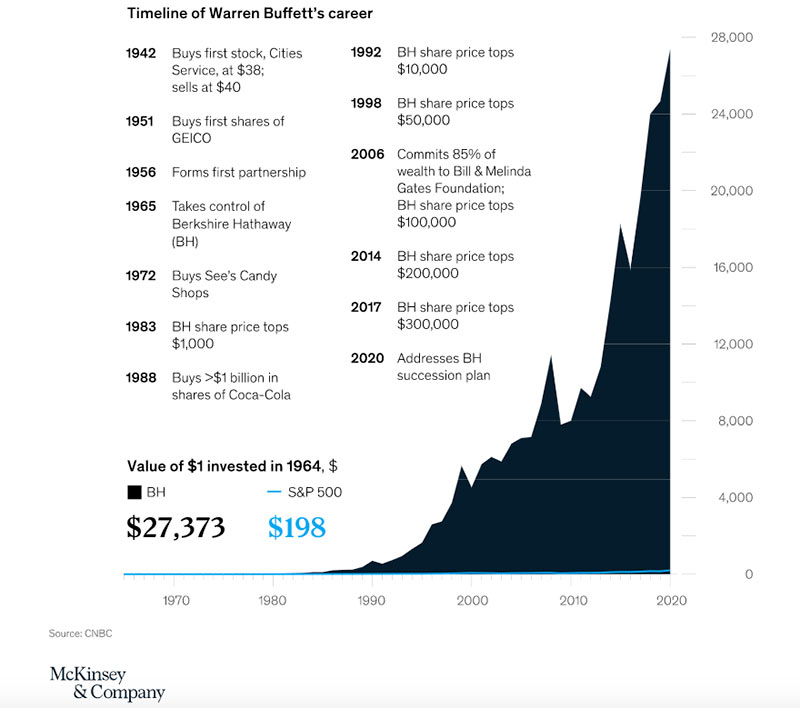

Berkshire Hathaway earnings were up 86 per cent in the second quarter, compared with a 20 per cent gain for the S&P 500 in the same period.

The S&P 500 measures the stock performance of 500 large companies listed on stock exchanges in the United States.

This is a long-term trend for Berkshire founder and CEO Warren Buffett, who is looking far from ‘washed up’ despite turning 90 years old this week.

A dollar invested in Berkshire in 1964 would be worth $US27,373 ($37,242) today, versus $US198 had that same dollar been invested in the S&P 500, says McKinsey & Co partner Tim Koller:

Buffett is a ‘conservative’ investor, focusing on low-risk businesses that have steady cash flows and will generate high returns.

“Yes, volatile times call for quick responses and fast action,” Koller says.

“But as Warren Buffett has shown, there are also significant advantages to keeping the long term in mind, as well.

“Specifically, there is value in consistency, caution, and patience and in simply trusting the math—in good times and bad.”

The ASX is bouncing back from Tuesday’s sharp drop after Wall Street rose overnight.

The benchmark ASX 200 was up 86 points, or 1.45 per cent, to 6,039.8 by ~12pm AEST.

Here are the best performing ASX small cap stocks at 12pm on Wednesday September 2:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| KIS | King Island Scheelite | 0.099 | 80.00% | $25.12M |

| GLA | Gladiator Resources | 0.003 | 50.00% | $4.7M |

| VKA | Viking Mines | 0.016 | 45.45% | $3.5M |

| SRZ | Stellar Resources | 0.024 | 41.18% | $7.5M |

| WBE | Whitebark Energy | 0.004 | 33.33% | $12.2M |

| MIO | Macarthur Minerals | 0.65 | 30.00% | $53.6M |

| WMX | Wiluna Mining | 1.54 | 25.61% | $123.6M |

| JHL | Jayex Healthcare | 0.038 | 26.67% | $5.3M |

| MTB | Mount Burgess Mining | 0.011 | 22.22% | $6.6M |

| RHY | Rhythm Biosciences | 0.125 | 19.05% | $14.5M |

| SGQ | St George Mining | 0.115 | 16.16% | $56.4M |

| TRT | Todd River Resources | 0.047 | 14.63% | $14.4M |

| EX1 | Exopharm | 0.36 | 14.29% | $34.4M |

| ASP | Aspermont | 0.008 | 14.29% | $18.2M |

| YOW | Yowie Group | 0.04 | 14.29% | $7.6M |

| PAK | Pacific American Holdings | 0.017 | 13.33% | $4.2M |

| SCN | Scorpion Minerals | 0.085 | 13.33% | $15.5M |

| BDG | Black Dragon Gold | 0.13 | 13.04% | $15.3M |

| CDV | Cardinal Resources | 0.92 | 26.21% | $481.3M |

| DEG | De Grey Mining | 1.3 | 18.20% | $1.53B |

Near-term tungsten miner King Island Scheelite (ASX:KIS) has signed a big offtake deal.

Gold producer Wiluna Mining (ASX:WMX) hit grades up to 880g/t in drilling at its namesake operation in WA.

Tech company Brainchip Holdings (ASX:BRN) is partnering up with Texas-based VORAGO Technologies as part of a new development agreement.

And high flying gold explorer De Grey Mining (ASX:DEG) has made a new discovery at the mammoth Hemi project in the Pilbara.

Here are the worst performing ASX small cap stocks at 12pm on Wednesday September 2:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| XPE | XPED | 0.001 | -50.00% | $1.8M |

| TGO | Trimantium Growthops | 0.06 | -25.00% | $12.2M |

| CFO | Cfoam | 0.022 | -24.14% | $5.6M |

| CGB | Cann Global | 0.004 | -20.00% | $20.1M |

| PWN | Parkway Minerals | 0.006 | -18.75% | $13.7M |

| Z1P | Zip Co | 6.67 | -16.52% | $3.2B |

| TGN | Tungsten Mining | 0.125 | -16.67% | $115.6M |

| RLC | Reedy Lagoon | 0.011 | -15.38% | $6.1M |

| SBR | Sabre Resources | 0.006 | -14.29% | $8.8M |

| WWG | Wiseway | 0.125 | -13.79% | $20.4M |

| KPE | Kina Petroleum | 0.91 | -13.33% | $13.5M |

| SZL | Sezzle | 7.59 | -13.36% | $1.7B |

| CNJ | Conico | 0.014 | -12.50% | $7.1M |

| XTC | Xantippe Resources | 0.004 | -12.50% | $16.3M |

| SHK | Stone Resources Australia | 0.021 | -12.50% | $20.1M |

| OPY | Openpay | 3.52 | -12.22% | $432.6M |

| TIP | Teaminvest Private Group | 0.69 | -12.10% | $87.3M |

The biggest losers in early trade are buy now, pay later (BNPL) stocks, which continue to nose dive following yesterday’s news that PayPal will look to offer pay later services in the US.