ASX Small Cap Lunch Wrap: Who’s making a pig of themselves today?

News

Welcome to the long break.

In Science news, a man in the US has successfully accepted a pig’s heart into his chest as a way to keep on living. The University of Maryland Medical School confimred a 57yo Maryland man is recovering well after the first of its kind procedure, which saw a herd of pigs genetically treated first to get rid of a gene that produces a type of sugar.

That in the past has led to organ rejection in humans.

In Not Science news, China’s space agency has confirmed the “hut” its rover spotted on Mars is actually a rock, and the ABC did the hard yards to find a steak chef who confirms you can turn your steak as many times as you like.

Ridiculous.

No one’s getting experimental on the local bourse today. The ASX200 has countinued its slide since a minor recovery’s from last Thursday’s big fall, 200 is lower today, dropping 53.90 points or 0.72% to 7,393.20.

The index has now lost 2.59% for the last five days, after recently coming within 0.60% below of its 52-week high.

Blame the weak Wall St lead, where stocks bounced around a bit but finished flat, amid concerns over the pace of monetary policy tightening by the Fed in the year ahead.

It’s the start of the year; they’ll get over it. Unlike crypto fans, whose mettle is being tested while Bitcoin hovers with great trepidation around the US$40,000 mark. Rob Badman has all the up and down action covered here with his Mooners and Shakers.

Here’s today’s winners and losers on the ASX so far….

Here are the best performing ASX small cap stocks for January 10 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| VMG | VDM Group Limited | 0.002 | 100% | $6,927,660.95 |

| BAS | Bass Oil Ltd | 0.002 | 33% | $6,919,022.19 |

| NAE | New Age Exploration | 0.0165 | 27% | $18,666,685.83 |

| CCE | Carnegie Cln Energy | 0.0025 | 25% | $30,205,147.42 |

| CGB | Cann Global Limited | 0.0025 | 25% | $12,670,973.57 |

| EN1 | Engage:Bdr Limited | 0.0025 | 25% | $6,205,271.90 |

| PNV | Polynovo Limited | 1.75 | 22% | $945,784,902.92 |

| RGL | Riversgold | 0.022 | 22% | $7,272,759.53 |

| DDD | 3D Resources Limited | 0.0035 | 17% | $11,641,116.28 |

| GNM | Great Northern | 0.007 | 17% | $9,054,305.86 |

| MBK | Metal Bank Ltd | 0.007 | 17% | $15,646,908.96 |

| VOR | Vortiv Ltd | 0.03 | 15% | $3,653,633.44 |

| CT1 | Constellation Tech | 0.008 | 14% | $10,298,402.59 |

| ENT | Enterprise Metals | 0.016 | 14% | $8,022,282.03 |

| MRD | Mount Ridley Mines | 0.008 | 14% | $39,948,621.34 |

| IND | Industrialminerals | 0.25 | 14% | $6,055,500.00 |

| ADR | Adherium Ltd | 0.0135 | 13% | $26,444,034.49 |

| CLE | Cyclone Metals | 0.0045 | 13% | $19,812,503.49 |

| EVE | EVE Health Group Ltd | 0.0045 | 13% | $15,372,567.56 |

| MGT | Magnetite Mines | 0.037 | 12% | $103,974,647.07 |

| SLZ | Sultan Resources Ltd | 0.185 | 12% | $11,473,174.19 |

| MDI | Middle Island Res | 0.14 | 12% | $15,302,277.75 |

| VMT | Vmoto Limited | 0.47 | 12% | $117,331,235.28 |

| MHI | Merchant House | 0.098 | 11% | $8,295,451.65 |

| OOK | Ookami Limited | 0.2 | 11% | $5,930,400.06 |

Today’s big winner was again gold and lithium explorer New Age Exploration (ASX:NAE), which again pumped to be up 65% over the past two days on no news.

And again, the $21.5m market cap stock said it had “no idea what’s going on” in response to an ASX price query.

BHP is also pretty happy with itself after dropping US$100m into priveteer Kabanga Nickel’s Kabanga project, which will eventually convert into a 15% equity stake in the project.

It’s a bit of an FU to Andrew Forrest after he beat BHP to Canadian nickel explorer Noront Resources, and it’s a pretty good one.

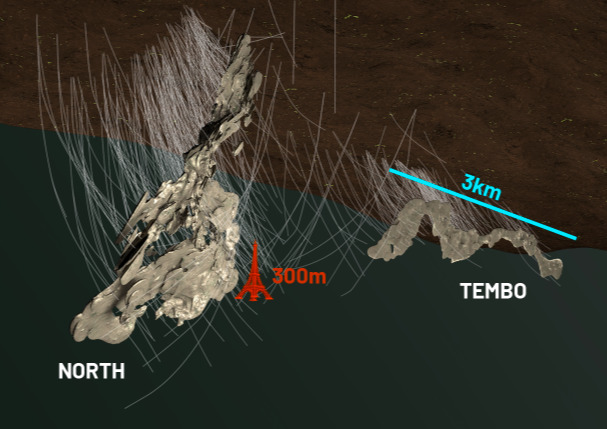

Previously owned by Glencore and Barrick and abandoned when the nickel price took a dive, the orebody at Kabanga North is deep. So deep the company uses Eiffel Towers at its chosen unit of measurement.

We’re not kidding:

The market remained unimpressed. Tough crowd.

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| WCN | White Cliff Min Ltd | 0.018 | -28% | $14,829,909.98 |

| ALT | Analytica Limited | 0.0015 | -25% | $9,227,602.26 |

| ANL | Amani Gold Ltd | 0.0015 | -25% | $45,751,128.21 |

| IRX | Inhalerx Limited | 0.083 | -17% | $16,846,695.70 |

| YPB | YPB Group Ltd | 0.0025 | -17% | $18,353,501.10 |

| PNX | PNX Metals Limited | 0.006 | -14% | $25,565,354.58 |

| AQS | Aquis Ent Ltd | 0.135 | -13% | $5,536,472.28 |

| BXN | Bioxyne Ltd | 0.025 | -12% | $18,244,143.84 |

| ASP | Aspermont Limited | 0.022 | -12% | $60,539,182.80 |

| SDI | SDI Limited | 0.91 | -12% | $122,431,495.90 |

| JPR | Jupiter Energy | 0.041 | -11% | $7,055,373.88 |

| NCL | Netccentric Ltd | 0.125 | -11% | $39,621,632.68 |

| M2M | Mtmalcolmminesnl | 0.13 | -10% | $7,645,270.15 |

| VAN | Vango Mining Ltd | 0.047 | -10% | $65,516,756.86 |

| RNU | Renascor Res Ltd | 0.19 | -10% | $397,016,234.79 |

| SCL | Schrole Group Ltd | 0.01 | -9% | $19,022,046.89 |

| TKM | Trek Metals Ltd | 0.1 | -9% | $34,150,616.50 |

| WSR | Westar Resources | 0.1 | -9% | $4,508,082.48 |

| ATU | Atrum Coal Ltd | 0.03 | -9% | $22,695,365.09 |

| NVX | Novonix Limited | 9.47 | -9% | $5,012,746,222.68 |

| CCX | City Chic Collective | 4.47 | -8% | $1,131,770,019.68 |

| AAR | Anglo Australian | 0.11 | -8% | $71,541,508.68 |

| CPM | Coopermetalslimited | 0.22 | -8% | $6,484,800.00 |

| AUQ | Alara Resources Ltd | 0.023 | -8% | $17,635,730.98 |

| KRR | King River Resources | 0.023 | -8% | $38,838,123.68 |

White Cliff Minerals (ASX:WCN) fell another 28% off its recent explosive highs, after releasing a sampling results from ts Yinnetharra pegmatite dykes.

It responded to a query from the ASX about the unusual rise a week ago by saying it had “no reasons to doubt the confidentiality of the results” prior to today’s release.