ASX September Winners: ASX breaks five-month winning streak but small caps hold ground

While the ASX slipped in September, small caps held firm. Pic: Getty Images

- After five months of consecutive gains, the ASX 200 fell 0.78% in September with nine of 11 sectors in the red

- Smaller companies performed strongly with the ASX Emerging Companies and ASX Small Ordinaries rising 13% and 3% respectively

- Embedded finance company Stakk surged 727% in September after landing major US contracts with Robinhood and T-Mobile USA

Australian equities took a breather in September after five consecutive months of gains with the ASX 200 declining 0.78%, according to S&P Dow Jones Indices (S&P DJI).

On Wall Street it was a different narrative with US markets rallying in September – traditionally a weaker month for equities – with the S&P 500 up 3.65%, Nasdaq gaining 5.6%, and Dow Jones rising 1.9%.

Both the S&P 500 and Nasdaq had their best September performance since 2010, according to S&P DJI. This was driven by the much-anticipated US Federal Reserve rate cut.

S&P DJI described Q3 CY25 in the US as “stellar” thanks to optimism surrounding rate cuts, big tech strength and robust consumer spending, with the

S&P 500 up 8% for the quarter.

“Despite ongoing trade negotiations coupled with inflation and labor market worries, the 500 notched 23 record closing highs, marking its best

September performance in 15 years,” S&P DJI said.

On the local bourse smaller companies continued to demonstrate strong performance in September with the ASX Emerging Companies and ASX Small Ordinaries rising 13% and 3%, respectively, while the ASX 20 dropped 2%.

Materials outperforms as energy leads losses

Nine out of 11 sectors in the ASX 200 reported losses, led down by energy, which dropped 10%. Materials outperformed, rising 6%, followed by utilities, which gained 1%.

S&P DJI said commodities rose overall, led by gold, which surged 10% and is up 44% YTD on heightened safe-haven demand.

Lower rates support bond prices

The Reserve Bank of Australia (RBA) kept interest rates on hold in September, citing concerns that “inflation in the September quarter may be higher than expected” at the time of its August meeting, where it lowered the cash rate by 25bps.

The central bank has lowered interest rates three times in 2025, from a peak of 4.35% prior to February’s board meeting.

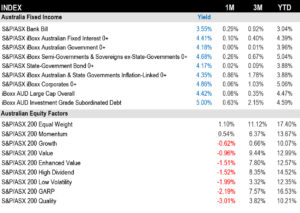

Lower rates supported bond prices, helping all reported fixed income indices record gains this month.

The 50 best performing ASX stocks in September

| CODE | COMPANY | LAST SHARE PRICE | SEPT RETURN % | MARKET CAP |

|---|---|---|---|---|

| SKK | Stakk Limited | 0.062 | 727% | $128,654,940 |

| RMX | Red Mount Mining | 0.035 | 338% | $22,438,067 |

| SRJ | SRJ Technologies | 0.021 | 250% | $28,962,046 |

| 4DX | 4D Medical | 1.98 | 247% | $995,842,119 |

| DRE | Dreadnought Resources | 0.041 | 242% | $208,259,500 |

| FDR | Finder | 0.39 | 239% | $149,173,442 |

| FXG | Felix Gold Limited | 0.58 | 222% | $254,993,604 |

| RNX | Renegade Exploration | 0.0095 | 217% | $19,494,286 |

| CXU | Cauldron Energy Ltd | 0.023 | 207% | $41,150,703 |

| SRL | Sunrise | 5.35 | 207% | $658,290,766 |

| KGD | Kula Gold Limited | 0.027 | 200% | $31,092,312 |

| WIN | WIN Metals | 0.056 | 195% | $38,504,146 |

| IS3 | I Synergy Group Ltd | 0.026 | 189% | $45,127,292 |

| SGQ | St George Mining | 0.125 | 178% | $365,506,702 |

| AUZ | Australian Mines Ltd | 0.022 | 175% | $39,852,202 |

| FLG | Flagship Min Ltd | 0.145 | 174% | $36,359,804 |

| ECT | Env Clean Tech | 0.155 | 167% | $41,493,153 |

| BML | Boab Metals Ltd | 0.46 | 163% | $128,445,082 |

| RAC | Race Oncology Ltd | 3.13 | 162% | $544,668,847 |

| T3D | 333D Limited | 0.13 | 160% | $25,850,995 |

| RCM | Rapid Critical | 0.08 | 158% | $63,881,503 |

| FGH | Foresta Group | 0.03 | 150% | $79,587,194 |

| ZNC | Zenith Minerals Ltd | 0.145 | 142% | $76,771,047 |

| AMS | Atomos | 0.012 | 140% | $14,690,261 |

| IBX | Imagion Biosystems | 0.036 | 140% | $15,780,291 |

| AVM | Advance Metals Ltd | 0.105 | 139% | $31,242,856 |

| ILT | Iltani Resources | 0.5 | 133% | $32,970,401 |

| KRR | King River Resources | 0.016 | 129% | $23,417,393 |

| TOE | Toro Energy Limited | 0.395 | 119% | $47,511,330 |

| CTT | Cettire | 0.69 | 119% | $263,054,372 |

| POD | Podium Minerals | 0.082 | 116% | $65,543,791 |

| AIS | Aeris Resources Ltd | 0.485 | 116% | $471,139,752 |

| MDI | Middle Island Res | 0.043 | 115% | $12,609,061 |

| XST | Xstate Resources | 0.019 | 111% | $4,776,236 |

| TM1 | Terra Metals Limited | 0.17 | 110% | $106,321,532 |

| IR1 | Irismetals | 0.205 | 107% | $47,416,938 |

| FME | Future Metals NL | 0.037 | 106% | $35,460,830 |

| MC2 | Marimaca Copper Corp | 12.31 | 105% | $260,582,549 |

| PVW | PVW Exploration | 0.041 | 105% | $10,202,070 |

| SPL | Starpharma Holdings | 0.255 | 104% | $106,647,319 |

| FML | Focus Minerals Ltd | 1.065 | 101% | $305,184,957 |

| GES | Genesis Resources | 0.012 | 100% | $9,394,096 |

| LNU | Linius Tech Limited | 0.002 | 100% | $13,179,029 |

| LRD | Lord Resources | 0.05 | 100% | $7,750,101 |

| MOM | Moab Minerals Ltd | 0.002 | 100% | $3,749,332 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | $14,466,230 |

| NES | Nelson Resources | 0.006 | 100% | $13,031,566 |

| ILA | Island Pharma | 0.44 | 100% | $111,661,775 |

| ORN | Orion Minerals Ltd | 0.02 | 100% | $150,048,037 |

| MI6 | Minerals 260 | 0.25 | 100% | $516,833,333 |

Embedded finance company Stakk (ASX:SKK) had a standout month in September, blasting up by 727% after landing major US contracts. SKK secured a two-year deal with US trading platform Robinhood to provide image capture, authentication, and transaction processing for its new Robinhood Banking service.

The agreement positions Stakk as a key vendor as Robinhood expands into full-service banking, with revenue from monthly platform fees and transaction charges. Stakk also signed a similar three-year deal with T-Mobile USA.

Red Mountain Mining (ASX:RMX) surged 338% in September on strong project news. Channel sampling at its Fry Lake project in Canada delivered gold grades up to 25.1 g/t, confirming high-grade mineralisation across three main vein prospects.

The company also expanded its antimony portfolio, securing 87 claims in Utah’s Antimony Canyon district and acquiring the Yellow Pine project in Idaho’s historic Stibnite Mining District.

4D Medical (ASX:4DX) had a milestone September up 247% with the US Food and Drug Administration (FDA) granting 510(k) clearance for its ventilation-perfusion product, CT:VQ.

The company also inked agreements with AstraZeneca, Royal Melbourne Hospital and Spectrum Medical Imaging to roll out its lung health analysis software.

The partnerships are expected to accelerate adoption of 4D’s technology across clinical and research settings, strengthening its position as a global leader in advanced lung imaging.

Worth reading: Dr Boreham’s Crucible: 4D Medical enters crucial US dimension with high hopes

The 50 worst performing ASX stocks in September

| CODE | COMPANY | LAST SHARE PRICE | SEPT RETURN % | MARKET CAP |

|---|---|---|---|---|

| 4DS | 4DS Memory Limited | 0.009 | -68% | $18,548,088 |

| AGN | Argenica | 0.26 | -60% | $33,398,745 |

| KLR | Kaili Resources Ltd | 0.28 | -58% | $41,272,102 |

| 1AD | Adalta Limited | 0.002 | -50% | $2,920,411 |

| MMR | Mec Resources | 0.004 | -50% | $7,487,959 |

| XGL | Xamble Group Limited | 0.015 | -46% | $6,780,284 |

| SPX | Spenda Limited | 0.004 | -43% | $18,460,862 |

| HFR | Highfield Res Ltd | 0.067 | -42% | $31,763,162 |

| QEM | QEM Limited | 0.023 | -41% | $5,437,208 |

| BPH | BPH Energy Ltd | 0.009 | -40% | $10,964,095 |

| PPY | Papyrus Australia | 0.009 | -40% | $5,425,936 |

| RKB | Rokeby Resources Ltd | 0.006 | -40% | $10,955,291 |

| IFG | Infocus Group | 0.023 | -38% | $10,067,353 |

| BDM | Burgundy Diamond Mines | 0.017 | -37% | $24,162,649 |

| PRO | Prophecy International | 0.22 | -36% | $16,225,645 |

| OMG | OMG Group Limited | 0.009 | -36% | $8,018,943 |

| ATH | Alterity Therapeutics | 0.009 | -36% | $97,878,747 |

| DM1 | Desert Metals | 0.011 | -35% | $5,042,907 |

| BMO | Bastion Minerals | 0.001 | -33% | $2,204,953 |

| GGE | Grand Gulf Energy | 0.002 | -33% | $5,640,850 |

| IPT | Impact Minerals | 0.006 | -33% | $24,679,980 |

| OLI | Oliver'S Real Food | 0.008 | -33% | $4,325,855 |

| PRX | Prodigy Gold NL | 0.002 | -33% | $13,483,725 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | $1,553,413 |

| PFM | Platformo Ltd | 0.036 | -32% | $3,416,699 |

| ASP | Aspermont Limited | 0.007 | -30% | $18,483,448 |

| PEC | Perpetual Res Ltd | 0.014 | -30% | $13,243,377 |

| FCT | Firstwave Cloud Tech | 0.012 | -29% | $20,562,224 |

| ALM | Alma Metals Ltd | 0.005 | -29% | $9,286,186 |

| PFT | Pure Foods Tas Ltd | 0.025 | -29% | $3,510,641 |

| RGT | Argent Biopharma Ltd | 0.093 | -28% | $7,232,505 |

| MYR | Myer Holdings Ltd | 0.48 | -28% | $829,467,371 |

| EXL | Elixinol Wellness | 0.013 | -28% | $3,600,888 |

| VBS | Vectus Biosystems | 0.06 | -28% | $3,200,000 |

| PPK | PPK Group Limited | 0.38 | -28% | $34,508,749 |

| BKT | Black Rock Mining | 0.02 | -27% | $33,852,883 |

| EQR | EQ Resources Limited | 0.03 | -27% | $109,853,677 |

| MGT | Magnetite Mines | 0.063 | -27% | $11,707,746 |

| MML | Mclaren Minerals | 0.022 | -27% | $4,372,165 |

| IRX | Inhalerx Limited | 0.028 | -26% | $5,976,550 |

| KNG | Kingsland Minerals | 0.13 | -26% | $9,432,918 |

| BCC | Beam Communications | 0.093 | -26% | $8,037,239 |

| ALB | Albion Resources | 0.071 | -25% | $10,095,017 |

| BRX | Belararox Ltd | 0.086 | -25% | $17,027,912 |

| FAL | Falcon Metals | 0.82 | -25% | $174,368,922 |

| AUG | Augustus Minerals | 0.036 | -25% | $7,428,941 |

| AYM | Australia United Min | 0.003 | -25% | $5,527,732 |

| BUY | Bounty Oil & Gas NL | 0.003 | -25% | $4,684,416 |

| CR9 | Corellares | 0.003 | -25% | $3,022,709 |

| DTI | DTI Group Ltd | 0.006 | -25% | $5,382,617 |

At Stockhead, we tell it like it is. While Red Mountain Mining is a Stockhead advertiser, it did not sponsor this article

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.