You might be interested in

Mining

REE Survival Guide Part 4 – These Aussie projects aim to be ready to supply refineries... and soon

Mining

REE Survival Guide - Part 1: Rare earths explorers are getting smarter - here’s what to look for

Mining

News

The ASX 200 rallied to a 9-month high earlier as the index surpassed the 7,500 mark before paring gains.

Local investors were digesting a mix of news, including earnings report both on Wall Street and locally, along with what Jerome Powell might say tonight at his post-FOMC meeting press conference tonight.

Overnight, all three major US benchmarks surged by well over 1% as FOMC members convened for their first monetary policy meeting of the year.

On the ASX, oil stocks were the worst performing today despite Exxon noting that it sees tight oil supplies ahead.

Coal miners were mixed after a note out of UBS said thermal coal prices had “passed their peak” and would continue to decline due to the relatively warm winter in Europe.

Meanwhile, gains were made in the Mining and Real Estate sectors.

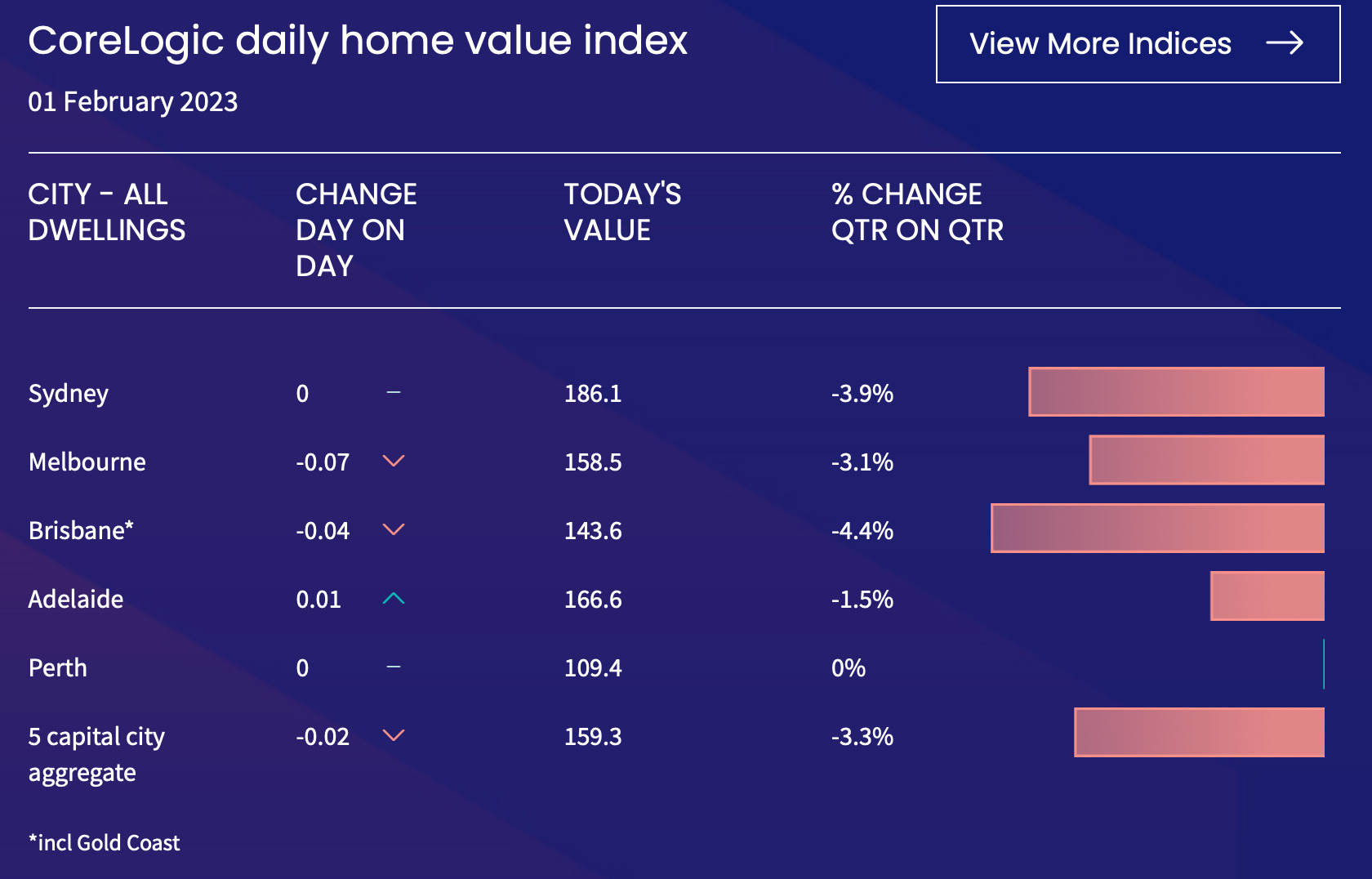

Property plays like Goodman Group (ASX:GMG) and Dexus (ASX:DXS) rose by around 1% despite Corelogic data showing that decline in Australia’s housing market has peaked in January.

CoreLogic’s national Home Value Index (HVI) fell a further -1.0% in January, a slight improvement on the -1.1% decline recorded in December.

Every capital city posted a decline in dwelling values through the month, led by Hobart (-1.7%) and Brisbane (-1.4%), while the smallest drops were recorded in Perth (-0.3%) and Darwin (-0.1%).

Sydney’s median dwelling value dropped below $1 million for the first time since March 2021, falling -1.2% in January, an improvement on December’s -1.4% decline.

These data came as RBA’s Marion Kohler said Australia’s inflation would have peaked in Q4 of 2022.

“What we can say is that we think the peak in inflation was at the end of 2022 – at around 8 per cent – and that inflation will begin to ease over the course of this year,” Kohler said.

Looking ahead to tonight, all eyes will glued to the Jerome Powell’s press conference, as the Fed is due to announce the outcomes of a two-day policy meeting which commenced last night.

Swipe or scroll to reveal the full table. Click headings to sort.

| Security | Description | Last | % | Volume | MktCap |

| ARU | Arafura Rare Earths | 0.62 | 11.82 | 25,960,606 | $1,159,753,655 |

| FLT | Flight Centre Travel | 17.16 | 8.37 | 6,273,064 | $3,168,930,814 |

| SDR | Siteminder | 4.04 | 7.45 | 425,576 | $1,033,454,319 |

| GRR | Grange Resources. | 1.08 | 5.91 | 3,099,912 | $1,174,698,778 |

| JHX | James Hardie Indust | 32.96 | 4.80 | 1,789,715 | $14,022,233,282 |

| AWC | Alumina Limited | 1.63 | 3.83 | 5,255,990 | $4,541,131,418 |

| CIA | Champion Iron Ltd | 7.41 | 3.64 | 1,511,568 | $3,697,930,851 |

| BFL | Bsp Financial Group | 4.70 | 3.52 | 14,975 | $2,121,178,705 |

| SFR | Sandfire Resources | 6.47 | 3.52 | 9,647,673 | $2,855,574,550 |

| TLC | The Lottery Corp | 4.87 | 3.51 | 1,989,526 | $10,461,127,004 |

| NIC | Nickel Industries | 1.13 | 3.42 | 16,366,925 | $3,274,462,966 |

| LYC | Lynas Rare Earths | 9.70 | 3.25 | 3,918,389 | $8,498,633,686 |

| SGP | Stockland | 4.05 | 2.93 | 6,401,552 | $9,381,584,632 |

Arafura Rare Earths (ASX:ARU) was the best large cap performer today, up 11% on no particular news.

The company did say yesterday that it was looking to renewables energy to power its Nolans rare earths project in the NT.

Flight Centre (ASX:FLT) rose almost 9% after exiting a trading a trading halt and announcing a $180m share placement to buy Scott Dunn, a leading UK-based luxury travel brand specialising in tailor-made luxury holidays, for an enterprise value of £121 million ($211 million).

Swipe or scroll to reveal the full table. Click headings to sort.

| Security | Description | Last | % | Volume | MktCap |

| PNI | Pinnacle Investment | 9.61 | -7.60 | 577,380 | $2,093,146,182 |

| SYR | Syrah Resources | 2.09 | -5.00 | 2,082,539 | $1,475,255,562 |

| CUV | Clinuvel Pharmaceut. | 24.07 | -4.37 | 221,779 | $1,243,658,207 |

| TLX | Telix Pharmaceutical | 6.81 | -3.95 | 588,756 | $2,242,870,239 |

| PDN | Paladin Energy Ltd | 0.82 | -3.82 | 10,764,039 | $2,533,083,049 |

| BGL | Bellevue Gold Ltd | 1.15 | -3.77 | 3,189,394 | $1,349,304,103 |

| WAM | WAM Capital Limited | 1.50 | -3.55 | 3,989,237 | $1,695,845,985 |

| REA | REA Group | 121.64 | -3.17 | 123,082 | $16,596,564,800 |

| DTL | Data#3 Limited | 7.09 | -3.14 | 237,006 | $1,131,666,027 |

| SLR | Silver Lake Resource | 1.26 | -3.08 | 5,046,127 | $1,208,667,633 |

| LOV | Lovisa Holdings Ltd | 25.54 | -2.85 | 280,278 | $2,834,899,678 |

| IRE | IRESS Limited | 9.63 | -2.78 | 772,473 | $1,827,366,493 |

| GOR | Gold Road Res Ltd | 1.60 | -2.74 | 2,301,685 | $1,770,218,806 |

| WAF | West African Res Ltd | 1.09 | -2.69 | 2,216,542 | $1,141,144,789 |

| CXL | Calix Limited | 5.41 | -2.52 | 195,130 | $1,004,408,109 |

Fundie Pinnacle Investment (ASX:PNI) lost 8% after broker UBS downgraded the stock from Neutral to a Sell rating.