As workers get dragged back to offices, this broker tips these ASX REITs to benefit

News

News

ASX stocks and REITS focused around offices have had a horror 12 months, but broker Ord Minnett thinks better days for some are around the corner as workers get forced back to offices.

CBDs across Australia were deserted for several weeks when COVID-19 hit and remained well below pre-COVID levels for the rest of 2020.

Even as COVID-19 cases remained low in most jurisdictions, the return to work was slow as firms were keen to minimise costs and employees were keen to minimise commuting.

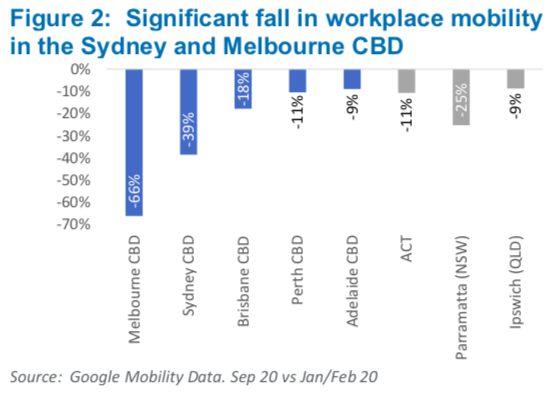

The Sydney and Melbourne CBDs were easily the worst hit.

Melbourne’s CBD mobility in September was down 66 per cent compared to 12 months ago, while Sydney was down 39 per cent.

Ord Minnett believes they will return, but it won’t be as it was pre-COVID.

In a report issued to clients last week it tipped a “hub and spoke” model to dominate post-COVID.

This would involve firms having a main office (hub) supported by satellite offices (spoke), implicitly in secondary centres such as Parramatta & Chatswood in Sydney.

“The cost benefits of adopting the hub and spoke model could be substantial, with Sydney CBD rents more than double Parramatta [and] Macquarie Park,” it said. “Similarly, Melbourne CBD rents are double North Melbourne, South East Melbourne and Outer East Melbourne.”

Ord Minnett argues 50 per cent of Australia’s top companies have adopted this model in some form and there is capacity to expand it.

It also argued there is capacity for companies to shift offices from Sydney and Melbourne to Brisbane, Adelaide and Perth.

Ord Minnett initiated coverage on two REITs – the Elanor Commercial Property Fund (ASX:ECF) and the Australian Unity Office Fund (ASX:AOF).

It argued these REITs had assets well positioned to benefit on this model.

The Australian Unity Office Fund has 47 per cent of its assets in Sydney’s Parramatta and Ryde areas which had 20-40,000 workers each that commuted out of the region for work.

“We estimate for every 1,000 workers that relocate to Parramatta or Ryde, an addition 11,500sqm of office space is required (equivalent to ~1 per cent of Parramatta’s total office stock),” Ord Minnett said.

“There is also a likelihood that Parramatta and Ryde can attract residents from nearby localities, including Blacktown, Baulkham Hills/Hawkesbury, Outer West/Blue Mountains and South West.”

Meanwhile, Elanor’s fund had commercial properties in suburban Brisbane – such as the Upper Mount Gravatt and Ipswich areas; which likewise had thousands leaving the area for work.

Again it argued for every 1,000 workers that relocated to those areas, an extra 11,500sqm of office space would be needed.

Ord Minnett also noted Elanor’s fund was one of only two office REITs to have no exposure whatsoever to the COVID-19 hit office markets of New South Wales and Victoria.