All eyes are on bitcoin as the halving approaches

News

All eyes in digital asset-land shift their focus towards bitcoin’s (BTC) upcoming halving.

It’s expected to occur on May 12, and will be arguably the most anticipated event on the BTC calendar this year.

So, what is exactly is halving and why is it so important?

Halving is all to do with mining.

The worker bees of the BTC blockchain are specialised computers known as miners. They verify and organise transactions on the BTC network into blocks. However, mining equipment is both expensive to buy and to run.

To cover these expenses, miners are rewarded a set amount of freshly created BTC per block mined – effectively, they digitally dig out new coins.

However, like gold, there is a limited supply of BTC, set at 21 million. The original code hardwired these halving events to occur every 210,000 blocks mined, approximately every four years.

Miners started off earning 50 BTC per block. The first halving was in November 2012 where it went to 25 BTC, then in July 2016 to 12.5 BTC. It will be reduced for a third time to 6.25 BTC. The halving process will continue until the final coin is mined in 2140.

It ensures that BTC behaves as a deflationary asset. As the asset supply becomes scarcer and demand increases, so too should its market value.

For investors, this deflationary quality presents an opportunity to hedge against inflation.

In response to COVID-19, mirroring economies around the world, the Reserve Bank of Australia (RBA) implemented quantitative easing (QE).

QE is central bank jargon for increasing the money supply in the economy. This can also increase inflation, as it dilutes the value of the existing money supply. For example, what cost $1 in Australia in 2018, cost $1.02 in 2019.

Although the challenges faced by the RBA are more complex than those facing BTC, the halving is an ideological contrast. BTC’s hard token limit and decreasing supply ensures the digital asset remains deflationary.

BTC market value experienced a 15.4 per cent gain this week. Its price fluctuated between $15,500 and $12,977. It currently sits at $15,422, according to BTC Markets data.

In the lead up to the halving, BTC has a year-to-date (YTD) gain of 50 per cent. The S&P ASX Small Ordinaries index (XSO) YTD return is currently down 17.57 per cent.

Digital asset total market capitalisation increased $44bn over the week, from $369bn to a high of $413bn on 8th May. BTC now accounts for 68 per cent of the total market capitalisation.

Data on BTC options and futures contracts may indicate a majority bullish sentiment leading up to the halving.

An options contract gives a trader the right to buy or sell an asset at a set price in the future. A futures contract is similar, however it’s an obligation to buy or sell when the contract expires.

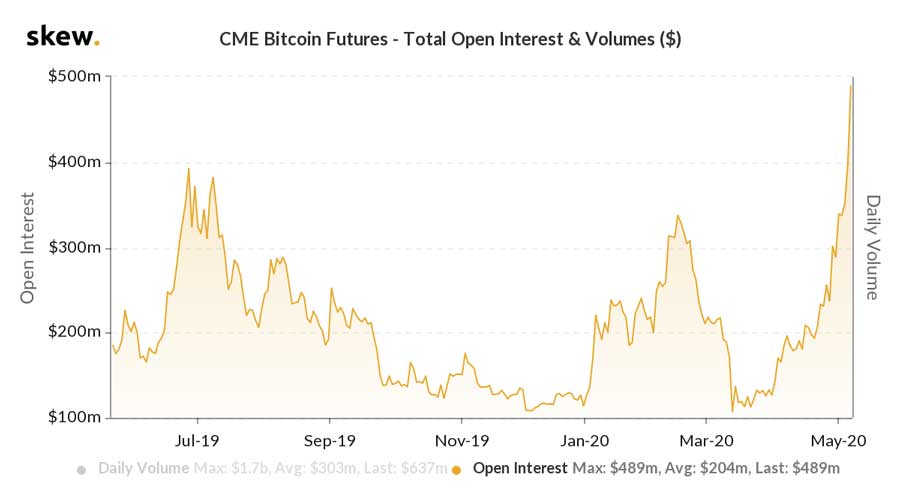

The data, from analytical firm skew.com, shows The Chicago Mercantile Exchange (CME) recorded all-time high volumes on both its options and futures market.

The BTC total open interest shows the dollar amount of futures contracts currently active. This reached $US489m ($749.9m) on May 7.

There is no doubt that investor interest in BTC has risen, however the question remains – are these investors bullish or bearish?

BTC’s put:call ratio – used to gauge the ‘mood’ of the market – may give some indication. It has increased to 0.81.

The ratio is the balance between how many ‘put’ and ‘call’ options are being bought. Put and call options are the right to sell or buy an asset, respectively, at a set price in the future.

As the ratio increases, it may show that investors are hedging (insuring) their portfolios in case BTC’s market value does decline post-halving.

This can be considered bullish sentiment. Why? Options can expire. Once they do, the contract to buy or sell is void a little loss to the investor.

When futures contracts expire, the investor holding the contract is obliged to buy or sell BTC. Therefore, the increase in volume of futures contracts on CME could indicate that investors are confident that prices will rise post halving.